No study questions

No related resources

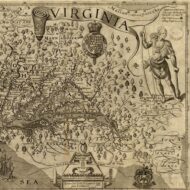

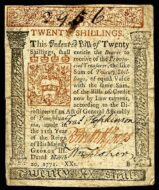

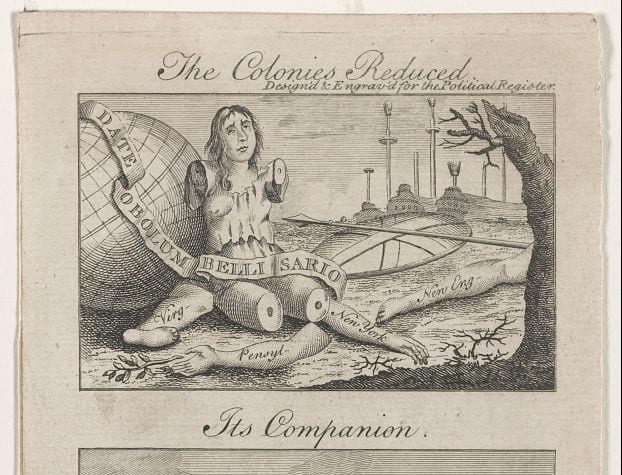

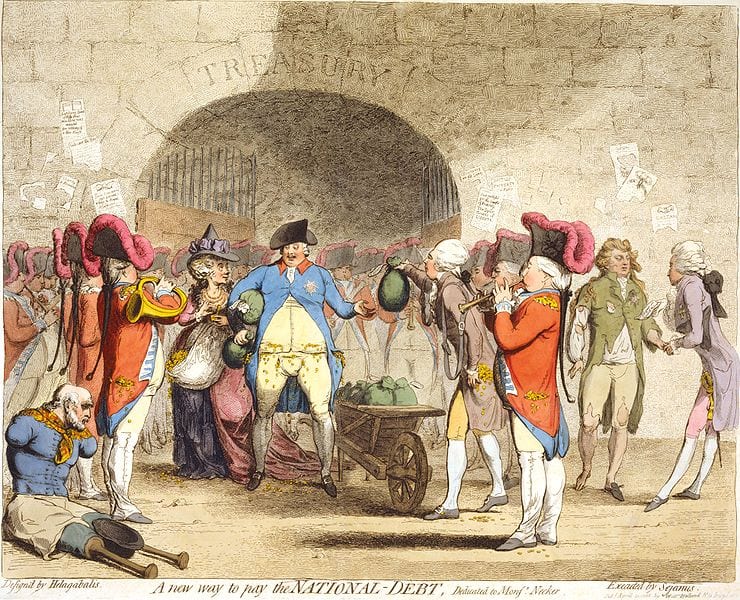

The Revenue that may be raised by the Duties which have been already, or by these [stamp dates] if they should be hereafter imposed, are all equally applied by Parliament, towards defraying the necessary Expenses of defending, protecting, and securing, the British Colonies and Plantations in America: Not that on the one hand an American Revenue might not have been applied to different Purposes; or on the other, that Great Britain is to contribute nothing to these: The very Words of the Act of Parliament and of the Resolution of the House of Commons imply, that the whole of the Expense is not to be charged upon the Colonies: They are under no Obligation to provide for this or any other particular national Expense; neither can they claim any Exemption from general Burthens; but being a part of the British Dominions, are to share all necessary Services with the rest. This in America does indeed first claim their Attention: They are immediately, they are principally concerned in it; and the Inhabitants of their Mother-Country would justly and loudly complain, if after all their Efforts for the Benefit of the Colonies, when every Point is gained, and every wish accomplished, they, and they alone should be called upon still to answer every additional Demand, that the Preservation of these Advantages and the Protection of the Colonies from future Dangers, may occasion: Great Britain has a Right at all Times, she is under a Necessity, upon this Occasion to demand their Assistance; but still she requires it in the Manner most suitable to their Circumstances; for by appropriating this Revenue towards the Defense and Security of the Provinces where it is raised, the Produce of it is kept in the Country, the People are not deprived of the Circulation of it is kept in the Country, the People are not deprived of the Circulation of what Cash they have amongst themselves, and hereby the severest Oppression of an American Tax, that of draining the Plantations of Money which they can so ill spare, is avoided. What part they ought to bear of the national Expense, that is necessary for their Protection, must depend upon their Ability, which is not yet sufficiently known: to the whole they are certainly unequal, that would include all the military and all the naval Establishment, all Fortifications which it may be thought proper to erect, the Ordnance and Stores that must be furnished, and the Provisions which it is necessary to supply; but surely a Part of this great Disbursement, a large Proportion at least of some particular Branches of it, cannot be an intolerable Burthen upon a Number of Subjects, upon a Territory so extensive, and upon the Wealth which they collectively possess. As to the Quota which each Individual must pay, it will be difficult to persuade the Inhabitants of this Country, where the neediest Cottager pays out of his Pittance, however scanty, and how hardly soever earned, our high Duties and Customs and Excise in the Price of all his Consumption; it will be difficult I say, to persuade those who see, who suffer, or who relieve such Oppression; that the West Indian out of his Opulence, and the North American out of his Competency, can contribute no more than it is now pretended they can afford towards the Expence of Services, the Benefit of which, as a Part of this Nation they share, and as Colonists they peculiarly enjoy. They have indeed their own civil Governments besides to support; but Great Britain has her civil Government too; she has also a large Peace Establishment to maintain; and the national Debt, tho’ so great a Part, and that the heaviest Part of it has been incurred by a Was undertaken for the Protection of the Colonies, lies solely still upon her.

