No related resources

Introduction

In NFIB v. Sebelius, the U.S. Supreme Court considered the legitimacy of the Affordable Care Act of 2010 (ACA), which expanded access to health-care coverage in various ways. One focus of the ACA was regulating health insurers, for instance by preventing insurers from denying health-care coverage to individuals with preexisting conditions. The ACA also required nearly all individuals to purchase health insurance coverage or pay a financial penalty (the individual mandate) and required large businesses to offer health coverage to their employees (the employer mandate). The ACA also directed states to expand eligibility for the federal-state Medicaid program and stipulated that nonparticipating states could lose the entirety of their federal Medicaid funding if they did not (the Medicaid expansion directive). Other parts of the wide-ranging law required states, or in their absence the federal government, to establish marketplaces where individuals and small businesses could shop for health insurance and many individuals could qualify for federal subsidies to defray the cost of purchasing insurance.

State attorneys general and private parties, including the National Federation of Independent Business, challenged various provisions of the ACA, focusing on the individual mandate and Medicaid expansion provisions. Plaintiffs (those bringing the case to court) argued that the individual mandate exceeded congressional power under the commerce clause (Article I, section 8, clause 3) and the Medicaid expansion directive exceeded congressional authority under the spending and tax clause (Article I, section 8, clause 1).

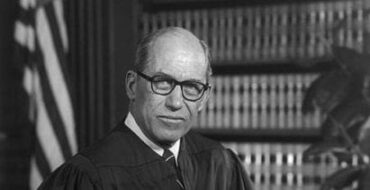

In its NFIB decision, the Supreme Court held that the individual mandate was not authorized by the commerce clause, but Chief Justice John Roberts (1955–) concluded that it could nevertheless be understood as a legitimate exercise of congressional authority pursuant to the tax clause.

Regarding the legitimacy of the Medicaid expansion provision, Roberts concluded that this provision could not survive in its current form, insofar as it threatened nonparticipating states with the loss of all their federal Medicaid funding. The Court began by considering the structure of the federal-state Medicaid program and the changes that the ACA made to this program. When Congress authorized the Medicaid program in 1965, it did so under the spending clause. States are not required to participate in the Medicaid program. However, states that do participate are required to abide by certain program requirements, with the understanding that the federal government will pay a certain share of the cost of operating the program. In enacting the ACA, Congress required states to expand eligibility for Medicaid coverage and promised to pay the entire cost of covering newly eligible Medicaid enrollees for several years and eventually to cover 90 percent of the cost. However, and this generated significant concern on the part of some state officials, Congress also stipulated that if a state chose not to expand Medicaid, the secretary of health and human services could discontinue any federal Medicaid funds for that state.

In determining whether the Medicaid expansion provision was a legitimate exercise of Congress’ spending power, Chief Justice Roberts concluded that Congress put undue pressure on states to adopt this policy, and in a way that could not be authorized under the spending power. The Chief Justice noted that in prior cases where the Court allowed Congress to place conditions on states’ receipt of federal funds, the amount of money at stake was modest, and therefore states still faced a real choice about whether to forgo the federal funds. But federal funding for Medicaid accounted for “over 10 percent of a state’s overall budget” in most cases. By enacting a Medicaid expansion provision that threatened states with the loss of all this money, Congress had engaged in “economic dragooning that leaves the states with no real option but to acquiesce in the Medicaid expansion.” Although some members of the Court contended that the proper remedy was to invalidate the entire Medicaid expansion provision, the majority settled for a more modest remedy, allowing Medicaid expansion to proceed but preventing Congress from punishing nonparticipating states with the loss of all their federal Medicaid funds.

Source: 567 U.S. 519 (2012), https://www.law.cornell.edu/supremecourt/text/11-393.

Chief Justice ROBERTS announced the judgment of the Court ....

In 2010, Congress enacted the Patient Protection and Affordable Care Act. The Act aims to increase the number of Americans covered by health insurance and decrease the cost of health care. The Act’s 10 titles stretch over 900 pages and contain hundreds of provisions. This case concerns constitutional challenges to two key provisions, commonly referred to as the individual mandate and the Medicaid expansion.

The individual mandate requires most Americans to maintain “minimum essential” health insurance coverage....

