No study questions

No related resources

Introduction

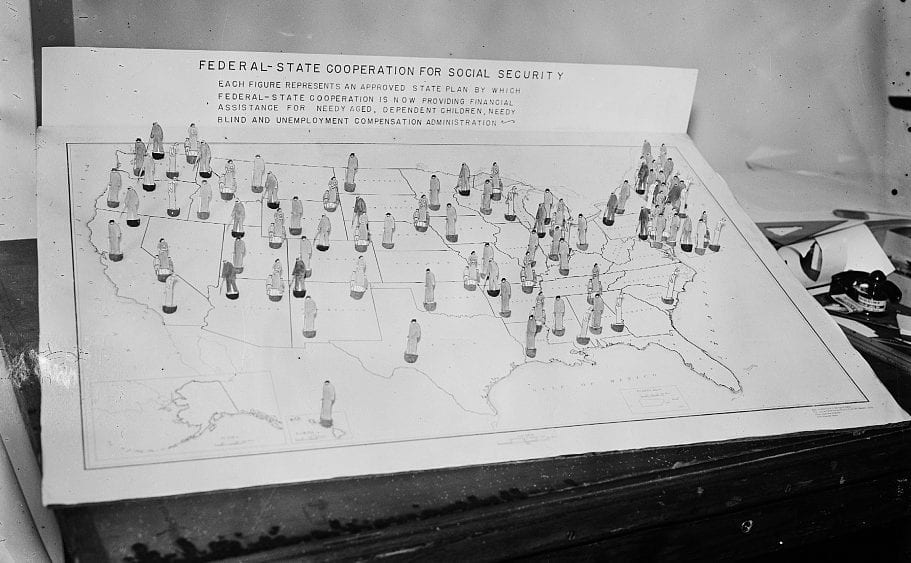

Democrats made impressive gains in the midterm elections of 1934, which President Franklin D. Roosevelt interpreted as a popular mandate for the New Deal that he had launched upon taking office in 1933. In 1935, therefore, he placed before Congress a series of measures on a wide variety of subjects in what has become known as the “Second New Deal.” Perhaps the most important of these was the Social Security Act, which provided for unemployment insurance and old-age pensions to be paid through a six percent payroll tax divided between employers and employees. The revenues generated from these payroll taxes would be more than sufficient to provide for the current elderly; the surplus would be deposited in a special fund that would – theoretically, at least – maintain the program in perpetuity. Other aspects of the plan directed that federal money would also be passed along to the states to support assistance programs for the blind, the disabled, and families with dependent children. While the benefits to the elderly would be managed at the federal level by a Social Security Administration, unemployment insurance and other assistance programs would remain under the control of the states.

