No study questions

No related resources

II. REPORTING AND DISCLOSURE REQUIREMENTS

Unlike the limitations on contributions and expenditures imposed by 18 U.S.C. 608 (1970 ed., Supp. IV), the disclosure requirements of the Act, 2 U.S.C. 431 et seq. (1970 ed., Supp. IV), are not challenged by appellants as per se unconstitutional restrictions on the exercise of First Amendment freedoms of speech and association. Indeed, appellants argue that “narrowly drawn disclosure requirements are the proper solution to virtually all of the evils Congress sought to remedy.” Brief for Appellants 171. The particular requirements embodied in the Act are attacked as overbroad — both in their application to minor—party and independent candidates and in their extension to contributions as small as $11 or $101. Appellants also challenge the provision for disclosure by those who make independent contributions and expenditures, 434 (e). The Court of Appeals found no constitutional infirmities in the provisions challenged here. We affirm the determination on overbreadth and hold that 434 (e), if narrowly construed, also is within constitutional bounds.

The first federal disclosure law was enacted in 1910. Act of June 25, 1910, c. 392, 36 Stat. 822. It required political committees, defined as national committees and national congressional campaign committees of parties, and organizations operating to influence congressional elections in two or more States, to disclose names of all contributors of $100 or more; identification of recipients of expenditures of $10 or more was also required. 1, 5—6, 36 Stat. 822 824. Annual expenditures of $50 or more “for the purpose of influencing or controlling, in two or more States, the result of” a congressional election had to be reported independently if they were not made through a political committee. 7, 36 Stat. 824. In 1911 the Act was revised to include prenomination transactions such as those involved in conventions and primary campaigns. Act of Aug. 19, 1911, 2, 37 Stat. 26. See United States v. Auto. Workers, 352 U.S., at 575—576.

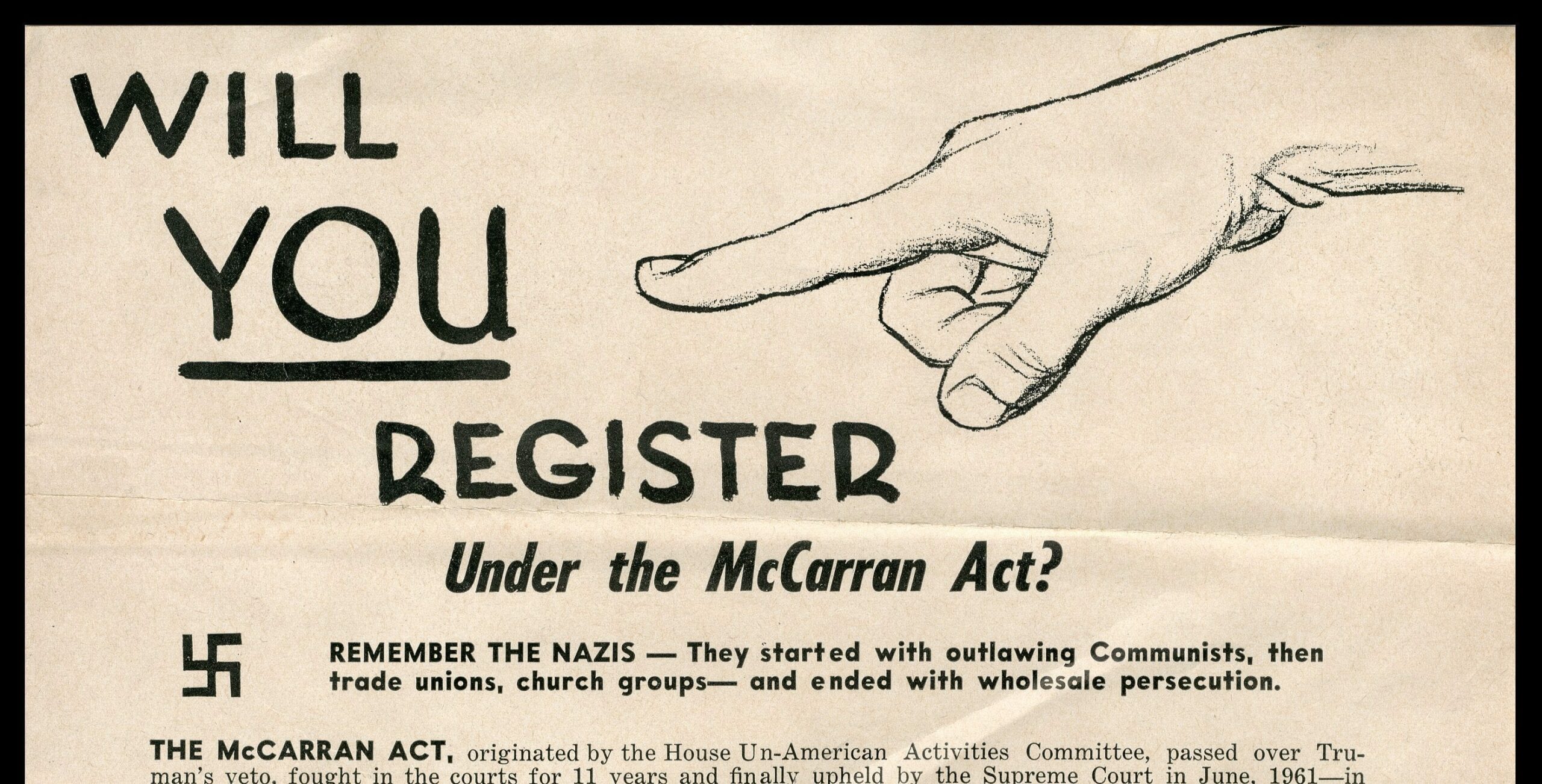

Disclosure requirements were broadened in the Federal Corrupt Practices Act of 1925 (Title III of the Act of Feb. 28, 1925), 43 Stat. 1070. That Act required political committees, defined as organizations that accept contributions or make expenditures “for the purpose of influencing or attempting to influence” the Presidential or Vice Presidential elections (a) in two or more States or (b) as a subsidiary of a national committee, 302 (c), 43 Stat. 1070, to report total contributions and expenditures, including the names and addresses of contributors of $100 or more and recipients of $10 or more in a calendar year. 305 (a), 43 Stat. 1071. The Act was upheld against a challenge that it infringed upon the prerogatives of the States in Burroughs v. United States, 290 U.S. 534 (1934). The Court held that it was within the power of Congress “to pass appropriate legislation to safeguard [a Presidential] election from the improper use of money to influence the result.” Id., at 545. Although the disclosure requirements were widely circumvented, no further attempts were made to tighten them until 1960, when the Senate passed a bill that would have closed some existing loopholes. S. 2436, 106 Cong. Rec. 1193. The attempt aborted because no similar effort was made in the House.

The Act presently under review replaced all prior disclosure laws. Its primary disclosure provisions impose reporting obligations on “political committees” and candidates. “Political committee” is defined in 431 (d) as a group of persons that receives “contributions” or makes “expenditures” of over $1,000 in a calendar year. “Contributions” and quot;expenditures” are defined in lengthy parallel provisions similar to those in Title 18, discussed above. Both definitions focus on the use of money or other objects of value “for the purpose of . . . influencing” the nomination or election of any person to federal office. 431 (e) (1), (f) (1).

Each political committee is required to register with the Commission, 433, and to keep detailed records of both contributions and expenditures, 432 (c), (d). These records must include the name and address of everyone making a contribution in excess of $10, along with the date and amount of the contribution. If a person’s contributions aggregate more than $100, his occupation and principal place of business are also to be included. 432 (c) (2). These files are subject to periodic audits and field investigations by the

Commission. 438 (a) (8).

Each committee and each candidate also is required to file quarterly reports. 434 (a). The reports are to contain detailed financial information, including the full name, mailing address, occupation, and principal place of business of each person who has contributed over $100 in a calendar year, as well as the amount and date of the contributions. 434 (b). They are to be made available by the Commission “for public inspection and copying.” 438 (a) (4). Every candidate for federal office is required to designate a “principal campaign committee,” which is to receive reports of contributions and expenditures made on the candidate’s behalf from other political committees and to compile and file these reports, together with its own statements, with the Commission. 432 (f).

