No study questions

No related resources

Introduction

Ronald Reagan won election as president in 1980 promising to restore American self-confidence undermined by a decade of low economic growth, inflation, the Iranian hostage crisis (November 4, 1979 – January 20, 1981), and the apparent success of the Soviet Union in extending its influence in Africa, the Middle East and Central Asia. (The Soviet Union invaded and occupied Afghanistan in December 1979.) Central to Reagan’s plans was reviving the American economy. After a deep recession early in Reagan’s first term, economic growth remained strong for the rest of the 1980s. The Berlin Wall fell in November 1989; Germans united their country by October 1990; and a year later, the Soviet Union collapsed. A few months before German reunification, the U.S. economy entered a recession that lasted until March 1991, although its effects, including unemployment, lingered on. (Unemployment reached a height of 7.5% in 1992, in part because of layoffs in defense industries as the Cold War ended.) The economic downturn, and a sense that a new era had begun with the end of the Cold War that required new leadership, helped Bill Clinton win election as President in November 1992. Clinton’s unofficial campaign slogan was: “It’s the economy, stupid.” Like Reagan twelve years before him, Clinton made restoring the economy a central part of his plans. The economic recovery was underway before Clinton took office. The economy continued to grow strongly throughout the decade until another brief recession occurred in 2001. Economists debate the effect of both Reagan’s and Clinton’s policies on the economic growth America enjoyed during their presidencies.

Documents in this chapter are available separately by following the hyperlinks below:

A. Address to the Nation on the Economy, President Ronald Reagan, February 5, 1981

B. The President’s Address to a Joint Session of Congress, President Bill Clinton, February 17, 1993

Discussion Questions

A. Both President Ronald Reagan and President Bill Clinton spoke of opportunity. What did they mean by this term? Why was it important? What policies did they propose to create opportunity? Reagan proposed tax cuts and Clinton tax increases. Why did they make these different proposals? Clinton used the term “invest” or “investment” 29 times in his speech. Reagan hardly mentioned it. What is an investment? What did Clinton mean by investment? Why was it important to him? How did Reagan and Clinton differ on the role of government in the economy?

B. Compare the speeches of Reagan and Clinton with the documents in Chapter 21, “Boom to Bust,” especially the documents A, C, D, and E. How do the ideas and proposals of Clinton and Reagan compare to those of Hoover and Roosevelt?

C. Consider the issues raised by the texts here in light of the discussion of politics and economics presented in Volume 1, Chapters 2 and 10; how do the claims and preferences of Reagan and Clinton relate to these earlier understandings of politics and economics and what Americans owe to one another and to their government?

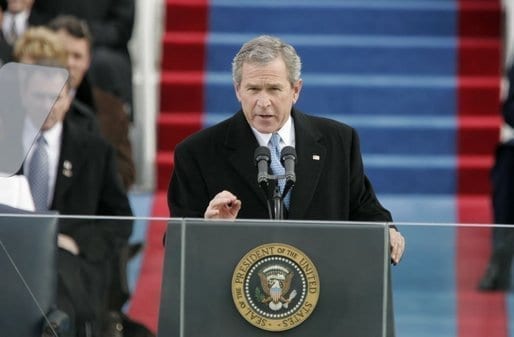

A. Address to the Nation on the Economy, President Ronald Reagan, February 5, 1981

Good evening.

I’m speaking to you tonight to give you a report on the state of our Nation’s economy. I regret to say that we’re in the worst economic mess since the Great Depression.

A few days ago I was presented with a report I’d asked for, a comprehensive audit, if you will, of our economic condition. You won’t like it. I didn’t like it. But we have to face the truth and then go to work to turn things around. And make no mistake about it, we can turn them around.

I’m not going to subject you to the jumble of charts, figures, and economic jargon of that audit, but rather will try to explain where we are, how we got there, and how we can get back. First, however, let me just give a few “attention getters” from the audit.

The federal budget is out of control, and we face runaway deficits of almost $80 billion for this budget year that ends September 30th. That deficit is larger than the entire Federal budget in 1957, and so is the almost $80 billion we will pay in interest this year on the national debt.