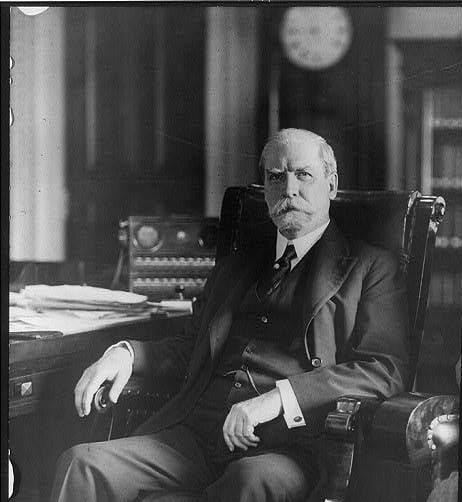

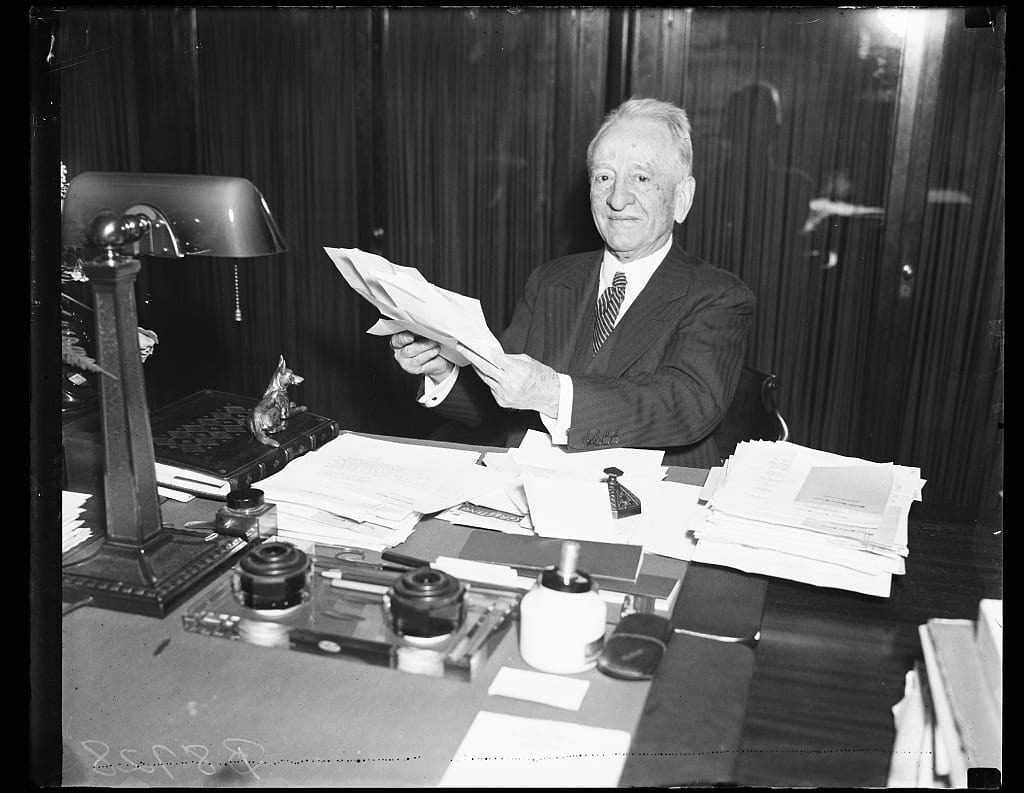

The Social Security Act appeared sufficiently moderate that it aroused little real opposition, except from a few die-hard conservatives such as Republican Representative James W. Wadsworth of New York (Document B), who feared that it would destroy incentives to work and save. Others claimed that the proposed payroll tax was excessive; not only would it retard recovery, but they feared that the resulting surplus might be used to fund other attempts at New Deal “social engineering.” In spite of such criticism the bill passed both houses by wide margins, and Roosevelt signed it into law on August 14, 1935.

Liberals felt the Act did not go far enough. They had hoped that the program would be funded from revenues generated by the income tax, so that it might redistribute wealth from rich to poor.