Every individual or group, other than a political committee or candidate, who makes “contributions” or “expenditures” of over $100 in a calendar year “other than by contribution to a political committee or candidate” is required to file a statement with the Commission. 434 (e). Any violation of these recordkeeping and reporting provisions is punishable by a fine of not more than $1,000 or a prison term of not more than a year, or both. 441 (a).

A. General Principles

Unlike the overall limitations on contributions and expenditures, the disclosure requirements impose no ceiling on campaign—related activities. But we have repeatedly found that compelled disclosure, in itself, can seriously infringe on privacy of association and belief guaranteed by the First Amendment. E. g., Gibson v. Florida Legislative Comm., 372 U.S. 539 (1963); NAACP v. Button, 371 U.S. 415 (1963); Shelton v. Tucker, 364 U.S. 479 (1960); Bates v. Little Rock, 361 U.S. 516 (1960); NAACP v. Alabama, 357 U.S. 449 (1958).

We long have recognized that significant encroachments on First Amendment rights of the sort that compelled disclosure imposes cannot be justified by a mere showing of some legitimate governmental interest. Since NAACP v. Alabama we have required that the subordinating interests of the State must survive exacting scrutiny. We also have insisted that there be a “relevant correlation” or “substantial relation” between the governmental interest and the information required to be disclosed. See Pollard v. Roberts, 283 F. Supp. 248, 257 (ED Ark.) (three—judge court), aff’d, 393 U.S. 14 (1968) (per curiam). This type of scrutiny is necessary even if any deterrent effect on the exercise of First Amendment rights arises, not through direct government action, but indirectly as an unintended but inevitable result of the government’s conduct in requiring disclosure. NAACP v. Alabama, supra, at 461. Cf. Kusper v. Pontikes, 414 U.S., at 57—58.

Appellees argue that the disclosure requirements of the Act differ significantly from those at issue in NAACP v. Alabama and its progeny because the Act only requires disclosure of the names of contributors and does not compel political organizations to submit the names of their members.

As we have seen, group association is protected because it enhances “[e]ffective advocacy.” NAACP v. Alabama, supra, at 460. The right to join together “for the advancement of beliefs and ideas,” ibid., is diluted if it does not include the right to pool money through contributions, for funds are often essential if “advocacy” is to be truly or optimally “effective.” Moreover, the invasion of privacy of belief may be as great when the information sought concerns the giving and spending of money as when it concerns the joining of organizations, for “[f]inancial transactions can reveal much about a person’s activities, associations, and beliefs.” California Bankers Assn. v. Shultz, 416 U.S. 21, 78—79 (1974) (POWELL, J., concurring). Our past decisions have not drawn fine lines between contributors and members but have treated them interchangeably. In Bates, for example, we applied the principles of NAACP v. Alabama and reversed convictions for failure to comply with a city ordinance that required the disclosure of “dues, assessments, and contributions paid, by whom and when paid.” 361 U.S., at 518. See also United States v. Rumely, 345 U.S. 41 (1953) (setting aside a contempt conviction of an organization official who refused to disclose names of those who made bulk purchases of books sold by the organization).

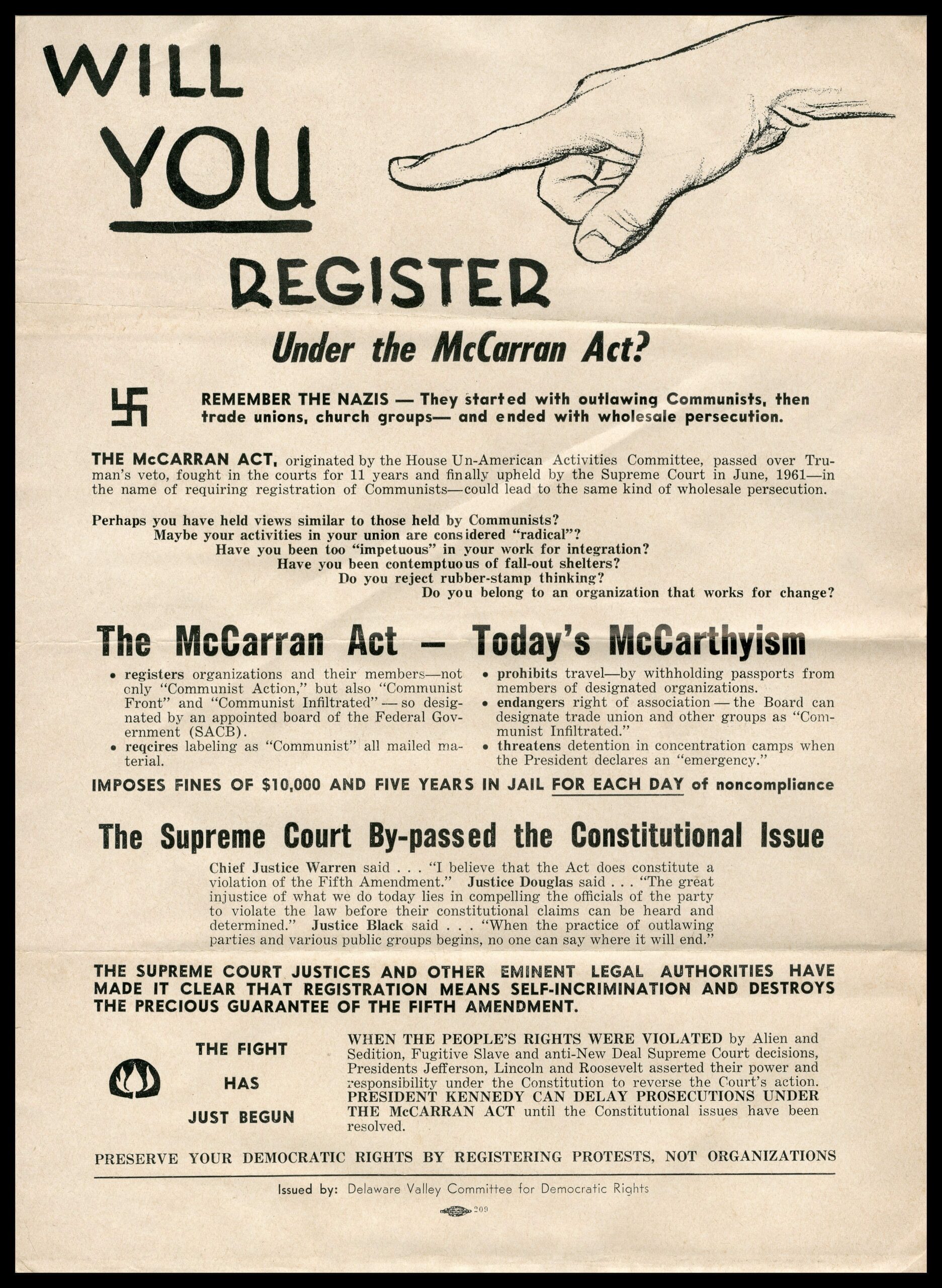

The strict test established by NAACP v. Alabama is necessary because compelled disclosure has the potential for substantially infringing the exercise of First Amendment rights. But we have acknowledged that there are governmental interests sufficiently important to outweigh the possibility of infringement, particularly when the “free functioning of our national institutions” is involved. Communist Party v.

Subversive Activities Control Bd., 367 U.S. 1, 97 (1961).

The governmental interests sought to be vindicated by the disclosure requirements are of this magnitude. They fall into three categories. First, disclosure provides the electorate with information “as to where political campaign money comes from and how it is spent by the candidate” in order to aid the voters in evaluating those who seek federal office. It allows voters to place each candidate in the political spectrum more precisely than is often possible solely on the basis of party labels and campaign speeches. The sources of a candidate’s financial support also alert the voter to the interests to which a candidate is most likely to be responsive and thus facilitate predictions of future performance in office.

Second, disclosure requirements deter actual corruption and avoid the appearance of corruption by exposing large contributions and expenditures to the light of publicity. This exposure may discourage those who would use money for improper purposes either before or after the election. A public armed with information about a candidate’s most generous supporters is better able to detect any post—election special favors that may be given in return. And, as we recognized in Burroughs v. United States, 290 U.S., at 548, Congress could reasonably conclude that full disclosure during an election campaign tends “to prevent the corrupt use of money to affect elections.” In enacting these requirements it may have been mindful of Mr. Justice Brandeis’ advice: “Publicity is justly commended as a remedy for social and industrial diseases. Sunlight is said to be the best of disinfectants; electric light the most efficient policeman.”

