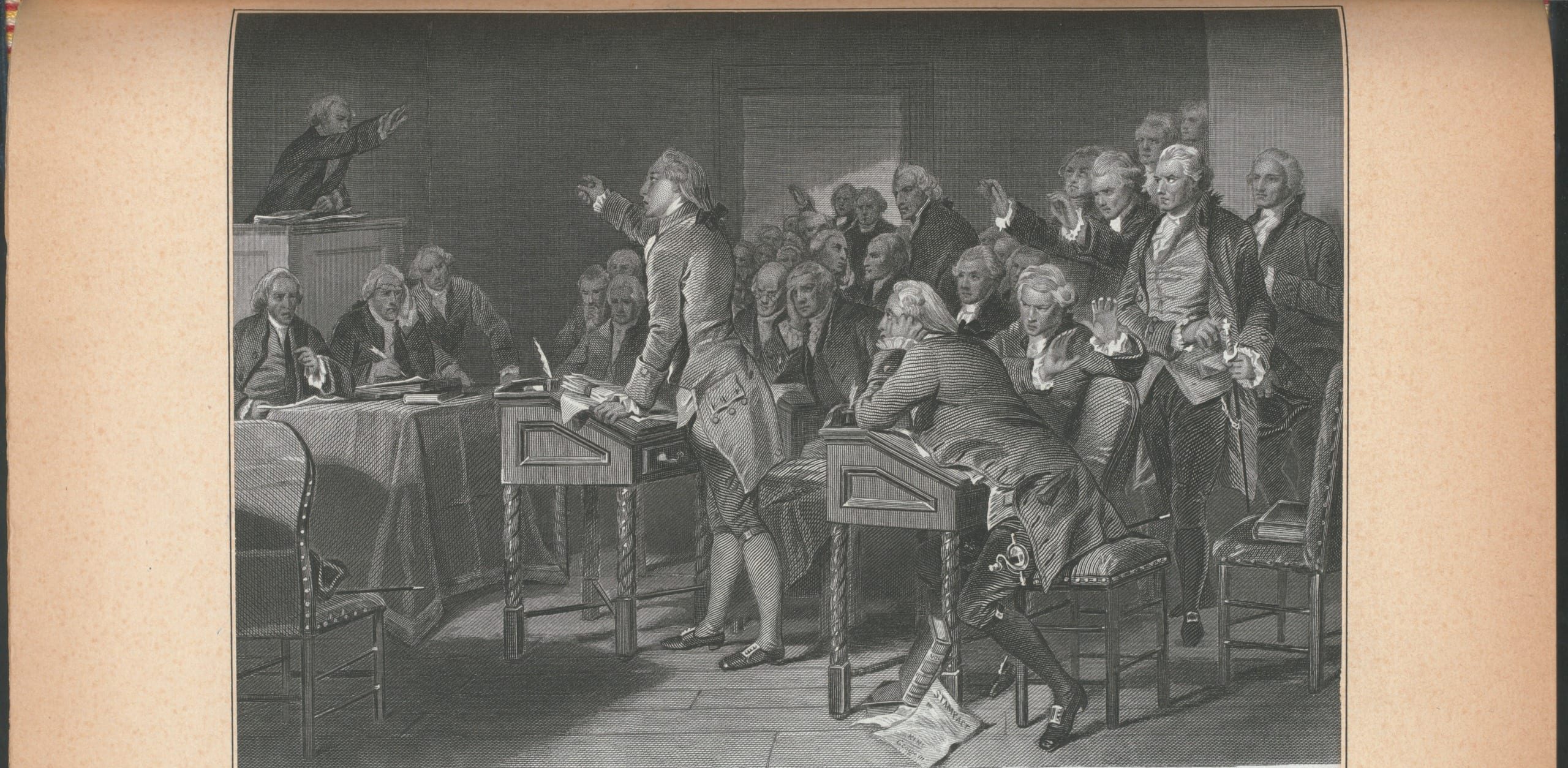

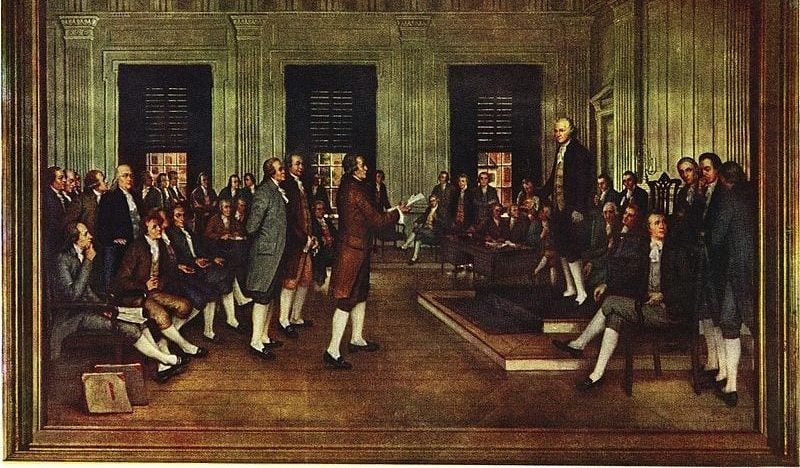

On the motion of Mr. Madison the whole proposition was new-modeled as follows;

That it is the opinion of Congress that the establishment of permanent and adequate funds to operate generally throughout the United States is indispensably necessary for doing complete justice to the creditors of the U.S. for restoring public credit, and for providing for the future exigencies of the war. The words to be collected under the authority of Congresswere as a separate question left to be added afterwards.