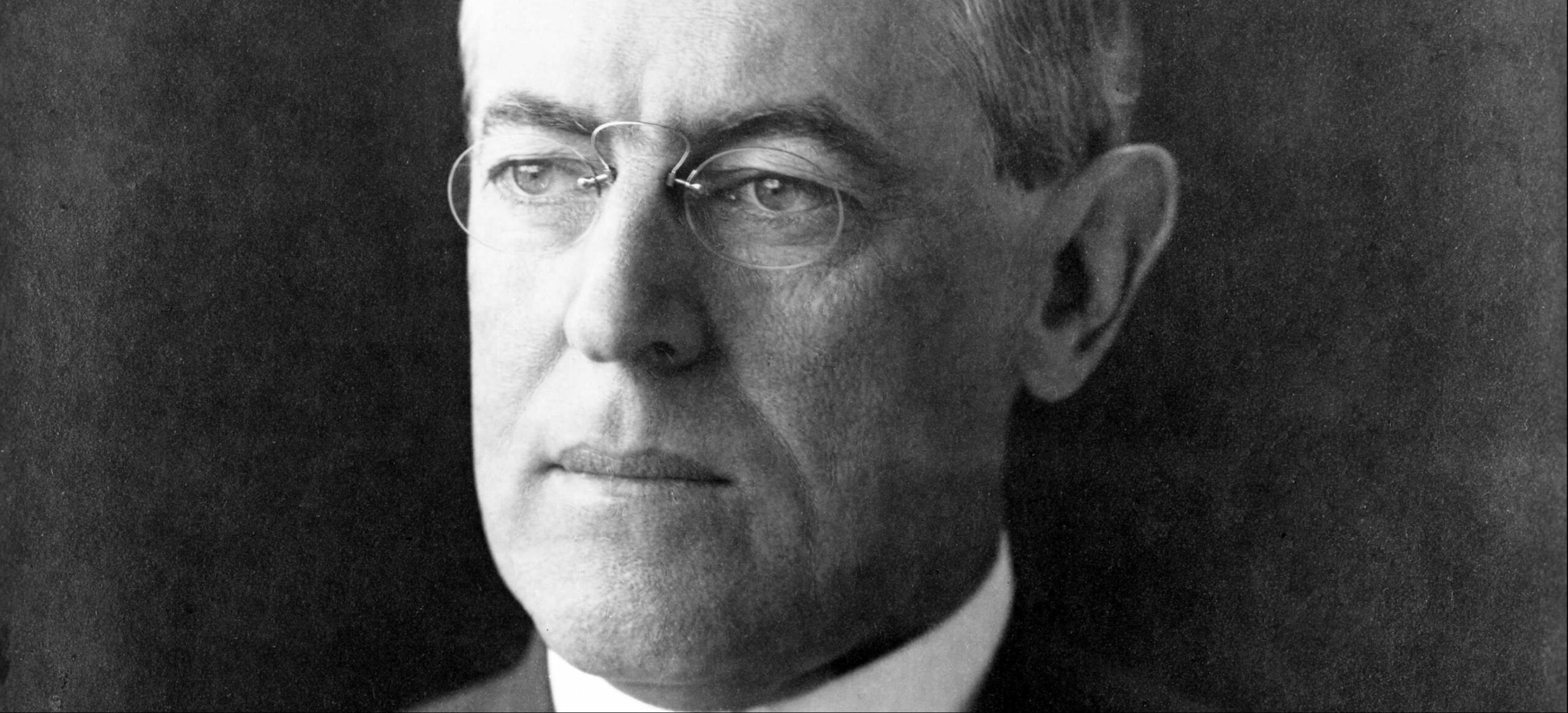

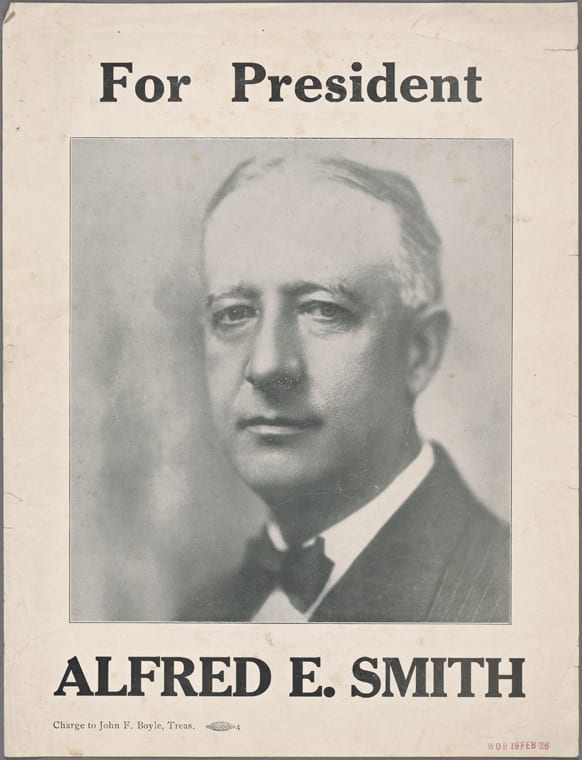

One of Roosevelt’s most prominent opponents on the left was Huey P. Long, who as a popular and reform-minded Democratic governor of Louisiana took on the oil industry and built a powerful state political organization. After being elected to the U.S. Senate (in 1930, although he did not take his seat until 1932), he used his national standing to issue frequent denunciations of the wealthy and the banking system. In 1932 he supported Roosevelt’s presidential campaign and supported most of the measures of the early New Deal. However, the personalities of the two men immediately clashed, and the New York patrician and the colorful, rural senator known as the “Kingfish” (after a character in the popular radio show Amos & Andy) came to loathe one another.

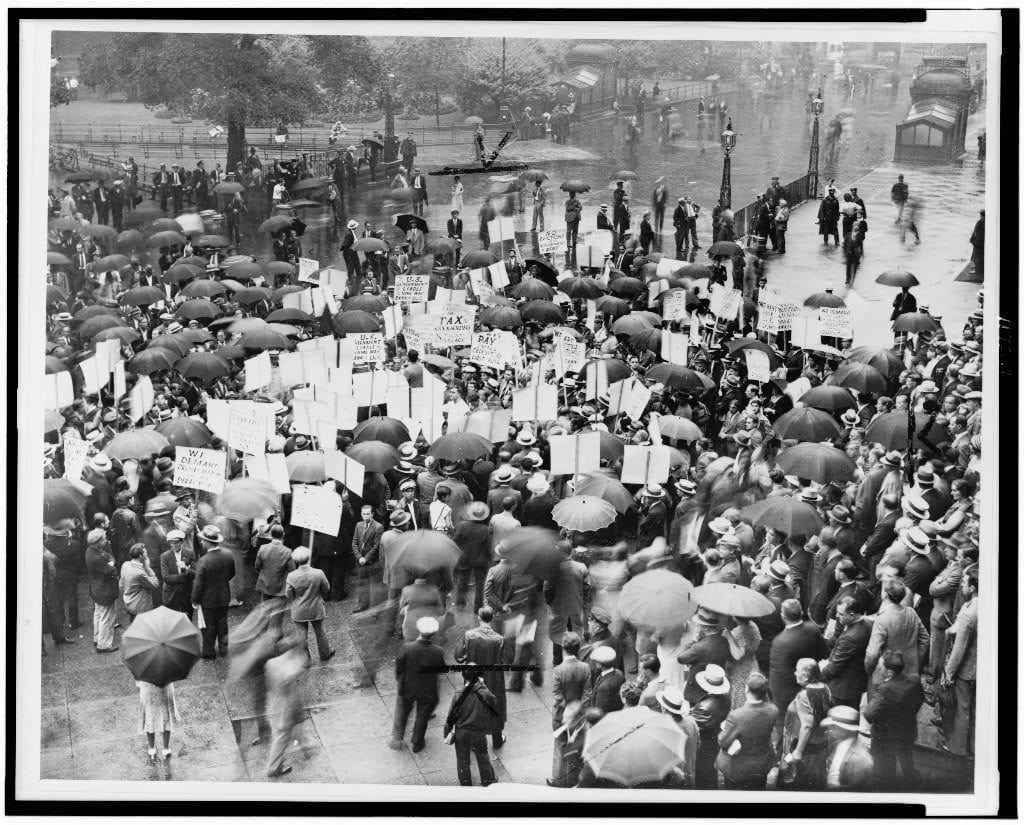

Long’s greatest complaint about the New Deal was that to his mind it did not go far enough in reducing the great inequalities of wealth in American society. In March 1933 he proposed a series of bills that would have seized all fortunes greater than $100 million, as well as all annual income in excess of $1 million. When these laws failed – as did, indeed, everything Long proposed as senator – he established a national organization called the Share Our Wealth Society (Document C). By 1935 the society boasted 27,000 chapters nationwide, with a total membership of 7.5 million. Long hoped to use this group as a launching pad for a presidential run in 1936; however, in September 1935 he was assassinated by the son of one of his many political enemies.