Third, and not least significant, recordkeeping, reporting, and disclosure requirements are an essential means of gathering the data necessary to detect violations of the contribution limitations described above.

The disclosure requirements, as a general matter, directly serve substantial governmental interests. In determining whether these interests are sufficient to justify the requirements we must look to the extent of the burden that they place on individual rights.

It is undoubtedly true that public disclosure of contributions to candidates and political parties will deter some individuals who otherwise might contribute. In some instances, disclosure may even expose contributors to harassment or retaliation. These are not insignificant burdens on individual rights, and they must be weighed carefully against the interests which Congress has sought to promote by this legislation. In this process, we note and agree with appellants’ concession that disclosure requirements — certainly in most applications — appear to be the least restrictive means of curbing the evils of campaign ignorance and corruption that Congress found to exist. Appellants argue, however, that the balance tips against disclosure when it is required of contributors to certain parties and candidates. We turn now to this contention.

B. Application to Minor Parties and Independents

Appellants contend that the Act’s requirements are overbroad insofar as they apply to contributions to minor parties and independent candidates because the governmental interest in this information is minimal and the danger of significant infringement on First Amendment rights is greatly increased.

1. Requisite Factual Showing

In NAACP v. Alabama the organization had “made an uncontroverted showing that on past occasions revelation of the identity of its rank—and—file members [had] exposed these members to economic reprisal, loss of employment, threat of physical coercion, and other manifestations of public hostility,” 357 U.S., at

462, and the State was unable to show that the disclosure it sought had a quot;substantial bearing” on the issues it sought to clarify, id., at 464. Under those circumstances, the Court held that “whatever interest the State may have in [disclosure] has not been shown to be sufficient to overcome petitioner’s constitutional objections.” Id., at 465.

The Court of Appeals rejected appellants’ suggestion that this case fits into the NAACP v. Alabama mold. It concluded that substantial governmental interests in “informing the electorate and preventing the corruption of the political process” were furthered by requiring disclosure of minor parties and independent

candidates, 171 U.S. App. D.C., at 218, 519 F.2d, at 867, and therefore found no “tenable rationale for assuming that the public interest in minority party disclosure of contributions above a reasonable cutoff point is uniformly outweighed by potential contributors’ associational rights,” id., at 219, 519 F.2d, at 868. The court left open the question of the application of the disclosure requirements to candidates (and parties) who could demonstrate injury of the sort at stake in NAACP v. Alabama. No record of harassment on a similar scale was found in this case. We agree with the Court of Appeals’ conclusion that NAACP v. Alabama is inapposite where, as here, any serious infringement on First Amendment rights brought about by the compelled disclosure of contributors is highly speculative.

It is true that the governmental interest in disclosure is diminished when the contribution in question is made to a minor party with little chance of winning an election. As minor parties usually represent definite and publicized viewpoints, there may be less need to inform the voters of the interests that specific candidates represent. Major parties encompass candidates of greater diversity. In many situations the label “Republican” or “Democrat” tells a voter little. The candidate who bears it may be supported by funds from the far right, the far left, or any place in between on the political spectrum. It is less likely that a candidate of, say, the Socialist Labor Party will represent interests that cannot be discerned from the party’s ideological position.

The Government’s interest in deterring the “buying” of elections and the undue influence of large contributors on officeholders also may be reduced where contributions to a minor party or an independent candidate are concerned, for it is less likely that the candidate will be victorious. But a minor party sometimes can play a significant role in an election. Even when a minor—party candidate has little or no chance of winning, he may be encouraged by major—party interests in order to divert votes from other major—party contenders.

We are not unmindful that the damage done by disclosure to the associational interests of the minor parties and their members and to supporters of independents could be significant. These movements are less likely to have a sound financial base and thus are more vulnerable to falloffs in contributions. In some instances fears of reprisal may deter contributions to the point where the movement cannot survive. The public interest also suffers if that result comes to pass, for there is a consequent reduction in the free circulation of ideas both within and without the political arena.

There could well be a case, similar to those before the Court in NAACP v. Alabama and Bates, where the threat to the exercise of First Amendment rights is so serious and the state interest furthered by disclosure so insubstantial that the Act’s requirements cannot be constitutionally applied. But no appellant in this case has tendered record evidence of the sort proffered in NAACP v. Alabama. Instead, appellants primarily rely on “the clearly articulated fears of individuals, well experienced in the political process.” Brief for Appellants 173. At best they offer the testimony of several minor—party officials that one or two persons refused to make contributions because of the possibility of disclosure. On this record, the substantial public interest in disclosure identified by the legislative history of this Act outweighs the harm generally alleged.

2. Blanket Exemption

Appellants agree that “the record here does not reflect the kind of focused and insistent harassment of contributors and members that existed in the NAACP cases.” Ibid. They argue, however, that a blanket exemption for minor parties is necessary lest irreparable injury be done before the required evidence can be gathered.

Those parties that would be sufficiently “minor” to be exempted from the requirements of 434 could be defined, appellants suggest, along the lines used for public—financing purposes, see Part III—A, infra, as those who received less than 25% of the vote in past elections. Appellants do not argue that this line is constitutionally required. They suggest as an alternative defining “minor parties” as those that do not qualify for automatic ballot access under state law. Presumably, other criteria, such as current political strength (measured by polls or petition), age, or degree of organization, could also be used.

The difficulty with these suggestions is that they reflect only a party’s past or present political strength and that is only one of the factors that must be considered. Some of the criteria are not precisely indicative of even that factor. Age, or past political success, for instance, may typically be associated with parties that have a high probability of success. But not all long—established parties are winners — some are consistent losers — and a new party may garner a great deal of support if it can associate itself with an issue that has captured the public’s imagination. None of the criteria suggested is precisely related to the other critical factor that must be considered, the possibility that disclosure will impinge upon protected associational activity.

An opinion dissenting in part from the Court of Appeals’ decision concedes that no one line is “constitutionally required.” It argues, however, that a flat exemption for minor parties must be carved out, even along arbitrary lines, if groups that would suffer impermissibly from disclosure are to be given any real protection. An approach that requires minor parties to submit evidence that the disclosure requirements cannot constitutionally be applied to them offers only an illusory safeguard, the argument goes, because the “evils” of “chill and harassment . . . are largely incapable of formal proof.” This dissent expressed its concern that a minor party, particularly a new party, may never be able to prove a substantial threat of harassment, however real that threat may be, because it would be required to come forward with witnesses who are too fearful to contribute but not too fearful to testify about their fear. A strict requirement that chill and harassment be directly attributable to the specific disclosure from which the exemption is sought would make the task even more difficult.

We recognize that unduly strict requirements of proof could impose a heavy burden, but it does not follow that a blanket exemption for minor parties is necessary. Minor parties must be allowed sufficient flexibility in the proof of injury to assure a fair consideration of their claim. The evidence offered need show only a reasonable probability that the compelled disclosure of a party’s contributors’ names will subject them to threats, harassment, or reprisals from either Government officials or private parties. The proof may include, for example, specific evidence of past or present harassment of members due to their associational ties, or of harassment directed against the organization itself. A pattern of threats or specific manifestations of public hostility may be sufficient. New parties that have no history upon which to draw may be able to offer evidence of reprisals and threats directed against individuals or organizations holding similar views.

Where it exists the type of chill and harassment identified in NAACP v. Alabama can be shown. We cannot assume that courts will be insensitive to similar showings when made in future cases. We therefore conclude that a blanket exemption is not required.

C. Section 434 (e)

Section 434 (e) requires “[e]very person (other than a political committee or candidate) who makes contributions or expenditures” aggregating over $100 in a calendar year “other than by contribution to a political committee or candidate” to file a statement with the Commission. Unlike the other disclosure provisions, this section does not seek the contribution list of any association. Instead, it requires direct disclosure of what an individual or group contributes or spends.

In considering this provision we must apply the same strict standard of scrutiny, for the right of associational privacy developed in NAACP v. Alabama derives from the rights of the organization’s members to advocate their personal points of view in the most effective way. 357 U.S., at 458, 460. See also NAACP v. Button, 371 U.S., at 429—431; Sweezy v. New Hampshire, 354 U.S., at 250.

