No study questions

No related resources

CHAPTER II THE EARLY PROTECTIVE MOVEMENT AND THE TARIFF OF 1828

In the present essay we shall consider, not so much the economic effect of the tariff, as the character of the early protective movement and its effect on political events and on legislation.

The protective movement in this country has been said to date from the year 1789, even from before 1789; and more frequently it has been said to begin with the tariff act of 1816. But whatever may have been, in earlier years, the utterances of individual public men, or the occasional drift of an uncertain public opinion, no strong popular movement for protection can be traced before the crisis of 1818-19. The act of 1816, which is generally said to mark the beginning of a distinctly protective policy in this country, belongs rather to the earlier series of acts, beginning with that of 1789, than to the group of acts of 1824,1828, and 1832. Its highest permanent rate of duty was twenty per cent., an increase over the previous rates which is chiefly accounted for by the heavy interest charge on the debt incurred during the war. But after the crash of 1819, a movement in favor of protection set in, which was backed by a strong popular feeling such as had been absent in the earlier years. The causes of the new movement are not far to seek. On the one halid there was a great collapse in the prices of land and of agricultural products, which had been much inflated during the years from 1815 to 1818. At the same time the foreign market for grain and provisions, which had been highly profitable during the time of the Napoleonic wars, and which there had been a spasmodic attempt to regain for two or three years after the close of our war in 1815, was almost entirely lost. On the other hand, a large number of manufacturing industries had grown up, still in the early stages of growth, and still beset with difficulties, yet likely in the end to hold their own and to prosper. That disposition to seek a remedy from legislation, which always shows itself after an industrial crisis, now led the farmers to ask for a home market, while the manufacturers wanted protection for young industries. The distress that followed the crisis brought out a plentiful I crop of pamphlets in favor of protection, of societies and conventions for the promotion of domestic industry, of petitions and memorials to Congress for higher duties. The movement undoubtedly had deep root in the feelings and convictions of the people, and the powerful hold which protective ideas then obtained influenced the policy of the nation long after the immediate effects of the crisis had ceased to be felt. 1

The first effect of this movement was seen in a series of measures which were proposed and earnestly pushed in Congress in the session of 1819-20. They included a bill for a general increase of duties, one for shortening credits on duties, and one for taxing sales by auction of imported goods. The first of these very nearly took an important place in our history, for it was passed by the House, and failed to pass the Senate by but a single vote. Although it did not become law, the protective movement which was expressed in the votes and speeches on it remained unchanged for several years, and brought about the act of 1824, while malting possible the act of 1828. Some understanding of the state of feeling in the different sections of the country is necessary before the peculiar events of 1828 can be made clear, and it may be conveniently reached at this point.