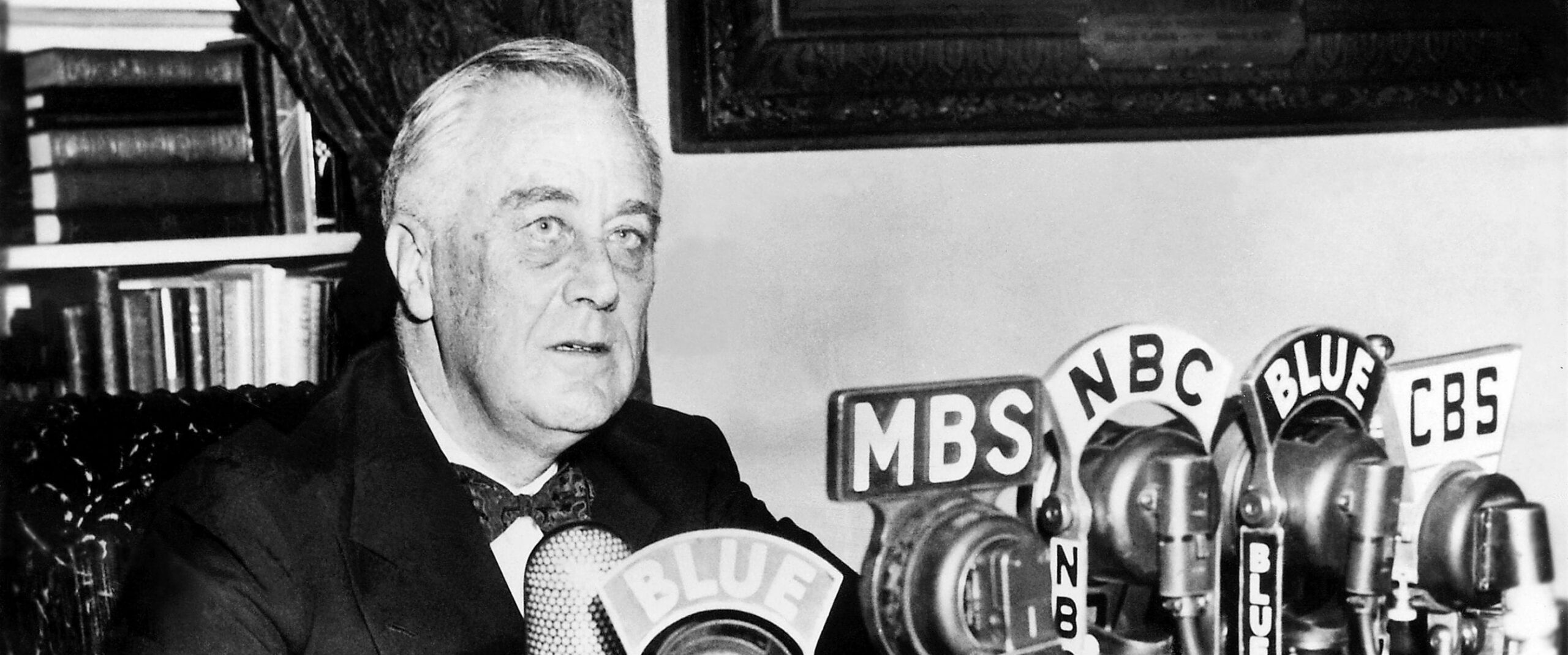

Social Security has been one of the most enduring legacies of the New Deal. Roosevelt insisted on funding Social Security through payroll taxes because it would give recipients “a legal, moral, and political right to collect their pensions and their unemployment benefits. With those [payroll] taxes in there, no damn politician can ever scrap my social security program.”

The program began paying out old-age benefits in 1940, when there were 159.2 taxpayers for every recipient. By 2013, however, according to the Social Security Administration, demographic patterns and longer life expectancy had changed the ratio to 2.8 taxpayers for every recipient. Without major changes, some have suggested that the Social Security system cannot remain solvent.

Documents in this chapter are available separately by following the hyperlinks below:

A. President Franklin D. Roosevelt, Speech to Congress on Social Security, January 17, 1935

B. Representative James W. Wadsworth (R-NY), Speech on Social Security, April 19, 1935

C. Senator Huey P. Long (D-LA), Statement on the Share Our Wealth Society, May 23, 1935

Discussion Questions

A. What does Roosevelt’s Social Security plan entail? How is it to be funded? Why does the president believe it is necessary? What misgivings does Representative Wadsworth have regarding how Social Security is to be funded? Why does he think it poses a danger to the republic? How does he predict the program will develop? Have his predictions come true? How might Roosevelt respond to Wadsworth’s criticisms? What does Huey Long regard as the fundamental cause of the Depression? In what ways does he think the New Deal has fallen short? What does he propose as a remedy? How does he seek to justify his program?

B. How does the New Deal compare to Reconstruction (Chapter 16) or the passage of the Civil Rights Act (Chapter 26)? What vision of the legitimate purposes and power of government are presented in each case? What connections, if any, do you see among the various policies? How does Long’s understanding of what society owes to its poorest members relate to the eugenics movement’s vision of what society owes to its weakest members (Chapter 19)?

C. How do the visions of a community of shared responsibility for the financial security of all presented in this chapter compare to those presented in Volume 1, Chapter 2? How do the concerns raised by conservative critics of the New Deal reflect those raised by Brutus in Volume 1, Chapter 7?

A. President Franklin D. Roosevelt, Speech to Congress on Social Security, January 17, 1935

In addressing you on June 8, 1934, I summarized the main objectives of our American program. Among these was, and is, the security of the men, women, and children of the nation against certain hazards and vicissitudes of life. This purpose is an essential part of our task. In my annual message to you I promised to submit a definite program of action. This I do in the form of a report to me by a Committee on Economic Security, appointed by me for the purpose of surveying the field and of recommending the basis of legislation. . . .

It is my best judgment that this legislation should be brought forward with a minimum of delay. Federal action is necessary to, and conditioned upon, the action of States. Forty-four legislatures are meeting or will meet soon. In order that the necessary State action may be taken promptly, it is important that the Federal Government proceed speedily.

