No related resources

Introduction

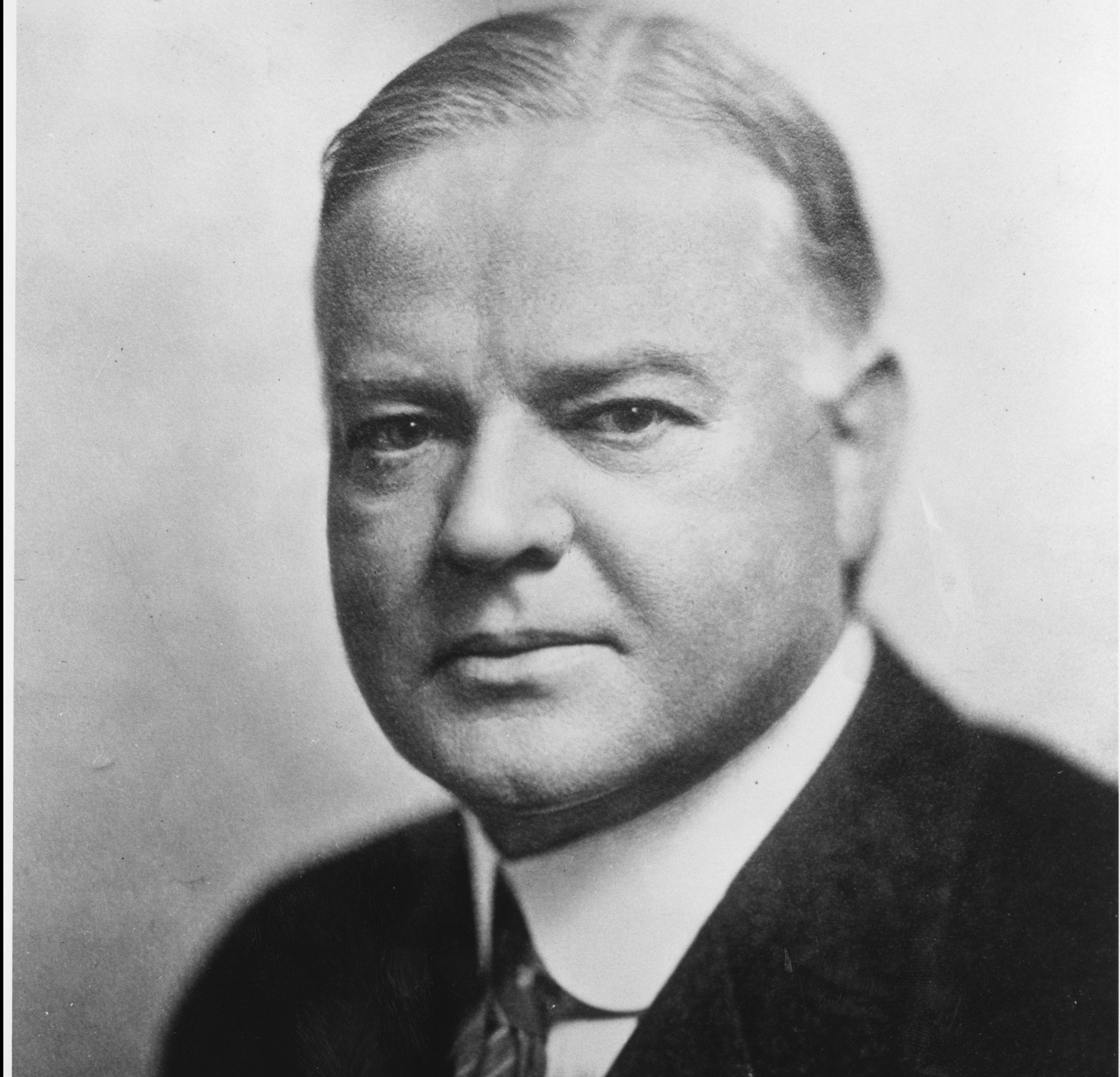

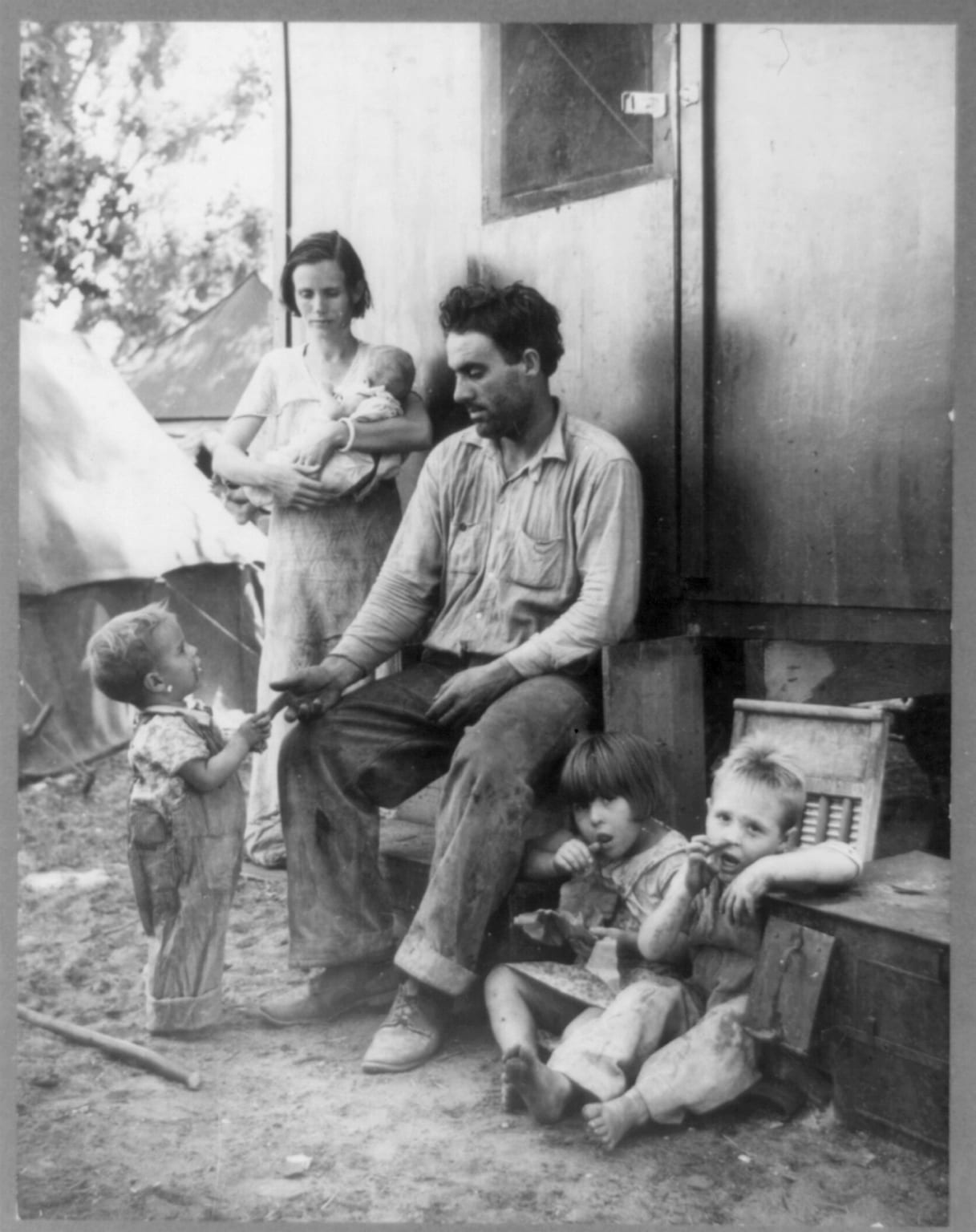

Although the economy showed some signs of improvement in early 1931, developments in Europe – the collapse of several major banks, followed by Great Britain’s decision to leave the gold standard – brought another plunge in wholesale prices, and another surge in unemployment. Several of Hoover’s closest advisers began to warn him that direct federal intervention was necessary in order to prevent complete financial chaos. Toward the end of the year, therefore, the president and his staff formulated a series of proposals aimed at restoring economic confidence. At the heart of the program was his call for the creation of a Reconstruction Finance Corporation, an agency empowered to make emergency loans to banks, building-and-loan societies, trust companies, credit unions, insurance companies, railroads, and agricultural stabilization corporations. As long as these institutions remained solvent, Hoover reasoned, the economy as a whole could weather the crisis.

Source: Herbert Hoover, “Special Message to the Congress on the Economic Recovery Program,” January 4, 1932. Online by Gerhard Peters and John T. Woolley, The American Presidency Project. https://teachingamericanhistory.org/lau0.

At the convening of the Congress on December 7, I laid proposals before it designed to check the further degeneration in prices and values, to fortify us against continued shocks from world instability and to unshackle the forces of recovery. The need is manifestly even more evident than at the date of my message a month ago. I should be derelict in my duty if I did not at this time emphasize the paramount importance to the nation of constructive action upon these questions at the earliest possible moment. These recommendations have been largely developed in consultation with leading men of both parties, of agriculture, of labor, of banking and of industry. They furnish the bases for full collaboration to effect these purposes. They have no partisan character. We can and must replace the unjustifiable fear in the country by confidence.

