No related resources

Introduction

Sherbert v. Verner is a free exercise case involving employment rights. The decision ordered accommodation of the religious practices of Seventh-day Adventist workers, so that they may collect state unemployment insurance. By insisting that Adell Sherbert be given state unemployment benefits, despite her refusal to work on her Saturday Sabbath and subsequent firing, the Court expanded what it did earlier in West Virginia v. Barnette, recognizing free exercise rights against government. The claim of religious free exercise may also be asserted by a for-profit corporation, as in the contraceptive mandate at issue in Burwell v. Hobby Lobby, and in Masterpiece Cakeshop v. Colorado Civil Rights Commission.

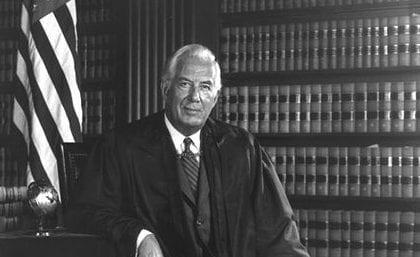

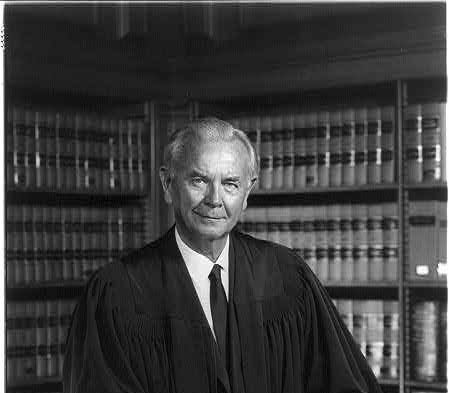

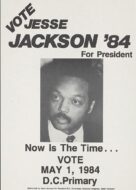

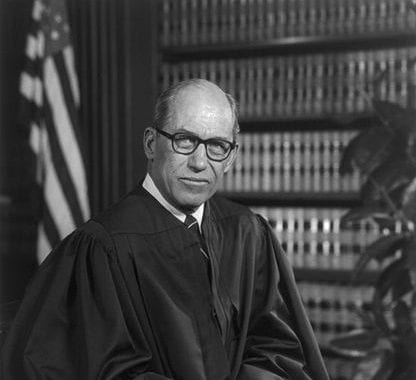

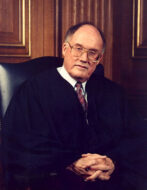

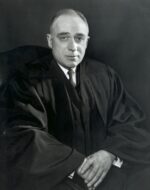

Source: 374 U.S. 398, https://www.law.cornell.edu/supremecourt/text/374/398. The Court decided the case 7–2. We have excerpted Justice William J. Brennan Jr.’s opinion for the Court and Justice John Marshall Harlan’s dissent. Footnotes added by the editors are preceded by “Ed. note.”

JUSTICE BRENNAN delivered the opinion of the Court.

Appellant,[1] a member of the Seventh-day Adventist Church, was discharged by her South Carolina employer because she would not work on Saturday, the Sabbath Day of her faith.[2] When she was unable to obtain other employment because, from conscientious scruples, she would not take Saturday work, she filed a claim for unemployment compensation benefits under the South Carolina Unemployment Compensation Act. That law provides that, to be eligible for benefits, a claimant must be “able to work and . . . available for work;” and, further, that a claimant is ineligible for benefits “[i]f . . . he has failed, without good cause . . . to accept available suitable work when offered him by the employment office or the employer. . . .” The appellee[3] Employment Security Commission, in administrative proceedings under the statute, found that appellant’s restriction upon her availability for Saturday work brought her within the provision disqualifying for benefits insured workers who fail, without good cause, to accept “suitable work when offered . . . by the employment office or the employer. . . .” . . . The State Supreme Court held specifically that appellant’s ineligibility infringed no constitutional liberties because such a construction of the statute places no restriction upon the appellant’s freedom of religion, nor does it in any way prevent her in the exercise of her right and freedom to observe her religious beliefs in accordance with the dictates of her conscience. . . . We reverse the judgment of the South Carolina Supreme Court and remand[4] for further proceedings not inconsistent with this opinion.