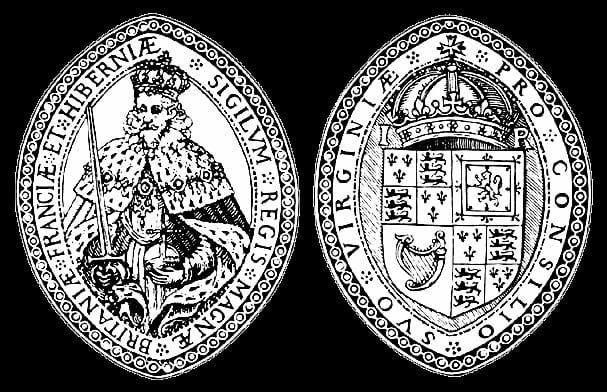

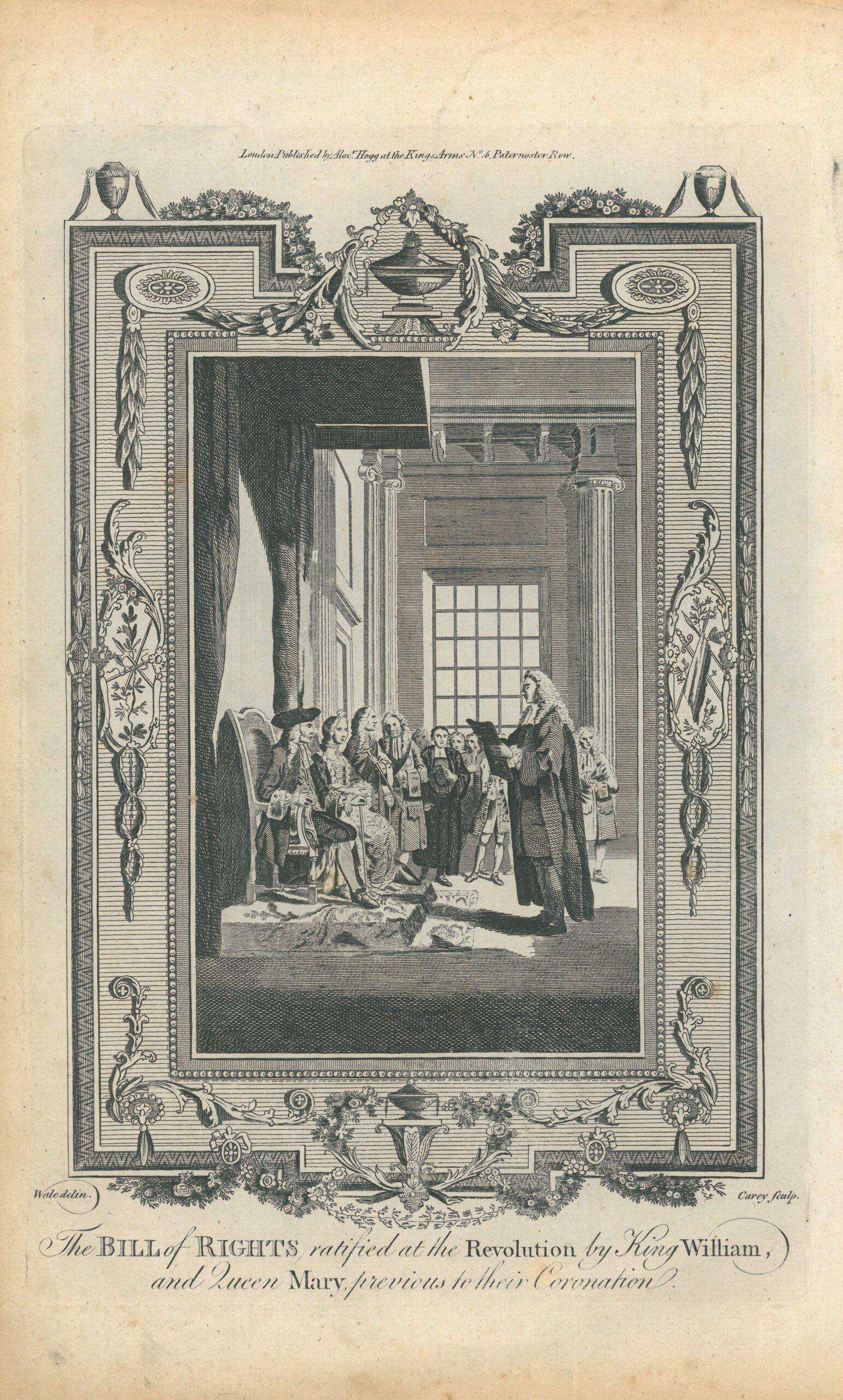

The Reasonableness, and even the Necessity of requiring an American Revenue being admitted, the Right of the Mother Country to impose such a Duty upon her Colonies, if duly considered, cannot be questioned: they claim it is true the Privilege, which is common to all British Subjects, of being taxed only with their own Consent, given by their Representatives; and may they ever enjoy the Privilege in all its Extent: May this sacred Pledge of Liberty be preserved inviolate, to the utmost Verge of our Dominions, and to the latest Page of our History! but let us not limit the legislative Rights of the British People to Subjects of Taxation only: No new Law whatever can bind us that is made without the Concurrence of our Representatives. The Acts of Trade and Navigation, and all other Acts that relate either to ourselves or to the Colonies, are founded upon no other Authority; they are not obligatory if a Stamp Act is not, and every Argument in support of an Exemption from the Superintendance of the British Parliament in the one Case, is equally applicable to the others. The Constitution knows no Distinction; the Colonies have never attempted to make one; but have acquiesced under several parliamentary Taxes. The 6 Geo. II. c. 13. Which has been already refered to, lays heavy Duties on all foreign Rum, Sugar, and Melasses, imported into the British Plantations: the Amount of the Impositions has been complained of; the Policy of the Laws has been objected to; but the Right of making such a Law, has never been questioned. These however, it may be said, are Duties upon Imports only, and there some imaginary Line has been supposed to be drawn; but had it ever existed, it was passed long before, for by 25 Charles II. c. 7. enforced by 7 and 8 Wil. and Mary, c. 22. and by 1 Geo. I. c. 12. The Exports of the West Indian Islands, not the Merchandize purchased by the Inhabitants, nor the Profits they might make by their Trade, but the Property they had at the Time, the Produce of their Lands, was taxed, by the Duties then imposed upon Sugar, Tobacco, Cotton, Indigo, Ginger, Logwood, Fustick, and Cocoa, exported from one British Plantation to another.