The principal subjects requiring immediate action are:

- The strengthening of the Federal Land Bank System to the farmer and to maintain at the highest level the credit of these institutions which furnish agriculture with much needed capital. This measure has passed the House of Representatives and is now before the Senate.

- The creation of a Reconstruction Finance Corporation to furnish during the period of the depression credits otherwise unobtainable under existing circumstances in order to give confidence to agriculture, industry and labor against further paralyzing influences. By such prompt assurance we can reopen many credit channels and reestablish the normal working of our commercial organization and thus contribute greatly to reestablish the resumption of employment and stability in prices and values.

- The creation of a system of Home Loan Discount Banks in order to revive employment by new construction and to mitigate the difficulties of many of our citizens in securing renewals of mortgages on their homes and farms. It has the further purpose of permanent encouragement of home ownership. To accomplish these purposes we must so liberate the resources of the country banks, the savings banks and the building and loan associations as to restore these institutions to normal functioning. Under the proposal before the Congress the most of the capital of these Discount Banks would be subscribed by the institutions participating in their use and such residue as might be necessary for the federal government to supply temporarily would be repaid in time by such institutions as in the case of the Farm Loan Banks when they were first organized.

- The discount facilities1 of our Federal Reserve Banks are restricted by law more than that of the central banks in other countries. This restriction in times such as these limits the liquidity of the banks and tends to increase the forces of deflation, cripples the smaller businesses, stifles new enterprise and thus limits employment. I recommend an enlargement of these discount privileges to take care of emergencies. To meet the needs of our situation it will not be necessary to go even as far as the current practice of foreign institutions of similar character. Such a measure has the support of most of the Governors of the Federal Reserve Banks.

- The development of a plan to assure early distribution to depositors in closed banks is necessary to relieve distress among millions of small depositors and small businesses, and to release vast sums of money now frozen.

- Revision of the laws relating to transportation in the direction recommended by the Interstate Commerce Commission2 would strengthen our principal transportation systems and restore confidence in the bonds of our railways. These bonds are held largely by our insurance companies, our savings banks, and benevolent trusts and are therefore the property of nearly every family in the United States. The railways are the largest employers of labor and purchasers of goods.

- Revision of banking laws in order to better safeguard depositors.

- The country must have confidence that the credit and stability of the Federal Government will be maintained by drastic economy in expenditure, by adequate increase of taxes, and by restriction of issues of Federal securities. The recent depreciation in prices of government securities is a serious warning which reflects the fear of further large and unnecessary issues of such securities. Promptness in adopting an adequate budget relief to taxpayers by resolute economy and restriction in security issues is essential to remove this uncertainty.

Combating a depression is indeed like a great war in that it is not a battle upon a single front but upon many fronts. These measures are all a necessary addition to the efficient and courageous efforts of our citizens throughout the nation. Our people through voluntary measures and through state and local action are providing for distress. Through the organized action of employers they are securing distribution of employment and thus mitigating the hardships of the depression. Through the mobilization of national credit associations they are aiding the country greatly. Our duty is so to supplement these steps as to make their efforts more fruitful.

The United States has the resources and resilience to make a large measure of recovery independent of the rest of the world. Our internal economy is our primary concern and we must fortify our economic structure in order to meet any situation that may arise and by so doing lay the foundations for recovery.

This does not mean that we are insensible to the welfare of other nations or that our own self-interest is not involved in economic rehabilitation abroad which would restore the markets for our agricultural and other commodities. But it is our duty to devote ourselves to the problems of our own internal economy not only as the first necessity to domestic welfare but as our best contribution to the stability of the world as a whole.

Action in these matters by the Congress will go far to reestablish confidence, to restore the functioning of our economic system, and to rebuilding of prices and values and to quickening employment. Our justified hope and confidence for the future rests upon unity of our people and of the government in prompt and courageous action.

- 1. “Discount facilities” or “discount windows” are terms used to denote the ability of a central bank to lend money to other banks and financial institutions and thus increase their liquidity or cash. When a bank increases its liquidity, it is able to lend more. The term “discount window” derives from the fact that borrowing from the central back originally occurred at a teller window in the bank.

- 2. Established in 1887, the Interstate Commerce Commission regulated rates charged for the transport of goods and people between states. Formed primarily to regulate railroad transport, it later regulated trucking and bus transport.

New State Ice Co. v. Liebmann

March 21, 1932

Conversation-based seminars for collegial PD, one-day and multi-day seminars, graduate credit seminars (MA degree), online and in-person.