No related resources

Introduction

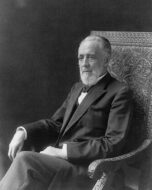

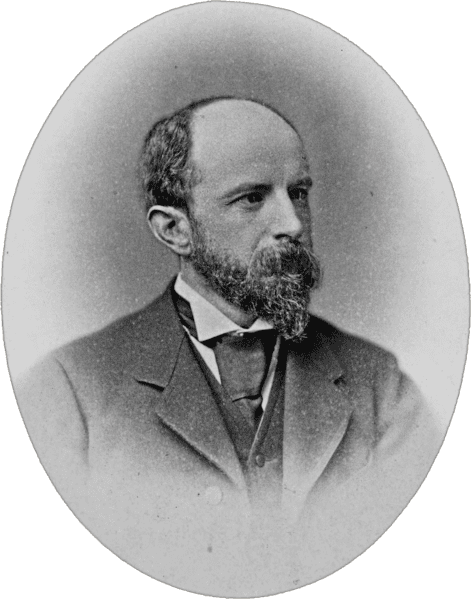

Richard T. Ely (1854–1943), a widely influential progressive economist, was a prolific scholar, public intellectual, social activist, and founder of the American Economic Association. A faculty member at Johns Hopkins University, Ely received his Ph.D. from the University of Heidelberg, Germany, where he came to embrace the historical school of economics, which suggested that economic behavior is best understood in terms of historical circumstance and development rather than abstract principles or transhistorical truths. Often associated with the Social Gospel movement, Ely frequently suggested that socialism ought to be given a fair hearing in the American academy and in the court of public opinion.

In the article reprinted here, Ely argued that short of the single tax, a tax only on landholdings (see Progress and Poverty), there were several means by which progressive reformers might seek to level the economic playing field and bring about a wider distribution of wealth in American society. In addition to education, trust busting, and the public ownership of certain utilities and modes of transportation and communication, Ely proposed the reform of inheritance laws. The latter was Ely’s main subject here, and he argued that liberal, individualistic notions of private property rights and contracts place no hard theoretical or moral limits on inheritance taxes and reform. He insisted that the community as a whole had a reasonable claim to an individual’s inherited wealth, and that wealth might then be used to fund a number of public projects aimed at promoting the common good.

Source: Richard T. Ely, “The Inheritance of Property,” North American Review 153, no. 146 (July 1891): 54–66, available online at the Hathi Trust Digital Library: https://babel.hathitrust.org/cgi/pt?id=hvd.32044092623693&view=1up&seq=62.

The chief modern industrial problem is often stated to be the distribution of property. What is wanted is widely diffused property, and it is desired to bring about this wide diffusion without injustice, and without injury to the springs of economic activity.

Many proposals are brought forward which aim to produce a more general prosperity. Two of the best known are the single tax and socialism.[1] These, however, apart from all other considerations, encounter the strongest obstacles to their introduction because they are so averse to powerful private interests. Wise social reform will always seek for the line of least resistance. It is granted that the end proposed by socialism and the single tax is desirable in so far as it contemplates a wide distribution of wealth; but before committing ourselves to any extreme doctrines it is well to ask, What can be done without radical change?—in other words, what can we accomplish in order to ameliorate the condition of the masses without departure from the fundamental principles of the existing social order? When we reflect upon it, we find that there are many things, and that these are quite sufficient to occupy the thoughts and energies of well-wishers of their kind for a long time to come. At the present time I feel inclined to classify the chief things required to bring about an improved condition of society in the United States under three heads, namely:

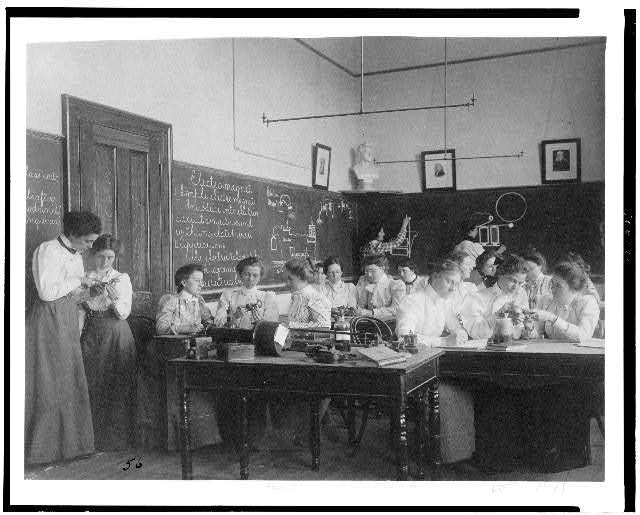

First—Education in its broadest sense, including kindergartens, manual training, technical schools, colleges, and universities.

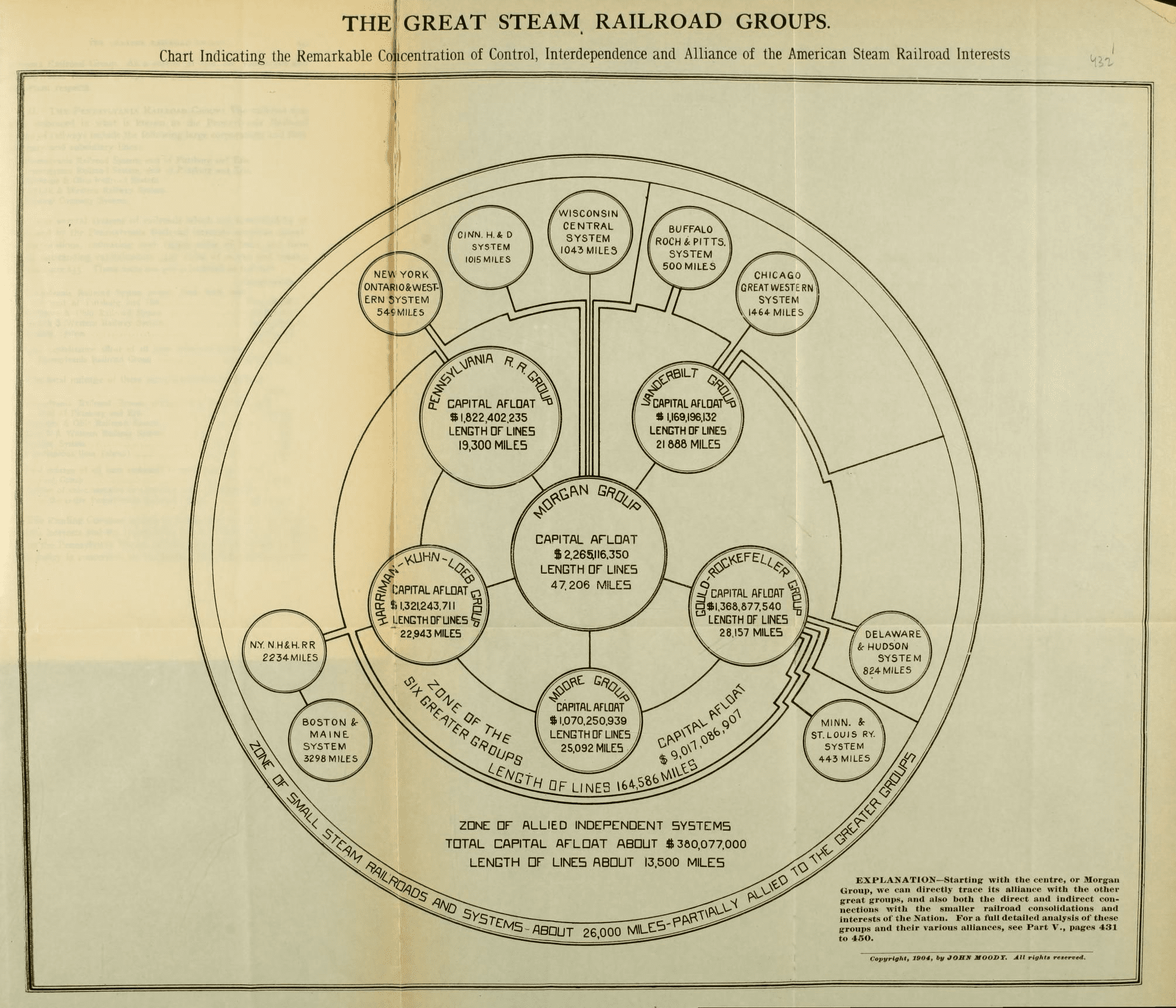

Second—The abolition of private monopoly, and the substitution therefor of public ownership and management of all those enterprises which are by nature monopolies, like railways, gas and electric-lighting businesses, telegraphs, telephones, etc.