It is in vain to call these only Regulations of Trade; the Trade of British Subjects may not be regulated by such Means, without the Concurrence of their Representatives. Duties laid for these Purposes, as well as for the Purposes of Revenue, are still Levies of Money upon the Peole. The Constitution again knows no Distinction between Impost Duties and internal Taxation; and if some speculative Difference should be attempted to be made, it certainly is contradicted by Fact; for an internal Tax also was laid on the Colonies by the Establishment of a Post Office there; which, however it may be represented, upon a Perusal of 9 Anne c. 10. Appear to be essentially a Tax, and that of the most authoritative Kind; for it is enforced by Provisions, more peculiarly prohibitory and compulsive, than others are usually attended with: The Conveyance of Letters thro’ any other Channel is forbidden, by which Restrictions, the Advantage which might be made by public Carriers and others of this Branch of their Business is taken away; and the Passage of Ferries is declared to be free for the Post, the Ferrymen being compellable immediately on Demand to give their Labour without pay, and the Proprietors being obliged to furnish the Means of Passage to the Post without Recompence. These Provisions are indeed very proper, and even necessary; but certainly Money levied by such Methods, the Effect of which is intended to be a Monopoly of the Carriage of Letters to the Officers of this Revenue, and by Means of which the People are forced to pay the Rates imposed upon all their Correspondence, is a public Tax to which they must submit, and not merely a Price required of them for a private Accomodation. The Act treats this and the British Postage upon exactly the same Footing, and expressly calls them both a Revenue. The Preamble of it declares, that the new Rates are fixed in the Manner therein specified with a View to enable her Majesty in some Measure to carry on and furnish the War. The Sum of 700l. per Week out of all the Duties arising from time to time by virtue of this Act is appropriated for that Purpose, and for other necessary Occasions; the Surplus after other Deductions, was made part of the civil List Revenues; it continued to be thus applied during the Reign of George I: and George II. and on his present Majesty’s Accession to the Throne, when the Civil List was put upon a different Establishment, the Post Office Revenues were carried with the others to the aggregate Fund, to be applied to the Uses, to which the said Fund is or shall be applicable. If all these Circumstances do not constitute a Tax, I do not know what do: the Stamp Duties are not marked with stronger Characters, to entitle them to that Denomination; and with respect to the Application of the Revenue, the Power of the Parliament of Great Britain over the Colonies was then held up much higher than it has been upon the present Occasion. The Revenue arising from the Postage in America is blended with that of England, is applied in Part to the carrying on of a continental War, and other public Purposes; the Remainder of it the Support of the Civil List; and now the whole of it to the Discharge of the National Debt by Means of the aggregate Fund; all these are Services that are either national or particular to Great Britain; but the Stamp Duties and the others that were laid last Year, are appropriated to such Services only as more particularly relate to the Colonies; and surely if the Right of the British Parliament to impose the one be acknowledged; that of laying on the other cannot be disputed. The Post-Office has indeed been called a meer Convenience; which therefore the People always cheerfully pay for. After what has been said, this Observation requires very little Notice; I will not call the Protection and Security of the Colonies, to which the Duties in question are applied, by so low a Name as a Convenience.