The detailed report of the Committee sets forth a series of proposals that will appeal to the sound sense of the American people. It has not attempted the impossible, nor has it failed to exercise sound caution and consideration of all of the factors concerned: the national credit, the rights and responsibilities of States, the capacity of industry to assume financial responsibilities and the fundamental necessity of proceeding in a manner that will merit the enthusiastic support of citizens of all sorts. . . . can we get rid of the orphans

Three principles should be observed in legislation on this subject. First, the system adopted, except for the money necessary to initiate it, should be self-sustaining in the sense that funds for the payment of insurance benefits should not come from the proceeds of general taxation. Second, excepting in old-age insurance, actual management should be left to the States subject to standards established by the Federal Government. Third, sound financial management of the funds and the reserves, and protection of the credit structure of the nation should be assured by retaining Federal control over all funds through trustees in the Treasury of the United States.

At this time, I recommend the following types of legislation looking to economic security:

1. Unemployment compensation.

2. Old-age benefits, including compulsory and voluntary annuities.

3. Federal aid to dependent children through grants to States for the support of existing mothers’ pension systems and for services for the protection and care of homeless, neglected, dependent, and crippled children.

4. Additional Federal aid to State and local public-health agencies and the strengthening of the Federal Public Health Service. I am not at this time recommending the adoption of so-called “health insurance,” although groups representing the medical profession are cooperating with the Federal Government in the further study of the subject and definite progress is being made.

With respect to unemployment compensation, I have concluded that the most practical proposal is the levy of a uniform Federal payroll tax, 90 percent of which should be allowed as an offset to employers contributing under a compulsory State unemployment compensation act. The purpose of this is to afford a requirement of a reasonably uniform character for all States cooperating with the Federal Government and to promote and encourage the passage of unemployment compensation laws in the States. The 10 percent not thus offset should be used to cover the costs of Federal and State administration of this broad system. Thus, States will largely administer unemployment compensation, assisted and guided by the Federal Government. An unemployment compensation system should be constructed in such a way as to afford every practicable aid and incentive toward the larger purpose of employment stabilization. This can be helped by the intelligent planning of both public and private employment. It also can be helped by correlating the system with public employment so that a person who has exhausted his benefits may be eligible for some form of public work as is recommended in this report. Moreover, in order to encourage the stabilization of private employment, Federal legislation should not foreclose the States from establishing means for inducing industries to afford an even greater stabilization of employment.

In the important field of security for our old people, it seems necessary to adopt three principles: First, noncontributory old-age pensions for those who are now too old to build up their own insurance. It is, of course, clear that for perhaps 30 years to come funds will have to be provided by the States and the Federal Government to meet these pensions. Second, compulsory contributory annuities which in time will establish a self-supporting system for those now young and for future generations. Third, voluntary contributory annuities by which individual initiative can increase the annual amounts received in old age. It is proposed that the Federal Government assume one-half of the cost of the old-age pension plan, which ought ultimately to be supplanted by self-supporting annuity plans. . . .

The establishment of sound means toward a greater future economic security of the American people is dictated by a prudent consideration of the hazards involved in our national life. No one can guarantee this country against the dangers of future depressions but we can reduce these dangers. We can eliminate many of the factors that cause economic depressions, and we can provide the means of mitigating their results. This plan for economic security is at once a measure of prevention and a method of alleviation.

We pay now for the dreadful consequence of economic insecurity – and dearly. This plan presents a more equitable and infinitely less expensive means of meeting these costs. We cannot afford to neglect the plain duty before us. I strongly recommend action to attain the objectives sought in this report.

B. Representative James W. Wadsworth (R-NY), Speech on Social Security, April 19, 1935

. . . I realize perfectly well that this bill is going to pass the House of Representatives . . . without any substantial change, and nothing that I can say will prevent it or even tend to prevent it, in view of the determination of the majority.

It is not my purpose to discuss it in detail . . . but I am going to endeavor to glance a little toward the far future and analyze some one or two things which seem to me to be susceptible of analysis, and certainly worth serious thought on the part of Members of the House regardless of their political affiliations.

First, as to the financing of the major portion of this program. As I understand it . . . these funds are to be established in the Treasury Department, through the collection of payroll taxes. . . . The bill provides in general that those moneys shall be invested solely in the bonds of the Government of the United States or bonds guaranteed as to the principal and interest by the Government. As I read the report and have listened to the discussion on the floor, it is apparent that the proponents of this bill expect that this fund will grow from time to time, year after year, until about 1970, if I am not mistaken, the fund will approximate $32,000,000,000, every penny of which must be invested in government bonds.

It is apparent that unless the national debt of the United States goes far, far beyond $32,000,000,000 in the time over which this calculation is extended, by the time this fund has been built up to any considerable degree it will become a fund large enough to absorb at least a major portion of the national debt, and finally absorb it all. . . .

Now, that may seem an effective and adequate way to finance the Government’s financial activities in all the years to come. I am trying to look to the future. Heretofore the Government has financed its undertakings primarily and fundamentally as a result of the confidence of the individual citizen in the soundness of the Government’s undertaking, but from this point on we are apparently going to abandon that philosophy of public confidence and resort to a very different practice. The Government is to impose a payroll tax through one of its agencies, collect the money into the Treasury Department, then the Treasury Department with its left hand on the proceeds of these taxes is to turn around and buy bonds of the United States Government issued by the right hand of the Treasury Department. Thus the Government of the United States, after this thing gets going, is no longer to be financed directly by its citizens, confident in the soundness of the Government, but it is to be financed instead by arrangements made within the bureaucracy – an undemocratic and dangerous undertaking. . . .

