No study questions

No related resources

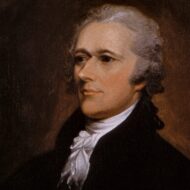

[To the Speaker of the House of Representatives]

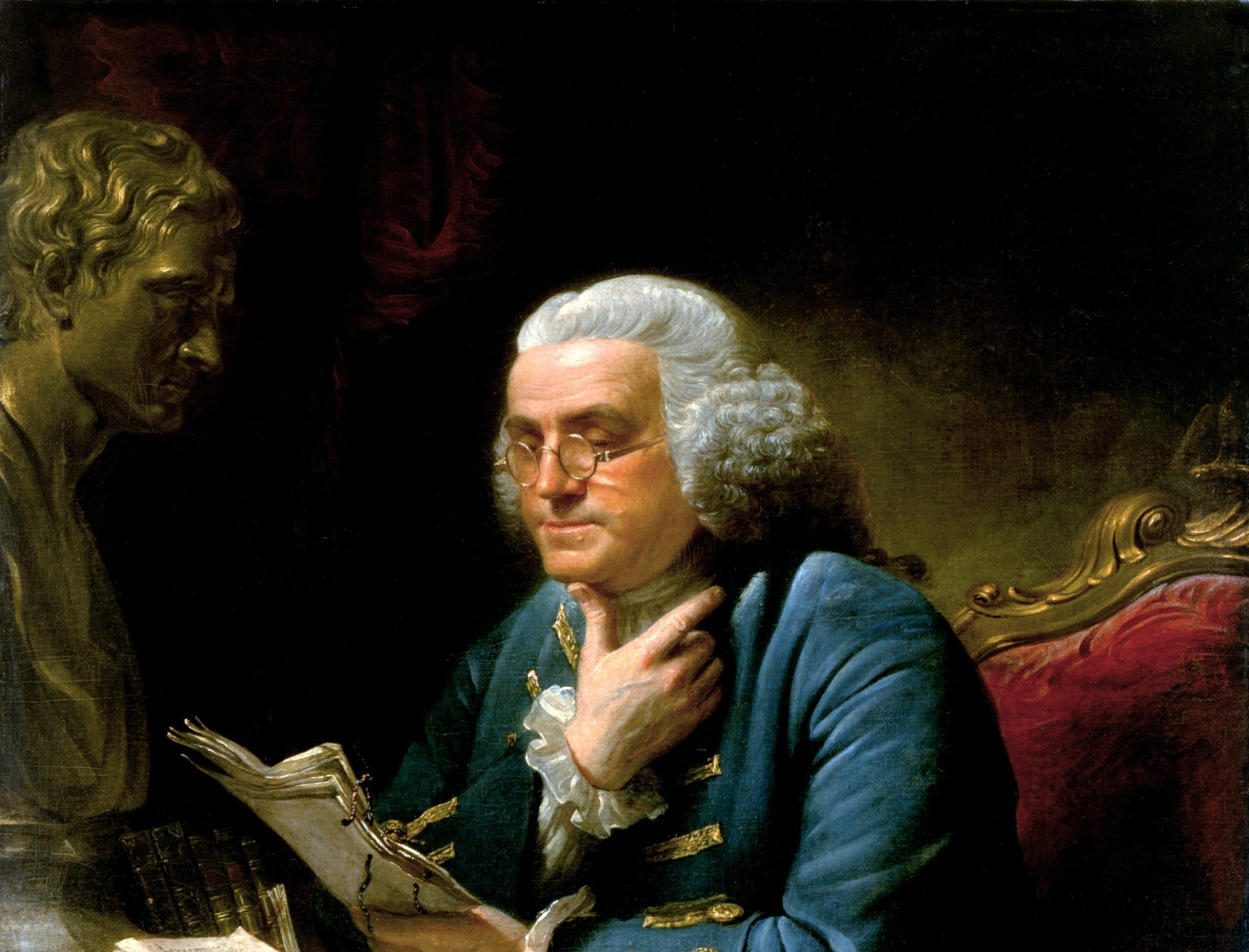

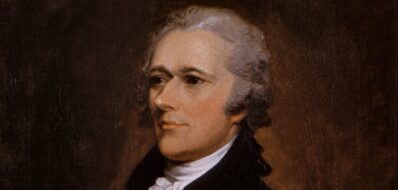

The Secretary of the Treasury, in obedience to the resolution of the House of Representatives, of the twenty-first day of September last, has, during the recess of Congress, applied himself to the consideration of a proper plan for the support of the Public Credit, with all the attention which was due to the authority of the House, and to the magnitude of the object.

