No related resources

Introduction

The Court, in a 5-4 vote, upheld a Cleveland program providing financial assistance in the form of vouchers to parents of children in low-performing schools districts, enabling them to attend other schools, including private, religious ones. The Court opinion and the dissenters disagreed over whether this case marks an overthrow of the first school aid cases (see Everson v. Board of Education, and McCollum v. Board of Education,) which had proclaimed a “wall of separation between church and state,” whose slightest breach constituted a violation of the Establishment Clause.

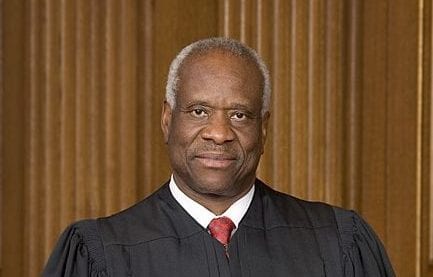

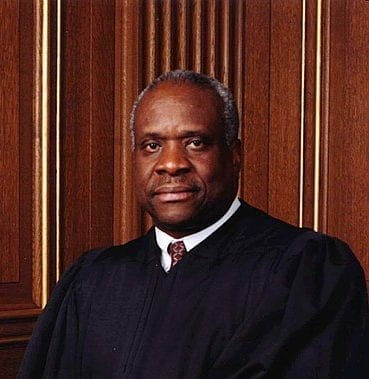

Source: 536 U.S. 639 (2002) https://www.law.cornell.edu/supct/html/00-1751.ZS.html. We omit Chief Justice William H. Rehnquist’s opinion for the court, the concurrences by Justices Sandra Day O’Connor and Clarence Thomas, and the dissents of Justices John Paul Stevens and Stephen G. Breyer. We present excerpts from Justice David H. Souter’s dissent for its recapitulation of establishment clause reasoning. It and the Chief Justice’s opinion differed on the facts and analysis of statistics. Footnotes added by the editors are preceded by “Ed. note.”

Justice Souter, with whom Justice Stevens, Justice Ginsburg, and Justice Breyer join, dissenting.

The Court’s majority holds that the Establishment Clause is no bar to Ohio’s payment of tuition at private religious elementary and middle schools under a scheme that systematically provides tax money to support the schools’ religious missions. The occasion for the legislation thus upheld is the condition of public education in the city of Cleveland. The record indicates that the schools are failing to serve their objective, and the vouchers in issue here are said to be needed to provide adequate alternatives to them. If there were an excuse for giving short shrift to the Establishment Clause, it would probably apply here. But there is no excuse. Constitutional limitations are placed on government to preserve constitutional values in hard cases, like these. . . . I therefore respectfully dissent.

The applicability of the Establishment Clause to public funding of benefits to religious schools was settled in Everson v. Board of Ed. of Ewing,[1] which inaugurated the modern era of establishment doctrine. The Court stated the principle in words from which there was no dissent:

“No tax in any amount, large or small, can be levied to support any religious activities or institutions, whatever they may be called, or whatever form they may adopt to teach or practice religion.” The Court has never in so many words repudiated this statement, let alone, in so many words, overruled Everson.

Today, however, the majority holds that the Establishment Clause is not offended by Ohio’s Pilot Project Scholarship Program, under which students may be eligible to receive as much as $2,250 in the form of tuition vouchers transferable to religious schools. In the city of Cleveland the overwhelming proportion of large appropriations for voucher money must be spent on religious schools if it is to be spent at all, and will be spent in amounts that cover almost all of tuition. The money will thus pay for eligible students’ instruction not only in secular subjects but in religion as well, in schools that can fairly be characterized as founded to teach religious doctrine and to imbue teaching in all subjects with a religious dimension. Public tax money will pay at a systemic level for teaching the covenant with Israel and Mosaic law in Jewish schools, the primacy of the Apostle Peter and the Papacy in Catholic schools, the truth of reformed Christianity in Protestant schools, and the revelation to the Prophet in Muslim schools, to speak only of major religious groupings in the republic.

How can a Court consistently leave Everson on the books and approve the Ohio vouchers? The answer is that it cannot. It is only by ignoring Everson that the majority can claim to rest on traditional law in its invocation of neutral aid provisions and private choice to sanction the Ohio law. It is, moreover, only by ignoring the meaning of neutrality and private choice themselves that the majority can even pretend to rest today’s decision on those criteria.

I

The majority’s statements of Establishment Clause doctrine cannot be appreciated without some historical perspective on the Court’s announced limitations on government aid to religious education, and its repeated repudiation of limits previously set. My object here is not to give any nuanced exposition of the cases, which I tried to classify in some detail in an earlier opinion, see Mitchell v. Helms, 530 U.S. 793, 873–899 (2000) (dissenting opinion), but to set out the broad doctrinal stages covered in the modern era, and to show that doctrinal bankruptcy has been reached today.