Mr. Rutlidge objected to the term generallyas implying a degree of uniformity in the tax which would render it unequal. He had in view particularly a land tax according to quantity as had been proposed by the office of finance. He thought the prejudices of the people opposed to the idea of a general tax and seemed on the whole to be disinclined to it himself, at least if extended beyond an impost on trade; urging the necessity of pursuing a valuation of land and requisitions grounded thereon.

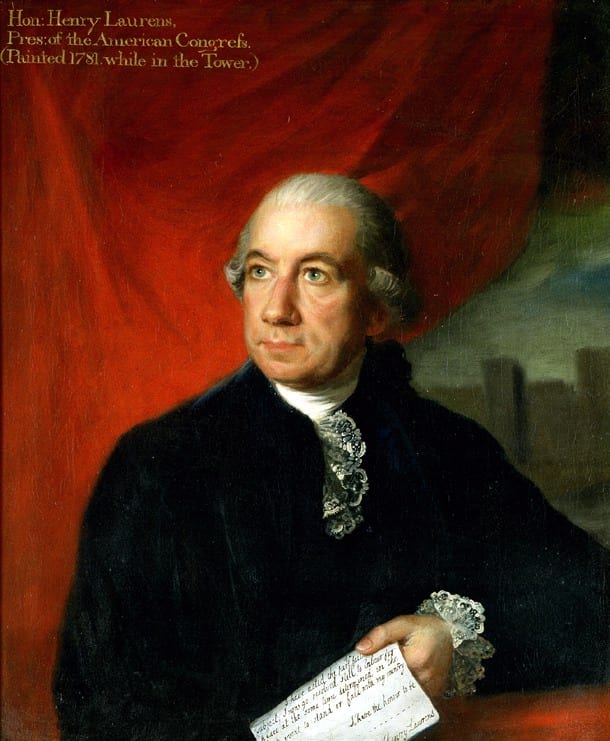

Mr. Lee 2ded the opposition to the term generalhe contended that the states would never consent to a uniform tax because it would be unequal; that it was moreover repugnant to the articles of confederation; and by placing the purse in the same hands with the sword, was subversive of the fundamental principles of liberty. He mentioned the repeal of the impost by Virginia himself alone opposing it and that too on the inexpediency in point of time, as proof the aversion to a general revenue. He reasoned upon the subject finally as if it was proposed that Congress said assume and exercise a power immediately and without the previous Sanction of the States, of levying money on them. In consequence.

Mr. Wilson rose and explained the import of the motion to be that Congress should recommend to the states the investing them with power. He observed that the confederation was so far from precluding, that it expressly provided for future alterations; that the power given to Congress by that Act was too little not too formidable, that there was more of a centrifugal than centripetal force in the states and that the funding of a common debt in the manner proposed would produce a salutary invigoration and cement of the Union.

Mr. Elseworth acknowledged himself to be undecided in his opinion: that on the one side he felt the necessity of continental funds for making good the continental engagements but on the other desponded of a unanimous concurrence of the states in such an establishment. He observed that it was a question of great importance how far the federal government can or ought to exert coercion against delinquent members of the confederacy; and that without such coercion no certainty could attend the constitutional mode which referred every thing to the unanimous punctuality of thirteen different councils. Considering therefore a continental revenue as unattainable, and periodical requisitions from Congress as inadequate, he was inclined to make trial of the middle mode of permanent state funds, to be provided at the recommendation of Congress and appropriated to the discharge of the common debt.