To attempt to enumerate the complicated variety of mischiefs in the whole system of the social economy, which proceed from a neglect of the maxims that uphold public credit, and justify the solicitude manifested by the House on this point, would be an improper intrusion on their time and patience.

In so strong a light nevertheless do they appear to the Secretary, that on their due observance at the present critical juncture, materially depends, in his judgment, the individual and aggregate prosperity of the citizens of the United States; their relief from the embarrassments they now experience; their character as a People; the cause of good government.

If the maintenance of public credit, then, be truly so important, the next enquiry which suggests itself is, by what means it is to be effected? The ready answer to which question is, by good faith, by a punctual performance of contracts. States, like individuals, who observe their engagements, are respected and trusted: while the reverse is the fate of those, who pursue an opposite conduct.

While the observance of that good faith, which is the basis of public credit, is recommended by the strongest inducements of political expediency, it is enforced by considerations of still greater authority. There are arguments for it, which rest on the immutable principles of moral obligation. And in proportion as the mind is disposed to contemplate, in the order of Providence, an intimate connection between public virtue and public happiness, will be its repugnancy to a violation of those principles.

This reflection derives additional strength from the nature of the debt of the United States. It was the price of liberty. The faith of America has been repeatedly pledged for it, and with solemnities, that give peculiar force to the obligation. There is indeed reason to regret that it has not hitherto been kept; that the necessities of the war, conspiring with inexperience in the subjects of finance, produced direct infractions; and that the subsequent period has been a continued scene of negative violation, or non-compliance. But a diminution of this regret arises from the reflection, that the last seven years have exhibited an earnest and uniform effort, on the part of the government of the union, to retrieve the national credit, by doing justice to the creditors of the nation; and that the embarrassments of a defective constitution, which defeated this laudable effort, have ceased.

It cannot but merit particular attention, that among ourselves the most enlightened friends of good government are those, whose expectations are the highest.

To justify and preserve their confidence; to promote the encreasing respectability of the American name; to answer the calls of justice; to restore landed property to its due value; to furnish new resources both to agriculture and commerce; to cement more closely the union of the states; to add to their security against foreign attack; to establish public order on the basis of an upright and liberal policy. These are the great and invaluable ends to be secured, by a proper and adequate provision, at the present period, for the support of public credit.

To this provision we are invited, not only by the general considerations, which have been noticed, but by others of a more particular nature. It will procure to every class of the community some important advantages, and remove some no less important disadvantages.

The advantage to the public creditors from the increased value of that part of their property which constitutes the public debt, needs no explanation.

But there is a consequence of this, less obvious, though not less true, in which every other citizen is interested. It is a well known fact, that in countries in which the national debt is properly funded, and an object of established confidence, it answers most of the purposes of money. Transfers of stock or public debt are there equivalent to payments in specie; or in other words, stock, in the principal transactions of business, passes current as specie. The same thing would, in all probability happen here, under the like circumstances.

The benefits of this are various and obvious.

First. Trade is extended by it; because there is a larger capital to carry it on, and the merchant can at the same time, afford to trade for smaller profits; as his stock, which, when unemployed, brings him in an interest from the government, serves him also as money, when he has a call for it in his commercial operations.

Secondly. Agriculture and manufactures are also promoted by it: For the like reason, that more capital can be commanded to be employed in both; and because the merchant, whose enterprize in foreign trade, gives to them activity and extension, has greater means for enterprize.

Thirdly. The interest of money will be lowered by it; for this is always in a ratio, to the quantity of money, and to the quickness of circulation. This circumstance will enable both the public and individuals to borrow on easier and cheaper terms.

It is agreed on all hands, that that part of the debt which has been contracted abroad, and is denominated the foreign debt, ought to be provided for, according to the precise terms of the contracts relating to it. The discussions, which can arise, therefore, will have reference essentially to the domestic part of it, or to that which has been contracted at home. It is to be regretted, that there is not the same unanimity of sentiment on this part, as on the other.

The Secretary has too much deference for the opinions of every part of the community, not to have observed one, which has, more than once, made its appearance in the public prints, and which is occasionally to be met with in conversation. It involves this question, whether a discrimination ought not to be made between original holders of the public securities, and present possessors, by purchase. Those who advocate a discrimination are for making a full provision for the securities of the former, at their nominal value; but contend, that the latter ought to receive no more than the cost to them, and the interest: And the idea is sometimes suggested of making good the difference to the primitive possessor.

The impolicy of a discrimination results from two considerations; one, that it proceeds upon a principle destructive of that quality of the public debt, or the stock of the nation, which is essential to its capacity for answering the purposes of money–that is the security of transfer; the other, that as well on this account, as because it includes a breach of faith, it renders property in the funds less valuable; consequently induces lenders to demand a higher premium for what they lend, and produces every other inconvenience of a bad state of public credit.