Third—A reform of the laws of inheritance.

What can be done by a regulation of inheritance to change the distribution of property, and consequently of the opportunities and income which property yields? Once in a generation nearly all property changes owners, and that gives opportunity for bringing about the greatest changes within half a century. There is a perpetual flow of property from the dead to the living, and it is possible by means of law to exercise much influence over this current. When we attempt to bring about reform and improvement by a wise regulation of inheritance, we have a solid basis of experience to help us. One part of such legislation which naturally suggests itself is the taxation of the estates of decedents, and such estates are taxed to a greater or less extent in nearly all—perhaps in all—great modern nations. We may mention England, Australia, New Zealand, and Switzerland as countries with particularly instructive experience in the taxation of inheritances. Pennsylvania, New York, and Maryland in the United States have experience which is valuable as far as it goes. Three of the countries named, Australia, New Zealand, and Switzerland, have taxation of inheritances, which amounts to a conscious attempt to influence the distribution of property.

Someone may interrupt at this point with the objection, “You are proposing measures which impair the rights of private property.” The objection is not valid. The right of inheritance is one right, and the right of private property is another and a distinct right. He has made but little progress in the fundamental principles of jurisprudence who does not see how clearly separated are these two rights. The right of property means an exclusive right of control over a thing, but the right of inheritance means the transfer of this right in one manner or another. If there is no will, it means the right of someone to succeed to property, and this right is a product of positive law. If a will is made, the right of inheritance means not an exclusive right of control vested in a person, but the right of a person to say who shall exercise the right of property over things which were his while he was living, after he is dead, and, consequently, after he has lost all rights of property, because the dead have no proprietary rights whatever. Blackstone in his Commentaries on the Laws of England clearly discriminates between the rights of property and the rights which we lump together under the designation “inheritance.” He says:

Naturally speaking, the instant a man ceases to be, he ceases to have any dominion: else if he had a right to dispose of his acquisitions one moment beyond his life he would also have a right to direct their disposal for a million of ages after him, which would be highly absurd and inconvenient. All property must, therefore, cease upon death, considering men as absolute individuals unconnected with civil society. . . . Wills, therefore, and testaments, rights of inheritance and succession, are all of them creatures of the civil or municipal laws, and accordingly are in all respects regulated by them; every distinct country having distinct ceremonies and requisites to make a testament completely valid; neither does anything vary more than the right of inheritance under different national establishments.[2]

Blackstone says it is an erroneous principle to suppose that “the son has by nature a right to succeed to his father’s lands,” or that the owner “is by nature entitled to direct the succession of his property after his own decease.”[3]

The right of property in itself is not an unlimited one, but is limited and regulated to an increasing extent by all modern nations. . . . But when we come to the claim that my right of disposing of property by last will and testament is practically unlimited, it means not only my right to regulate the use of certain portions of the earth’s surface, or claims to certain portions of other valuable things in this earth, during my lifetime, but for all future time. There are those, indeed, who go so far as to hold that a man may establish certain regulations for the use of property after he is dead and gone, and that these regulations must be binding upon all future generations. Could any claim be more monstrous? It is in itself the extremest radicalism. We may say, in fact, that it is the furthest reach which radicalism has yet attained. . . .