Now, this may not seem important at this moment. I may be old-fashioned. . . . It seems to me that we are moving away from democracy in this new and manipulative method of financing the obligations of the United States. I do not question the integrity and the honor of the men who are going to manage this fund or the men who will be Secretaries of the Treasury down through the years to come, but there is something offensive to me in the spectacle of one branch of the Treasury Department having collected a fund by taxing the working people of America, and then using that money for the floating of its own bonds. It seems to me to present the possibility of a vicious circle, and is certainly removing the financial support of the Government of the United States far from the people themselves and confining it to an inner ring, bureaucratic in character. I am trying to look ahead and visualize what that may mean in the preservation of democracy. . . .

One other thing looking toward the future. . . . I know the appeal this bill has to every human being, that it appeals to the humane instincts of men and women everywhere. We will not deny, however, that it constitutes an immense, immense departure from the traditional functions of the Federal Government for it to be projected into the field of pensioning the individual citizens of the several States. It launches the Federal Government into an immense undertaking which in the aggregate will reach dimensions none of us can really visualize and which in the last analysis, you will admit, affects millions and millions of individuals. Remember, once we pay pensions and supervise annuities, we cannot withdraw from the undertaking no matter how demoralizing and subversive it may become. Pensions and annuities are never abandoned; nor are they ever reduced. The recipients ever clamor for more. To gain their ends they organize politically. They may not constitute a majority of the electorate, but their power will be immense. On more than one occasion we have witnessed the political achievements of organized minorities. This bill opens the door and invites the entrance into the political field of a power so vast, so powerful as to threaten the integrity of our institutions and so pull the pillars of the temple down upon the heads of our descendants.

We are taking a step here today which may well be fateful. I ask you to consider it, to reexamine the fundamental philosophy of this bill, to estimate the future and ask yourselves the questions, “In what sort of country shall our grandchildren live? Shall it be a free country or one in which the citizen is a subject taught to depend upon government?”

C. Senator Huey P. Long (D-LA), Statement on the Share Our Wealth Society, May 23, 1935

The Share Our Wealth Society proposes to enforce the traditions on which this country was founded, rather than to have them harmed; we aim to carry out the guaranties of our immortal Declaration of Independence and our Constitution of the United States, as interpreted by our forefathers who wrote them and who gave them to us; we will make the works and compacts of the Pilgrim fathers, taken from the Laws of God, from which we were warned never to depart, breathe into our Government again that spirit of liberty, justice, and mercy which they inspired in our founders in the days when they gave life and hope to our country. God has beckoned fullness and peace to our land; our forefathers have set the guide stakes so that none need fail to share in this abundance. Will we not have our generation, and the generations which are to come, cheated of such heritage because of the greed and control of wealth and opportunity by 600 families?

To members and well-wishers of the Share Our Wealth Society:

For 20 years I have been in the battle to provide that, so long as America has, or can produce, an abundance of the things which make life comfortable and happy, that none should own such much [sic] of the things which he does not need and cannot use as to deprive the balance of the people of a reasonable proportion of the necessities and conveniences of life. The whole line of any political thought has always been that America must face the time when the whole country would shoulder the obligation which it owes to every child born on earth – that is, a fair chance to life, liberty, and happiness. . . .

It is not out of place for me to say that the support which I brought to Mr. Roosevelt to secure his nomination and election as President – and without which it was hardly probabl[e] he would ever have been nominated – was on the assurances which I had that he would take the proper stand for the redistribution of wealth in the campaign. He did that much in the campaign; but after his election, what then? I need not tell you the story. We have not time to cry over our disappointments, over promises which others did not keep, and over pledges which were broken. . . .