It will be perceived at first sight, that the transferable quality of stock is essential to its operation as money, and that this depends on the idea of complete security to the transferree, and a firm persuasion, that no distinction can in any circumstances be made between him and the original proprietor.

The Secretary concluding, that a discrimination, between the different classes of creditors of the United States, cannot with propriety be made, proceeds to examine whether a difference ought to be permitted to remain between them, and another description of public creditors–Those of the states individually.

The Secretary, after mature reflection on this point, entertains a full conviction, that an assumption of the debts of the particular states by the union, and a like provision for them, as for those of the union, will be a measure of sound policy and substantial justice.

It would, in the opinion of the Secretary, contribute, in an eminent degree, to an orderly, stable and satisfactory arrangement of the national finances.

The principal question then must be, whether such a provision cannot be more conveniently and effectually made, by one general plan issuing from one authority, than by different plans originating in different authorities.

…Persuaded as the Secretary is, that the proper funding of the present debt, will render it a national blessing: Yet he is so far from acceding to the position, in the latitude in which it is sometimes laid down, that “public debts are public benefits,” a position inviting to prodigality, and liable to dangerous abuse,–that he ardently wishes to see it incorporated, as a fundamental maxim, in the system of public credit of the United States, that the creation of debt should always be accompanied with the means of extinguishment. This he regards as the true secret for rendering public credit immortal. And he presumes, that it is difficult to conceive a situation, in which there may not be an adherence to the maxim. At least he feels an unfeigned solicitude, that this may be attempted by the United States, and that they may commence their measures for the establishment of credit, with the observance of it.