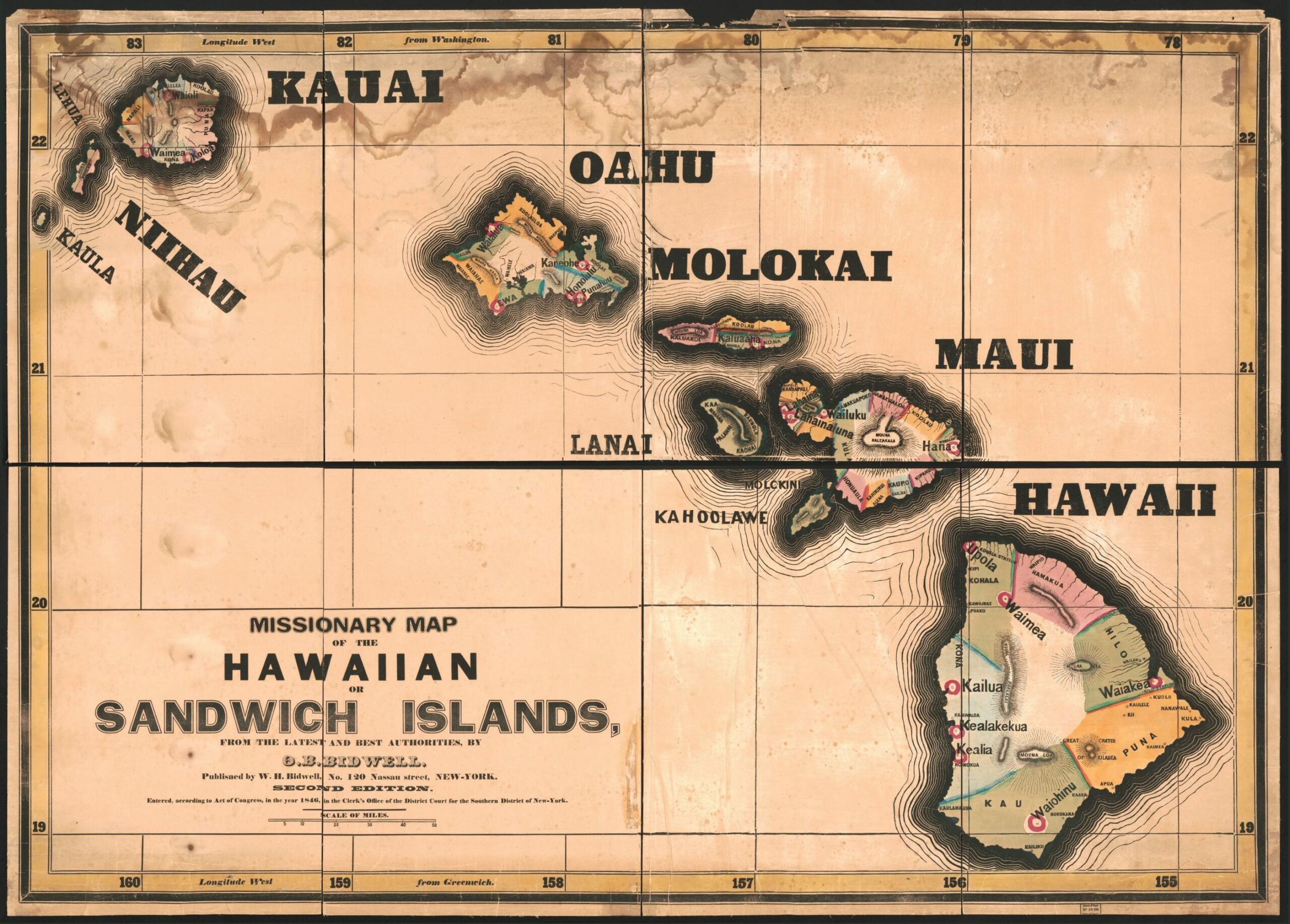

The stronghold of the protective movement was in the Middle and Western states of those days-in New York, New Jersey, Pennsylvania, Ohio, and Kentucky. They were the great agricultural State; they felt most keenly the loss of the foreign market of the early years of the century, and were appealed to most directly by the cry for a home market. At the same time they had been most deeply involved in the inflation of the years 1816-19, and were in that condition of general distress and confusion which leads people to look for some panacea. The idea of protection as a cure for their troubles had obtained a strong hold on their minds. It is not surprising, when we consider the impetuous character of the element in American democracy at that time represented by them, that the idea was applied in a sweeping and indiscriminate manner. They wanted protection not only for the manufactures that were to bring them a home market, but for many of their own products, such as wool, hemp, flax, even for wheat and corn. For the two last mentioned they asked aid more particularly in the form of higher duties on rum and brandy, which were supposed to compete with spirits distilled from home-grown grain. A duty on molasses was a natural supplement to that on rum. Iron was already produced to a considerable extent in Pennsylvania and New Jersey, and for that also protection was asked.

In New England there was a strong opposition to many of these demands. The business community of New England was still made up mainly of importers, dealers in foreign goods, shipping merchants, and vessel owners, who naturally looked with aversion at measures that tended to lessen the volume of foreign trade. Moreover, they had special objections to many of the duties asked for by the agricultural states. Hemp in the form of cordage, flax in the form of sail duck, and iron, were important items in the cost of building and equipping ships. The duties on molasses and rum were aimed at an industry carried on almost exclusively in New England : the importation of molasses from the West Indies in exchange for fish, provisions, and lumber, and its subsequent manufacture into rum. Wool was the raw material of a rapidly growing manufacture. So far the circumstances led to opposition to the protective movement. On the other hand, the manufacture of cotton and woollen goods was increasing rapidly and steadily, and was the moving force of a current in favor of protection that became stronger year by year. We have seen that the beginning of New England’s manufacturing career dates back to the War of 1812. Before 1820 she was fairly launched on it, and between 1820 and 1830 she made enormous advances. The manufacturers carried on a conflict, unequal at first, but rapidly becoming less unequal, with the merchants and ship-owners. As early as 1820 Connecticut and Rhode Island were petty firmly protective; but Massachusetts hesitated. Under the first weight of the crisis of 1819, the protective feeling was strong enough to cause a majority of her congressmen to vote for the bill of 1820. But there was great opposition to that bill, and after 1820 the protective feeling died down. 2 In 1824 Massachusetts was still disinclined to adopt the protective system, and it was not until the end of the decade that she came squarely in line with the agricultural states on that subject.

The South took its stand against the protective system with a promptness and decision characteristic of the political history of the slave states. The opposition of the Southern members to the tariff bill of 1820 is significant of the change in the nature of the protective movement between 1816 and 1820. The Southern leaders had advocated the passage of the act of 1816, but they bitterly opposed the bill of 1820. It is possible that the Missouri Compromise struggle had opened their eyes to the connection between slavery and free trade.3 At all events, they had grasped the fact that slavery made the growth of manufactures in the South impossible, that manufactured goods must be bought in Europe or in the North, and that, wherever bought, a protective tariff would tend to make them dearer. Moreover, Cotton was not yet King, and the South was not sure that its staple was indispensable for all the world. While the export of cotton on a large scale had begun, it was feared that England, in retaliation for high duties on English goods, might tax or exclude American cotton.