Appellants attack 434 (e) as a direct intrusion on privacy of belief, in violation of Talley v. California, 362 U.S. 60 (1960), and as imposing “very real, practical burdens . . . certain to deter individuals from making expenditures for their independent political speech” analogous to those held to be impermissible in Thomas

v. Collins, 323 U.S. 516 (1945).

1. The Role of 434 (e)

The Court of Appeals upheld 434 (e) as necessary to enforce the independent—expenditure ceiling imposed by 18 U.S.C. 608 (e) (1) (1970 ed., Supp. IV). It said:

“If . . . Congress has both the authority and a compelling interest to regulate independent expenditures under section 608 (e), surely it can require that there be disclosure to prevent misuse of the spending channel.” 171 U.S. App. D.C., at 220 519 F.2d, at 869.

We have found that 608 (e) (1) unconstitutionally infringes upon First Amendment rights. If the sole function of 434 (e) were to aid in the enforcement of that provision, it would no longer serve any governmental purpose.

But the two provisions are not so intimately tied. The legislative history on the function of 434 (e) is bare, but it was clearly intended to stand independently of 608 (e) (1). It was enacted with the general disclosure provisions in 1971 as part of the original Act, while 608 (e) (1) was part of the 1974 amendments. Like the other disclosure provisions, 434 (e) could play a role in the enforcement of the expanded contribution and expenditure limitations included in the 1974 amendments, but it also has independent functions. Section 434 (e) is part of Congress’ effort to achieve “total disclosure” by reaching “every kind of political activity” in order to insure that the voters are fully informed and to achieve through publicity the maximum deterrence to corruption and undue influence possible. The provision is responsive to the legitimate fear that efforts would be made, as they had been in the past, to avoid the disclosure requirements by routing financial support of candidates through avenues not explicitly covered by the general provisions of the Act.

2. Vagueness Problems

In its effort to be all—inclusive, however, the provision raises serious problems of vagueness, particularly treacherous where, as here, the violation of its terms carries criminal penalties and fear of incurring these sanctions may deter those who seek to exercise protected First Amendment rights.

Section 434 (e) applies to “[e]very person . . . who makes contributions or expenditures.” “Contributions” and “expenditures” are defined in parallel provisions in terms of the use of money or other valuable assets “for the purpose of . . . influencing” the nomination or election of candidates for federal office. It is the ambiguity of this phrase that poses constitutional problems.

Due process requires that a criminal statute provide adequate notice to a person of ordinary intelligence that his contemplated conduct is illegal, for “no man shall be held criminally responsible for conduct which he could not reasonably understand to be proscribed.” United States v. Harriss, 347 U.S. 612, 617 (1954). See also Papachristou v. City of Jacksonville, 405 U.S. 156 (1972). Where First Amendment rights are involved, an even “greater degree of specificity” is required. Smith v. Goguen, 415 U.S., at 573. See Grayned v. City of Rockford, 408 U.S. 104, 109 (1972); Kunz v. New York, 340 U.S. 290 (1951).

There is no legislative history to guide us in determining the scope of the critical phrase “for the purpose of . . . influencing.” It appears to have been adopted without comment from earlier disclosure Acts. Congress “has voiced its wishes in [most] muted strains,” leaving us to draw upon “those common—sense assumptions that must be made in determining direction without a compass.” Rosado v. Wyman, 397 U.S. 397, 412 (1970). Where the constitutional requirement of definiteness is at stake, we have the further obligation to construe the statute, if that can be done consistent with the legislature’s purpose, to avoid the shoals of vagueness. United States v. Harriss, supra, at 618; United States v. Rumely, 345 U.S., at 45.

In enacting the legislation under review Congress addressed broadly the problem of political campaign financing. It wished to promote full disclosure of campaign—oriented spending to insure both the reality and the appearance of the purity and openness of the federal election process. Our task is to construe “for the purpose of . . . influencing,” incorporated in 434 (e) through the definitions of “contributions” and “expenditures,” in a manner that precisely furthers this goal.

In Part I we discussed what constituted a “contribution” for purposes of the contribution limitations set forth in 18 U.S.C. 608 (b) (1970 ed., Supp. IV). We construed that term to include not only contributions made directly or indirectly to a candidate, political party, or campaign committee, and contributions made to other organizations or individuals but earmarked for political purposes, but also all expenditures placed in cooperation with or with the consent of a candidate, his agents, or an authorized committee of the candidate. The definition of “contribution” in 431 (e) for disclosure purposes parallels the definition in Title 18 almost word for word, and we construe the former provision as we have the latter. So defined, “contributions” have a sufficiently close relationship to the goals of the Act, for they are connected with a candidate or his campaign.

When we attempt to define “expenditure” in a similarly narrow way we encounter line—drawing problems of the sort we faced in 18 U.S.C. 608 (e) (1) (1970 ed., Supp. IV). Although the phrase, “for the purpose of . . . influencing” an election or nomination, differs from the language used in 608 (e) (1), it shares the same potential for encompassing both issue discussion and advocacy of a political result. The general requirement that “political committees” and candidates disclose their expenditures could raise similar vagueness problems, for “political committee” is defined only in terms of amount of annual “contributions” and “expenditures,” and could be interpreted to reach groups engaged purely in issue discussion. The lower courts have construed the words “political committee” more narrowly. To fulfill the purposes of the Act they need only encompass organizations that are under the control of a candidate or the major purpose of which is the nomination or election of a candidate. Expenditures of candidates and of “political committees” so construed can be assumed to fall within the core area sought to be addressed by Congress. They are, by definition, campaign related.

But when the maker of the expenditure is not within these categories — when it is an individual other than a candidate or a group other than a “political committee” — the relation of the information sought to the purposes of the Act may be too remote. To insure that the reach of 434 (e) is not impermissibly broad, we construe “expenditure” for purposes of that section in the same way we construed the terms of 608 (e) — to reach only funds used for communications that expressly advocate the election or defeat of a clearly identified candidate. This reading is directed precisely to that spending that is unambiguously related to the campaign of a particular federal candidate.

In summary, 434 (e), as construed, imposes independent reporting requirements on individuals and groups that are not candidates or political committees only in the following circumstances: (1) when they make contributions earmarked for political purposes or authorized or requested by a candidate or his agent, to some person other than a candidate or political committee, and (2) when they make expenditures for communications that expressly advocate the election or defeat of a clearly identified candidate.

Unlike 18 U.S.C. 608 (e) (1) (1970 ed., Supp. IV), 434 (e), as construed, bears a sufficient relationship to a substantial governmental interest. As narrowed, 434 (e), like 608 (e) (1), does not reach all partisan discussion for it only requires disclosure of those expenditures that expressly advocate a particular election result. This might have been fatal if the only purpose of 434 (e) were to stem corruption or its appearance by closing a loophole in the general disclosure requirements. But the disclosure provisions, including 434 (e), serve another, informational interest, and even as construed 434 (e) increases the fund of information concerning those who support the candidates. It goes beyond the general disclosure requirements to shed the light of publicity on spending that is unambiguously campaign related but would not otherwise be reported because it takes the form of independent expenditures or of contributions to an individual or group not itself required to report the names of its contributors. By the same token, it is not fatal that 434 (e) encompasses purely independent expenditures uncoordinated with a particular candidate or his agent. The corruption potential of these expenditures may be significantly different, but the informational interest can be as strong as it is in coordinated spending, for disclosure helps voters to define more of the candidates’ constituencies.

Section 434 (e), as we have construed it, does not contain the infirmities of the provisions before the Court in Talley v. California, 362 U.S. 60 (1960), and Thomas v. Collins, 323 U.S. 516 (1945). The ordinance found wanting in Talley forbade all distribution of handbills that did not contain the name of the printer, author, or manufacturer, and the name of the distributor. The city urged that the ordinance was aimed at identifying those responsible for fraud, false advertising, and libel, but the Court found that it was “in no manner so limited.” 362 U.S., at 64. Here, as we have seen, the disclosure requirement is narrowly limited to those situations where the information sought has a substantial connection with the governmental interests sought to be advanced. Thomas held unconstitutional a prior restraint in the form of a registration requirement for labor organizers. The Court found the State’s interest insufficient to justify the restrictive effect of the statute. The burden imposed by 434 (e) is no prior restraint, but a reasonable and minimally restrictive method of furthering First Amendment values by opening the basic processes of our federal election system to public view.