Twenty years ago, in 1960, our federal government payroll was less than $13 billion. Today it is 75 billion. During these twenty years our population has only increased by 23.3 percent. The federal budget has gone up 528 percent.

Now, we’ve just had two years of back-to-back double-digit inflation – 13.3 percent in 1979, 12.4 percent last year. The last time this happened was in World War I.

In 1960 mortgage interest rates averaged about 6 percent. They’re 2 1/2 times as high now, 15.4 percent.

The percentage of your earnings the federal Government took in taxes in 1960 has almost doubled.

And finally there are 7 million Americans caught up in the personal indignity and human tragedy of unemployment. If they stood in a line, allowing three feet for each person, the line would reach from the coast of Maine to California.

Well, so much for the audit itself. Let me try to put this in personal terms. Here is a dollar such as you earned, spent, or saved in 1960. And here is a quarter, a dime, and a penny—36 cents. That’s what this 1960 dollar is worth today. And if the present world inflation rate should continue 3 more years, that dollar of 1960 will be worth a quarter. What initiative is there to save? And if we don’t save we’re short of the investment capital needed for business and industry expansion. Workers in Japan and West Germany save several times the percentage of their income that Americans do.

What’s happened to that American dream of owning a home? Only ten years ago a family could buy a home, and the monthly payment averaged little more than a quarter – 27 cents out of each dollar earned. Today, it takes 42 cents out of every dollar of income. So, fewer than 1 out of 11 families can afford to buy their first new home.

Regulations adopted by government with the best of intentions have added $666 to the cost of an automobile. It is estimated that altogether regulations of every kind, on shopkeepers, farmers, and major industries, add $100 billion or more to the cost of the goods and services we buy. And then another 20 billion is spent by government handling the paperwork created by those regulations.

I’m sure you’re getting the idea that the audit presented to me found government policies of the last few decades responsible for our economic troubles. We forgot or just overlooked the fact that government – any government – has a built-in tendency to grow. Now, we all had a hand in looking to government for benefits as if government had some source of revenue other than our earnings. Many if not most of the things we thought of or that government offered to us seemed attractive.

In the years following the Second World War it was easy, for a while at least, to overlook the price tag. Our income more than doubled in the 25 years after the war. We increased our take-home pay in those 25 years by more than we had amassed in all the preceding 150 years put together. Yes, there was some inflation, 1 or 1 1/2 percent a year. That didn’t bother us. But if we look back at those golden years, we recall that even then voices had been raised, warning that inflation, like radioactivity, was cumulative and that once started it could get out of control.

Some government programs seemed so worthwhile that borrowing to fund them didn’t bother us. By 1960 our national debt stood at $284 billion. Congress in 1971 decided to put a ceiling of 400 billion on our ability to borrow. Today the debt is 934 billion. So-called temporary increases or extensions in the debt ceiling have been allowed 21 times in these 10 years, and now I’ve been forced to ask for another increase in the debt ceiling or the government will be unable to function past the middle of February – and I’ve only been here 16 days. Before we reach the day when we can reduce the debt ceiling, we may in spite of our best efforts see a national debt in excess of a trillion dollars. Now, this is a figure that’s literally beyond our comprehension.

We know now that inflation results from all that deficit spending. Government has only two ways of getting money other than raising taxes. It can go into the money market and borrow, competing with its own citizens and driving up interest rates, which it has done, or it can print money, and it’s done that. Both methods are inflationary.

We’re victims of language. The very word “inflation” leads us to think of it as just high prices. Then, of course, we resent the person who puts on the price tags, forgetting that he or she is also a victim of inflation. Inflation is not just high prices; it’s a reduction in the value of our money. When the money supply is increased but the goods and services available for buying are not, we have too much money chasing too few goods. Wars are usually accompanied by inflation. Everyone is working or fighting, but production is of weapons and munitions, not things we can buy and use.