Such was in 1820 the feeling in regard to the protective system in the different parts of the country. After the failure of the bill of that year, the movement for higher duties seems for a while to have lost headway. The lowest point of industrial and commercial depression, so far as indicated by the revenue, was reached at the close of 1820, and, as affairs began to mend, protective measures received less vigorous support. Bills to increase duties, similar to the bill of 1820, were introduced in Congress in 1821 and 1822, but they were not pressed and led to no legislation.4

Public opinion in most of the Northern States, however, continued to favor protection ; the more so because, after the first shock of the crisis of 1819 was over, recovery, though steady, was slow. As a Presidential election approached and caused public men to respond more readily to popular feeling, the protectionists gained a decided victory. The tariff of 1824 was passed, the first and the most direct fruit of the early protective movement. The Presidential election of that year undoubtedly had an effect in causing its passage ; but the influence of politics and political ambition was in this case hardly a harmful one. Not only Clay, the sponsor of the American System, but Adams, Crawford, and Jackson were declared advocates of protection. Party lines, so far as they existed at all, were not regarded in the vote on the tariff. It was carried mainly by the votes of the Western and Middle states. The South was in opposition, New England was divided ; Rhode Island and Connecticut voted for the bill, Massachusetts and the other New England states were decidedly opposed.5

The opposition of Massachusetts was the natural result of the character of the new tariff. The most important changes made by it were in the increased duties on iron, lead, wool, hemp, cotton-bagging, and other articles whose protection was desired chiefly by the Middle and Western States. The duties on textile fabrics, it is true, were also raised. Those on cotton and woollen goods went up from 2; to 335 per cent. This increase, however, was offset, so far as woollens were concerned, by the imposition of a duty of 30 per cent on wool, which had before been admitted at 15 per cent. The manufacturers of woollen goods were, therefore, as far as the tariff was concerned, in about the same position as before.6 The heavier duties on iron and hemp, on the other hand, were injurious to the ship-builders.

The manufacture of textiles was rapidly extending in all the New England States. At first that of cottons received most attention, and played the most important part in the protective controversy. But by 1824 the cotton industry was firmly established and almost independent of support by duties. The woollen manufacture was in a less firm position, and in 1824 became the prominent candidate for protection. Between 1824 and 1828 a strong movement set in for higher duties on woollens, which led eventually to some of the most striking features of the tariff act of 1828.

The duties proposed and finally established on woollens were modeled on the minimum duty of 1816 on cottons. By the tariff act of that year, it will be remembered, cotton goods were made subject to a general ad valoem duty of 25 per cent; but it was further provided that “all cotton cloths, whose value shall be less than 25 cents per square yard, shall be taken and deemed to have cost 2 cents per square yard, and shall be charged with duty accordingly.” That is, a specific duty of six and a quarter cents a square yard was imposed on all cotton cloths costing twenty-five cents a square yard or less. The minimum duties, originally intended to affect chiefly East Indian goods and goods made from East Indian cotton, had an effect in practice mainly on goods from England, whether made of American or of Indian cotton. In a few years, as the use of the power loom and other improvements in manufacture brought the price of coarse cottons much below twenty-five cents, the minimum duties became prohibitory. How far they were needed in order to promote the success and prosperity of the cotton manufacture in years following their imposition, we have already discussed.7 At all events, whether or not in consequence of the duties, large profits were made by those who entered on it, and in a few years the cheaper grades of cotton cloth were produced so cheaply, and of such good quality, that the manufacturers freely asserted that the duty had become nominal, and that foreign competition no longer was feared.

This example had its effect on the manufacturers of woollen goods, and on the advocates of protection in general. In the tariff bill of 1820, minimum duties on linen and on other goods had been proposed. In 1824 an earnest effort was made to extend the minimum system to woollens. The committee which reported the tariff bill of that year recommended the adoption in regard to woollens of a proviso framed after that, of the tariff of 1816 in regard to cottons, the minimum valuation being eighty cents a yard. The House first lowered the valuation to forty cents and finally struck out the whole provision by a scant majority of three votes.8 There was one great obstacle in the way of a high duty on cheap wollen goods: they were imported largely for the use of slaves on Southern plantations. Tender treatment of the peculiar institution had already begun, and there was strong opposition to a duty which had the appearance of being aimed against the slave-holders. The application of the minimum principle to other than cheap woollen goods apparently had not yet been thought of; but the idea was obvious, and soon was brought forward.