I

The door of the Free Exercise Clause stands tightly closed against any governmental regulation of religious beliefs as such, Cantwell v. Connecticut, 310 U.S. 296. Government may neither compel affirmation of a repugnant belief; nor penalize or discriminate against individuals or groups because they hold religious views abhorrent to the authorities; nor employ the taxing power to inhibit the dissemination of particular religious views. On the other hand, the Court has rejected challenges under the Free Exercise Clause to governmental regulation of certain overt acts prompted by religious beliefs or principles, for “even when the action is in accord with one’s religious convictions, [it] is not totally free from legislative restrictions.” Braunfeld v. Brown. The conduct or actions so regulated have invariably posed some substantial threat to public safety, peace or order. See, e.g., Reynolds v. United States, 98 U.S. 145. . . ..[5]

Plainly enough, appellant’s conscientious objection to Saturday work constitutes no conduct prompted by religious principles of a kind within the reach of state legislation. If, therefore, the decision of the South Carolina Supreme Court is to withstand appellant’s constitutional challenge, it must be either because her disqualification as a beneficiary represents no infringement by the state of her constitutional rights of free exercise, or because any incidental burden on the free exercise of appellant’s religion may be justified by a “compelling state interest in the regulation of a subject within the state’s constitutional power to regulate. . . .”[6]

II

We turn first to the question whether the disqualification for benefits imposes any burden on the free exercise of appellant’s religion. We think it is clear that it does. In a sense, the consequences of such a disqualification to religious principles and practices may be only an indirect result of welfare legislation within the state’s general competence to enact; it is true that no criminal sanctions directly compel appellant to work a six-day week. But this is only the beginning, not the end, of our inquiry. For “[i]f the purpose or effect of a law is to impede the observance of one or all religions or is to discriminate invidiously between religions, that law is constitutionally invalid even though the burden may be characterized as being only indirect.”[7] Here, not only is it apparent that appellant’s declared ineligibility for benefits derives solely from the practice of her religion, but the pressure upon her to forego that practice is unmistakable. The ruling forces her to choose between following the precepts of her religion and forfeiting benefits, on the one hand, and abandoning one of the precepts of her religion in order to accept work, on the other hand. Governmental imposition of such a choice puts the same kind of burden upon the free exercise of religion as would a fine imposed against appellant for her Saturday worship.

Nor may the South Carolina court’s construction of the statute be saved from constitutional infirmity on the ground that unemployment compensation benefits are not appellant’s “right,” but merely a “privilege.” It is too late in the day to doubt that the liberties of religion and expression may be infringed by the denial of or placing of conditions upon a benefit or privilege. . . .

Significantly, South Carolina expressly saves the Sunday worshipper from having to make the kind of choice which we here hold infringes the Sabbatarian’s religious liberty. When, in times of “national emergency,” the textile plants are authorized by the state commissioner of labor to operate on Sunday, “no employee shall be required to work on Sunday . . . who is conscientiously opposed to Sunday work, and if any employee should refuse to work on Sunday on account of conscientious . . . objections, he or she shall not jeopardize his or her seniority by such refusal or be discriminated against in any other manner.” No question of the disqualification of a Sunday worshipper for benefits is likely to arise, since we cannot suppose that an employer will discharge him in violation of this statute. The unconstitutionality of the disqualification of the Sabbatarian is thus compounded by the religious discrimination which South Carolina’s general statutory scheme necessarily effects.

III

We must next consider whether some compelling state interest enforced in the eligibility provisions of the South Carolina statute justifies the substantial infringement of appellant’s First Amendment right. It is basic that no showing merely of a rational relationship to some colorable[8] state interest would suffice; in this highly sensitive constitutional area, “[o]nly the gravest abuses, endangering paramount interests, give occasion for permissible limitation.”[9] No such abuse or danger has been advanced in the present case. The appellees suggest no more than a possibility that the filing of fraudulent claims by unscrupulous claimants feigning religious objections to Saturday work might not only dilute the unemployment compensation fund, but also hinder the scheduling by employers of necessary Saturday work. But that possibility is not apposite here, because no such objection appears to have been made before the South Carolina Supreme Court, and we are unwilling to assess the importance of an asserted state interest without the views of the state court. Nor, if the contention had been made below, would the record appear to sustain it; there is no proof whatever to warrant such fears of malingering or deceit as those which the respondents now advance. Even if consideration of such evidence is not foreclosed by the prohibition against judicial inquiry into the truth or falsity of religious beliefs,—a question as to which we intimate no view, since it is not before us—it is highly doubtful whether such evidence would be sufficient to warrant a substantial infringement of religious liberties. For even if the possibility of spurious claims did threaten to dilute the fund and disrupt the scheduling of work, it would plainly be incumbent upon the appellees to demonstrate that no alternative forms of regulation would combat such abuses without infringing First Amendment rights.