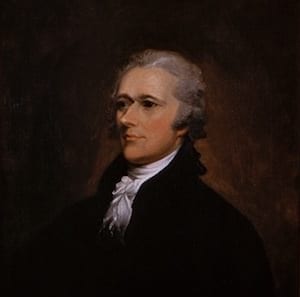

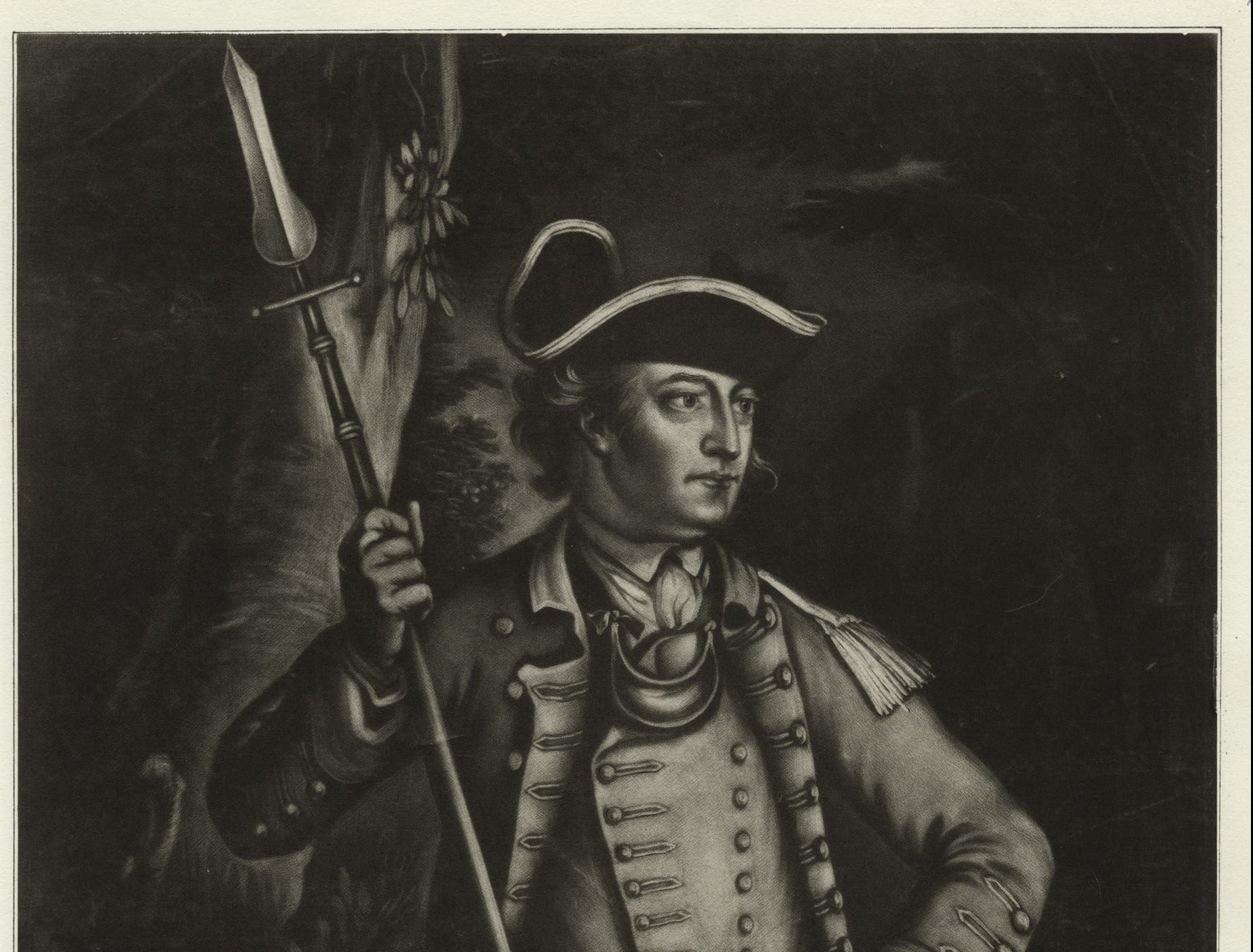

Mr. Hamilton in reply to Mr. Elseworth dwelt long on the inefficacy of State funds, he supposed too that greater obstacles would arise to the execution of the plan than to that of a general revenue. As an additional reason for the latter to be collected by officers under the appointment of Congress, he signified that as the energy of the federal government was evidently short of the degree necessary for pervading and uniting the states it was expedient to introduce the influence of officers deriving their emoluments from and consequently interested in supporting the power of Congress.

Mr. Williamson was of opinion that continental funds, although desirable, were unattainable at least to the full amount of the public exigencies. He thought if they could be obtained for the foreign debt, it would be as much as could be expected, and that they would also be less essential for the domestic debt.

Mr. Madison observed that it was needless to go into proofs of the necessity of paying the public debts; that the idea of erecting our national independence on the ruins of public faith and national honor must be horrid to every mind which retained either honesty or pride; that the motion before Congress contained a simple proposition with respect to the truth of which every member was called upon to give his opinion. That this opinion must necessarily be in the affirmative, unless the several objects; of doing justice to the public creditors could be compasses by some other plan than the one proposed, that the two last objects depended essentially on the first; since the doing justice to the creditors alone would restore public credit and the restoration of this alone could provide for the future exigencies of the war. Is then a continual revenue indispensably necessary for doing complete justice? This is the question. To answer it the other plans proposed must first be reviewed.

In order to do complete justice to the public creditors, either the principal must be paid off, or the interest paid punctually. The first periodical requisitions according to the federal articles; secondly, permanent funds established by each states within itself and the proceeds consigned to the discharge of public debts.

Will the first be adequate to the object? The contrary seems to be maintained by no one. If reason did not sufficiently premonish, experience has sufficiently demonstrated that a punctual and unfailing compliance by 13 separate and independent governments with periodical demands of money from Congress, can never be reckoned upon with the certainty requisite to satisfy our present creditors, or to tempt others to become our creditors in future.

Secondly, will funds separately established within each state and the amount submitted to the appropriation of Congress be adequate to the object? The only advantage which is thought to recommend this plan, is that the states will be with less difficulty prevailed upon to adopt it. Its imperfections are first that it must be preceded by a final and satisfactory adjustment of all accounts between the U.S. and individual states; and by an apportionment founded on a valuation of all the lands throughout each of the states in pursuance of the law of the confederation: for although the states do not as yet insist on these prerequisites in the case of annual demands on them with which they very little comply and that only in the way of an open account; yet these conditions would certainly be exacted in case of a permanent session of revenue and the difficulties and delays to say the least incident to these conditions, can escape no on. Secondly, the produce of the funds being always in the first instance in the hands and under the control of the states separately, might at any time and on various pretences, be diverted to state-objects. Thirdly, that jealousy which is as natural to the states as to individuals and of which so many proofs have of the common obligations, will be continually and mutually suspending remittances to the common treasury, until it finally stops them altogether. These imperfections are too radical to be admitted into any plan intended for the purposes in question.

It remains to examine the merits of the plan of a general revenue operating throughout the U.S. under the superintendence of Congress.

One obvious advantage is suggested by the last objection to separate revenues in the different states; that is, it will exclude all jealousy among them on that head, since each will know whilst it is submitting to the tax, that all the others are necessarily at the same instant bearing their respective portions of the burden.

Again it will take from the states the opportunity as well as the temptation to divert their incomes from the general to internal purposes since these incomes will pass directly into the treasury of the U.S.

Another advantage attending a general revenue is that in case of the concurrence of the states in establishing it, it would become soonest productive; and would consequently soonest obtain the objects in view. Nay so assured a prospect would give instantaneous confidence and content to the public creditors at home and abroad and place our affairs in the most happy train.