After 1824 there was another lull in the agitation for protection. Trade was buoyant in 1825, and production profitable. For the first time since 1818 there was a swing in business operations. This seems to have been particularly the case with the woollen manufacturers. During the years from 1815 to 1818-19, they, like other manufacturers, had met with great difficulties; and when the first shock of the crisis of the latter year was over, matters began to mend but slowly. About 1824, however, according to the accounts both of their friends and of their opponents on the tariff question, they extended their operations largely.9 It is clear that this expansion, such as it was, was not tile effect of any stimulus given by the tariff of 1824, for, as we have seen, the encouragement given the woollen manufacturers by that act was no greater than had been given under the act of 1816. At all events, the upward movement lasted but a short time. In England a similar movement had been carried to the extreme of speculation and had resulted in the crisis of 1825-26. From England the panic was communicated to the United States; but, as the speculative movement had not been carried so far in this country, the revulsion was less severely felt. It seems, however, to have fallen on the woollen manufacturers with peculiar weight. Parliament, it so happened, in 1824 had abolished almost entirely the duty on wool imported into England. It went down from twelve pence to one penny a pound.10 The imports of woollen goods into the United States had in 1825 been unusually large; the markets were well stocked; the English manufacturers were at once enabled to sell cheaply by the lower price of their raw material, and pushed to do so by the depression of trade.

A vigorous effort was now made to secure legislative aid to the woollen makers, similar to that given the cotton manufacturers. Massachusetts was the chief seat of the woollen industry. The woollen manufacturers held meetings in Boston and united for common action, and it was determined to ask Congress to extend the minimum system to woollen goods.11 The legislature of the State passed resolutions asking for further protection for woollens, and these resolutions were presented in the federal House of Representatives by Webster. 12 A deputation of manufacturers was sent to Washington to present the case to the committee on manufactures. Their efforts promised to be successful. When Congress met for the session of 1826-27, the committee (which in those days had charge of tariff legislation) reported a bill which gave the manufacturers all they asked for.

This measure contained the provisions which, when finally put in force in the tariff of 1828, became the object of the most violent attack by the opponents of protection. It made no change in the nominal rate of duty, which was to remain at 33$ per cent. But minimum valuations were added, on the plan of the minima on cottons, in such a way as to carry the actual duty far beyond the point indicated by the nominal rate. The bill provided that all goods costing less than 40 cents a square yard were to pay duty as if they had cost 40 cents; all costing more than 40 cents and less than $2.50 were to be charged as if they had cost $2.50 ; all costing between $2.50 and $4.00 to be charged as if they had cost $4.00. A similar course was proposed in regard to raw wool. The ad valorem rate on raw wool was to be 30 per cent in the first place, and to rise by steps to 40 per cent; and it was to be charged on all wool costing between 16 cents and 40 cents a pound as if the wool had cost 40 cents. The effect of this somewhat complicated machinery was evidently to levy specific duties both on wool and on woollens. On wool the duty was to be, eventually, 16 cents a pound. On woollens it was to be 13; cents a yard on woollens of the first class, 839 cents on those of the second class, and $1.334 on those of the third class.

The minimum system, applied in this way, imposed ad Valorenz duties in form, specific duties in fact. It had some of the disadvantages of both systems. It offered temptations to fraudulent undervaluation stronger than those offered by ad valorem duties. For example, under the bill of 1827, the duty on goods worth in the neighborhood of 40 cents a yard would be 134 cents if the value was less than 40 cents; but if the value was more than 40 cents, the duty would be 833 cents. If the value could be made to appear less than forty cents, the importer saved 70 cents a yard in duties. Similarly, at the next step in the minimum points, the duty was 834 cents if the goods were worth less than $2.50, and $1.339 cents if the goods were worth more than $2.50. The temptation to undervalue was obviously very strong under such a system, in the case of all goods which could be brought with any plausibility near one of the minimum points. On the other hand, the system had the want of elasticity which goes with specific duties. All goods costing between 40 cents and $2.50 were charged with the same duty, so that cheap goods were taxed at a higher rate than dear goods. The great gap between the first and second minimum points (40 cents and $2.50) made this objection the stronger. But that gap was not the result of accident. It was intended to bring about a very heavy duty on goods of the grade chiefly manufactured in this country. The most important domestic goods were worth about a dollar a yard, and their makers, under this bill, would get a protective duty of 83+ cents a yard. The object was to secure a very high duty, while retaining nominally the existing rate of 33 and 1/3 percent.

The woollens bill of 1827 had a fate similar to that of the general tariff bill of 1820. It was passed in the House, but lost in the Senate by the casting vote of the Vice-President. In the House the Massachusetts members, with one exception, voted for it, and both Senators from Massachusetts supported it.13