Beginning in 2014, those who do not comply with the mandate must make a “[s]hared responsibility payment” to the federal government. That payment, which the Act describes as a “penalty,” is calculated as a percentage of household income, subject to a floor based on a specified dollar amount and a ceiling based on the average annual premium the individual would have to pay for qualifying private health insurance. In 2016, for example, the penalty will be 2.5 percent of an individual’s household income, but no less than $695 and no more than the average yearly premium for insurance that covers 60 percent of the cost of 10 specified services (e.g., prescription drugs and hospitalization). The Act provides that the penalty will be paid to the Internal Revenue Service with an individual’s taxes, and “shall be assessed and collected in the same manner” as tax penalties, such as the penalty for claiming too large an income tax refund....

On the day the president signed the Act into law, Florida and 12 other states filed a complaint in the Federal District Court for the Northern District of Florida. Those plaintiffs ... were subsequently joined by 13 more states, several individuals, and the National Federation of Independent Business. The plaintiffs alleged, among other things, that the individual mandate provisions of the Act exceeded Congress’ powers under Article I of the Constitution....

The second provision of the Affordable Care Act directly challenged here is the Medicaid expansion. Enacted in 1965, Medicaid offers federal funding to states to assist pregnant women, children, needy families, the blind, the elderly, and the disabled in obtaining medical care. In order to receive that funding, states must comply with federal criteria governing matters such as who receives care and what services are provided at what cost. By 1982 every state had chosen to participate in Medicaid. Federal funds received through the Medicaid program have become a substantial part of state budgets, now constituting over 10 percent of most states’ total revenue.

The Affordable Care Act expands the scope of the Medicaid program and increases the number of individuals the states must cover. For example, the Act requires state programs to provide Medicaid coverage to adults with incomes up to 133 percent of the federal poverty level, whereas many states now cover adults with children only if their income is considerably lower, and do not cover childless adults at all. The Act increases federal funding to cover the states’ costs in expanding Medicaid coverage, although states will bear a portion of the costs on their own. If a state does not comply with the Act’s new coverage requirements, it may lose not only the federal funding for those requirements, but all of its federal Medicaid funds.

Along with their challenge to the individual mandate, the state plaintiffs in the Eleventh Circuit1 argued that the Medicaid expansion exceeds Congress’ constitutional powers....

The Government’s first argument is that the individual mandate is a valid exercise of Congress’s power under the commerce clause and the necessary and proper clause.2 According to the Government, the health care market is characterized by a significant cost-shifting problem. Everyone will eventually need health care at a time and to an extent they cannot predict, but if they do not have insurance, they often will not be able to pay for it. Because state and federal laws nonetheless require hospitals to provide a certain degree of care to individuals without regard to their ability to pay, hospitals end up receiving compensation for only a portion of the services they provide. To recoup the losses, hospitals pass on the cost to insurers through higher rates, and insurers, in turn, pass on the cost to policy holders in the form of higher premiums. Congress estimated that the cost of uncompensated care raises family health insurance premiums, on average, by over $1,000 per year....

... By requiring that individuals purchase health insurance, the mandate prevents cost-shifting by those who would otherwise go without it. In addition, the mandate forces into the insurance risk pool more healthy individuals, whose premiums on average will be higher than their health care expenses. This allows insurers to subsidize the costs of covering the unhealthy individuals the reforms require them to accept. The Government claims that Congress has power under the commerce and necessary and proper clauses to enact this solution....

Given its expansive scope, it is no surprise that Congress has employed the commerce power in a wide variety of ways to address the pressing needs of the time. But Congress has never attempted to rely on that power to compel individuals not engaged in commerce to purchase an unwanted product....

The individual mandate ... does not regulate existing commercial activity. It instead compels individuals to become active in commerce by purchasing a product, on the ground that their failure to do so affects interstate commerce. Construing the commerce clause to permit Congress to regulate individuals precisely because they are doing nothing would open a new and potentially vast domain to congressional authority. Every day individuals do not do an infinite number of things. In some cases they decide not to do something; in others they simply fail to do it. Allowing Congress to justify federal regulation by pointing to the effect of inaction on commerce would bring countless decisions an individual could potentially make within the scope of federal regulation, and—under the Government’s theory—empower Congress to make those decisions for him....

Just as the individual mandate cannot be sustained as a law regulating the substantial effects of the failure to purchase health insurance, neither can it be upheld as a “necessary and proper” component of the insurance reforms. The commerce power thus does not authorize the mandate.

That is not the end of the matter. Because the commerce clause does not support the individual mandate, it is necessary to turn to the Government’s second argument: that the mandate may be upheld as within Congress’s enumerated power to “lay and collect taxes.”

The Government’s tax power argument asks us to view the statute differently than we did in considering its commerce power theory. In making its Commerce clause argument, the Government defended the mandate as a regulation requiring individuals to purchase health insurance. The Government does not claim that the taxing power allows Congress to issue such a command. Instead, the Government asks us to read the mandate not as ordering individuals to buy insurance, but rather as imposing a tax on those who do not buy that product.