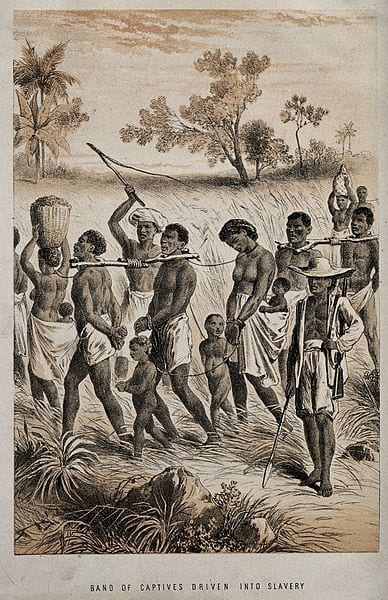

The consequences with respect to the Union of omitting such a provision of the debts of the Union also claims particular attention. The tenor of the memorial from Pennsylvania and of the information just given on the floor by one of its delegates (Mr. Fitzimmons) renders it extremely probable that that state would as son as it said be known that Congress had declined such provision or the states rejected it, appropriate the revenue required by Congress, to the payment of its own citizens and troops, creditors of the U.S. The irregular conduct of other states on this subject enforced by such an example could not fail to spread the evil throughout the whole continent. What then would become of the confederation? What would be the authority of Congress? Wt. the tie by which the states could be held together? What the source by which the army could be subsisted and clothed? What the mode of dividing and discharging our foreign debts? What the rule of settling the internal accounts? What the tribunal by which controversies among the states could be adjudicated?