When no will is made, the rule according to which property is divided among wife and children in this country is, perhaps, tolerably satisfactory; but suppose a man dies making no will, and has only collateral relatives: what should be their legal claim upon the estate? The modern laws which provide that even distant relatives may inherit the property of intestates are survivals of an earlier period, when large family groups lived together and formed a kind of a family partnership under the authority of the patriarch. When a man died under such circumstances, it was only natural that his property should pass to the family or the clan, itself but a larger family, for all were united together by the ties of interest and affection. There was a correspondence between rights and duties. But what is the case at the present time? The peculiar ties which bind together distant relatives are practically unworthy of consideration. Rights and duties ought to be coordinate, but distant relatives recognize no special duties toward one another, and do not think about their common relationship unless there is some property to be inherited from a distant rich relative, for whom they care nothing. In the absence of a will, there is positively no reason whatever why anyone should inherit from a third cousin. The family reason does not cover the case, because family feeling does not in our day extend so far, and, indeed, there is no reason why it should. . . .

All inheritances of every sort should be taxed, provided the share of an heir exceeds a certain amount. The state or the local political unit—as town or city—must be recognized as a co-heir entitled to a share in all inheritances. A man is made what he is by family, by town, or the local political circle which surrounds him, and by the state in which he lives, and all have claims which ought to be recognized. Taxation of inheritance is the means whereby this claim of the state and town may secure recognition. It should, however, be borne in mind that it is a peculiar tax, and rests upon a different basis from the ordinary tax. The justification which appeals to me most strongly is that the political organisms are co-heirs. There are, however, many different standpoints from which the taxation of inheritances can be justified. Property which comes by inheritance is an income received without toil. It is for the one receiving it an unearned increment of property, and on this account may properly be taxed. The most satisfactory basis upon which property can rest is personal toil and exertion of some kind, and when property comes otherwise than as a return for social service, a special tax finds a good solid basis in justice.

It generally happens, perhaps universally, that a large property does not pay its fair share of taxes during the lifetime of its owner, and the tax upon estates when their owners die may be regarded—if it is not too large—as a payment of back taxes. It is notorious with us that personal property bears relatively a very small proportion of the burdens of government, and it has been proposed that the ordinary property tax on personal property should be abolished, and that in the place thereof there should be substituted a tax on all estates of decedents in so far as they consist of personal property. These, however, are grounds only for a limited tax, which in the case of personal property ought to be added to the regular inheritance tax, if personal property is otherwise exempted from taxation.

The taxation of inheritances should be graduated, the tax increasing as the relationship becomes more distant, and as the property becomes larger. This is in the line of the present development of taxation of inheritances. . . .

The use to be made of the funds acquired by the taxation of inheritances, and by establishing the co-heirship of town and state, must vary according to time and place. . . . In cases of cities, towns, and states weighed down with debt, the payment of bonds would be an excellent employment of the funds. In case taxes are extraordinarily high and are weighing down industry, the tax rate might be reduced. I think, however, that there are very few places in the United States where a properly developed tax system would not provide for all present expenditures of government without overburdening anyone. But there are great improvements which it is desirable to carry out, and these funds could be used to effect improvements which cost too much to be defrayed out of the ordinary taxation.

The states of the Union, and many of the towns, ought to go into forestry, purchasing large tracts of land, especially on mountains and along river courses, and covering these with trees. States and cities have allowed the ownership of valuable public works to slip away from them into the hands of private corporations. Waterworks, gasworks, streetcar lines, and the like might be purchased and operated at cost. All great cities require a larger number of parks, especially of small parks in the crowded sections. Sanitary measures may be mentioned, and some of these are expensive. They, however, lower the death rate and improve the health of the community. There are many cities which ought to buy slums and tear down the houses in them. The city of Manchester, England, bought quite a large tract of land in the center of the city, which was the worst slum region in it, and tore down all the houses. It then leased the land for a limited term of years, to be built up with houses according to plans and specifications laid down. The result has been a remarkable improvement in Manchester, and it is said that, when these leases fall in, Manchester will be one of the richest, if not the richest, municipal corporation in the world. London has recently decided to undertake a similar improvement, but it is stated that in the case of London this will involve great expense.