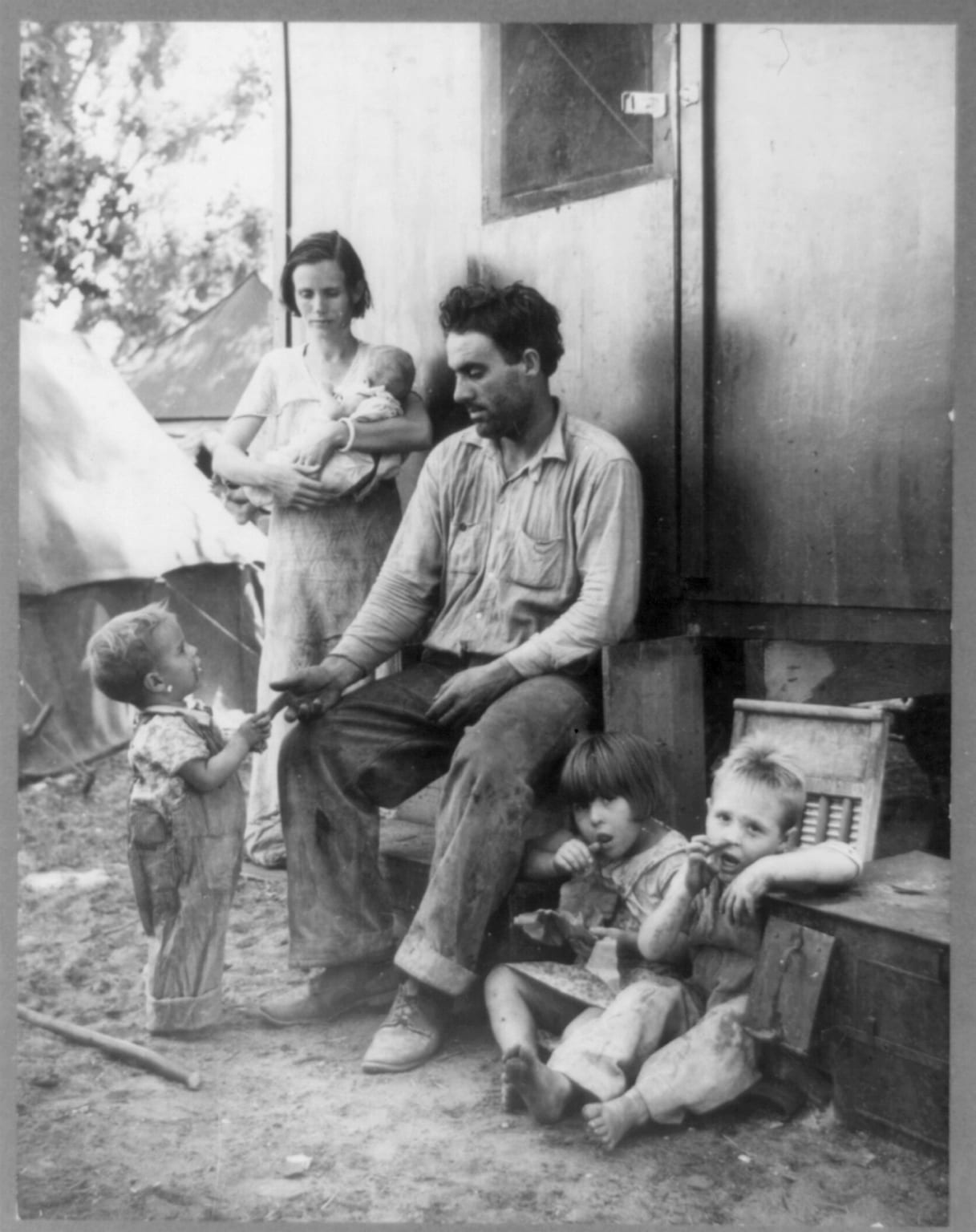

It is impossible for the United States to preserve itself as a republic or as a democracy when 600 families own more of this Nation’s wealth – in fact, twice as much – as all the balance of the people put together. Ninety-six percent of our people live below the poverty line, while four percent own eighty-seven percent of the wealth. America can have enough for all to live in comfort and still permit millionaires to own more than they can ever spend and to have more money than they can ever use; but America cannot allow the multimillionaires and the billionaires, a mere handful of them, to own everything unless we are willing to inflict starvation upon 125,000,000 people.

We looked upon the year 1929 as the year when too much was produced for the people to consume. We were told, and we believed, that the farmers raised too much cotton and wool for the people to wear and too much food for the people to eat. Therefore, much of it went to waste, some rotted, and much of it was burned or thrown into the river or into the ocean. But, when we picked up the bulletin of the Department of Agriculture for that year 1929, we found that, according to the diet which they said everyone should eat in order to be healthy, multiplying it by 120,000,000, the number of people we had in 1929, had all of our people had the things which the Government said that [they] should eat in order to live well[? W]e did not have enough even in 1929 to feed the people. In fact, these statistics show that in some instances we had from one-third to one-half less than the people needed, particularly of milk, eggs, butter, and dried fruits.

But why in the year 1929 did it appear we had too much? Because the people could not buy the things they wanted to eat and needed to eat. That showed the need for and duty of the Government then and there, to have forced a sharing of our wealth, and a redistribution, and Roosevelt was elected on the pledge to do that very thing.

But what was done? Cotton was plowed under the ground. Hogs and cattle were burned by the millions. The same was done to wheat and corn, and farmers were paid starvation money not to raise and not to plant because of the fact that we did not want so much because of people having no money with which to buy. Less and less was produced, when already there was less produced than the people needed if they ate what the Government said they needed to sustain life. God forgive those rulers who burned hogs, threw milk in the river, and plowed under cotton while little children cried for meat and milk and something to put on their naked backs!

But the good God who placed this race on earth did not leave us without an understanding of how to meet such problems; nor did the Pilgrim fathers who landed at Plymouth in 1620 fail to set an example as to how a country and a nation of people should act under such circumstances, and our great statesman like Thomas Jefferson, Daniel Webster, Abraham Lincoln, Theodore Roosevelt, and Ralph Waldo Emerson did not fail to explain the need and necessity for following the precedents and purposes, which are necessary, even in a land of abundance, if all the people are to share the fruits produced therein. God’s law commanded that the wealth of the country should be redistributed ever so often, so that none should become too rich and none should become too poor; it commanded that debts should be canceled and released ever so often, so that the human race would not be loaded with a burden which it could never pay. When the Pilgrims landed at Plymouth in 1620, they established their law by compact, signed by everyone who was on board the Mayflower, and it provided that at the end of every seven years the finances of their newly formed country would be readjusted and that all debts would be released and property redistributed, so that none should starve in the land of plenty, and none should have an abundance of more than he needed. These principles were preserved in the Declaration of Independence, signed in 1776, and in our Constitution. Our great statesmen, such men as James Madison, who wrote the Constitution of the United States, and Daniel Webster, its greatest exponent, admonished the generations of America to come that they must never forget to require the redistribution of wealth if they desire that their Republic should live.