This bill having failed, the advocates of protection determined to continue their agitation, and to give it wider scope. A national convention of protectionists was determined on.14 Meetings were held in the different States in which the protective policy was popular, and delegates were appointed to a general convention. In midsummer of 1827 about a hundred persons assembled at Harrisburg, and held the Harrisburg convention, well known in its day. Most of the delegates were manufacturers, some were newspaper editors and pamphleteers, a few were politicians.15 The convention did not confine its attention to wool and woollens. It considered all the industries which were supposed to need protection. It recommended higher duties for the aid of agriculture; others on manufactures of cotton, hemp, flax, iron, and glass; and finally, new duties on wool and woollens. The movement was primarily for the aid of the woollen industry; other interests were included in it as a means of gaining strength. The duties which were demanded on woollens were on the same plan as those proposed in the bill of 1827, differing only in that they were higher. The ad valorem rate on woollen goods was to be 40 per cent. in the first place, and was to be raised gradually until it reached 50 percent. It was to be assessed on minimum valuations of fifty cents, two dollars i and a half, four dollars, and six dollars a yard. ’ The duty on wool was to be twenty cents a pound in the first instance, and was to be raised each year by 2; cents until it should reach fifty cents a pound. A Needless to say, the duty would be prohibitory long before this limit was reached. Wool costing less than eight cents was to be admitted free. 16