D. Thresholds

Appellants’ third contention, based on alleged overbreadth, is that the monetary thresholds in the recordkeeping and reporting provisions lack a substantial nexus with the claimed governmental interests, for the amounts involved are too low even to attract the attention of the candidate, much less have a corrupting influence.

The provisions contain two thresholds. Records are to be kept by political committees of the names and addresses of those who make contributions in excess of $10, 432 (c) (2), and these records are subject to Commission audit, 438 (a) (8). If a person’s contributions to a committee or candidate aggregate more than $100, his name and address, as well as his occupation and principal place of business, are to be included in reports filed by committees and candidates with the Commission, 434 (b) (2), and made available for public inspection, 438 (a) (4).

The Court of Appeals rejected appellants’ contention that these thresholds are unconstitutional. It found the challenge on First Amendment grounds to the $10 threshold to be premature, for it could “discern no basis in the statute for authorizing disclosure outside the Commission . . ., and hence no substantial `inhibitory effect’ operating upon” appellants. 171 U.S. App. D.C., at 216, 519 F.2d, at 865. The $100 threshold was found to be within the “reasonable latitude” given the legislature “as to where to draw the line.” Ibid. We agree.

The $10 and $100 thresholds are indeed low. Contributors of relatively small amounts are likely to be especially sensitive to recording or disclosure of their political preferences. These strict requirements may well discourage participation by some citizens in the political process, a result that Congress hardly could have intended. Indeed, there is little in the legislative history to indicate that Congress focused carefully on the appropriate level at which to require recording and disclosure. Rather, it seems merely to have adopted the thresholds existing in similar disclosure laws since 1910. But we cannot require Congress to establish that it has chosen the highest reasonable threshold. The line is necessarily a judgmental decision, best left in the context of this complex legislation to congressional discretion. We cannot say, on this bare record, that the limits designated are wholly without rationality.

We are mindful that disclosure serves informational functions, as well as the prevention of corruption and the enforcement of the contribution limitations. Congress is not required to set a threshold that is tailored only to the latter goals. In addition, the enforcement goal can never be well served if the threshold is so high that disclosure becomes equivalent to admitting violation of the contribution limitations.

The $10 recordkeeping threshold, in a somewhat similar fashion, facilitates the enforcement of the disclosure provisions by making it relatively difficult to aggregate secret contributions in amounts that surpass the $100 limit. We agree with the Court of Appeals that there is no warrant for assuming that public disclosure of contributions between $10 and $100 is authorized by the Act. Accordingly, we do not reach the question whether information concerning gifts of this size can be made available to the public without trespassing impermissibly on First Amendment rights. Cf. California Bankers Assn. v. Shultz, 416 U.S., at 56—57.

In summary, we find no constitutional infirmities in the recordkeeping, reporting, and disclosure provisions of the Act.

III. PUBLIC FINANCING OF PRESIDENTIAL ELECTION CAMPAIGNS

A series of statutes for the public financing of Presidential election campaigns produced the scheme now found in 6096 and Subtitle H of the Internal Revenue Code of 1954, 26 U.S.C. 6096, 9001—9012, 9031—9042 (1970 ed., Supp. IV). Both the District Court, 401 F. Supp. 1235, and the Court of Appeals, 171 U.S. App. D.C., at 229—238, 519 F.2d, at 878—887, sustained Subtitle H against a constitutional attack. Appellants renew their challenge here, contending that the legislation violates the First and Fifth Amendments. We find no merit in their claims and affirm.

A. Summary of Subtitle H

Section 9006 establishes a Presidential Election Campaign Fund (Fund), financed from general revenues in the aggregate amount designated by individual taxpayers, under 6096, who on their income tax returns may authorize payment to the Fund of one dollar of their tax liability in the case of an individual return or two dollars in the case of a joint return. The Fund consists of three separate accounts to finance (1) party nominating conventions, 9008 (a), (2) general election campaigns, 9006 (a), and (3) primary campaigns, 9037 (a).

Chapter 95 of Title 26, which concerns financing of party nominating conventions and general election campaigns, distinguishes among “major,” “minor,” and “new” parties. A major party is defined as a party whose candidate for President in the most recent election received 25% or more of the popular vote. 9002 (6). A minor party is defined as a party whose candidate received at least 5% but less than 25% of the vote at the most recent election. 9002 (7). All other parties are new parties, 9002 (8), including both newly created parties and those receiving less than 5% of the vote in the last election.

Major parties are entitled to $2,000,000 to defray their national committee Presidential nominating convention expenses, must limit total expenditures to that amount, 9008 (d), and may not use any of this money to benefit a particular candidate or delegate, 9008 (c). A minor party receives a portion of the major—party entitlement determined by the ratio of the votes received by the party’s candidate in the last election to the average of the votes received by the major parties’ candidates. 9008 (b) (2). The amounts given to the parties and the expenditure limit are adjusted for inflation, using 1974 as the base year. 9008 (b) (5). No financing is provided for new parties, nor is there any express provision for financing independent candidates or parties not holding a convention.

For expenses in the general election campaign, 9004 (a) (1) entitles each major—party candidate to $20,000,000. This amount is also adjusted for inflation. See 9004 (a) (1). To be eligible for funds the candidate must pledge not to incur expenses in excess of the entitlement under 9004 (a) (1) and not to accept private contributions except to the extent that the fund is insufficient to provide the full entitlement. 9003 (b) Minor—party candidates are also entitled to funding, again based on the ratio of the vote received by the party’s candidate in the preceding election to the average of the major—party candidates. 9004 (a) (2) (A). Minor—party candidates must certify that they will not incur campaign expenses in excess of the major—party entitlement and that they will accept private contributions only to the extent needed to make up the difference between that amount and the public funding grant. 9003 (c). New—party candidates receive no money prior to the general election, but any candidate receiving 5% or more of the popular vote in the election is entitled to post—election payments according to the formula applicable to minor—party candidates. 9004 (a) (3). Similarly, minor—party candidates are entitled to post—election funds if they receive a greater percentage of the average major—party vote than their party’s candidate did in the preceding election; the amount of such payments is the difference between the entitlement based on the preceding election and that based on the actual vote in the current election. 9004 (a) (3). A further eligibility requirement for minor— and new—party candidates is that the candidate’s name must appear on the ballot, or electors pledged to the candidate must be on the ballot, in at least 10 States. 9002 (2) (B).

Chapter 96 establishes a third account in the Fund, the Presidential Primary Matching Payment Account. 9037 (a). This funding is intended to aid campaigns by candidates seeking Presidential nomination “by a political party,” 9033 (b) (2), in “primary elections,” 9032 (7). The threshold eligibility requirement is that the candidate raise at least $5,000 in each of 20 States, counting only the first $250 from each person contributing to the candidate. 9033 (b) (3), (4). In addition, the candidate must agree to abide by the spending limits in 9035. See 9033 (b) (1). Funding is provided according to a matching formula: each qualified candidate is entitled to a sum equal to the total private contributions received, disregarding contributions from any person to the extent that total contributions to the candidate by that person exceed $250. 9034 (a). Payments to any candidate under Chapter 96 may not exceed 50% of the overall expenditure ceiling accepted by the candidate. 9034 (b).

B. Constitutionality of Subtitle H

Appellants argue that Subtitle H is invalid (1) as “contrary to the `general welfare,’” Art. I, 8, (2) because any scheme of public financing of election campaigns is inconsistent with the First Amendment, and (3) because Subtitle H invidiously discriminates against certain interests in violation of the Due Process Clause of the Fifth Amendment. We find no merit in these contentions.

Appellants’”general welfare” contention erroneously treats the General Welfare Clause as a limitation upon congressional power. It is rather a grant of power, the scope of which is quite expansive, particularly in view of the enlargement of power by the Necessary and Proper Clause. M`Culloch v. Maryland, 4 Wheat. 316, 420 (1819). Congress has power to regulate Presidential elections and primaries, United States v.