Now, one way out would be to raise taxes so that government need not borrow or print money. But in all these years of government growth, we’ve reached, indeed surpassed, the limit of our people’s tolerance or ability to bear an increase in the tax burden. Prior to World War II, taxes were such that on the average we only had to work just a little over 1 month each year to pay our total federal, state, and local tax bill. Today we have to work 4 months to pay that bill.

Some say shift the tax burden to business and industry, but business doesn’t pay taxes. Oh, don’t get the wrong idea. Business is being taxed, so much so that we’re being priced out of the world market. But business must pass its costs of operations – and that includes taxes – on to the customer in the price of the product. Only people pay taxes, all the taxes. Government just uses business in a kind of sneaky way to help collect the taxes. They’re hidden in the price; we aren’t aware of how much tax we actually pay.

Today this once great industrial giant of ours has the lowest rate of gain in productivity of virtually all the industrial nations with whom we must compete in the world market. We can’t even hold our own market here in America against foreign automobiles, steel, and a number of other products. Japanese production of automobiles is almost twice as great per worker as it is in America. Japanese steelworkers outproduce their American counterparts by about 25 percent.

Now, this isn’t because they’re better workers. I’ll match the American working man or woman against anyone in the world. But we have to give them the tools and equipment that workers in the other industrial nations have.

We invented the assembly line and mass production, but punitive tax policies and excessive and unnecessary regulations plus government borrowing have stifled our ability to update plant and equipment. When capital investment is made, it’s too often for some unproductive alterations demanded by government to meet various of its regulations. Excessive taxation of individuals has robbed us of incentive and made overtime unprofitable.

We once produced about 40 percent of the world’s steel. We now produce 19 percent. We were once the greatest producer of automobiles, producing more than all the rest of the world combined. That is no longer true, and in addition, the “Big Three,” the major auto companies in our land, have sustained tremendous losses in the past year and have been forced to lay off thousands of workers.

All of you who are working know that even with cost-of-living pay raises, you can’t keep up with inflation. In our progressive tax system, as you increase the number of dollars you earn, you find yourself moved up into higher tax brackets, paying a higher tax rate just for trying to hold your own. The result? Your standard of living is going down.

Over the past decades we’ve talked of curtailing government spending so that we can then lower the tax burden. Sometimes we’ve even taken a run at doing that. But there were always those who told us that taxes couldn’t be cut until spending was reduced. Well, you know, we can lecture our children about extravagance until we run out of voice and breath. Or we can cure their extravagance by simply reducing their allowance.

It’s time to recognize that we’ve come to a turning point. We’re threatened with an economic calamity of tremendous proportions, and the old business-as-usual treatment can’t save us. Together, we must chart a different course.

We must increase productivity. That means making it possible for industry to modernize and make use of the technology which we ourselves invented. That means putting Americans back to work. And that means above all bringing government spending back within government revenues, which is the only way, together with increased productivity, that we can reduce and, yes, eliminate inflation.

In the past we’ve tried to fight inflation one year and then, with unemployment increased, turn the next year to fighting unemployment with more deficit spending as a pump primer. So, again, up goes inflation. It hasn’t worked. We don’t have to choose between inflation and unemployment – they go hand in hand. It’s time to try something different, and that’s what we’re going to do. . . .

On February 18th, I will present in detail an economic program to Congress embodying the features I’ve just stated. It will propose budget cuts in virtually every department of government. It is my belief that these actual budget cuts will only be part of the savings. As our Cabinet Secretaries take charge of their departments, they will search out areas of waste, extravagance, and costly overhead which could yield additional and substantial reductions.

Now, at the same time we’re doing this, we must go forward with a tax relief package. I shall ask for a 10-percent reduction across the board in personal income tax rates for each of the next 3 years. Proposals will also be submitted for accelerated depreciation allowances for business to provide necessary capital so as to create jobs.

Now, here again, in saying this, I know that language, as I said earlier, can get in the way of a clear understanding of what our program is intended to do. Budget cuts can sound as if we’re going to reduce total government spending to a lower level than was spent the year before. Well, this is not the case. The budgets will increase as our population increases, and each year we’ll see spending increases to match that growth. Government revenues will increase as the economy grows, but the burden will be lighter for each individual, because the economic base will have been expanded by reason of the reduced rates. . . .

