No related resources

Introduction

May the State of Missouri forbid religious schools from competing for state grants for purchase of playground paving materials? A 7-2 Court majority found no violation of the Establishment Clause by opening competition for state funds to religious schools. Justice Neil Gorsuch urged a broader scope for religious free exercise than Chief Justice John G. Roberts Jr.’s Court opinion might imply. Dissenting Justice Sonia Sotomayor’s view of the Religion Clauses, seemed to come close to restricting religious free exercise to freedom of worship, when state aid is involved. Justice Gorsuch’s concurrence and Justice Sotomayor’s dissent summarized two leading views of the Free Exercise and Establishment Clauses and thus present the principles underlying future clashes. Both opinions presented the facts of the case.

Source: 582 U.S. ___ (2017), https://www.oyez.org/cases/2016/15-577. Footnotes added by the editors are preceded by “Ed. note.”

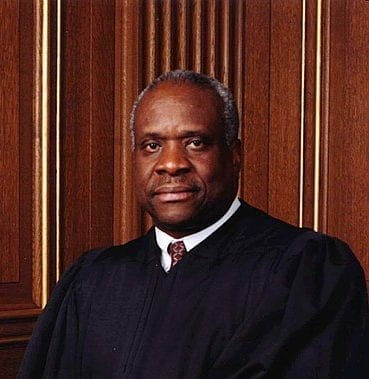

Justice Gorsuch, with whom Justice Thomas joins, concurring in part.

Missouri’s law bars Trinity Lutheran from participating in a public benefits program only because it is a church. I agree this violates the First Amendment and I am pleased to join nearly all of the Court’s opinion. I offer only two modest qualifications.

First, the Court leaves open the possibility a useful distinction might be drawn between laws that discriminate on the basis of religious status and religious use. Respectfully, I harbor doubts about the stability of such a line. Does a religious man say grace before dinner? Or does a man begin his meal in a religious manner? Is it a religious group that built the playground? Or did a group build the playground so it might be used to advance a religious mission? The distinction blurs in much the same way the line between acts and omissions can blur when stared at too long, leaving us to ask (for example) whether the man who drowns by awaiting the incoming tide does so by act (coming upon the sea) or omission (allowing the sea to come upon him). Often enough the same facts can be described both ways.

Neither do I see why the First Amendment’s Free Exercise Clause should care. After all, that clause guarantees the free exercise of religion, not just the right to inward belief (or status). And this Court has long explained that government may not “devise mechanisms, overt or disguised, designed to persecute or oppress a religion or its practices.”[1] Generally the government may not force people to choose between participation in a public program and their right to free exercise of religion. I don’t see why it should matter whether we describe that benefit, say, as closed to Lutherans (status) or closed to people who do Lutheran things (use). It is free exercise either way.

For these reasons, reliance on the status-use distinction does not suffice for me to distinguish Locke v. Davey.[2] In that case, this Court upheld a funding restriction barring a student from using a scholarship to pursue a degree in devotional theology. But can it really matter whether the restriction in Locke was phrased in terms of use instead of status (for was it a student who wanted a vocational degree in religion? or was it a religious student who wanted the necessary education for his chosen vocation?). If that case can be correct and distinguished, it seems it might be only because of the opinion’s claim of a long tradition against the use of public funds for training of the clergy, a tradition the Court correctly explains has no analogue here.

Second and for similar reasons, I am unable to join [Chief Justice Roberts’] footnoted observation that “[t]his case involves express discrimination based on religious identity with respect to playground resurfacing.” Of course the footnote is entirely correct, but I worry that some might mistakenly read it to suggest that only “playground resurfacing” cases, or only those with some association with children’s safety or health, or perhaps some other social good we find sufficiently worthy, are governed by the legal rules recounted in and faithfully applied by the Court’s opinion. Such a reading would be unreasonable for our cases are “governed by general principles, rather than ad hoc improvisations.”[3] And the general principles here do not permit discrimination against religious exercise—whether on the playground or anywhere else.

Justice Sotomayor, with whom Justice Ginsburg joins, dissenting.

To hear the Court tell it, this is a simple case about recycling tires to resurface a playground. The stakes are higher. This case is about nothing less than the relationship between religious institutions and the civil government—that is, between church and state. The Court today profoundly changes that relationship by holding, for the first time, that the Constitution requires the government to provide public funds directly to a church. Its decision slights both our precedents and our history, and its reasoning weakens this country’s longstanding commitment to a separation of church and state beneficial to both. . . .

I

. . . The [Trinity Lutheran] Learning Center serves as “a ministry of the Church and incorporates daily religion and developmentally appropriate activities into . . . [its] program.”[4] In this way, “[t]hrough the Learning Center, the church teaches a Christian world view to children of members of the church, as well as children of non-member residents” of the area. These activities represent the church’s “sincere religious belief . . . to use [the Learning Center] to teach the Gospel to children of its members, as well to bring the Gospel message to non-members.”. . .

. . . Missouri denied the church funding based on Article I, §7, of its state constitution, which prohibits the use of public funds “in aid of any church, sect, or denomination of religion.”