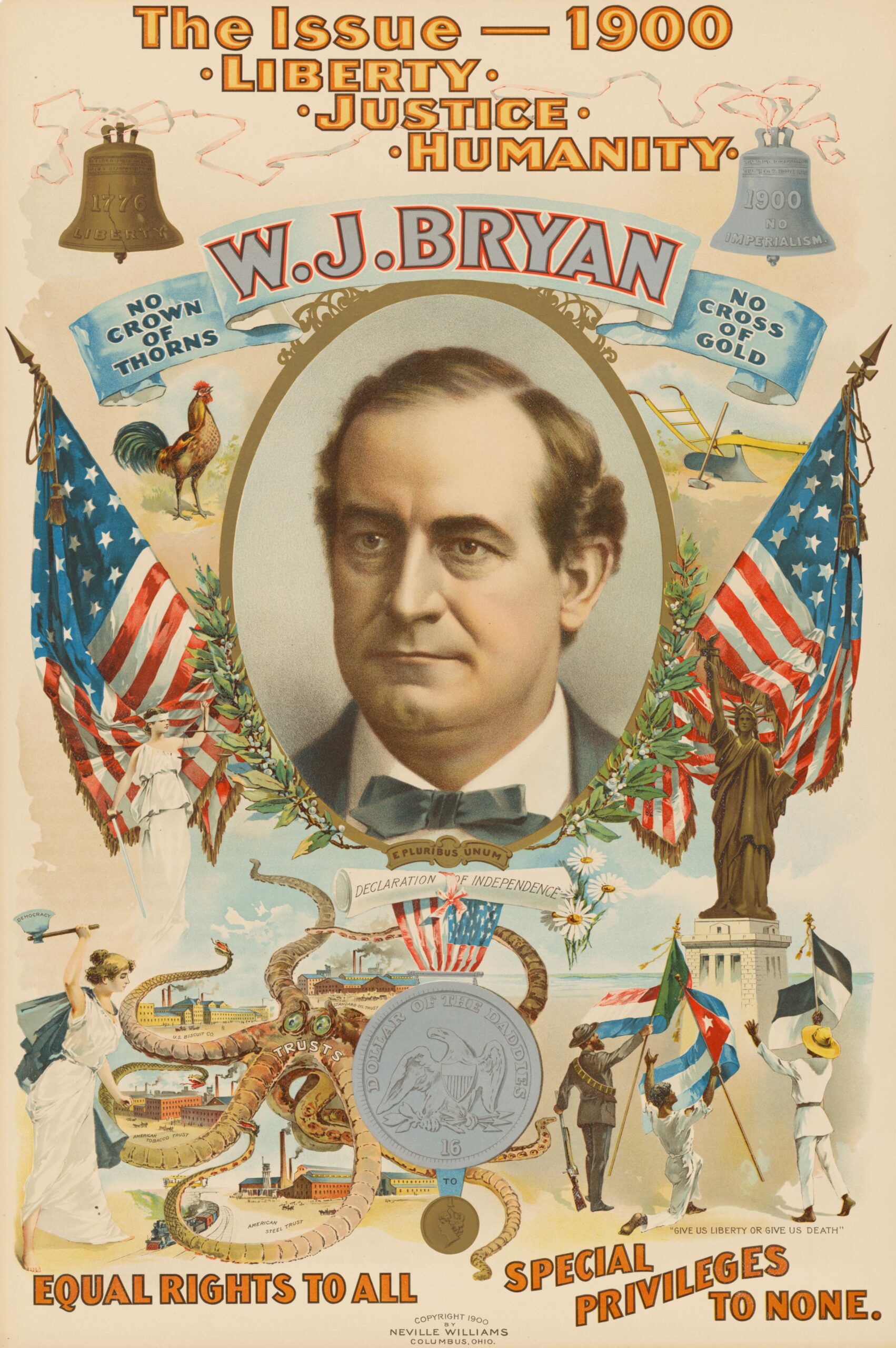

At this point a new factor, which we may call “politics,” began to make itself felt in the protective movement. The natural pressure of public opinion on public men had exercised its effect in previous years, and had had its share in bringing about the tariff act of 1824 and the woollens bill of 1827. But the gradual crystallization of two parties, the Adams and Jackson parties, Whigs and Democrats, as they soon came to be called-put a new face on the political situation, and had an unexpected effect on tariff legislation. The contest between them had begun in earnest before the Harrisburg convention met, and some of the Jackson men alleged that the convention was no more than a demonstration got up by the Adams men as a means of bringing the protective movement to bear in their aid; but this was denied, and such evidence as we have seems to support the denial.17 Yet the Adams men were undoubtedly helped by the protective movement. Although there was not then, nor for a number of years after, a clear-cut division on party lines between protectionists and so-called free traders, the Adams men were more firmly and unitedly in favor of protection than their opponents. Adams was a protectionist, though not an extreme one; Clay, the leader and spokesman of the party, was more than any other public man identified with the American system. They were at least willing that the protective question should be brought into the foreground of the political contest. 18

The position of the Jackson men, on the other hand, was a very difficult one. Their party had at this time no settled policy in regard to the questions which were to be the subjects of the political struggles of the next twenty years. They were united on only one point, a determination to oust the other side. On the tariff, as well as on the bank and internal improvements, the various elements of the party held very different opinions. The Southern members, who were almost to a man supporters of Jackson, were opposed unconditionally not only to an increase of duties, but to the high range which the tariff had already reached. They were convinced, and in the main justly convinced, that the taxes levied by the tariff fell with peculiar weight on the slave States, and their oppositionwas already tinged with the bitterness which made possible, a few years later, the attempt at nullification of the tariff of 1832. On the other hand, the protective policy was popular throughout the North, more especially in the very States whose votes were essential to Jackson, in New York, Pennsylvania, and Ohio. The Jackson men needed the votes of these States, and were not so confident of getting them as they might reasonably have been. They failed, as completely as their opponents, to gauge the strength of the enthusiasm of the masses for their candidate, and they did not venture to give the Adams men a chance of posing as the only true friends of domestic industry.

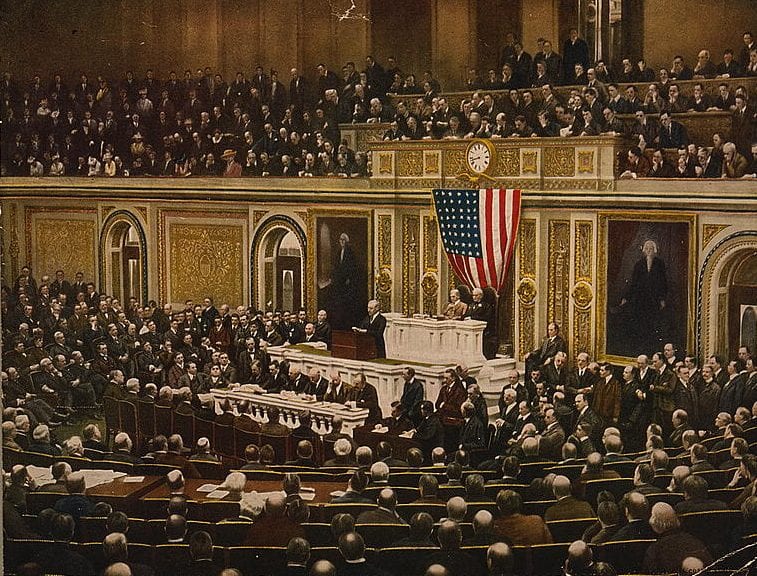

The twentieth Congress met for its first session in December, 1827. The elections of 1826, at which its members were chosen, had not been fortunate for the administration. When Congress met there was some doubt as to the political complexion of the House; but this was set at rest by the election to the speakership of the Democratic candidate, Stephenson of Virginia.19 The new Speaker, in the formation of the committees, assumed for his party the direction of the measures of the House. On the committee on manufactures, from which the tariff report and the tariff bill were to come, he appointed five supporters of Jackson and two supporters of Adams. The chairmanship, however, was given to one of the latter, Mallary, of Vermont, who, it will be remembered, had been a member of the Harrisburg convention. Much doubt was entertained as to the line of action the committee would follow. The Adams men feared at first that it would adopt a policy of simple delay and inaction. This fear was confirmed when, a few weeks after the beginning of the session, the committee asked for power to send for persons and papers in order to obtain more information on the tariff, a request which was opposed by Mallary, their chairman, on the ground that it was made only as a pretext for delay. The Adams men, who formed the bulk of the ardent protectionists, voted with him against granting the desired power. But the Southern members united with the Jackson men from the North, and between them they secured the passage of the resolution asked by the committee. 20 The debate and vote on the resolution sounded the key-note of the events of the session. They showed that the Jackson men from the South and the North, though opposed to each other on the tariff question, were yet united as against the Adams men. 21