Our spending cuts will not be at the expense of the truly needy. We will, however, seek to eliminate benefits to those who are not really qualified by reason of need. . . .

Our basic system is sound. We can, with compassion, continue to meet our responsibility to those who, through no fault of their own, need our help. We can meet fully the other legitimate responsibilities of government. We cannot continue any longer our wasteful ways at the expense of the workers of this land or of our children.

Since 1960 our government has spent $5.1 trillion. Our debt has grown by 648 billion. Prices have exploded by 178 percent. How much better off are we for all that? Well, we all know we’re very much worse off. When we measure how harshly these years of inflation, lower productivity, and uncontrolled government growth have affected our lives, we know we must act and act now. We must not be timid. We will restore the freedom of all men and women to excel and to create. We will unleash the energy and genius of the American people, traits which have never failed us. . . .

We can create the incentives which take advantage of the genius of our economic system – a system, as Walter Lippmann observed more than 40 years ago, which for the first time in history gave men “a way of producing wealth in which the good fortune of others multiplied their own.”

Our aim is to increase our national wealth so all will have more, not just redistribute what we already have which is just a sharing of scarcity. We can begin to reward hard work and risk-taking, by forcing this Government to live within its means. . . .

And to you, my fellow citizens, let us join in a new determination to rebuild the foundation of our society, to work together, to act responsibly. Let us do so with the most profound respect for that which must be preserved as well as with sensitive understanding and compassion for those who must be protected.

We can leave our children with an unrepayable massive debt and a shattered economy, or we can leave them liberty in a land where every individual has the opportunity to be whatever God intended us to be. All it takes is a little common sense and recognition of our own ability. Together we can forge a new beginning for America.

Thank you, and good night.

B. The President’s Address to a Joint Session of Congress, President Bill Clinton, February 17, 1993

. . . When Presidents speak to the Congress and the nation from this podium, typically they comment on the full range and challenges and opportunities that face the United States. But this is not an ordinary time, and for all the many tasks that require our attention, I believe tonight one calls on us to focus, to unite and to act, and that is our economy. For more than anything else, our task tonight as Americans is to make our economy thrive again. Let me begin by saying that it has been too long – at least three decades – since a President has come and challenged Americans to join him on a great national journey, not merely to consume the bounty of today but to invest for a much greater one tomorrow. . . .

We have always been a people of youthful energy and daring spirit. And at this historic moment, as Communism has fallen, as freedom is spreading around the world, as a global economy is taking shape before our eyes, Americans have called for change – and now it is up to those of us in this room to deliver for them.

Our nation needs a new direction. Tonight, I present to you a comprehensive plan to set our nation on that new course.

I believe we will find our new direction in the basic old values that brought us here over the last two centuries: a commitment to opportunity, to individual responsibility, to community, to work, to family and to faith. We must now break the old habits of both political parties and say that there can be no more something for nothing, and admit frankly that we are all in this together.

The conditions which brought us as a nation to this point are well known. Two decades of low productivity growth and stagnant wages; persistent unemployment and underemployment; years of huge government deficits and declining investment in our future; exploding health care costs and lack of coverage for millions of Americans; legions of poor children; education and job training opportunities inadequate to the demands of this tough global economy. For too long we drifted without a strong sense of purpose or responsibility or community, and our political system so often has seemed paralyzed by special interest groups, by partisan bickering and by the sheer complexity of our problems.

I believe we can do better, because we remain the greatest nation on earth, the world’s strongest economy, the world’s only military superpower. If we have the vision, the will and the heart to make the changes we must, we can still enter the 21st century with possibilities our parents could not even have imagined, and enter it having secured the American dream for ourselves and for future generations.

I well remember twelve years ago President Reagan stood at this very podium and told you and the American people that if our national debt were stacked in thousand dollar bills, the stack would reach 67 miles into space. Well, today, that stack would reach 267 miles. . . .