Classic, 313 U.S. 299 (1941); Burroughs v. United States, 290 U.S. 534 (1934); and public financing of Presidential elections as a means to reform the electoral process was clearly a choice within the granted power. It is for Congress to decide which expenditures will promote the general welfare: “[T]he power of Congress to authorize expenditure of public moneys for public purposes is not limited by the direct grants of legislative power found in the Constitution.” United States v. Butler, 297 U.S. 1, 66 (1936). See Helvering v. Davis, 301 U.S. 619, 640—641 (1937). Any limitations upon the exercise of that granted power must be found elsewhere in the Constitution. In this case, Congress was legislating for the “general welfare” — to reduce the deleterious influence of large contributions on our political process, to facilitate communication by candidates with the electorate, and to free candidates from the rigors of fundraising. See S. Rep. No. 93—689, Pp. 1—10 (1974). Whether the chosen means appear “bad,” “unwise,” or quot;unworkable” to us is irrelevant; Congress has concluded that the means are “necessary and proper” to promote the general welfare, and we thus decline to find this legislation without the grant of power in Art. I, 8.

Appellants’ challenge to the dollar check—off provision ( 6096) fails for the same reason. They maintain that Congress is required to permit taxpayers to designate particular candidates or parties as recipients of their money. But the appropriation to the Fund in 9006 is like any other appropriation from the general revenue except that its amount is determined by reference to the aggregate of the one—and wo—dollar authorization on taxpayers’ income tax returns. This detail does not constitute the appropriation any less an appropriation by Congress. The fallacy of appellants’ argument is therefore apparent; every appropriation made by Congress uses public money in a manner to which some taxpayers object.

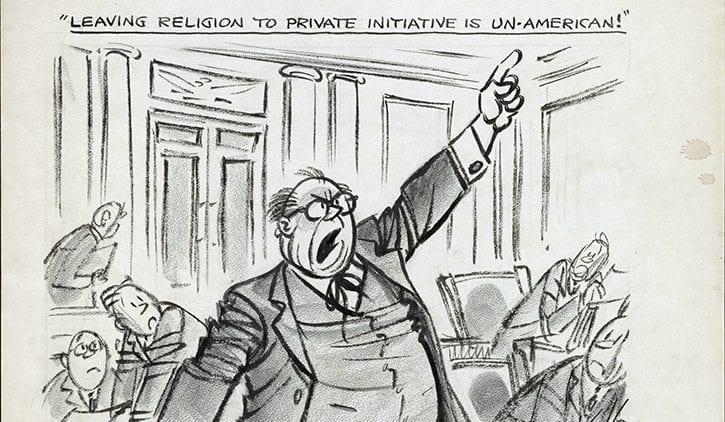

Appellants next argue that “by analogy” to the Religion Clauses of the First Amendment public financing of election campaigns, however meritorious, violates the First Amendment. We have, of course, held that the Religion Clauses — “Congress shall make no law respecting an establishment of religion, or prohibiting the free exercise thereof” — require Congress, and the States through the Fourteenth Amendment, to remain neutral in matters of religion. E. g., Abington School Dist. v. Schempp, 374 U.S. 203, 222—226 (1963). The government may not aid one religion to the detriment of others or impose a burden on one religion that is not imposed on others, and may not even aid all religions. E. g., Everson v. Board of Education, 330 U.S. 1, 15—16 (1947). See Kurland, Of Church and State and the Supreme Court, 29 U. Chi. L. Rev. 1, 96 (1961). But the analogy is patently inapplicable to our issue here. Although “Congress shall make no law . . . abridging the freedom of speech, or the press,” Subtitle H is a congressional effort, not to abridge, restrict, or censor speech, but rather to use public money to facilitate and enlarge public discussion and participation in the electoral process, goals vital to a self—governing people. Thus, Subtitle H furthers, not abridges, pertinent First Amendment values. Appellants argue, however, that as constructed public financing invidiously discriminates in violation of the Fifth Amendment. We turn therefore to that argument.

Equal protection analysis in the Fifth Amendment area is the same as that under the Fourteenth Amendment. Weinberger v. Wiesenfeld, 420 U.S. 636, 638 n. 2 (1975), and cases cited. In several situations concerning the electoral process, the principle has been developed that restrictions on access to the electoral process must survive exacting scrutiny. The restriction can be sustained only if it furthers a “vital” governmental interest, American Party of Texas v. White, 415 U.S. 767, 780—781 (1974), that is “achieved by a means that does not unfairly or unnecessarily burden either a minority party’s or an individual candidate’s equally important interest in the continued availability of political opportunity.” Lubin v. Panish, 415 U.S. 709, 716 (1974). See American Party of Texas v. White, supra, at 780; Storer v. Brown, 415 U.S. 724, 729—730 (1974). These cases, however, dealt primarily with state laws requiring a candidate to satisfy certain requirements in order to have his name appear on the ballot. These were, of course, direct burdens not only on the candidate’s ability to run for office but also on the voter’s ability to voice preferences regarding representative government and contemporary issues. In contrast, the denial of public financing to some Presidential candidates is not restrictive of voters’ rights and less restrictive of candidates’. Subtitle H does not prevent any candidate from getting on the ballot or any voter from casting a vote for the candidate of his choice; the inability, if any, of minor—party candidates to wage effective campaigns will derive not from lack of public funding but from their inability to raise private contributions. Any disadvantage suffered by operation of the eligibility formulae under Subtitle H is thus limited to the claimed denial of the enhancement of opportunity to communicate with the electorate that the formulae afford eligible candidates. But eligible candidates suffer a countervailing denial. As we more fully develop later, acceptance of public financing entails voluntary acceptance of an expenditure ceiling. Non—eligible candidates are not subject to that limitation. Accordingly, we conclude that public financing is generally less restrictive of access to the electoral process than the ballot—access regulations dealt with in prior cases. In any event, Congress enacted Subtitle H in furtherance of sufficiently important governmental interests and has not unfairly or unnecessarily burdened the political opportunity of any party or candidate.

It cannot be gainsaid that public financing as a means of eliminating the improper influence of large private contributions furthers a significant governmental interest. S. Rep. No. 93—689, pp. 4—5 (1974). In addition, the limits on contributions necessarily increase the burden of fundraising, and Congress properly regarded public financing as an appropriate means of relieving major—party Presidential candidates from the rigors of soliciting private contributions. See id., at 5. The States have also been held to have important interests in limiting places on the ballot to those candidates who demonstrate substantial popular support. E. g., Storer v. Brown, supra, at 736; Lubin v. Panish, supra, at 718—719; Jenness v. Fortson, 403 U.S. 431, 442 (1971); Williams v. Rhodes, 393 U.S., at 31—33. Congress’ interest in not funding hopeless candidacies with large sums of public money, S. Rep. No. 93—689, supra, at 7, necessarily justifies the withholding of public assistance from candidates without significant public support. Thus, Congress may legitimately require “some preliminary showing of a significant modicum of support,” Jenness v. Fortson, supra, at 442, as an eligibility requirement for public funds. This requirement also serves the important public interest against providing artificial incentives to “splintered parties and unrestrained factionalism.” Storer v. Brown, supra, at 736; S. Rep. No. 93—689, supra, at 8; H. R. Rep. No. 93—1239, p. 13 (1974). Cf. Bullock v. Carter, 405 U.S. 134, 145 (1972).

At the same time Congress recognized the constitutional restraints against inhibition of the present opportunity of minor parties to become major political entities if they obtain widespread support. S. Rep. No. 93—689, supra, at 8—10; H. R. Rep. No. 93—1239, supra, at 13. As the Court of Appeals said, “provisions for public funding of Presidential campaigns . . . could operate to give an unfair advantage to established parties, thus reducing, to the nation’s detriment. . . . the `potential fluidity of American political life.’” 171 U.S. App. D.C., at 231, 519 F.2d, at 880, quoting from Jenness v. Fortson, supra, at 439.

1. General Election Campaign Financing

Appellants insist that Chapter 95 falls short of the constitutional requirement in that its provisions supply larger, and equal, sums to candidates of major parties, use prior vote levels as the sole criterion for pre—election funding, limit new—party candidates to post—election funds, and deny any funds to candidates of parties receiving less than 5% of the vote. These provisions, it is argued, are fatal to the validity of the scheme, because they work invidious discrimination against minor and new parties in violation of the Fifth Amendment. We disagree.

