No related resources

Introduction

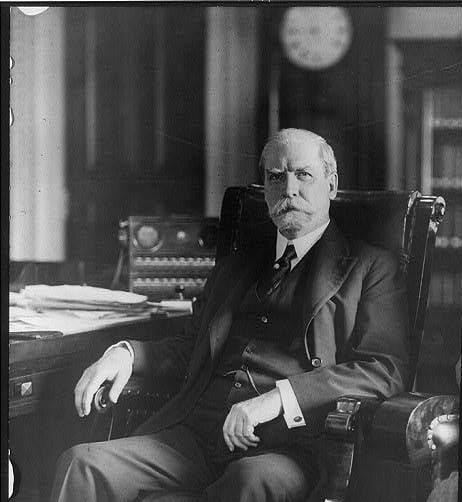

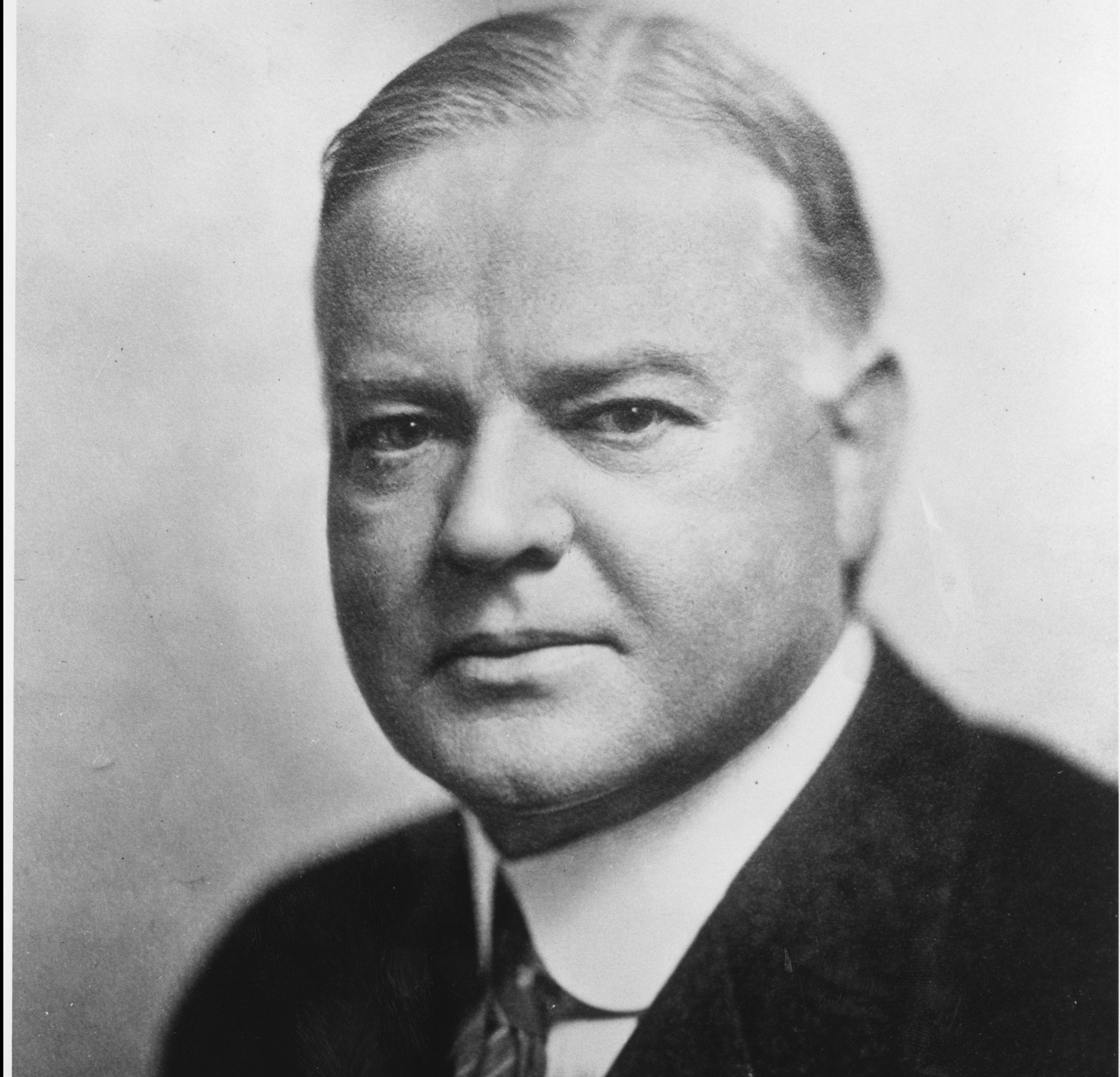

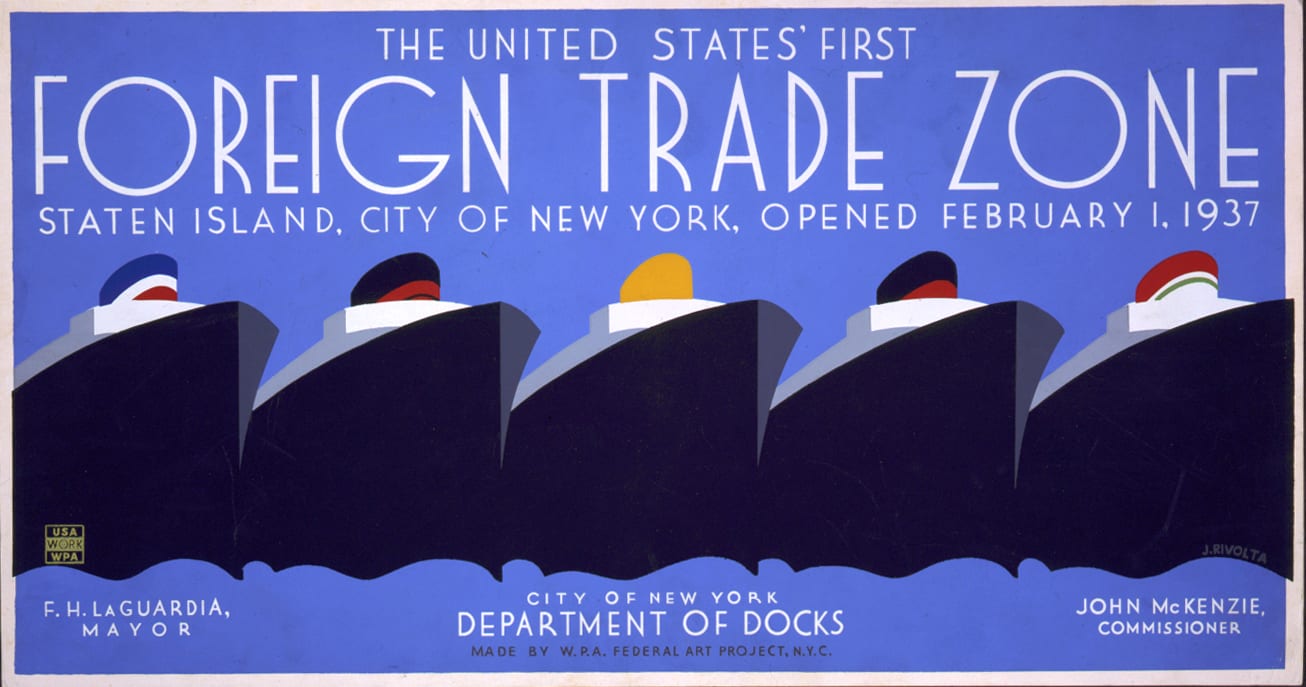

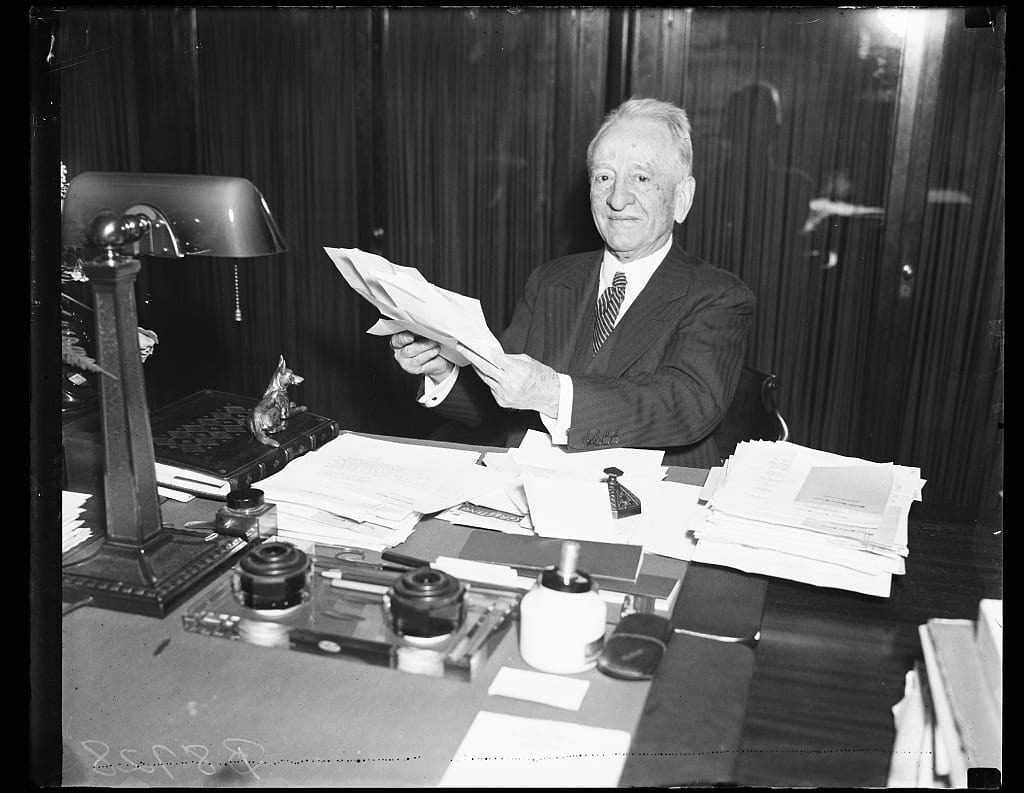

Even during his 1928 presidential campaign, Hoover had been calling for tariff reform, specifically for the protection of agriculture. Congressional leaders began work on a new trade bill in 1929, but it soon became clear that it would seek to protect more than just farmers. Fearing that the worsening global economic downturn would result in a flood of cheap foreign goods hitting U.S. markets, manufacturers lobbied hard for higher rates on their products. The resulting Smoot-Hawley Tariff (named for its sponsors in the Senate and House, Senator Reed Smoot [R-Utah] and Representative Willis C. Hawley [R-Oregon]) raised rates on practically everything. In spite of warnings from economists that it could worsen the global depression by making it harder for foreign countries to sell their products in the United States, Hoover announced that he would sign the bill.