But the policy of delay, if such in fact had been entertained by the opposition, was abandoned. On January 31st, the committee presented a report and a draft of a tariff bill, which showed that they had determined on a new plan, and an ingenious one. What that plan was, Calhoun explained very frankly nine years later, in a speech reviewing the events of 1828 and defending the course taken by himself and his Southern fellow-members. 22 A high-tariff bill was to be laid before the House. It was to contain not only a high general range of duties, but duties especially high on those raw materials on which New England wanted the duties to be low. It was to satisfy the protective demands of the Western and Middle States, and at the same time to be obnoxious to the New England members. The Jackson men of all shades, the protectionists from the North and the free-traders from the South, were to unite in preventing any amendments; that bill, and no other, was to be voted on. When the final vote came, the Southern men were to turn around and vote against their own measure. The New England men, and the Adams men in general, would be unable to swallow it, and would also vote against it. Combined, they would prevent its passage, even though the Jackson men from the North voted for it. The result expected was that no tariff bill at all would be passed during the session, which was the object of the Southern wing of the opposition On the other hand, the obloquy of defeating it would be cast on the Adams party, which was the object of the Jacksonians of the North. The tariff bill would be defeated, and yet the Jackson men would be able to parade as the true “friends of domestic industry.”

The bill by which this ingenious solution of the difficulties of the opposition was to be reached, was reported to the House on January 31st by the committee on manufactures. 23 To the surprise of its authors, it was eventually passed both by House and Senate, and became, with a few unessential changes, the tariff act of 1828.

The committee’s bill in the first place proposed a large increase of duties on almost all raw materials. The duty on pig-iron was to go up from 56 to 624 cents per hundredweight, that on hammered bar-iron from go to 112 cents per hundredweight, and that on rolled bar from $30 to $37 per ton. The increase on hammered bar had been asked by the Harrisburg convention. But on pig and on rolled bar no one had asked for an increase, not even the manufacturers of iron who had testified before the committee. 24

The most important of the proposed duties on raw materials, however, were on hemp, flax, and wool. The existing duty on hemp was $35 per ton. It was proposed to increase it immediately to $45, and further to increase it by an annual increment of $5, till it should finally reach $60. Hemp of coarse quality was largely raised in the country at that time, especially in Kentucky. It was suitable for the making of common ropes and of cotton bagging, and for those purposes met with no competition from imported hemp. Better hemp, suitable for making cordage and cables, was not raised in the country at all, the supply coming exclusively from importation. The preparation of this better quality (water-rotted hemp) required so much manual labor, and labor of so disagreeable a character, that it would not have been undertaken in any event by the hemp growers of this country. 25 Under such conditions an increase of duty on hemp could be of no benefit to the American grower. Its effect would be simply to burden the rope makers and the users of cordage, and ultimately the ship-builders and ship owners. Essentially the same state of things has continued to our own day. The high duties on hemp have never succeeded in checking a large and continuous importation. The facts were then, and are now, very similar with flax; yet the same duty of $60 per ton was to be put on flax.

On wool a proposal of a similar kind was made. The duty under the tariff of 1824 had been 30 per cent. This was to be changed to a mixed specific and ad valorem duty, the first mixed duty of importance in the United States.26 Wool was to pay seven cents a pound (this was reduced to four cents in the act as finally passed), and in addition 40 percent in 1828, 45 percent in 1829, and thereafter 50 per cent. The object of the mixed duty was to make sure that a heavy tax should be put on coarse wool. The coarse wool, used in the manufacture of carpets and of some cheap flannels and cloths, was not then grown in the United States to any extent, and, indeed, has been grown at no time in this country, but has always been imported, mainly from Asia Minor and from South America. Its cost at the place of exportation was in 1828 from four to ten cents a pound.27 The price being so low, a simple ad valorem duty would not have affected it much. But the additional specific duty of seven (four) cents weighted it heavily. The ad valorem part of the duty reached the higher grades of wool, which were raised in this country it was calculated to please the farmer. The specific part reached the lower grades, which were not raised in this country, and was calculated to annoy and embarrass the manufacturers. This double object, and especially the second half of it, the Jackson men wanted to attain, and for that reason the policy of admitting the cheap wool at low rates was set aside,–a policy which has been followed in all our protective tariffs, with the sole exception of that of 1828.28

Another characteristic part of the scheme was the handling of those duties on woollens that corresponded to the duties on cheap wool. It had been customary to fix low duties on the coarse woollen goods made from cheap wool, partly because of the low duty on the wool itself, and partly because coarse woollens were used largely for slaves on Southern plantations. Thus in 1824 woollen goods costing less than 33 cents a yard had been admitted at a duty of 25 per cent., while woollens in general paid 339 per cent. In 1828 this low duty on coarse woollens was continued, although the wool of which they were made was subject for the first time to a heavy duty. The object again was to embarrass the manufacturers, and make the bill unpalatable to the protectionists and the Adams men.