In these respects, then, the state interest asserted in the present case is wholly dissimilar to the interests which were found to justify the less direct burden upon religious practices in Braunfeld v. Brown. The Court recognized that the Sunday closing law which that decision sustained undoubtedly served “to make the practice of [the Orthodox Jewish merchants’] . . . religious beliefs more expensive.” But the statute was nevertheless saved by a countervailing factor which finds no equivalent in the instant case—a strong state interest in providing one uniform day of rest for all workers. That secular objective could be achieved, the Court found, only by declaring Sunday to be that day of rest. Requiring exemptions for Sabbatarians, while theoretically possible, appeared to present an administrative problem of such magnitude, or to afford the exempted class so great a competitive advantage, that such a requirement would have rendered the entire statutory scheme unworkable. In the present case, no such justifications underlie the determination of the state court that appellant’s religion makes her ineligible to receive benefits.

IV

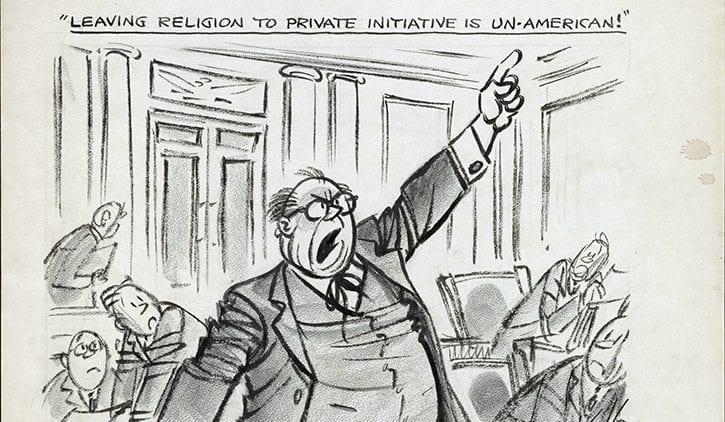

In holding as we do, plainly we are not fostering the “establishment” of the Seventh-day Adventist religion in South Carolina, for the extension of unemployment benefits to Sabbatarians in common with Sunday worshippers reflects nothing more than the governmental obligation of neutrality in the face of religious differences, and does not represent that involvement of religious with secular institutions which it is the object of the Establishment Clause to forestall. Nor does the recognition of the appellant’s right to unemployment benefits under the state statute serve to abridge any other person’s religious liberties. Nor do we, by our decision today, declare the existence of a constitutional right to unemployment benefits on the part of all persons whose religious convictions are the cause of their unemployment. This is not a case in which an employee’s religious convictions serve to make him a nonproductive member of society. Finally, nothing we say today constrains the states to adopt any particular form or scheme of unemployment compensation. Our holding today is only that South Carolina may not constitutionally apply the eligibility provisions so as to constrain a worker to abandon his religious convictions respecting the day of rest. This holding but reaffirms a principle that we announced a decade and a half ago, namely that no state may “exclude individual Catholics, Lutherans, Mohammedans, Baptists, Jews, Methodists, Non-believers, Presbyterians, or the members of any other faith, because of their faith, or lack of it, from receiving the benefits of public welfare legislation.” Everson v. Board of Education, 330 U.S. 1, 16.[10]

In view of the result we have reached under the First and Fourteenth Amendments’ guarantee of free exercise of religion, we have no occasion to consider appellant’s claim that the denial of benefits also deprived her of the equal protection of the laws in violation of the Fourteenth Amendment. . . .

JUSTICE HARLAN, whom MR. JUSTICE WHITE joins, dissenting.

Today’s decision is disturbing both in its rejection of existing precedent and in its implications for the future. The significance of the decision can best be understood after an examination of the state law applied in this case.

South Carolina’s Unemployment Compensation Law was enacted in 1936 in response to the grave social and economic problems that arose during the depression of that period. As stated in the statute itself:

Economic insecurity due to unemployment is a serious menace to health, morals and welfare of the people of this state; involuntary unemployment is therefore a subject of general interest and concern . . . ; the achievement of social security requires protection against this greatest hazard of our economic life; this can be provided by encouraging the employers to provide more stable employment and by the systematic accumulation of funds during periods of employment to provide benefits for periods of unemployment, thus maintaining purchasing power and limiting the serious social consequences of poor relief assistance.” (Emphasis added.)