Source: Herbert Hoover, “Statement on the Tariff Bill,” June 16, 1930. Online by Gerhard Peters and John T. Woolley, The American Presidency Project. https://teachingamericanhistory.org/bu8t.

I SHALL approve the tariff bill. . . .

This tariff law is like all other tariff legislation, whether framed primarily upon a protective or a revenue basis. It contains many compromises between sectional interests and between different industries. No tariff bill has ever been enacted or ever will be enacted under the present system that will be perfect. A large portion of the items are always adjusted with good judgment, but it is bound to contain some inequalities and inequitable compromises. There are items upon which duties will prove too high and others upon which duties will prove to be too low.

Certainly no President, with his other duties, can pretend to make that exhaustive determination of the complex facts which surround each of those 3,300 items, and which has required the attention of hundreds of men in Congress for nearly a year and a third. That responsibility must rest upon the Congress in a legislative rate revision.

On the administrative side I have insisted, however, that there should be created a new basis for the flexible tariff and it has been incorporated in this law. Thereby the means are established for objective and judicial review of these rates upon principles laid down by the Congress, free from pressures inherent in legislative action. Thus, the outstanding step of this tariff legislation has been the reorganization of the largely inoperative flexible provision of 1922[1] into a form which should render it possible to secure prompt and scientific adjustment of serious inequities and inequalities which may prove to have been incorporated in the bill.