As conceded by appellants, the Constitution does not require Congress to treat all declared candidates the same for public financing purposes. As we said in Jenness v. Fortson, “there are obvious differences in kind between the needs and potentials of a political party with historically established broad support, on the one hand, and a new or small political organization on the other. . . . Sometimes the grossest discrimination can lie in treating things that are different as though they were exactly alike, a truism well illustrated in Williams v. Rhodes, supra.” 403 U.S., at 441—442. Since the Presidential elections of 1856 and 1860, when the Whigs were replaced as a major party by the Republicans, no third party has posed a credible threat to the two major parties in Presidential elections. Third parties have been completely incapable of matching the major parties’ ability to raise money and win elections. Congress was, of course, aware of this fact of American life, and thus was justified in providing both major parties full funding and all other parties only a percentage of the major—party entitlement. Identical treatment of all parties, on the other hand, “would not only make it easy to raid the United States Treasury, it would also artificially foster the proliferation of splinter parties.” 171 U.S. App. D.C., at 231, 519 F.2d, at 881. The Constitution does not require the Government to “finance the efforts of every nascent political group,” American Party of Texas v. White, 415 U.S., at 794, merely because Congress chose to finance the efforts of the major parties.

Furthermore, appellants have made no showing that the election funding plan disadvantages nonmajor parties by operating to reduce their strength below that attained without any public financing. First, such parties are free to raise money from private sources, and by our holding today new parties are freed from any expenditure limits, although admittedly those limits may be a largely academic matter to them. But since any major—party candidate accepting public financing of a campaign voluntarily assents to a spending ceiling, other candidates will be able to spend more in relation to the major—party candidates. The relative position of minor parties that do qualify to receive some public funds because they received 5% of the vote in the previous Presidential election is also enhanced. Public funding for candidates of major parties is intended as a substitute for private contributions; but for minor—party candidates such assistance may be viewed as a supplement to private contributions since these candidates may continue to solicit private funds up to the applicable spending limit. Thus, we conclude that the general election funding system does not work an invidious discrimination against candidates of nonmajor parties.

Appellants challenge reliance on the vote in past elections as the basis for determining eligibility. That challenge is foreclosed, however, by our holding in Jenness v. Fortson, 403 U.S., at 439—440, that popular vote totals in the last election are a proper measure of public support. And Congress was not obliged to select instead from among appellants’ suggested alternatives. Congress could properly regard the means chosen as preferable, since the alternative of petition drives presents cost and administrative problems in validating signatures, and the alternative of opinion polls might be thought inappropriate since it would involve a Government agency in the business of certifying polls or conducting its own investigation of support for various candidates, in addition to serious problems with reliability.

Appellants next argue, relying on the ballot—access decisions of this Court, that the absence of any alternative means of obtaining pre—election funding renders the scheme unjustifiably restrictive of minority political interests. Appellants’ reliance on the ballot—access decisions is misplaced. To be sure, the regulation sustained in Jenness v. Fortson, for example, incorporated alternative means of qualifying for the ballot, 403 U.S., at 440, and the lack of an alternative was a defect in the scheme struck down in Lubin v. Panish, 415 U.S., at 718. To suggest, however, that the constitutionality of Subtitle H therefore hinges solely on whether some alternative is afforded overlooks the rationale of the operative constitutional principles. Our decisions finding a need for an alternative means turn on the nature and extent of the burden imposed in the absence of available alternatives. We have earlier stated our view that Chapter 95 is far less burdensome upon and restrictive of constitutional rights than the regulations involved in the ballot—access cases. See supra, at 94—95. Moreover, expenditure limits for major parties and candidates may well improve the chances of nonmajor parties and their candidates to receive funds and increase their spending. Any risk of harm to minority interests is speculative due to our present lack of knowledge of the practical effects of public financing and cannot overcome the force of the governmental interests against use of public money to foster frivolous candidacies, create a system of splintered parties, and encourage unrestrained factionalism.

Appellants’ reliance on the alternative—means analyses of the ballot—access cases generally fails to recognize a significant distinction from the instant case. The primary goal of all candidates is to carry on a successful campaign by communicating to the voters persuasive reasons for electing them. In some of the ballot—access cases the States afforded candidates alternative means for qualifying for the ballot, a step in any campaign that, with rare exceptions, is essential to successful effort. Chapter 95 concededly provides only one method of obtaining pre—election financing; such funding is, however, not as necessary as being on the ballot. See n. 128, supra. Plainly, campaigns can be successfully carried out by means other than public financing; they have been up to this date, and this avenue is still open to all candidates.

And, after all, the important achievements of minority political groups in furthering the development of American democracy were accomplished without the help of public funds. Thus, the limited participation or nonparticipation of nonmajor parties or candidates in public funding does not unconstitutionally disadvantage them.

Of course, nonmajor parties and their candidates may qualify for post—election participation in public funding and in that sense the claimed discrimination is not total. Appellants contend, however, that the benefit of any such participation is illusory due to 9004 (c), which bars the use of the money for any purpose other than paying campaign expenses or repaying loans that had been used to defray such expenses. The only meaningful use for post—election funds is thus to repay loans; but loans, except from national banks, are “contributions” subject to the general limitations on contributions, 18 U.S.C. 591 (e) (1970 ed., Supp. IV). Further, they argue, loans are not readily available to nonmajor parties or candidates before elections to finance their campaigns. Availability of post—election funds therefore assertedly gives them nothing. But in the nature of things the willingness of lenders to make loans will depend upon the pre—election probability that the candidate and his party will attract 5% or more of the voters. When a reasonable prospect of such support appears, the party and candidate may be an acceptable loan risk since the prospect of post—election participation in public funding will be good.

Finally, appellants challenge the validity of the 5% threshold requirement for general election funding. They argue that, since most state regulations governing ballot access have threshold requirements well below 5%, and because in their view the 5% requirement here is actually stricter than that upheld in Jenness v. Fortson, 403 U.S. 431 (1971), the requirement is unreasonable. We have already concluded that the restriction under Chapter 95 is generally less burdensome than ballot—access regulations. Supra, at 94—95. Further, the Georgia provision sustained in Jenness required the candidate to obtain the signatures of 5% of all eligible voters, without regard to party. To be sure, the public funding formula does not permit anyone who voted for another party in the last election to be part of a candidate’s 5%. But under Chapter 95 a Presidential candidate needs only 5% or more of the actual vote, not the larger universe of eligible voters. As a result, we cannot say that Chapter 95 is numerically more, or less, restrictive than the regulation in Jenness. In any event, the choice of the percentage requirement that best accommodates the competing interests involved was for Congress to make. See Louisville Gas Co. v. Coleman, 277 U.S. 32, 41 (1928) (Holmes, J., dissenting); n. 111, supra. Without any doubt a range of formulations would sufficiently protect the public fisc and not foster factionalism, and would also recognize the public interest in the fluidity of our political affairs. We cannot say that Congress’ choice falls without the permissible range.

2. Nominating Convention Financing

The foregoing analysis and reasoning sustaining general election funding apply in large part to convention funding under Chapter 95 and suffice to support our rejection of appellants’ challenge to these provisions. Funding of party conventions has increasingly been derived from large private contributions, see H. R. Rep. No. 93—1239, p. 14 (1974), and the governmental interest in eliminating this reliance is as vital as in the case of private contributions to individual candidates. The expenditure limitations on major parties participating in public financing enhance the ability of nonmajor parties to increase their spending relative to the major parties; further, in soliciting private contributions to finance conventions, parties are not subject to the $1,000 contribution limit pertaining to candidates. We therefore conclude that appellants’ constitutional challenge to the provisions for funding nominating conventions must also be rejected.