The instances that have been mentioned prove, that the Right of the Parliament of Great Britain to impose Taxes of every Kind on the Colonies, has been always admitted; but were there no Precendents to support the Claim, it would still be incontestable, being founded on the Principles of our Constitution; for the Fact is, that the Inhabitants of the Colonies are represented in Parliament: they do not indeed chuse the Members of that Assembly; neither are Nine Tenths of the People of Britain Electors; for the Right of Election is annexed to certain Species of Property, to peculiar Franchises, and to Inhabitancy in some particular Places; but these Descriptions comprehend only a very small Part of the Land, the Property, and the People of this Island: all Copyhold, all Leasehold Estates, under the Crown, under the Church, or under private Person, tho’ for Terms ever so long; all landed Property in short, that is not Freehold, and all monied Property whatsoever are excluded: the Possessors of these have no Votes in the Election of Members of Parliament; Women and Persons under Age be their Property ever so large, and all of it Freehold, have none. The Merchants of London, a numerous and respectable Body of Men, whose Opulence exceeds all that America could collect; the Proprietors of that vast Accumulation of Wealth, the public Funds; the Inhabitants of Leeds, of Halifax, of Birmingham, and of Manchester, Towns that are each of them larger than the Largest in the Plantations; many of less Note that are yet incorporated; and that great Corporation the East India Company, whose Rights over the Countries they possess, fall little short of Sovereignty, and whose Trade and whose Fleets are sufficient to constitute them a maritime Power, are all in the same Circumstances; none of them chuse their Representatives; and yet are they not represented in Parliament? Is their vast Property subject to Taxes without their Consent? Are they all arbitrarily bound by Laws to which they have not agreed? The Colonies are in exactly the same Situation: All British Subjects are really in the same; none are actually, all are virtually represented in Parliament; for every Member of Parliament sits in the House, not as Representative of his own Constituents, but as one of that august Assembly by which the Commons of Great Britain are represented. Their Rights and their Interests, however his own Borough may be affected by general Dispositions, ought to be the great Objects of his Attention, and the only Rules for his Conduct; and sacrifice these to a partial Advantage in favour of the Place where he was chosen, would be a Departure from his Duty: if it were otherwise, Old Sarum would enjoy Privileges essential to Liberty, which are denied to Birmingham and to Manchester; but as it is, they and the Colonies and all British Subjects whatever, have an equal Share in the general Representation of the Commons of Great Britain, and are bound by the Consent of the Majority of that House, whether their own particular Representatives consented to or opposed the Measures there taken, or whether they had or had not particular Representatives there.

The Inhabitants of the Colonies however have by some been supposed to be excepted, because they are represented in their respective Assemblies. So are the Citizens of London in their Common Council; and yet so far from excluding them from the national Representation, it does not impeach their Right to chuse Members of Parliament: it is true, that the Powers vested in the Common Council of London, are not equal to those which the Assemblies in the Plantation enjoy; but still they are legislative Powers, to be exercised within their District, and over their Citizens; yet not exclusively of the general SUperintendance of the great Council of the Nation: The Subjects of a By-law and of an Act of Parliament may possibly be the same; yet it never was imagined that the Privileges of London were incompatible with the Authority of Parliament; and indeed what Contradiction, what Absurdity, does a double Representation imply? What difficulty is there in allowing both, tho’ both should even be vested with equal legislative Powers, if the one is to be exercised for local, and the other for general Purposes? and where is the Necessity that the Subordinate Power must derogate from the superior Authority? It would be a singular Objection to a Man’s Vote for a Member of Parliament, that being represented in a provincial, he cannot be represented in a national Assembly; and if this is not sufficient Ground for an Objection, neither is it for an Exemption, or for any Pretence of an Exclusion.

The Charter and the Proprietary Governments in America, are in this Respect, on the same Footing with the Rest. The comprehending them also, both in a provincial and national Representation, is not necessarily attended with any Inconsistency, and nothing contained in their Grants can establish one; for all who took those Grants were British Subjects, inhabiting British Dominions, and who at the Time of taking, were indisputably under the Authority of Parliament; no other Power can abridge that Authority, or dispense with the Obedience that is due to it: those therefore, to whom the Charters were originally given, could have no Exemption granted to them: and what the Fathers never received, the Children cannot claim as an Inheritance; nor was it ever in Idea that they should; even the Charters themselves, so far from allowing guard against the Supposition.