Viewed with the necessary generality, the cases can be categorized in three groups. In the period from 1947 to 1968, the basic principle of no aid to religion through school benefits was unquestioned. Thereafter for some 15 years, the Court termed its efforts as attempts to draw a line against aid that would be divertible to support the religious, as distinct from the secular, activity of an institutional beneficiary. Then, starting in 1983, concern with divertibility was gradually lost in favor of approving aid in amounts unlikely to afford substantial benefits to religious schools, when offered evenhandedly without regard to a recipient’s religious character, and when channeled to a religious institution only by the genuinely free choice of some private individual. Now, the three stages are succeeded by a fourth, in which the substantial character of government aid is held to have no constitutional significance, and the espoused criteria of neutrality in offering aid, and private choice in directing it, are shown to be nothing but examples of verbal formalism. . . .

II

Although it has taken half a century since Everson to reach the majority’s twin standards of neutrality and free choice, the facts show that, in the majority’s hands, even these criteria cannot convincingly legitimize the Ohio scheme. . . .

. . . .

B

The majority addresses the issue of choice the same way it addresses neutrality, by asking whether recipients or potential recipients of voucher aid have a choice of public schools among secular alternatives to religious schools. Again, however, the majority asks the wrong question and misapplies the criterion. The majority has confused choice in spending scholarships with choice from the entire menu of possible educational placements, most of them open to anyone willing to attend a public school. . . .

There is, in any case, no way to interpret the 96.6% of current voucher money going to religious schools as reflecting a free and genuine choice by the families that apply for vouchers. The 96.6% reflects, instead, the fact that too few nonreligious school desks are available and few but religious schools can afford to accept more than a handful of voucher students. And contrary to the majority’s assertion, public schools in adjacent districts hardly have a financial incentive to participate in the Ohio voucher program, and none has. For the overwhelming number of children in the voucher scheme, the only alternative to the public schools is religious. And it is entirely irrelevant that the state did not deliberately design the network of private schools for the sake of channeling money into religious institutions. The criterion is one of genuinely free choice on the part of the private individuals who choose, and a Hobson’s choice is not a choice, whatever the reason for being Hobsonian.[2]

III

I do not dissent merely because the majority has misapplied its own law, for even if I assumed arguendo[3] that the majority’s formal criteria were satisfied on the facts, today’s conclusion would be profoundly at odds with the Constitution. Proof of this is clear on two levels. The first is circumstantial, in the now discarded symptom of violation, the substantial dimension of the aid. The second is direct, in the defiance of every objective supposed to be served by the bar against establishment.

A

The scale of the aid to religious schools approved today is unprecedented, both in the number of dollars and in the proportion of systemic school expenditure supported. . . .

The Cleveland voucher program has cost Ohio taxpayers $33 million since its implementation in 1996 ($28 million in voucher payments, $5 million in administrative costs), and its cost was expected to exceed $8 million in the 2001–2002 school year. These tax-raised funds are on top of the textbooks, reading and math tutors, laboratory equipment, and the like that Ohio provides to private schools, worth roughly $600 per child.

The gross amounts of public money contributed are symptomatic of the scope of what the taxpayers’ money buys for a broad class of religious-school students. In paying for practically the full amount of tuition for thousands of qualifying students, the scholarships purchase everything that tuition purchases, be it instruction in math or indoctrination in faith. The consequences of “substantial” aid hypothesized in Meek[4] are realized here: the majority makes no pretense that substantial amounts of tax money are not systematically underwriting religious practice and indoctrination.

B

It is virtually superfluous to point out that every objective underlying the prohibition of religious establishment is betrayed by this scheme, but something has to be said about the enormity of the violation. I anticipated these objectives earlier in discussing Everson, which cataloged them, the first being respect for freedom of conscience. Jefferson described it as the idea that no one “shall be compelled to … support any religious worship, place, or ministry whatsoever,” A Bill for Establishing Religious Freedom, even a “teacher of his own religious persuasion” and Madison thought it violated by any “authority which can force a citizen to contribute three pence . . . of his property for the support of any . . . establishment.” Memorial and Remonstrance. “Any tax to establish religion is antithetical to the command that the minds of men always be wholly free.” Mitchell, 530 U.S., at 871 (Souter, J., dissenting). Madison’s objection to three pence has simply been lost in the majority’s formalism.