School funds ought to be increased until they become great enough, with the aid of current taxation, to provide the entire population with the best educational facilities of every sort, including manual training, kindergartens, public libraries, universities, industrial museums, art galleries, and the like. It would be especially desirable to improve the schools in the rural communities, establishing good high schools wherever the population is sufficient to furnish them with pupils. Good schools in the country districts would tend to keep people in the country, for now many leave the country and go to the cities purposely to educate their children. It is on every account desirable to make the country pleasanter and more attractive as a place of abode. Another fund may be suggested as suitable to be accumulated out of property inherited by the state and town, and that would be a highway fund, designed to help to improve the streets and roads of the state. The income of this fund could be distributed to towns and counties in such a manner as to encourage them in the improvement of roads and streets. It might be provided, for example, that for every two or three dollars expended by the local political unit one should be granted from the fund.

I believe the line of reform proposed in this article will stand every test which can be applied to it. It is, as already mentioned, a reform which meets with approval wherever tried, and with increasing approval the longer it is tried. It is a reform especially in keeping with democratic institutions, and it has succeeded best in democratic countries. So perfectly is it in keeping with true democracy that the purer, the more complete, and the more cultured the democratic countries have become in which this reform has been tried, the more they are inclined to move further along the same line. It is entirely compatible with the fundamental principles of the existing social order, and does not interfere with its normal and peaceful evolution. It antagonizes no other line of progress, but helps forward every other true reform. It provides ample public funds when accompanied by a rational system of taxation, and yet lays a burden heavy to be borne on no one.

We may examine this reform of the laws of inheritance with respect to the family, and we find that it tends to the development of the family as an institution far better than the existing laws in the United States. It recognizes the solidarity of the family. The husband is responsible to the wife and the wife to the husband, and both are responsible for the children they have brought into the world. It coordinates rights and duties. It may be stated, however, in this connection that duty should be extended among the various members of a family; in particular the reciprocal duties of parents and children should be sharpened and strengthened. The duty of support—and adequate support in proportion to means—should apply both to parents and to children, parents supporting the children in their youth, and children the parents in their old age. The various members of the family organism should be drawn together by an extension of duties. It may be questioned whether anyone should have the right to inherit from a person provided he may not under any circumstances be called upon to minister to his support. As Emerson and the other great thinkers have long been saying, it is time now to stop talking so much about rights, and to begin to emphasize duties.[4]

If we look at this reform from the standpoint of society, we find that it stands every test to which it can be subjected. It diffuses property widely and results in a great number of families with an ample competence, and tends to prevent the growth of plutocracy. It is these families with a competence lifting them above a severe struggle for bare physical necessities that carry forward the world’s civilization. It is from these families that the great leaders of men come, and not from either of the two extremes of society, the very rich or the very poor, both of which extremes we wish to abolish. Excessive wealth discourages exertion, but a suitable reform of the laws of inheritance will remove from us many idle persons who consume annually immense quantities of wealth but contribute nothing to the support of the race; and who, leading idle lives, cultivate bad ideals and disseminate social poison. For the sake of the sons of the rich, as well as for the sake of the sons of the poor, we need a reform of the laws of inheritance.

A reform of the laws of inheritance of property will help us to approach that ideal condition in which the man who does not work shall not eat, and it will also tend to an equalization of opportunities so as to give all a fairer start in life, allowing each one to make such use of his opportunities as his capacity and diligence permit, and thus rendering inequalities, economic and social, less odious and injurious, more stimulating and helpful. This reform tends to make income a reward for service, thus realizing in a higher degree than at present the demands of justice. It must tend indirectly to discourage idleness and to encourage industry, and to repress that gambling, speculative spirit which desires something for nothing and wants to get a living without rendering an honest return of some kind.

- 1. On the single tax, see the introduction to Progress and Poverty in this volume.

- 2. See William Blackstone, Commentaries on the Laws of England, book II, chapter 1, “Of Property, in General.”

- 3. Blackstone, Commentaries, “Of Property, in General.”

- 4. New England transcendentalist Ralph Waldo Emerson (1803–1882).

Annual Message to Congress (1891)

December 09, 1891

Conversation-based seminars for collegial PD, one-day and multi-day seminars, graduate credit seminars (MA degree), online and in-person.