Thus, the purpose of the legislature was to tide people over, and to avoid social and economic chaos, during periods when work was unavailable. But, at the same time, there was clearly no intent to provide relief for those who, for purely personal reasons, were or became unavailable for work. In accordance with this design, the legislature provided, in § 68-113, that “[a]n unemployed insured worker shall be eligible to receive benefits with respect to any week only if the Commission finds that . . . [h]e is able to work and is available for work. . . . “ (Emphasis added.)

The South Carolina Supreme Court has uniformly applied this law in conformity with its clearly expressed purpose. It has consistently held that one is not “available for work” if his unemployment has resulted not from the inability of industry to provide a job, but rather from personal circumstances, no matter how compelling. The reference to “involuntary unemployment” in the legislative statement of policy, whatever a sociologist, philosopher, or theologian might say, has been interpreted not to embrace such personal circumstances. . . . In the present case, all that the state court has done is to apply these accepted principles. Since virtually all of the mills in the Spartanburg area were operating on a six-day week, the appellant was “unavailable for work,” and thus ineligible for benefits, when personal considerations prevented her from accepting employment on a full-time basis in the industry and locality in which she had worked. The fact that these personal considerations sprang from her religious convictions was wholly without relevance to the state court’s application of the law. Thus, in no proper sense can it be said that the state discriminated against the appellant on the basis of her religious beliefs or that she was denied benefits because she was a Seventh-day Adventist. She was denied benefits just as any other claimant would be denied benefits who was not “available for work” for personal reasons.

With this background, this Court’s decision comes into clearer focus. What the Court is holding is that, if the state chooses to condition unemployment compensation on the applicant’s availability for work, it is constitutionally compelled to carve out an exception—and to provide benefits—for those whose unavailability is due to their religious convictions. Such a holding has particular significance in two respects.

First, despite the Court’s protestations to the contrary, the decision necessarily overrules Braunfeld v. Brown, which held that it did not offend the “Free Exercise” Clause of the Constitution for a state to forbid a Sabbatarian to do business on Sunday. The secular purpose of the statute before us today is even clearer than that involved in Braunfeld. And just as in Braunfeld—where exceptions to the Sunday closing laws for Sabbatarians would have been inconsistent with the purpose to achieve a uniform day of rest and would have required case-by-case inquiry into religious beliefs—so here, an exception to the rules of eligibility based on religious convictions would necessitate judicial examination of those convictions and would be at odds with the limited purpose of the statute to smooth out the economy during periods of industrial instability. Finally, the indirect financial burden of the present law is far less than that involved in Braunfeld. Forcing a store owner to close his business on Sunday may well have the effect of depriving him of a satisfactory livelihood if his religious convictions require him to close on Saturday as well. Here we are dealing only with temporary benefits, amounting to a fraction of regular weekly wages and running for not more than 22 weeks. Clearly, any differences between this case and Braunfeld cut against the present appellant.

Second, the implications of the present decision are far more troublesome than its apparently narrow dimensions would indicate at first glance. The meaning of today’s holding, as already noted, is that the state must furnish unemployment benefits to one who is unavailable for work if the unavailability stems from the exercise of religious convictions. The state, in other words, must single out for financial assistance those whose behavior is religiously motivated, even though it denies such assistance to others whose identical behavior (in this case, inability to work on Saturdays) is not religiously motivated. It has been suggested that such singling out of religious conduct for special treatment may violate the constitutional limitations on state action. My own view, however, is that, at least under the circumstances of this case, it would be a permissible accommodation of religion for the state, if it chose to do so, to create an exception to its eligibility requirements for persons like the appellant. The constitutional obligation of “neutrality”[11] is not so narrow a channel that the slightest deviation from an absolutely straight course leads to condemnation. There are too many instances in which no such course can be charted, too many areas in which the pervasive activities of the state justify some special provision for religion to prevent it from being submerged by an all-embracing secularism. The state violates its obligation of neutrality when, for example, it mandates a daily religious exercise in its public schools, with all the attendant pressures on the school children that such an exercise entails. But there is, I believe, enough flexibility in the Constitution to permit a legislative judgment accommodating an unemployment compensation law to the exercise of religious beliefs such as appellant’s.