And, now, what of America? Will we allow the political sports, the high heelers, the wiseacres, and those who ridicule us in our misery and poverty to keep us from organizing these societies in every hamlet so that they may bring back to life this law and custom of God and of this country? Is there a man or woman with a child born on the earth, or who expects ever to have a child born on earth, who is willing to have it raised under the present-day practices of piracy, where it comes into life burdened with debt, condemned to a system of slavery by which the sweat of its brow throughout its existence must go to satisfy the vanity and the luxury of a leisurely few, who can never be made to see that they are destroying the root and branch of the greatest country ever to have risen? Our country is calling; the laws of the Lord are calling; the graces [graves] of our forefathers would open today if their occupants could see the bloom and flower of their creation withering and dying because the greed of the financial masters of this country has starved and withheld from mankind those things produced by his own labor. To hell with the ridicule of the wise street-corner politician. Pay no attention to any newspaper or magazine that has sold its columns to perpetuate this crime against the people of America. Save this country. Save mankind. Who can be wrong in such a work, and who cares what consequences may come following the mandates of the Lord, of the Pilgrims, of Jefferson, Webster, and Lincoln? He who falls in this fight falls in the radiance of the future. Better to make this fight and lose than to be a party to a system that strangles humanity.

It took the genius of labor and the lives of all Americans to produce the wealth of this land. If any man, or hundred men, wind up with all that has been produced by 120,000,000 people, that does not mean that those hundred men produced the wealth of the country; it means that those hundred men stole, directly or indirectly, what 125,000,000 people produced. Let no one tell you that the money masters made this country. They did [no] such thing. Very few of them ever hewed the forest; very few ever hacked a crosstie; very few ever nailed a board; fewer of them ever laid a brick. Their fortunes came from manipulated finance, control of government, rigging of markets, the spider webs that have grabbed all businesses; they grab the fruits of the land, the conveniences and the luxuries that are intended for 125,000,000 people, and run their heelers to our meetings to set up the cry, “We earned it honestly.” The Lord says they did no such thing. The voices of our forefathers say they did no such thing. In this land of abundance, they have no right to impose starvation, misery, and pestilence for the purpose of vaunting their own pride and greed. . . .

Here is the whole sum and substance of the share-our-wealth movement:

1. Every family to be furnished by the Government a homestead allowance, free of debt, of not less than one-third the average family wealth of the country, which means, at the lowest, that every family shall have the reasonable comforts of life up to a value of from $5,000 to $6,000. No person to have a fortune of more than 100 to 300 times the average family fortune, which means that the limit to fortunes is between $1,500,000 and $5,000,000, with annual capital levy taxes imposed on all above $1,000,000.

2. The yearly income of every family shall be not less than one-third of the average family income, which means that, according to the estimates of the statisticians of the United States Government and Wall Street, no family’s annual income would be less than from $2,000 to $[2,500]. No yearly income shall be allowed to any person larger than from 100 to 300 times the size of the average family income, which means that no person would be allowed to earn in any year more than from $600,000 to $1,800,000, all to be subject to present income-tax laws.

3. To limit or regulate the hours of work to such an extent as to prevent overproduction; the most modern and efficient machinery would be encouraged, so that as much would be produced as possible so as to satisfy all demands of the people, but to also allow the maximum time to the workers for recreation, convenience, education, and luxuries of life.

4. An old-age pension to the persons over 60.

5. To balance agricultural production with what can be consumed according to the laws of God, which includes the preserving and storage of surplus commodities to be paid for and held by the Government for the emergencies when such are needed. Please bear in mind, however, that when the people of America have had money to buy things they needed, we have never had a surplus of any commodity. This plan of God does not call for destroying any of the things raised to eat or wear, nor does it countenance wholesale destruction of hogs, cattle, or milk.

6. To pay the veterans of our wars what we owe them and to care for their disabled.

7. Education and training for all children to be equal in opportunity in all schools, colleges, universities, and other institutions for training in the professions and vocations of life; to be regulated on the capacity of children to learn, and not on the ability of parents to pay the costs. Training for life’s work to be as much universal and thorough for all walks in life as has been the training in the arts of killing.

8. The raising of revenue and taxes for the support of this program to come from the reduction of swollen fortunes from the top, as well as for the support of public works to give employment whenever there may be any slackening necessary in private enterprise.

I now ask those who read this circular to help us at once in this work of giving life and happiness to our people – not a starvation dole upon which someone may live in misery from week to week. Before this miserable system of wreckage has destroyed the life germ of respect and culture in our American people let us save what was here, merely by having none too poor and none too rich. The theory of the Share Our Wealth Society is to have enough for all, but not to have one with so much that less than enough remains for the balance of the people.

Please, therefore, let me ask you who read this document – please help this work before it is too late for us to be of help to our people. We ask you now, (1) help to get your neighbor into the work of this society and (2) help get other Share Our Wealth societies started in your county and in adjoining counties and get them to go out to organize other societies.

To print and mail out this circular costs about 60 cents per hundred, or $6 per thousand. Anyone who reads this and wants more circulars of this kind to use in the work, can get them for that price by sending the money to me, and I will pay the printer for him. Better still, if you can have this circular reprinted in your own town or city.

Let everyone who feels he wishes to help in our work start right out and go ahead. One man or woman is as important as any other. Take up the fight! Do not wait for someone else to tell you what to do. There are no high lights in this effort. We have no State managers and no city managers. Everyone can take up the work, and as many societies can be organized as there are people to organize them. One is the same as another. The reward and compensation is the salvation of humanity. Fear no opposition. “He who fails in this fight falls in the radiance of the future!”

Inaugural Address (1937)

January 20, 1937

Conversation-based seminars for collegial PD, one-day and multi-day seminars, graduate credit seminars (MA degree), online and in-person.