The text of a statute can sometimes have more than one possible meaning. To take a familiar example, a law that reads “no vehicles in the park” might, or might not, ban bicycles in the park. And it is well established that if a statute has two possible meanings, one of which violates the Constitution, courts should adopt the meaning that does not do so....

The most straightforward reading of the mandate is that it commands individuals to purchase insurance. After all, it states that individuals “shall” maintain health insurance. Congress thought it could enact such a command under the commerce clause, and the Government primarily defended the law on that basis. But, for the reasons explained above, the commerce clause does not give Congress that power. Under our precedent, it is therefore necessary to ask whether the Government’s alternative reading of the statute—that it only imposes a tax on those without insurance—is a reasonable one....

The question is not whether that is the most natural interpretation of the mandate, but only whether it is a “fairly possible” one.3 As we have explained, “every reasonable construction must be resorted to, in order to save a statute from unconstitutionality.”4 The Government asks us to interpret the mandate as imposing a tax, if it would otherwise violate the Constitution. Granting the Act the full measure of deference owed to federal statutes, it can be so read....

The Affordable Care Act’s requirement that certain individuals pay a financial penalty for not obtaining health insurance may reasonably be characterized as a tax. Because the Constitution permits such a tax, it is not our role to forbid it, or to pass upon its wisdom or fairness....

The states also contend that the Medicaid expansion exceeds Congress’s authority under the spending clause. They claim that Congress is coercing the states to adopt the changes it wants by threatening to withhold all of a state’s Medicaid grants, unless the state accepts the new expanded funding and complies with the conditions that come with it. This, they argue, violates the basic principle that the “federal government may not compel the states to enact or administer a federal regulatory program.”5

There is no doubt that the Act dramatically increases state obligations under Medicaid. The current Medicaid program requires states to cover only certain discrete categories of needy individuals—pregnant women, children, needy families, the blind, the elderly, and the disabled. There is no mandatory coverage for most childless adults, and the states typically do not offer any such coverage. The states also enjoy considerable flexibility with respect to the coverage levels for parents of needy families. On average states cover only those unemployed parents who make less than 37 percent of the federal poverty level, and only those employed parents who make less than 63 percent of the poverty line.

The Medicaid provisions of the Affordable Care Act, in contrast, require states to expand their Medicaid programs by 2014 to cover all individuals under the age of 65 with incomes below 133 percent of the federal poverty line. The Act also establishes a new “[e]ssential health benefits” package, which states must provide to all new Medicaid recipients—a level sufficient to satisfy a recipient’s obligations under the individual mandate. The Affordable Care Act provides that the federal government will pay 100 percent of the costs of covering these newly eligible individuals through 2016. In the following years, the federal payment level gradually decreases, to a minimum of 90 percent. ...

As our decision in Steward Machine6 confirms, Congress may attach appropriate conditions to federal taxing and spending programs to preserve its control over the use of federal funds. In the typical case we look to the states to defend their prerogatives by adopting “the simple expedient of not yielding” to federal blandishments when they do not want to embrace the federal policies as their own.7 The states are separate and independent sovereigns. Sometimes they have to act like it.

The states, however, argue that the Medicaid expansion is far from the typical case. They object that Congress has “crossed the line distinguishing encouragement from coercion,” in the way it has structured the funding: Instead of simply refusing to grant the new funds to states that will not accept the new conditions, Congress has also threatened to withhold those states’ existing Medicaid funds. The states claim that this threat serves no purpose other than to force unwilling states to sign up for the dramatic expansion in health care coverage effected by the Act.

Given the nature of the threat and the programs at issue here, we must agree. We have upheld Congress’ authority to condition the receipt of funds on the states’ complying with restrictions on the use of those funds, because that is the means by which Congress ensures that the funds are spent according to its view of the “general welfare.” Conditions that do not here govern the use of the funds, however, cannot be justified on that basis. When, for example, such conditions take the form of threats to terminate other significant independent grants, the conditions are properly viewed as a means of pressuring the states to accept policy changes.

In South Dakota v. Dole,8 we considered a challenge to a federal law that threatened to withhold five percent of a state’s federal highway funds if the state did not raise its drinking age to 21. The Court found that the condition was “directly related to one of the main purposes for which highway funds are expended—safe interstate travel.” At the same time, the condition was not a restriction on how the highway funds—set aside for specific highway improvement and maintenance efforts—were to be used.