As for the second objective, to save religion from its own corruption, Madison wrote of the “experience . . . that ecclesiastical establishments, instead of maintaining the purity and efficacy of Religion, have had a contrary operation.” Memorial and Remonstrance. In Madison’s time, the manifestations were “pride and indolence in the clergy; ignorance and servility in the laity[,] in both, superstition, bigotry and persecution;” in the 21st century, the risk is one of “corrosive secularism” to religious schools and the specific threat is to the primacy of the schools’ mission to educate the children of the faithful according to the unaltered precepts of their faith. Even “[t]he favored religion may be compromised as political figures reshape the religion’s beliefs for their own purposes; it may be reformed as government largesse brings government regulation.” Lee v. Weisman, 505 U.S. 577, 608 (1992) (Blackmun, J., concurring).

The risk is already being realized. In Ohio, for example, a condition of receiving government money under the program is that participating religious schools may not “discriminate on the basis of . . . religion,” which means the school may not give admission preferences to children who are members of the patron faith; children of a parish are generally consigned to the same admission lotteries as non-believers. This indeed was the exact object of a 1999 amendment repealing the portion of a predecessor statute that had allowed an admission preference for “[c]hildren . . . whose parents are affiliated with any organization that provides financial support to the school, at the discretion of the school.” Nor is the state’s religious antidiscrimination restriction limited to student admission policies: by its terms, a participating religious school may well be forbidden to choose a member of its own clergy to serve as teacher or principal over a layperson of a different religion claiming equal qualification for the job. Indeed, a separate condition that “[t]he school . . . not . . . teach hatred of any person or group on the basis of . . . religion” could be understood (or subsequently broadened) to prohibit religions from teaching traditionally legitimate articles of faith as to the error, sinfulness, or ignorance of others, if they want government money for their schools.

For perspective on this foot-in-the-door of religious regulation, it is well to remember that the money has barely begun to flow. . . .

When government aid goes up, so does reliance on it; the only thing likely to go down is independence. . . . A day will come when religious schools will learn what political leverage can do, just as Ohio’s politicians are now getting a lesson in the leverage exercised by religion.

Increased voucher spending is not, however, the sole portent of growing regulation of religious practice in the school, for state mandates to moderate religious teaching may well be the most obvious response to the third concern behind the ban on establishment, its inextricable link with social conflict. As appropriations for religious subsidy rise, competition for the money will tap sectarian religion’s capacity for discord. . . .

Justice Breyer has addressed this issue in his own dissenting opinion, which I join, and here it is enough to say that the intensity of the expectable friction can be gauged by realizing that the scramble for money will energize not only contending sectarians, but taxpayers who take their liberty of conscience seriously. Religious teaching at taxpayer expense simply cannot be cordoned from taxpayer politics, and every major religion currently espouses social positions that provoke intense opposition. Not all taxpaying Protestant citizens, for example, will be content to underwrite the teaching of the Roman Catholic Church condemning the death penalty. Nor will all of America’s Muslims acquiesce in paying for the endorsement of the religious Zionism taught in many religious Jewish schools, which combines “a nationalistic sentiment” in support of Israel with a “deeply religious” element. Nor will every secular taxpayer be content to support Muslim views on differential treatment of the sexes, or, for that matter, to fund the espousal of a wife’s obligation of obedience to her husband, presumably taught in any schools adopting the articles of faith of the Southern Baptist Convention. Views like these, and innumerable others, have been safe in the sectarian pulpits and classrooms of this nation not only because the Free Exercise Clause protects them directly, but because the ban on supporting religious establishment has protected free exercise, by keeping it relatively private. With the arrival of vouchers in religious schools, that privacy will go, and along with it will go confidence that religious disagreement will stay moderate.

. . .

If the divisiveness permitted by today’s majority is to be avoided in the short term, it will be avoided only by action of the political branches at the state and national levels. Legislatures not driven to desperation by the problems of public education may be able to see the threat in vouchers negotiable in sectarian schools. Perhaps even cities with problems like Cleveland’s will perceive the danger, now that they know a federal court will not save them from it.

My own course as a judge on the Court cannot, however, simply be to hope that the political branches will save us from the consequences of the majority’s decision. Everson’s statement is still the touchstone of sound law, even though the reality is that in the matter of educational aid the Establishment Clause has largely been read away. True, the majority has not approved vouchers for religious schools alone, or aid earmarked for religious instruction. But no scheme so clumsy will ever get before us, and in the cases that we may see, like these, the Establishment Clause is largely silenced. I do not have the option to leave it silent, and I hope that a future Court will reconsider today’s dramatic departure from basic Establishment Clause principle.

- 1. Ed. note: Engel v. Vitale

- 2. Ed. note: A Hobson’s choice is one in which the choice is between something and nothing. The phrase is thought to have originated from the practice of a stable owner named Hobson, who would offer customers the horse near the stable door or none at all.

- 3. Ed. note: for the sake of argument

- 4. Meek v. Pittenger, 421 U.S. 349 (1975)

Speech to the American Enterprise Institute

February 26, 2003

Conversation-based seminars for collegial PD, one-day and multi-day seminars, graduate credit seminars (MA degree), online and in-person.