The plan I offer you has four fundamental components:

First, it shifts our emphasis in public and private spending from consumption to investment[,] initially by jump-starting the economy in the short term and investing in our people, their jobs and their incomes over the long run.

Second, it changes the rhetoric of the past into the actions of the present, by honoring work and families in every part of our public decision-making.

Third, it substantially reduces the federal deficit, honestly and credibly, by using in the beginning the most conservative estimates of government revenues, not as the Executive Branch has done so often in the past, using the most optimistic ones.

And finally, it seeks to earn the trust of the American people by paying for these plans first with cuts in government waste and efficiency, second with cuts, not gimmicks, in government spending, and by fairness, for a change, in the way additional burdens are borne.

Tonight, I want to talk with you about what government can do, because I believe government must do more. But let me say first that the real engine of economic growth in this country is the private sector. And second that each of us must be an engine of growth and change. The truth is that as government creates more opportunity in this new and different time, we must also demand more responsibility in turn.

Our immediate priority must be to create jobs. . . . Some people say well we’re in a recovery and we don’t have to do that. Well, we all hope we’re in a recovery. But we’re sure not creating new jobs. And there’s no recovery worth its salt that doesn’t put the American people back to work.

To create jobs and guarantee a strong recovery, I call on Congress to enact an immediate package of jobs investments over $30 billion to put people to work now to create a half a million jobs: jobs to rebuild our highways and airports, to renovate housing, to bring new life to rural communities and spread hope and opportunity among our nation’s youth. Especially I want to emphasize after the events of last year in Los Angeles and the countless stories of despair in our cities and in our poor rural communities, this proposal will create almost 700,000 new summer jobs for displaced unemployed young people alone this summer. And tonight I invite America’s business leaders to join us in this effort so that together we can provide over one million summer jobs in cities and poor rural areas for our young people.

Second, our plan looks beyond today’s business cycle, because our aspirations extend into the next century. The heart of this plan deals with the long term. It is an investment program designed to increase public and private investment in areas critical to our economic future. And it has a deficit reduction program that will increase the savings available for the private sector to invest, will lower interest rates, will decrease the percentage of the Federal budget claimed by interest payments, and decrease the risk of financial market disruptions that could adversely affect our economy.

Over the long run, all this will bring us a higher rate of economic growth, improved productivity, more high-quality jobs and an improved economic competitive position in the world.

In order to accomplish both increased investment and deficit reduction – something no American Government has ever been called upon to do at the same time before, spending must be cut and taxes must be raised. Spending cuts I recommend were carefully thought through in a way to minimize any adverse economic impact, to capture the peace dividend for investment purposes, and to switch the balance in the budget from consumption to more investment. The tax increases and the spending cuts were both designed to assure that the cost of this historic program to face and deal with our problems will be borne by those who could readily afford it the most.

Our plan is designed, furthermore, and perhaps in some ways most important, to improve the health of American business through lower interest rates, more incentives to invest and better-trained workers.

Because small business has created such a high percentage of all the jobs in our nation over the last 10 or 15 years, our plan includes the boldest targeted incentives for small business in history. We propose a permanent investment tax credit for the smallest firms in this country with revenues of under $5 million. That’s about 90 percent of the firms in America, employing about 40 percent of the work force but creating a big majority of the net new jobs for more than a decade. And we propose new rewards for entrepreneurs who take new risks. We propose to give small business access to all the new technologies of our time, and we propose to attack this credit crunch which has denied small business the credit they need to flourish and prosper.

With a new network of community development banks, and one billion dollars to make the dream of enterprise zones real, we propose to bring new hope and new jobs to storefronts and factories from South Boston to South Texas to South-Central Los Angeles.

This plan invests in our roads, our bridges, our transit systems; in high-speed railways and high-tech information systems; and it provides the most ambitious environmental cleanup in partnership with state and local government of our time to put people to work and to preserve the environment for our future.