And after all, does any Friend to the Colonies desire the Exemption? he cannot, if he will reflect but a Moment on the Consequences. We value the Right of being represented in the national Legislature as the dearest Privilege we enjoy; how justly would the Colonies complain, if they alone were deprived of it? They acknowledge Dependence upon their Mother Country; but that Dependence would be Slavery not Connection, if they bore no Part in the Government of the whole: they would then indeed be in a worse Situation than the Inhabitants of Britain, for these are all of them virtually, tho’ few of them are actually represented in the House of Commons; if the Colonies were not, they could not expect that their Interests and their Privileges would be any otherwise considered there, than as subservient to those of Great Britain; for to deny the Authority of a Legislature, is to surrender all claims to a Share in its Councils; and if this were the Tenor of their Charters, a Grant more insidious and more replete with Mischief, could not have been invented: a permanent Title to a Share in national Councils would be exchanged for a precarious Representation in a provincial Assembly; and a Forfeiture of their Rights would be couched under the Appearance of Privileges; they would be reduced from Equality to Subordination, and be at the same Time deprived of the Benefits, and liable to the Incoveniences, both of Independency and of Connection. Happily for them, this is not their Condition. They are on the contrary a Part, and an important Part of the Commons of Great Britain: they are represented in Parliament in the same Manner as those Inhabitants of Britain are, who have not Voices in Elections; and they enjoy, with the Rest of their Fellow-subjects the inestimable Privilege of not being bound by any Laws, or subject to any Taxes, to which the Majority of the Representatives of the Commons have not consented.

If there really were any Inconsistency between a national and a provincial Legislature, the Consequence would be the Abolition of the latter; for the Advantages that attend it are purely local: the District it is confined to might be governed without it, by means of the national Representatives; and it is unequal to great general Operations; whereas the other is absolutely necessary for the Benefit and Preservation of the whole: But so far are they from being incompatible, that they will be seldom found to interfere with one another: The Parliament will not often have occasion to exercise its Power over the Colonies except for those Purposes, which the Assemblies cannot provide for. A general Tax is of this Kind; the Necessity for it, the Extent, the Application of it, are Matters which Councils limited in their Views and in their Operations cannot properly judge of; and when therefore the national Council determine these Particulars, it does not pretend to, never claimed, or wished, nor can ever be vested with: The latter remains in exactly the same State as it was before, providing for the same Services, by the same Means, and on the same Subjects; but conscious of its own Inability to answer greater Purposes than those for which it was instituted, it leaves the care of more general Concerns to that higher Legislature, in whose Province alone the Direction of them always was, is, and will be. The Exertion of that Authority which belongs to its universal Superintedance, neither lowers the Dignity, nor deprecates the Usefulness of more limited Powers: They retain all that they ever had, and are really incapable of more.

The Concurrence therefore of the provincial Representatives cannot be necessary in great public Measures to which none but the national Representatives are equal: The Parliament of Great Britain not only may but must tax the Colonies, when the public Occasions require a Revenue there: The present Circumstances of the Nation require one now; and a Stamp Act, of which we have had so long an Experience in this, and which is not unknown in that Country, seems an eligible Mode of Taxation. From all these Considerations, and from many others which will occur upon Reflexion and need not be suggested, it must appear proper to charge certain Stamp Duties in the Plantations to be applied towards defraying the necessary Expences of defending, protecting, and securing the British Colonies and Plantations in America. This Vote of the House of Commons closed the Measures taken last Year on the Subject of the Colonies: They appear to have been founded upon true Principles of Policy, of Commerce, and of Finance; to be wise with respect to the Mother-Country; just and even beneficial to the Plantations; and therefore it may reasonably be expected that either in their immediate Operations, or in their distant Effects, they will improve the Advantages we possess, confirm the Blessings we enjoy, and promote the public Welfare.

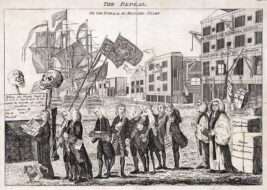

The Declaratory Act

March 18, 1766

Conversation-based seminars for collegial PD, one-day and multi-day seminars, graduate credit seminars (MA degree), online and in-person.