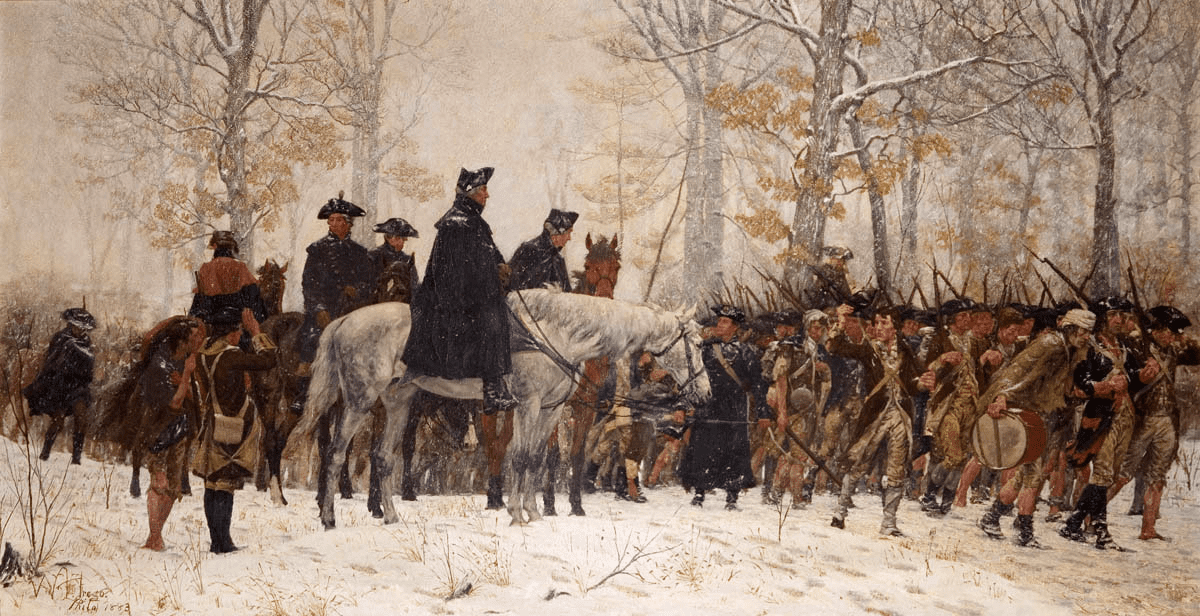

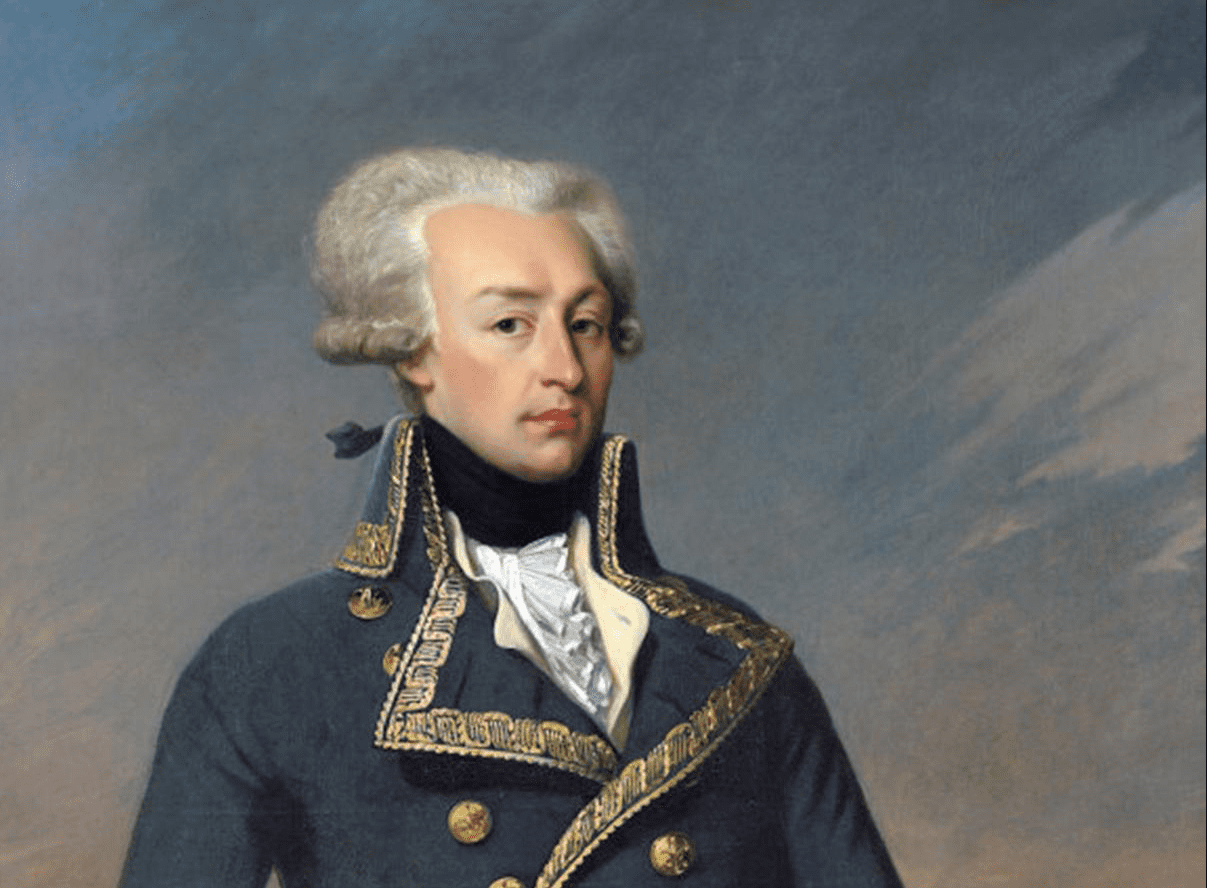

It ought to be carefully remembered that this subject was brought before Congress by a very solemn appeal from the army to the justice and gratitude of their country. Besides immediate pay, they ask for permanent security for arrears. Is not this request a reasonable one? Will it be just or politic to pass over the only adequate security that can be devised and instead of fulfilling the stipulations of the U.S. to them, to leave them to seek their rewards separately from the stats to which they respectively belong? The patience of the army had been equal to their bravery, but that patience must have its limits; and the result of despair can not be foreseen, nor ought it to be risked.

It has been objected against a general revenue that it contravenes the articles of confederation. These articles as has been observed have presupposed the necessity of alterations in the federal system and have left a door open for them: they moreover authorize Congress to borrow money, Now in order to borrow money permanent and certain provision is necessary, and if this provision cannot be made in any other way as has been shown, a general revenue is within the spirit of the confederation.

It has been objected that such a revenue is subversive of the sovereignty and liberty of the states. If it were to be assumed without the free gift of the states this objection might be of force, but no assumption is proposed. In fact Congress are already invested by the states with the constitutional authority over the purse as well as the sword. A general revenue would only give this authority a more certain and equal efficacy. They have a right to fix the quantum of money necessary for the common purposes. The right of the states is limited to the mode of supply. A requisition of Congress on the states for money is as much a law to them; as their revenue acts when passes are laws to their respective citizens. If for want of the faculty or means of enforcing a requisition, the law of Congress proves inefficient; does it not follow that in order to fulfill the views of the federal constitution, such a change should be made as will render it efficient? Without such efficiency the end of this Constitution which is to preserve like order and justice among its members.

It has been objected that the states have manifested such aversion to the impost on trade as renders any recommendations of a general revenue hopeless and imprudent. It must be admitted that the conduct of the states on the subject is less encouraging than were to be wished. A review of it however does not excited despondence. The impost was adopted immediately and in its utmost latitude by several of the states. Several also which complied partially with it at first have since complied more liberally. One of them after long refusal has complied substantially. Two states only have failed altogether and as to one of them it is not known that its failure has proceeded from a decided opposition to it. On the whole it appears that the necessity and reasonableness of the scheme have been gaining ground among the states. He was aware that one exception ought to be made to this interference: an exception to which peculiarly concerned him to advert to. The state of Virginia as appears by an act yesterday laid before congress, has withdrawn its assent once given to the scheme. This circumstance could not but produce some embarrassment in a representative of that state advocating the scheme; one too whose principles were extremely unfavorable to a disregard of the sense of constitutions. But it ought not to deter him from listening to considerations which in the present case ought to prevail over it. One of these considerations was that although the delegates who compose congress, more immediately represented and were amenable to the states from which they respectively come, yet in another view they owed a fidelity to the collective interests of the whole. Secondly, although not only the express instructions, but even the declared sense of constituents as in the present case, were to be a law in general to these representatives, still there were occasions on which the latter ought to hazard personal consequences from a respect to what his clear conviction determines to be the true interest of the former; and the present he conceived to fall under this exception. Lastly the part he took on the present occasion was the more fully justified to his own mind by his thorough persuasion, that with the same knowledge of public affairs which his station commanded, the legislature of Virginia would not have repealed the law in favor of the impost and would even now rescind the repeal.

The result of these observations was that it was the duty of Congress under whose authority the public debts had been contracted to aim at a general revenue as the only means of discharging them and that this dictate of justice and gratitude was enforced by a regard to the preservation of the confederacy to our reputation abroad and to our internal tranquility.