Standing as we are on the edge of the new century, we know that economic growth depends as never before on opening up new markets overseas and expanding the volume of world trade. And so we will insist on fair trade rules in international markets as a part of a national economic strategy to expand trade, including the successful completion of the latest round of world trade talks and the successful completion of a North American Free Trade Agreement with appropriate safeguards for our workers and for the environment. . . .

. . . The world is changing so fast that we must have aggressive targeted attempts to create the high-wage jobs of the future; that’s what all our competitors are doing. We must give special attention to those critical industries that are going to explode in the 21st century but that are in trouble in America today, like aerospace. We must provide special assistance to areas and to workers displaced by cuts in defense budget and by other unavoidable economic dislocations. . . .

But all of our efforts to strengthen the economy will fail – let me say this again – I feel so strongly about this. All of our efforts to strengthen the economy will fail unless we also take, this year, not next year, not five years from now, but this year, bold steps to reform our health care system. . . .

The combination of the rising costs of care and the lack of care and the fear of losing care are endangering the security and the very lives of millions of our people, and they are weakening our economy every day. Reducing health-care costs can liberate literally hundreds of billions of dollars for new investment in growth and jobs. Bringing health costs in line with inflation would do more for the private sector in this country than any tax cut we could give and any spending program we could promote. Reforming health care over the long run is critically essential to reducing not only our deficit but to expanding investment in America. . . .

Perhaps the most fundamental change the new direction I propose offers is its focus on the future and its investment which I seek in our children. Each day we delay really making a commitment to our children carries a dear cost. Half of the 2-year-olds in this country today don’t receive the immunizations they need against deadly diseases. Our plan will provide them for every eligible child and we know now that we will save $10 later for every $1 we spend by eliminating preventable childhood diseases – that’s a good investment no matter how you measure it.

I recommend that the Women, Infants and Children’s nutrition program be expanded so that every expectant mother who needs the help gets it. We all know that Head Start, a program that prepares children for school, is a success story. We all know that it saves money, but today it just reaches barely over a third of all the eligible children. Under this plan, every eligible child will be able to get a head start.

This is not just the right thing to do; it is the smart thing to do. For every dollar we invest today we’ll save three tomorrow. . . .

We have to recognize that all of our high school graduates need some further education in order to be competitive in this global economy. So we have to establish a partnership between businesses and education and the government, for apprenticeship programs in every state in this country to give our people the skills they need. Lifelong learning must benefit not just young high school graduates but workers, too, throughout their career. The average 18-year-old today will change jobs seven times in a lifetime.

We have done a lot in this country on worker training in the last few years, but the system is too fractured. We must develop a unified, simplified, sensible, streamlined worker-training program so that workers receive the training they need regardless of why they lost their jobs or whether they simply need to learn something new to keep them. We have got to do better on this.

Finally, I propose a program that got a great response from the American people all across this country last year, a program of national service to make college loans available to all Americans; and to challenge them at the same time to give something back to their country – as teachers or police officers or community service workers. To give them the option to pay the loans back, but at tax time so they can’t beat the bill, but to encourage them instead to pay it back by making their country stronger and making their country better and giving us the benefit of their talents.

A generation ago, when President Kennedy proposed and the United States Congress embraced the Peace Corps, it defined the character of a whole generation of Americans committed to serving people around the world. In this national service program we will provide more than twice as many slots for people before they go to college to be in national service than ever served in the Peace Corps. . . .

If we believe in jobs and we believe in learning, we must believe in rewarding work. If we believe in restoring the values that make America special, we must believe that there is dignity in all work and there must be dignity for all workers.

For those who care for our sick and tend our children who do our most difficult and tiring jobs, the new direction I propose will make this solemn simple commitment. By expanding the refundable earned income tax credit we will make history, we will reward the work of millions of working poor Americans by realizing the principle that if you work 40 hours a week and you’ve got a child in the house, you will no longer be in poverty.