This new provision has even a larger importance. If a perfect tariff bill were enacted today, the increased rapidity of economic change and the constant shifting of our relations to industries abroad will create a continuous stream of items which would work hardship upon some segment of the American people except for the provision of this relief. Without a workable flexible provision we would require even more frequent congressional tariff revision than during the past. With it the country should be freed from further general revision for many years to come. Congressional revisions are not only disturbing to business but with all their necessary collateral surroundings in lobbies, log rolling,[2] and the activities of group interests, are disturbing to public confidence.

Under the old flexible provisions, the task of adjustment was imposed directly upon the President, and the limitations in the law which circumscribed it were such that action was long delayed and it was largely inoperative, although important benefits were brought to the dairying, flax, glass, and other industries through it.

The new flexible provision established the responsibility for revisions upon a reorganized Tariff Commission, composed of members equal of both parties as a definite rate making body acting through semi-judicial methods of open hearings and investigation by which items can be taken up one by one upon direction or upon application of aggrieved parties. Recommendations are to be made to the President, he being given authority to promulgate or veto the conclusions of the Commission. Such revision can be accomplished without disturbance to business, as they concern but one item at a time, and the principles laid down assure a protective basis.

The principle of a protective tariff for the benefit of labor, industry, and the farmer is established in the bill by the requirement that the Commission shall adjust the rates so as to cover the differences in cost of production at home and abroad, and it is authorized to increase or decrease the duties by 50 percent to effect this end. The means and methods of ascertaining such differences by the Commission are provided in such fashion as should expedite prompt and effective action if grievances develop.

When the flexible principle was first written into law in 1922, by tradition and force of habit the old conception of legislative revision was so firmly fixed that the innovation was bound to be used with caution and in a restricted field, even had it not been largely inoperative for other reasons. Now, however, and particularly after the record of the last 15 months, there is a growing and widespread realization that in this highly complicated and intricately organized and rapidly shifting modern economic world, the time has come when a more scientific and businesslike method of tariff revision must be devised. Toward this the new flexible provision takes a long step.

These provisions meet the repeated demands of statesmen and industrial and agricultural leaders over the past 25 years. It complies in full degree with the proposals made 20 years ago by President Roosevelt.[3] It now covers proposals which I urged in 1922.

If, however, by any chance the flexible provisions now made should prove insufficient for effective action, I shall ask for further authority for the Commission, for I believe that public opinion will give wholehearted support to the carrying out of such a program on a generous scale to the end that we may develop a protective system free from the vices which have characterized every tariff revision in the past.

The complaints from some foreign countries that these duties have been placed unduly high can be remedied, if justified, by proper application to the Tariff Commission.

It is urgent that the uncertainties in the business world which have been added to by the long-extended debate of the measure should be ended. They can be ended only by completion of this bill. Meritorious demands for further protection to agriculture and labor which have developed since the tariff of 1922 would not end if this bill fails of enactment. Agitation for legislative tariff revision would necessarily continue before the country. Nothing would contribute to retard business recovery more than this continued agitation.

As I have said, I do not assume the rate structure in this or any other tariff bill is perfect, but I am convinced that the disposal of the whole question is urgent. I believe that the flexible provisions can within reasonable time remedy inequalities; that this provision is a progressive advance and gives great hope of taking the tariff away from politics, lobbying, and log rolling; that the bill gives protection to agriculture for the market of its products and to several industries in need of such protection for the wage of their labor; that with returning normal conditions our foreign trade will continue to expand.

- 1. The “largely inoperative flexible provision of 1922” refers to the Fordney-McCumber Tariff, sponsored by Representative Joseph W. Fordney (R-MI) and Senator Porter J. McCumber (R-ND). The first tariff to apply a “scientific” method to the calculation of import duties, it was intended to protect American factory and farm output against a feared flood of cheaper products from post-war Europe.

- 2. Legislators engage in log rolling when they vote for legislation they normally would not support in exchange for support for their own legislation.

- 3. President Theodore Roosevelt

Speech on the Smoot-Hawley Tariff

July 03, 1930

Conversation-based seminars for collegial PD, one-day and multi-day seminars, graduate credit seminars (MA degree), online and in-person.