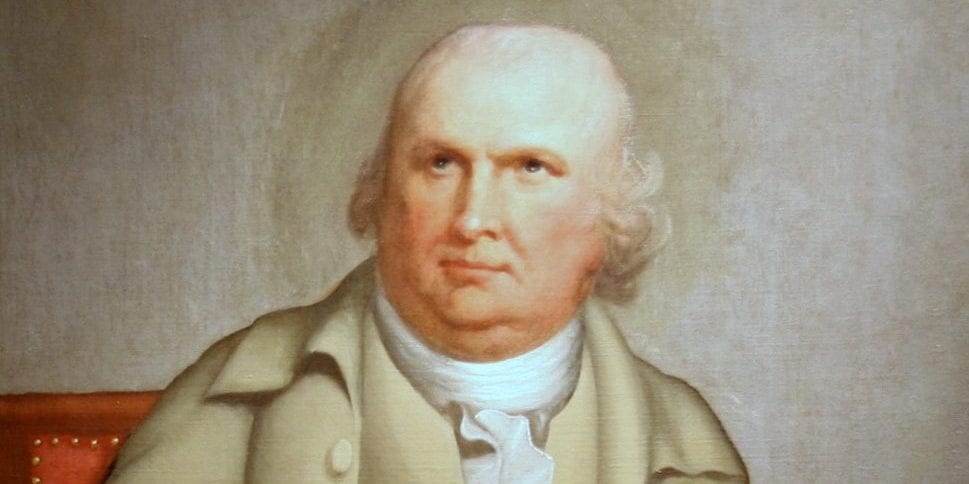

Mr. Rutledge complained that those who so strenuously urged the necessity and competency of a general revenue operating throughout all the states at the same time, declined specifying any general objects from which such a revenue could be drawn. He was thought to insinuate that these objects were kept back intentionally until the general principle could be irrevocably fixed when Congress would be bound at all events to go on with the project, whereupon Mr. Fitzimmons expressed some concern at the turn which mutual confidence prevailed no progress could be made towards the attainment of those ends which all in some way or another aimed at. It was a mistake to suppose that any specific plan had been preconcerted among the patrons of a general revenue.

Mr. Wilson with whom the motion originated gave his assurances that it was neither the effect of preconcert with others, nor of any determinate plan matured by himself, that he had been led into it by the declaration on Saturday last by Congress that substantial funds ought to be provided; by the memorial of the army from which that declaration had resulted, by the memorials from the State of Pennsylvania holding out the idea of separate appropriations of her revenue unless provision were made for the public creditors, by the deplorable and dishonorable situation of public affairs which had compelled Congress to draw bills on the unpromised and contingent bounty of their ally, and which was likely to vanish the Superintendent of Finance whose place could not be supplied, from his department. He observed that he had not introduced details into the debated because he thought them premature, until a general principle should be fixed; and that as soon as the principle should be fixed he would although not furnished with any digested plan, contribute all in his power to the forming such a one.

Mr. Rutlidge moved that the proposition might be committed in order that some practicable plan might be reported, before Congress should declare that it ought to be adopted.

Mr. Izard seconded the motion from a conciliating view.

Mr. Madison thought the commitment unnecessary and would have the appearance of delay; that too much delay had already taken place, that the deputation of the army had a right to expect an answer to their memorial as soon as it could be decided by Congress. He differed from Mr. Wilson in thinking that a specification of the objects of a general revenue would be improper, and thought that those who doubted of its practicability had a right to expect proof of it from details before they could be expected to assent to the general principle; but he differed also fro the purpose; since his views would be answered by a greater latitude. He suggested as practicable objects of a general revenue. First an impost on trade, secondly a poll tax under certain qualifications, thirdly a land tax under do.

Mr. Hamilton suggested a house and window tax. He was in favor of the mode of conducting the discussion urged by Mr. Madison.

On the motion for the commt. six states were in favor of it, and five against it so it was lost — in this vote the merits of the main proposition very little entered.

Mr. Lee said that it was a waste of time to be forming resolutions and settling principles on this subject. He asked whether these would ever bring any money into the public treasury. His opinion was that Congress ought in order to guard against the inconveniency of meetings of the different Legislatures at different and even distant periods; to call upon the Executives to convoke them all at one period and to lay before them a full state of our public affairs. He said the states would never agree to those plans which tended to aggrandize Congress; that they were jealous of the power of Congress and that he acknowledged himself to be one of those who thought this jealousy not an unreasonable one; that no one who have ever opened a page or read a line on the subject of liberty, could be insensible to the danger of surrendering the purse into the same hand which held the sword.

The debate was suspended by an adjournment.