Later this year we will offer a plan to end welfare as we know it. I have worked on this issue for the better part of a decade and I know from personal conversations with many people, that no one wants to change the welfare system as badly as those who are trapped in it. I want to offer the people on welfare the education, the training, the child care, the health care they need to get back on their feet, but say after two years they must get back to work, too, in private business if possible, in public service if necessary. We have to end welfare as a way of life and make it a path to independence and dignity.

Our next great goal should be to strengthen our families. I compliment the Congress for passing the Family and Medical Leave Act as a good first step, but it is time to do more. This plan will give this country the toughest child-support enforcement system it has ever had. It is time to demand that people take responsibility for the children they bring in this world. . . .

Next, to revolutionize government we have to insure that we live within our means, and that should start at the top and with the White House. In the last few days I have announced a cut in the White House staff of 25 percent, saving approximately $10 million. I have ordered administrative cuts in budgets of agencies and departments; I have cut the federal bureaucracy – or will over the next four years – by approximately 100,000 positions, for a combined savings of $9 billion.

It is time for government to demonstrate, in the condition we’re in, that we can be as frugal as any household in America, and that’s why I also want to congratulate the Congress. I noticed the announcement of the leadership today that Congress is taking similar steps to cut its costs. I think that is important; I think it will send a very clear signal to the American people.

But if we really want to cut spending we’re going to have to do more and some of it will be difficult. Tonight I call for an across-the-board freeze in federal government salaries for one year. And thereafter during this four-year period I recommend that salaries rise at one point lower than the cost-of-living allowance normally involved in federal pay increases.

Next, I recommend that we make 150 specific budget cuts, as you know, and that all those who say we should cut more, be as specific as I have been.

Finally let me say to my friends on both sides of the aisle, it is not enough simply to cut government – we have to rethink the whole way it works. . . .

So I want to bring a new spirit of innovation into every government department. . . .

In the aftermath of all the difficulties with the savings and loans, we must use federal bank regulators to protect the security and safety of our financial institutions – but they should not be used to continue the credit crunch, to stop people from making sensible loans.

I’d like for us to not only have welfare reform, but to re-examine the whole focus of all of our programs that help people to shift them from entitlement programs to empowerment programs. In the end, we want people not to need us anymore. I think that’s important.

But in the end, we have to get back to the deficit. . . . [T]his plan does – it tackles the budget deficit seriously and over the long term. It puts in place one of the biggest deficit reductions and one of the biggest changes in federal priorities, from consumption to investment, in the history of this country at the same time[:] over the next four years. . . .

. . . We have to cut the deficit because the more we spend paying off the debt, the less tax dollars we have to invest in jobs and education and the future of this country.

And the more money we take out of the pool of available savings, the harder it is for people in the private sector to borrow money at affordable interest rates for a college loan for their children, for a home mortgage, or to start a new business. That’s why we’ve got to reduce the debt, because it is crowding out other activities that we ought to be engaged in and that the American people ought to be engaged in.

We cut the deficit so that our children will be able to buy a home, so that our companies can invest in the future and in retraining their workers, so that our government can make the kinds of investments we need to be a stronger and smarter and safer nation.

If we don’t act now, you and I might not even recognize this Government 10 years from now. . . .

We’ll still be the world’s largest debtor and when members of Congress come here, they’ll be devoting over 20 cents on the dollar to interest payments, more than half of the budget to health care and to other entitlements. And you will come here and deliberate and argue over six or seven cents on the dollar, no matter what America’s problems are. We will not be able to have the independence we need to chart the future that we must and we’ll be terribly dependent on foreign funds for a large portion of our investment.

This budget plan by contrast will, by 1997, cut $140 billion in that year alone from the deficit, a real spending cut, a real revenue increase, a real deficit reduction, using the independent numbers of the Congressional Budget Office. . . .

I know this economic plan is ambitious but I honestly believe it is necessary for the continued greatness of the United States. And I think it is paid for fairly, first by cutting Government, then by asking the most of those who benefited the most in the past and by asking more Americans to contribute today so that all of us can prosper tomorrow. For the wealthiest, those earning more than $180,000 per year, I ask you all who are listening tonight to support a raise in the top rate for federal income taxes from 31 to 36 percent.