For very much the same reasons, however, I cannot subscribe to the conclusion that the state is constitutionally compelled to carve out an exception to its general rule of eligibility in the present case. Those situations in which the Constitution may require special treatment on account of religion are, in my view, few and far between, and this view is amply supported by the course of constitutional litigation in this area. Such compulsion in the present case is particularly inappropriate in light of the indirect, remote, and insubstantial effect of the decision below on the exercise of appellant’s religion and in light of the direct financial assistance to religion that today’s decision requires.

For these reasons I respectfully dissent from the opinion and judgment of the Court.

- 1. Ed. note: person who applies to a higher court to reverse the decision of a lower court

- 2. Appellant became a member of the Seventh-day Adventist Church in 1957, at a time when her employer, a textile mill operator, permitted her to work a five-day week. It was not until 1959 that the work week was changed to six days, including Saturday, for all three shifts in the employer's mill. No question has been raised in this case concerning the sincerity of appellant's religious beliefs. Nor is there any doubt that the prohibition against Saturday labor is a basic tenet of the Seventh-day Adventist creed, based upon that religion's interpretation of the only Bible.

- 3. Ed. note: the party against whom an appeal is filed

- 4. Ed. note: return a case to a lower court for reconsideration

- 5. Ed. note: Reynolds v. United States

- 6. Ed. note: Justice Brennan cited NAACP v. Button, 371 U.S. 415, 438.

- 7. Ed. note: Justice Brennan cited Braunfeld v. Brown, 607.

- 8. Ed. note: an apparently correct or justified claim or interest

- 9. Ed. note: Justice Brennan cited Thomas v. Collins, 323 U.S. 516, 530.

- 10. Ed. note: Everson v. Board of Education of the Township of Ewing

- 11. Ed. note: Justice John Marshall Harlan cited School District of Abington Township v. Schempp https://www.law.cornell.edu/supremecourt/text/374/203, in which the Court found that a requirement to read Bible passages or the Lord’s prayer was an establishment of religion and thus prohibited by the First Amendment.

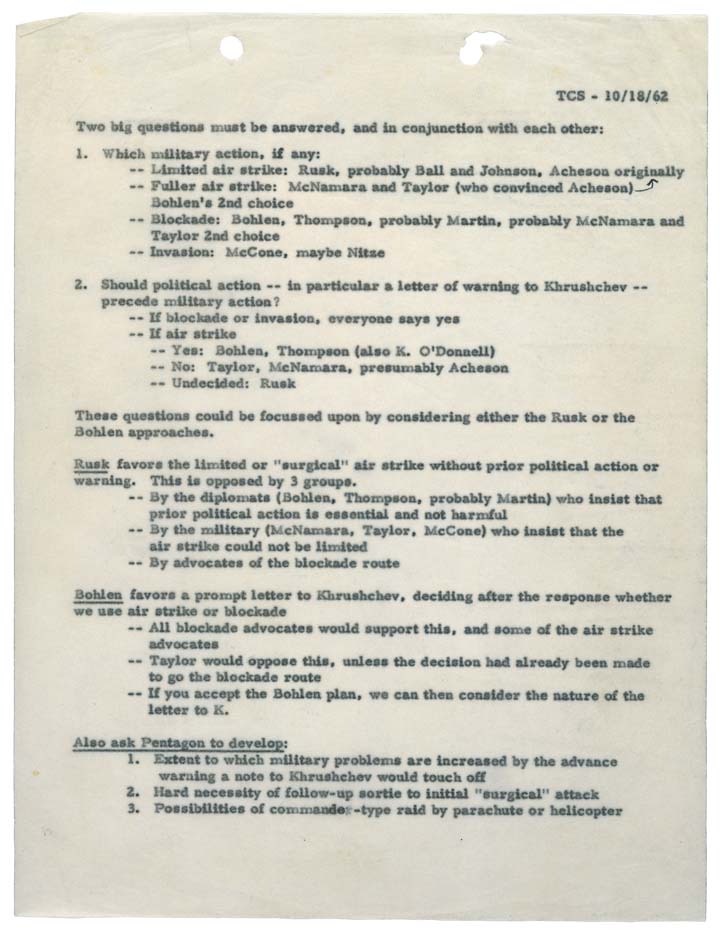

Abington School District v. Schempp

June 17, 1963

Conversation-based seminars for collegial PD, one-day and multi-day seminars, graduate credit seminars (MA degree), online and in-person.