3. Primary Election Campaign Financing

Appellants’ final challenge is to the constitutionality of Chapter 96, which provides funding of primary campaigns. They contend that these provisions are constitutionally invalid (1) because they do not provide funds for candidates not running in party primaries and (2) because the eligibility formula actually increases the influence of money on the electoral process. In not providing assistance to candidates who do not enter party primaries, Congress has merely chosen to limit at this time the reach of the reforms encompassed in Chapter 96. This Congress could do without constituting the reforms a constitutionally invidious discrimination. The governing principle was stated in Katzenbach v. Morgan, 384 U.S. 641, 657 (1966):

“[I]n deciding the constitutional propriety of the limitations in such a reform measure we are guided by the familiar principles that a `statute is not invalid under the Constitution because it might have gone farther than it did,’ Roschen v. Ward, 279 U.S. 337, 339, that a legislature need not `strike at all evils at the same time,’ Semler v. Dental Examiners, 294 U.S. 608, 610, and that `reform may take one step at a time, addressing itself to the phase of the problem which seems most acute to the legislative mind,’

Williamson v. Lee Optical Co., 348 U.S. 483, 489.”

The choice to limit matching funds to candidates running in primaries may reflect that concern about large private contributions to candidates centered on primary races and that there is no historical evidence of similar abuses involving contributions to candidates who engage in petition drives to qualify for state ballots. Moreover, assistance to candidates and nonmajor parties forced to resort to petition drives to gain ballot access implicates the policies against fostering frivolous candidacies, creating a system of splintered parties, and encouraging unrestrained factionalism.

The eligibility requirements in Chapter 96 are surely not an unreasonable way to measure popular support for a candidate, accomplishing the objective of limiting subsidization to those candidates with a substantial chance of being nominated. Counting only the first $250 of each contribution for eligibility purposes requires candidates to solicit smaller contributions from numerous people. Requiring the money to come from citizens of a minimum number of States eliminates candidates whose appeal is limited geographically; a President is elected not by popular vote, but by winning the popular vote in enough States to have a majority in the Electoral College.

We also reject as without merit appellants’ argument that the matching formula favors wealthy voters and candidates. The thrust of the legislation is to reduce financial barriers and to enhance the importance of smaller contributions. Some candidates undoubtedly could raise large sums of money and thus have little need for public funds, but candidates with lesser fundraising capabilities will gain substantial benefits from matching funds. In addition, one eligibility requirement for matching funds is acceptance of an expenditure ceiling, and candidates with little fundraising ability will be able to increase their spending relative to candidates capable of raising large amounts in private funds.

For the reasons stated, we reject appellants’ claims that Subtitle H is facially unconstitutional.

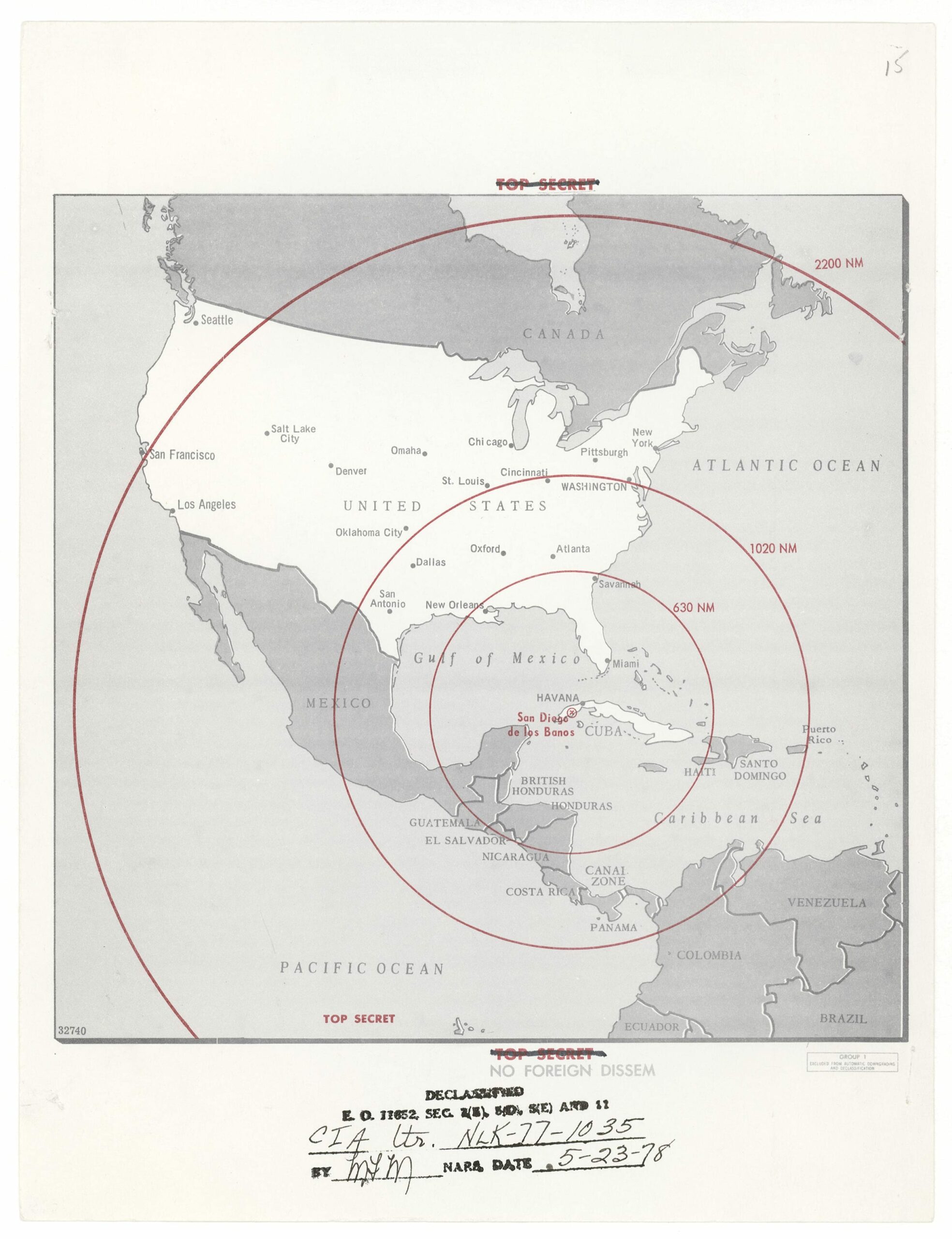

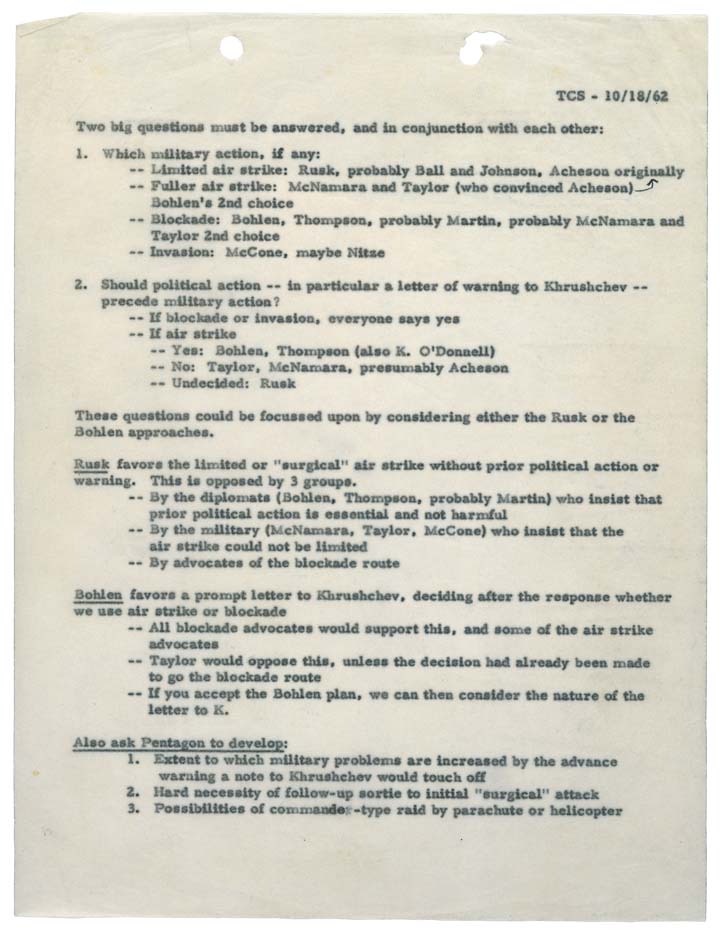

Meeting on Cuba

March 24, 1976

Conversation-based seminars for collegial PD, one-day and multi-day seminars, graduate credit seminars (MA degree), online and in-person.