We accordingly asked whether “the financial inducement offered by Congress” was “so coercive as to pass the point at which ‘pressure turns into compulsion.’” By “financial inducement” the Court meant the threat of losing five percent of highway funds; no new money was offered to the states to raise their drinking ages. We found that the inducement was not impermissibly coercive, because Congress was offering only “relatively mild encouragement to the states.” We observed that “all South Dakota would lose if she adheres to her chosen course as to a suitable minimum drinking age is 5%” of her highway funds. In fact, the federal funds at stake constituted less than half of one percent of South Dakota’s budget at the time. In consequence, “we conclude[d] that [the] encouragement to state action [was] a valid use of the spending power.” Whether to accept the drinking age change “remain[ed] the prerogative of the states not merely in theory but in fact.”

In this case, the financial “inducement” Congress has chosen is much more than “relatively mild encouragement”—it is a gun to the head. Section 1396c of the Medicaid Act provides that if a state’s Medicaid plan does not comply with the Act’s requirements, the secretary of health and human services may declare that “further payments will not be made to the state.” A state that opts out of the Affordable Care Act’s expansion in health care coverage thus stands to lose not merely “a relatively small percentage” of its existing Medicaid funding, but all of it. Medicaid spending accounts for over 20 percent of the average state’s total budget, with federal funds covering 50 to 83 percent of those costs. The federal government estimates that it will pay out approximately $3.3 trillion between 2010 and 2019 in order to cover the costs of pre-expansion Medicaid. In addition, the states have developed intricate statutory and administrative regimes over the course of many decades to implement their objectives under existing Medicaid. It is easy to see how the Dole Court could conclude that the threatened loss of less than half of one percent of South Dakota’s budget left that state with a “prerogative” to reject Congress’s desired policy, “not merely in theory but in fact.” The threatened loss of over 10 percent of a state’s overall budget, in contrast, is economic dragooning that leaves the states with no real option but to acquiesce in the Medicaid expansion....

Nothing in our opinion precludes Congress from offering funds under the Affordable Care Act to expand the availability of health care, and requiring that states accepting such funds comply with the conditions on their use. What Congress is not free to do is to penalize states that choose not to participate in that new program by taking away their existing Medicaid funding. Section 1396c gives the secretary of health and human services the authority to do just that. It allows her to withhold all “further [Medicaid] payments ... to the state” if she determines that the state is out of compliance with any Medicaid requirement, including those contained in the expansion. In light of the Court’s holding, the secretary cannot apply §1396c to withdraw existing Medicaid funds for failure to comply with the requirements set out in the expansion....

The Affordable Care Act is constitutional in part and unconstitutional in part. The individual mandate cannot be upheld as an exercise of Congress’ power under the commerce clause. That clause authorizes Congress to regulate interstate commerce, not to order individuals to engage in it. In this case, however, it is reasonable to construe what Congress has done as increasing taxes on those who have a certain amount of income, but choose to go without health insurance. Such legislation is within Congress’ power to tax.

As for the Medicaid expansion, that portion of the Affordable Care Act violates the Constitution by threatening existing Medicaid funding. Congress has no authority to order the states to regulate according to its instructions. Congress may offer the states grants and require the states to comply with accompanying conditions, but the states must have a genuine choice whether to accept the offer. The states are given no such choice in this case: They must either accept a basic change in the nature of Medicaid, or risk losing all Medicaid funding. The remedy for that constitutional violation is to preclude the federal government from imposing such a sanction. That remedy does not require striking down other portions of the Affordable Care Act.

The Framers created a federal government of limited powers, and assigned to this Court the duty of enforcing those limits. The Court does so today. But the Court does not express any opinion on the wisdom of the Affordable Care Act. Under the Constitution, that judgment is reserved to the people....

- 1. The Federal Appeals Court with jurisdiction over the Federal District Court for the Northern District of Florida, among others.

- 2. The necessary and proper clause is Article I, section 8, clause 18.

- 3. Chief Justice Roberts’ note: Crowell v. Benson (1932).

- 4. Chief Justice Roberts’ note: Hooper v. California (1895).

- 5. Chief Justice Roberts’ note: New York, 505 U.S., at 188

- 6. Steward Machine Company v. Davis, 301 U.S. 548 (1937).

- 7. Chief Justice Roberts’ note: Massachusetts v. Mellon (1923).

- 8. South Dakota v. Dole, June 23, 1987

Conversation-based seminars for collegial PD, one-day and multi-day seminars, graduate credit seminars (MA degree), online and in-person.