II

Properly understood then, this is a case about whether Missouri can decline to fund improvements to the facilities the church uses to practice and spread its religious views. This Court has repeatedly warned that funding of exactly this kind—payments from the government to a house of worship—would cross the line drawn by the Establishment Clause. . . .

A

The government may not directly fund religious exercise. . . . Put in doctrinal terms, such funding violates the Establishment Clause because it impermissibly “advanc[es] . . . religion.”

Nowhere is this rule more clearly implicated than when funds flow directly from the public treasury to a house of worship. . . . Within its walls, worshippers gather to practice and reaffirm their faith. And from its base, the faithful reach out to those not yet convinced of the group’s beliefs. When a government funds a house of worship, it underwrites this religious exercise. . . .

. . . The church seeks state funds to improve the Learning Center’s facilities, which, by the church’s own avowed description, are used to assist the spiritual growth of the children of its members and to spread the church’s faith to the children of nonmembers. The church’s playground surface—like a Sunday School room’s walls or the sanctuary’s pews—are integrated with and integral to its religious mission. The conclusion that the funding the church seeks would impermissibly advance religion is inescapable.

True, this Court has found some direct government funding of religious institutions to be consistent with the Establishment Clause. But the funding in those cases came with assurances that public funds would not be used for religious activity, despite the religious nature of the institution. The church has not and cannot provide such assurances here. The church has a religious mission, one that it pursues through the Learning Center. The playground surface cannot be confined to secular use any more than lumber used to frame the church’s walls, glass stained and used to form its windows, or nails used to build its altar.

B

The Court may simply disagree with this account of the facts and think that the church does not put its playground to religious use. If so, its mistake is limited to this case. But if it agrees that the state’s funding would further religious activity and sees no Establishment Clause problem, then it must be implicitly applying a rule other than the one agreed to in our precedents. . . .

Today’s opinion suggests the Court has made the leap the Mitchell plurality could not. For if it agrees that the funding here will finance religious activities, then only a rule that considers that fact irrelevant could support a conclusion of constitutionality. The problems of the “secular and neutral” approach have been aired before. It has no basis in the history to which the Court has repeatedly turned to inform its understanding of the Establishment Clause. It permits direct subsidies for religious indoctrination, with all the attendant concerns that led to the Establishment Clause. And it favors certain religious groups, those with a belief system that allows them to compete for public dollars and those well-organized and well-funded enough to do so successfully.

Such a break with precedent would mark a radical mistake. The Establishment Clause protects both religion and government from the dangers that result when the two become entwined, “not by providing every religion with an equal opportunity (say, to secure state funding or to pray in the public schools), but by drawing fairly clear lines of separation between church and state—at least where the heartland of religious belief, such as primary religious [worship], is at issue.”[5]

III

Even assuming the absence of an Establishment Clause violation and proceeding on the Court’s preferred front—the Free Exercise Clause—the Court errs. It claims that the government may not draw lines based on an entity’s religious “status.” But we have repeatedly said that it can. When confronted with government action that draws such a line, we have carefully considered whether the interests embodied in the Religion Clauses justify that line. The question here is thus whether those interests support the line drawn in Missouri’s Article I, §7, separating the state’s treasury from those of houses of worship. They unquestionably do.

A

The Establishment Clause prohibits laws “respecting an establishment of religion” and the Free Exercise Clause prohibits laws “prohibiting the free exercise thereof.” Even in the absence of a violation of one of the Religion Clauses, the interaction of government and religion can raise concerns that sound in both clauses. For that reason, the government may sometimes act to accommodate those concerns, even when not required to do so by the Free Exercise Clause, without violating the Establishment Clause. And the government may sometimes act to accommodate those concerns, even when not required to do so by the Establishment Clause, without violating the Free Exercise Clause. “[T]here is room for play in the joints productive of a benevolent neutrality which will permit religious exercise to exist without sponsorship and without interference.”[6] This space between the two clauses gives government some room to recognize the unique status of religious entities and to single them out on that basis for exclusion from otherwise generally applicable laws.

Invoking this principle, this Court has held that the government may sometimes relieve religious entities from the requirements of government programs. A state need not, for example, require nonprofit houses of worship to pay property taxes. It may instead “spar[e] the exercise of religion from the burden of property taxation levied on private profit institutions” and spare the government “the direct confrontations and conflicts that follow in the train of those legal processes” associated with taxation.[7] Nor must a state require nonprofit religious entities to abstain from making employment decisions on the basis of religion. It may instead avoid imposing on these institutions a “[f]ear of potential liability [that] might affect the way” it “carried out what it understood to be its religious mission” and on the government the sensitive task of policing compliance.[8] But the government may not invoke the space between the Religion Clauses in a manner that “devolve[s] into an unlawful fostering of religion.”[9]

Invoking this same principle, this Court has held that the government may sometimes close off certain government aid programs to religious entities. The state need not, for example, fund the training of a religious group’s leaders, those “who will preach their beliefs, teach their faith, and carry out their mission.”[10] It may instead avoid the historic “antiestablishment interests” raised by the use of “taxpayer funds to support church leaders.”[11]

When reviewing a law that, like this one, singles out religious entities for exclusion from its reach, we thus have not myopically focused on the fact that a law singles out religious entities, but on the reasons that it does so.