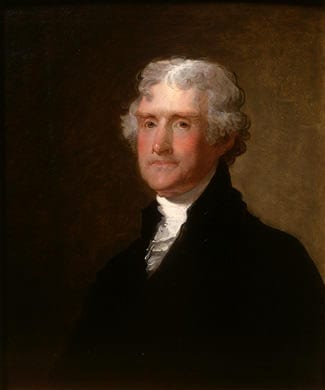

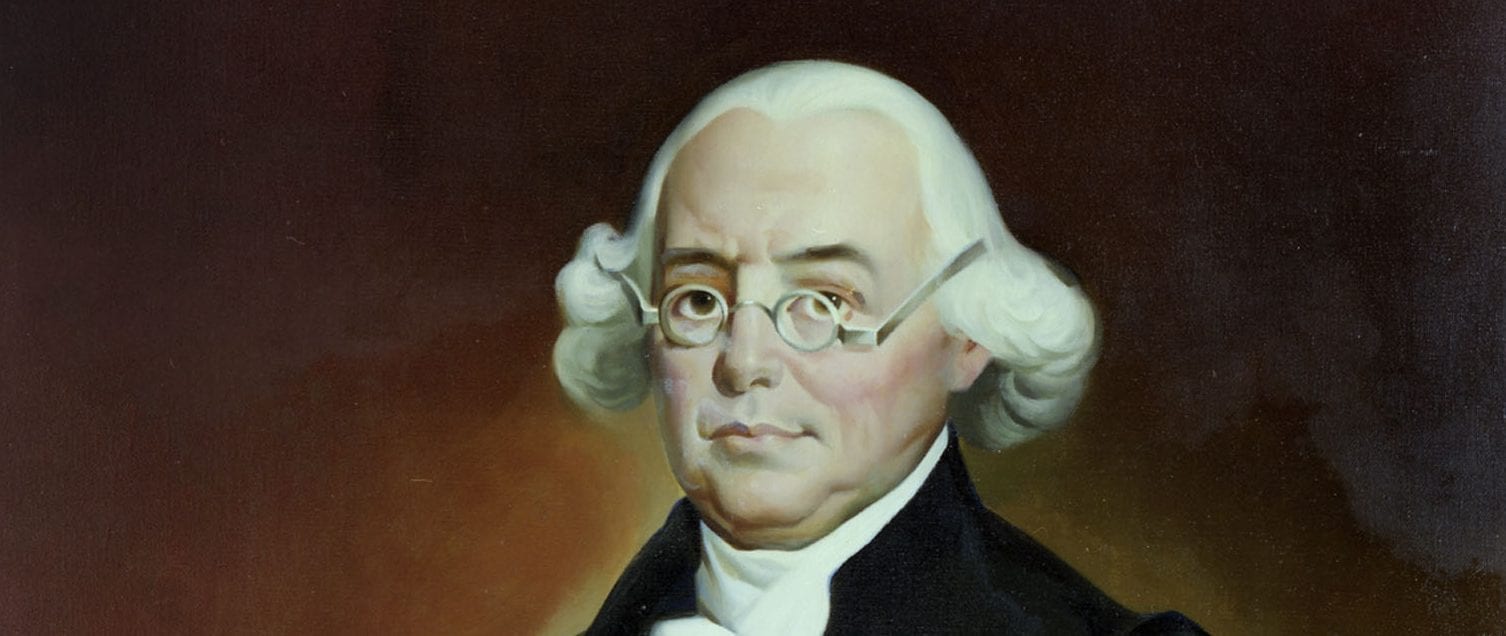

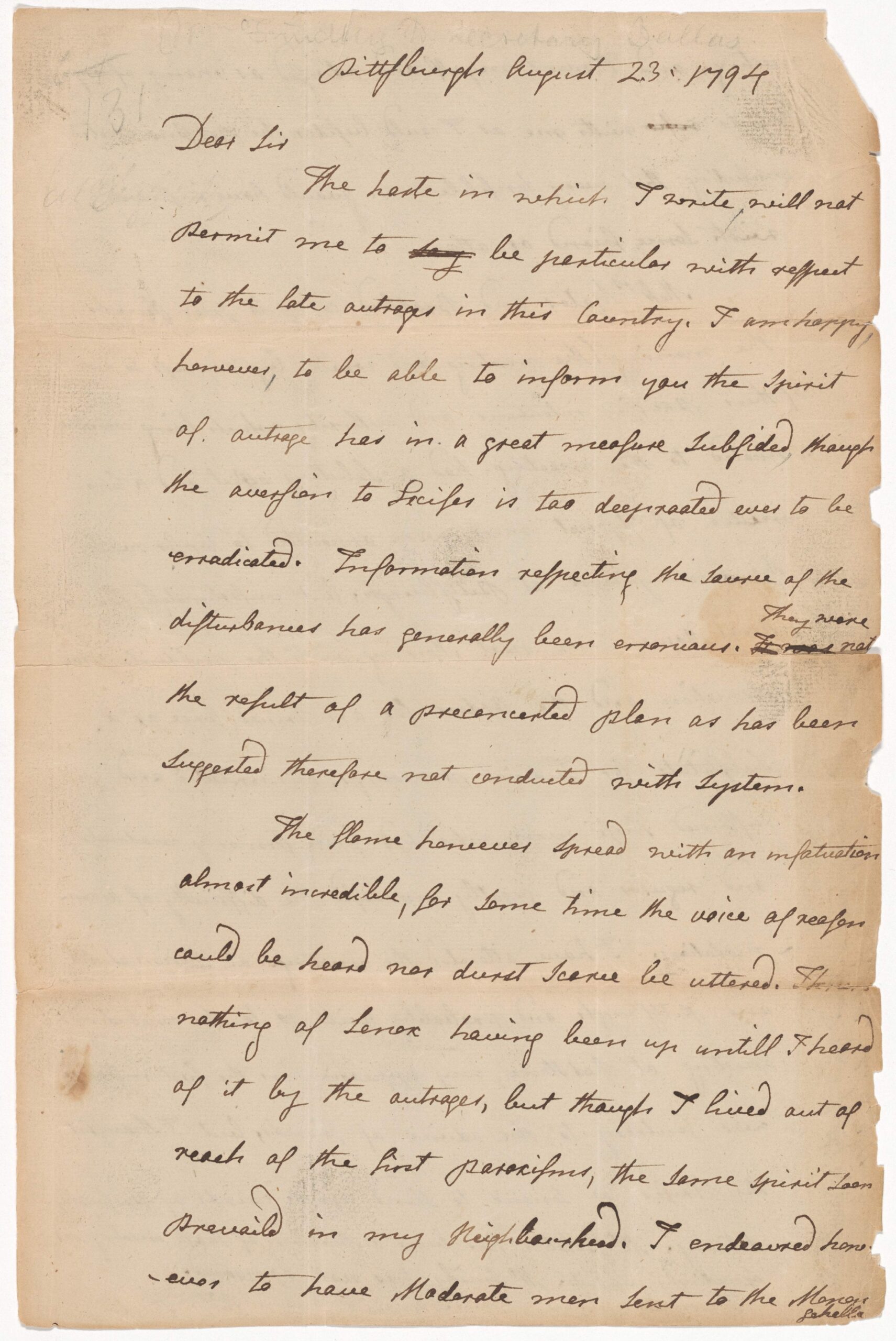

Letter from James Madison to Thomas Jefferson (1790)

February 04, 1790

Conversation-based seminars for collegial PD, one-day and multi-day seminars, graduate credit seminars (MA degree), online and in-person.