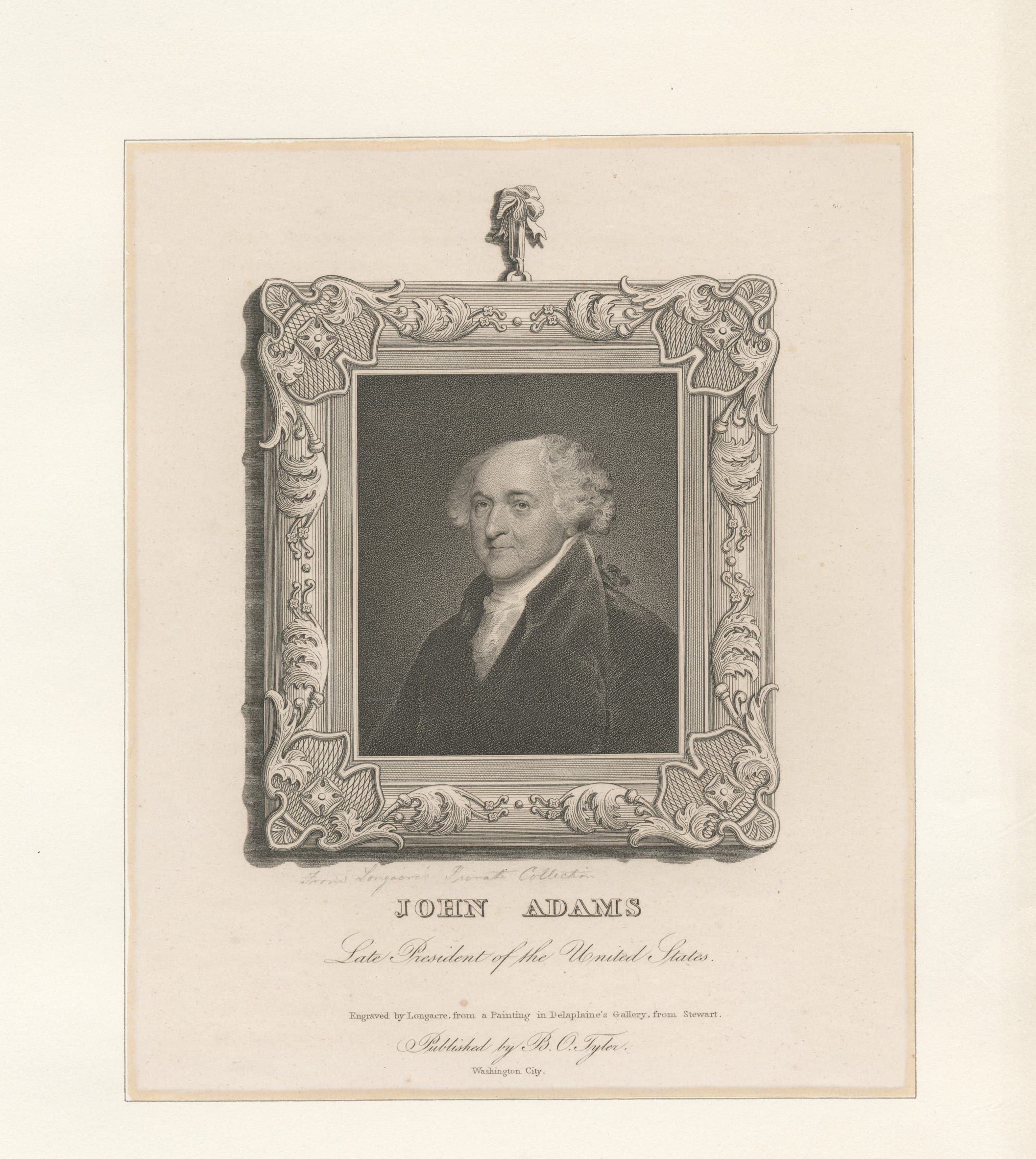

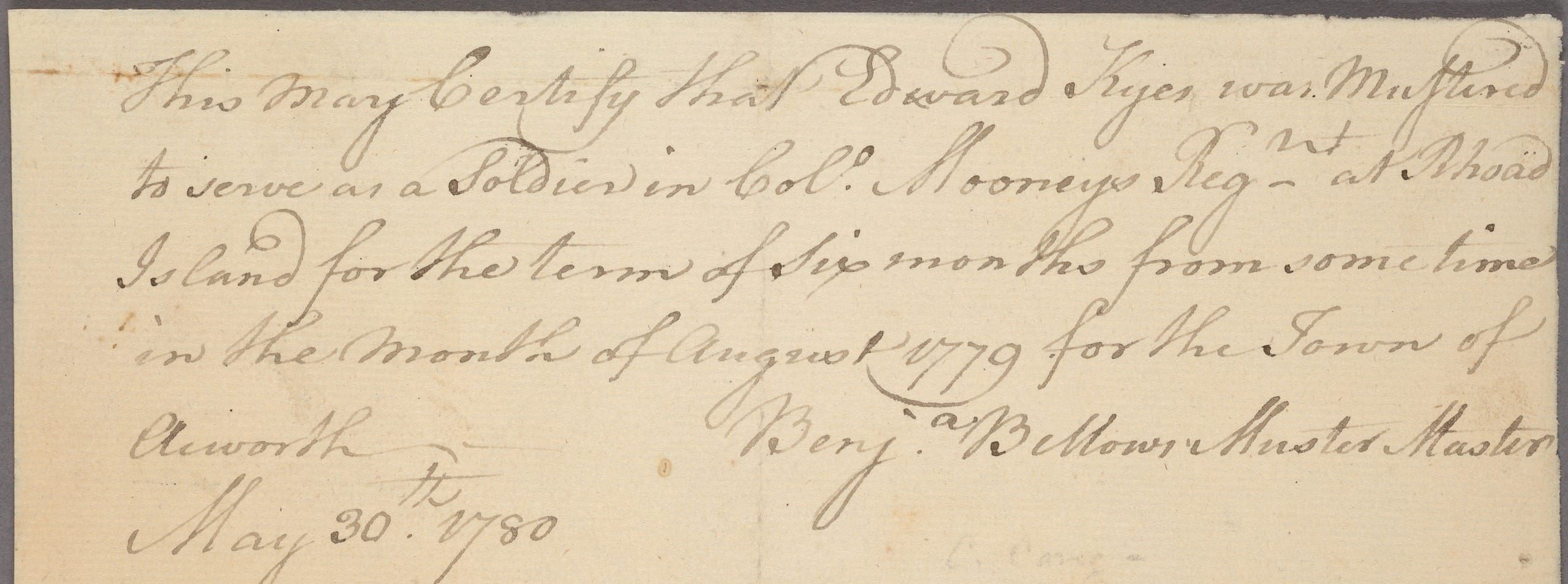

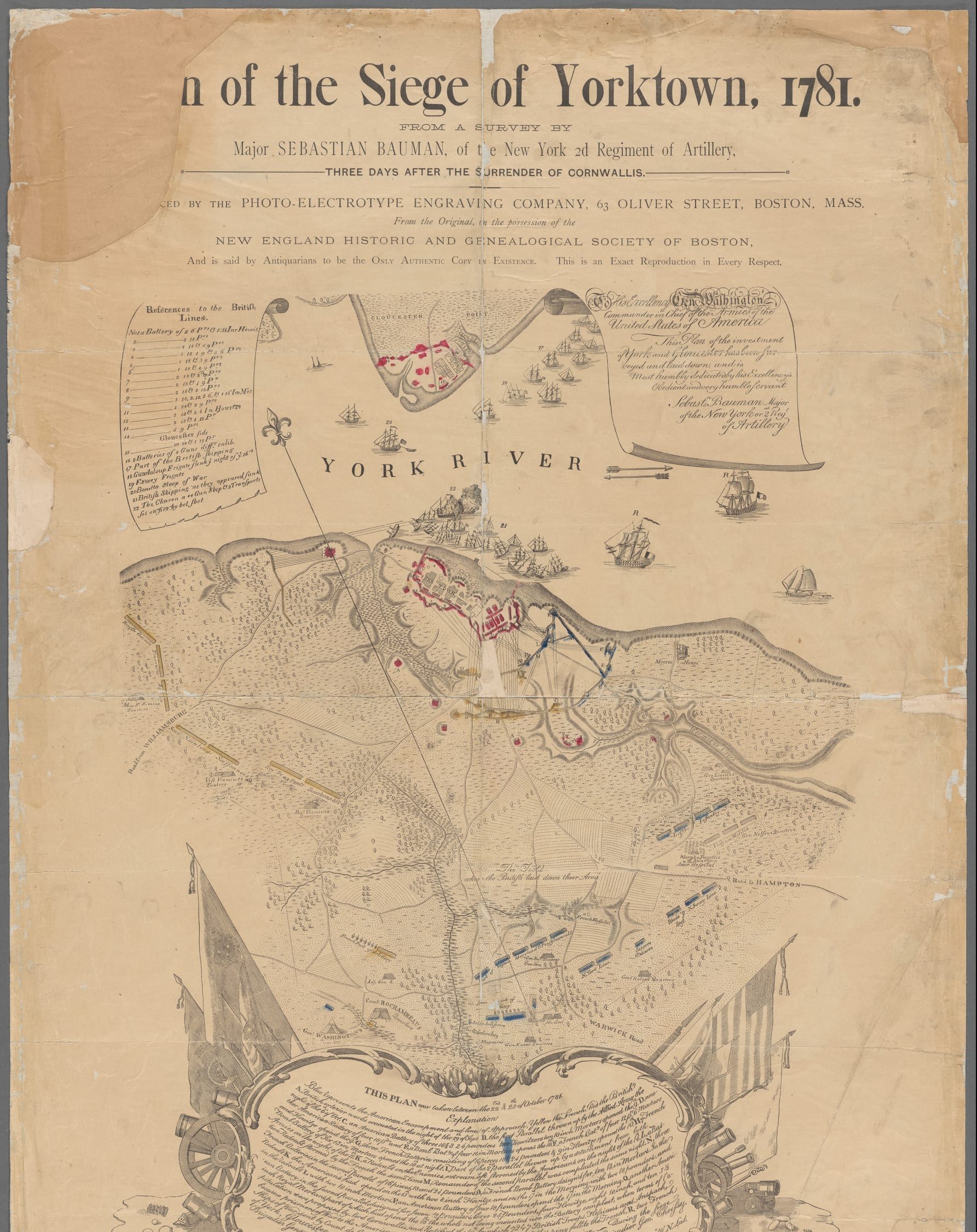

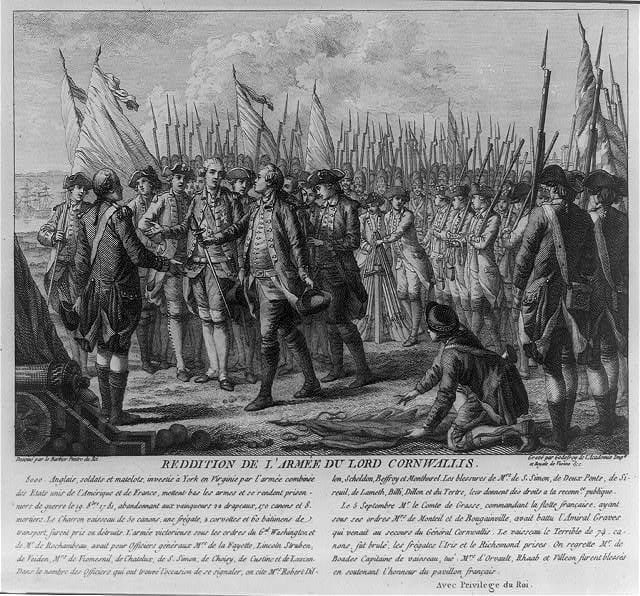

Letter to Major General Nathanael Greene

February 06, 1783

Conversation-based seminars for collegial PD, one-day and multi-day seminars, graduate credit seminars (MA degree), online and in-person.