We recommend a 10 percent surtax on incomes over $250,000 a year and we recommend closing some loopholes that let some people get away without paying any tax at all.

For businesses with taxable incomes in excess of $10 million, we recommend a rate raise in the corporate tax rate, also [to] 36 percent, as well as a cut in the deduction for business entertainment expenses. Our plan seeks to attack tax subsidies that actually reward companies more for shutting their operations down here and moving them overseas, than for staying here and reinvesting in America. . . .

. . . We will seek to ensure that through effective tax enforcement, foreign corporations who do make money in America simply pay the same taxes that American companies make on the same income.

To middle-class Americans who have paid a great deal for the last 12 years and from whom I ask a contribution tonight, I will say again as I did on Monday night: You’re not going alone anymore, you’re certainly not going first and you’re not going to pay more for less as you have too often in the past.

I want to emphasize the facts about this plan: 98.8 percent of America’s families will have no increase in their income tax rates. Only 1.2 percent at the top.

Let me be clear: There will also be no new cuts in benefits for Medicare. As we move toward the fourth year with the explosion in health-care costs, as I said, projected to account for 50 percent of the growth in the deficit between now and the year 2000, there must be planned cuts in payments to providers – the doctors, the hospitals, the labs – as a way of controlling health-care costs. But I see these only as a stopgap until we can reform the entire health-care system. If you’ll help me do that, we can be fair to the providers and to the consumers of health care. . . .

Secondly, the only change we are making in Social Security is one that has already been publicized: the plan does ask older Americans with higher incomes, who do not rely solely on Social Security to get by, to contribute more. This plan will not affect the 80 percent of Social Security recipients who do not pay taxes on Social Security now. Those who do not pay tax on Social Security now will not be affected by this plan.

Our plan does include a broad-base tax on energy. . . .

Taken together, these measures will cost an American family with an income of about $40,000 a year less than $17 a month. It will cost American families with incomes under $30,000 nothing, because of other programs we propose, principally those raising the earned income tax credit.

Because of our publicly stated determination to reduce the deficit, if we do these things we will see the continuation of what’s happened just since the election. Just since the election, since the Secretary of the Treasury, the director of the Office of Management and Budget and others who have begun to speak out publicly in favor of a tough deficit reduction plan, interest rates have continued to fall long-term.

That means that for the middle class who will pay something more each month, if they have any credit needs or demands, their increased energy costs will be more than offset by lower interest costs for mortgages, consumer loans, credit cards. This can be a wise investment for them and their country now. . . .

Now I ask all of you to consider this: whatever you think of the tax program, whatever you think of the spending cuts – consider the cost of not changing. Remember the numbers that you all know.

If we just keep on doing what we’re doing, by the end of the decade we’ll have a $650 billion a year deficit. If we just keep on doing what we’re doing, by the end of the decade 20 percent of our national income will go to health care every year – twice as much as any other country on the face of the globe. If we just keep on doing what we’re doing, over 20 cents on the dollar will have to go to service the debt.

Unless we have the courage now to start building our future and stop borrowing from it, we’re condemning ourselves to years of stagnation interrupted by occasional recession, to slow growth in jobs, to no more growth in income, to more debt, to more disappointment. Worse, unless we change, unless we increase investment and reduce the debt to raise productivity so that we can generate both jobs and incomes, we will be condemning our children and our children’s children to a lesser life than we enjoy.

Once Americans looked forward to doubling their living standards every 25 years. At present productivity rates it will take a hundred years to double living standards, until our grandchildren’s grandchildren are born. I say that is too long to wait. . . .

My fellow Americans, the test of this plan cannot be “what is in it for me.” It has got to be “what is in it for us.” . . .

There’s so much good, so much possibility, so much excitement in this country now that if we act boldly and honestly, as leaders should, our legacy will be one of prosperity and progress. This must be America’s new direction. Let us summon the courage to seize it.

Thank you. God bless America.

Conversation-based seminars for collegial PD, one-day and multi-day seminars, graduate credit seminars (MA degree), online and in-person.