B

Missouri has decided that the unique status of houses of worship requires a special rule when it comes to public funds. Its Constitution reflects that choice and provides:

That no money shall ever be taken from the public treasury, directly or indirectly, in aid of any church, sect, or denomination of religion, or in aid of any priest, preacher, minister or teacher thereof, as such; and that no preference shall be given to nor any discrimination made against any church, sect or creed of religion, or any form of religious faith or worship.” Art. I, §7.

Missouri’s decision, which has deep roots in our nation’s history, reflects a reasonable and constitutional judgment.

This Court has consistently looked to history for guidance when applying the Constitution’s Religion Clauses. Those clauses guard against a return to the past, and so that past properly informs their meaning. This case is no different.

This nation’s early experience with, and eventual rejection of, established religion—shorthand for “sponsorship, financial support, and active involvement of the sovereign in religious activity,”[12]—defies easy summary. [There follows a summary of the Founders’ views and of recent Court decisions that the justice claims support this rejection.] . . . At bottom, the Court creates the following rule today: The government may draw lines on the basis of religious status to grant a benefit to religious persons or entities but it may not draw lines on that basis when doing so would further the interests the Religion Clauses protect in other ways. Nothing supports this lopsided outcome. Not the Religion Clauses, as they protect establishment and free exercise interests in the same constitutional breath, neither privileged over the other. Not precedent, since we have repeatedly explained that the clauses protect not religion but “the individual’s freedom of conscience,”[13]—that which allows him to choose religion, reject it, or remain undecided. And not reason, because as this case shows, the same interests served by lifting government-imposed burdens on certain religious entities may sometimes be equally served by denying government-provided benefits to certain religious entities. . . .

On top of all of this, the Court’s application of its new rule here is mistaken. In concluding that Missouri’s Article I, §7, cannot withstand strict scrutiny, the Court describes Missouri’s interest as a mere “policy preference for skating as far as possible from religious establishment concerns.” The constitutional provisions of thirty-nine states—all but invalidated today—the weighty interests they protect, and the history they draw on deserve more than this judicial brush aside.

Today’s decision discounts centuries of history and jeopardizes the government’s ability to remain secular. Just three years ago, this Court claimed to understand that, in this area of law, to “sweep away what has so long been settled would create new controversy and begin anew the very divisions along religious lines that the Establishment Clause seeks to prevent.”[14] It makes clear today that this principle applies only when preference suits.

IV

The Religion Clauses of the First Amendment contain a promise from our government and a backstop that disables our government from breaking it. The Free Exercise Clause extends the promise. We each retain our inalienable right to “the free exercise” of religion, to choose for ourselves whether to believe and how to worship. And the Establishment Clause erects the backstop. Government cannot, through the enactment of a “law respecting an establishment of religion,” start us down the path to the past, when this right was routinely abridged.

The Court today dismantles a core protection for religious freedom provided in these clauses. It holds not just that a government may support houses of worship with taxpayer funds, but that—at least in this case and perhaps in others—it must do so whenever it decides to create a funding program. History shows that the Religion Clauses separate the public treasury from religious coffers as one measure to secure the kind of freedom of conscience that benefits both religion and government. If this separation means anything, it means that the government cannot, or at the very least need not, tax its citizens and turn that money over to houses of worship. The Court today blinds itself to the outcome this history requires and leads us instead to a place where separation of church and state is a constitutional slogan, not a constitutional commitment. I dissent.

- 1. Ed. note: Church of Lukumi Babalu Aye, Inc. v. Hialeah

- 2. Ed. note: Locke v. Davey

- 3. Ed. note: Elk Grove Unified School Dist. v. Newdow, https://www.law.cornell.edu/supct/html/02-1624.ZO.html

- 4. Ed. note: Justice Sotomayor cites “Our Story,” http://www.trinity-lcms.org/story.

- 5. Ed. note: Zelman v. Simmons-Harris

- 6. Walz v. Tax Commission of the City of New York, 397 U. S., (1970) at 669.

- 7. Walz, 397 U. S., at 673–674.

- 8. Corporation of Presiding Bishop of Church of Jesus Christ of Latter-day Saints v. Amos, 483 U. S. 327, 336 (1987)

- 9. Cutter v. Wilkinson, 544 U. S. 709, 714 (2005)

- 10. Hosanna-Tabor, 597 F. 3d 769 (2012)

- 11. Locke v. Davey, 540 U. S. 712, 722 (2004).

- 12. Walz, 397 U. S., at 668

- 13. Wallace v. Jaffree, 472 U.S., at 50

- 14. Town of Greece v. Galloway, 572 U. S. ___, ___ (2014).

Conversation-based seminars for collegial PD, one-day and multi-day seminars, graduate credit seminars (MA degree), online and in-person.