The same object appeared in the duty on molasses, which was to be doubled, going from five to ten cents a gallon. A spiteful proviso was added in regard to the drawback which it had been customary to allow on the exportation of run1 distilled from imported molasses. The bill of 1828, and the act as finally passed, expressly refused all drawbacks on rum; the intention obviously being to irritate the New Englanders. The animus appeared again in the heavy duty on sail-duck, and the refusal of drawback on sail-duck exported by vessels in small quantities for their own use.29

In the duties on woollen goods the changes from the schedule proposed by the Harrisburg convention were on the surface not very great; but in reality they were important. The committee gave up all pretence of ad valorem duties. This was not an insignificant circumstance for the ad valorem rate of the minimum system was said by its opponents to be no more than a device for disguising the heavy duties actually levied under it. The committee brushed aside this device, and made the duties on woollens specific and unambiguous. On goods costing 50 cents a square yard or less, the duty was 16 cents; on goods costing between 50 cents and $1.00, 40 cents; on those costing between $1.00 and $2.50, $1.00; and on those costing between $2.50 and $4.00, $1.60. Goods costing more than $4.00 were to pay 45 per cent. These specific duties, it will be seen, were the same as if an ad valorem duty of 40 percent had been assessed, on the minimum principle, on valuations of 50 cents, $1.00, $2.50, and $4.00. The changes from the Harrisburg convention scheme were, therefore, the arrangement of specific duties in such a way that they were equivalent to an ad valorem rate of but 40 per cent. (the convention had asked 50 per cent.) and, next, the insertion of a minimum point of $1.00, the Harrisburg scheme having allowed no break between 40 cents and $2.50. The first change might have been submitted to by the protectionists; but the second was like putting a knife between the crevices of their armor. We have already noted the importance of the gap between the minimum points of 40 cents and $2.50. A very large part of the imported goods were worth, abroad, in the neighborhood of $1.00; and the largest branch of the domestic manufacture made goods of the same character and value. The original scheme had given a very heavy duty, practically a prohibitory duty, on these goods, while the new scheme gave a comparatively insignificant duty of 40 cents. As one of the protectionists said : “The dollar minimum was planted in the very midst of the woollen trade.” 30

The bill, in fact, was ingeniously framed with the intention of circumventing the Adams men, especially those from New England. The heavy duties on iron, hemp, flax and wool were bitter pills for them. The new dollar minimum took the life out of their scheme of duties on woollen goods. The molasses and sail-duck duties, and the refusal of drawbacks on rum and duck, were undisguised blows at New England. At the same time, some of these very features, especially the hemp, wool, and iron duties, served to make the bill popular in the Western and Middle States, and made opposition to it awkward for the Adams men. The whole scheme was a characteristic product of the politicians who were then becoming prominent as the leaders of the Democracy, men of a type very different from the statesmen of the preceding generation. Clay informs us that it was one of the many devices that had their origin in the fertile brain of Van Buren.31 Calhoun said in 1837 that the compact between the Southern members and the Jackson leaders had come about mainly through Silas Wright; and Wright made no denial.32

The result of this curious complication of wishes and motives was seen when the tariff bill was finally taken up in the House in March. Mallary, as chairman of the committee on manufactures, introduced and explained the bill. Being an Adams man, he was of course opposed to it, and moved to amend by inserting the scheme of the Harrisburg convention. The amendment was rejected by decisive votes, 102 to 75 in committee of the whole 33 and 14 to 80 in the House. The majority which defeated the amendment was composed of all the Southern members, and of the Jackson members from the North, chiefly from New York, Pennsylvania, Ohio, and Kentucky. The minority consisted almost exclusively of friends of the administration.34 Mallary then moved to substitute that part only of the Harrisburg convention scheme which fixed the duties on wool and woollens; that is, the original minimum scheme, with a uniform duty of forty percent on wool. This too was rejected, but by a narrow vote, 98 to 97.35 The Jackson men permitted only one change of any moment: they reduced the specific duty on raw wool from seven cents, the point fixed by the committee, to four cents, the ad valorem rate remaining at 40 percent.36 The duty on molasses was retained, by the same combination that refused to accept the Harrisburg scheme. 37 The Southern members openly said that they meant to make the tariff so bitter a pill that no New England member would be able to swallow it.

When the final vote on the bill came, the groups of members split up in the way expected by the Democrats. The Southern members, practically without exception, voted against it. Those from the Middle and Western States voted almost unanimously for it. The Jackson men voted for their own measure for consistencys sake; the Adams men from these States joined them, partly for political reasons, mainly because the bill, even with the obnoxious provisions, was acceptable to their constituents. Of the New England members, a majority, 23 out of 39, voted in the negative. The affirmative votes from New England, however, were sufficient, when added to those from the West and the Middle States, to ensure its passage. The bill accordingly passed the House.39

This result had not been entirely unexpected. The real struggle, it was felt, would come in the Senate, where the South and New England had a proportionately large representation. In previous years the Senate had maintained, in its action on the tariff bills of 1820 and 1824, a much more conservative position than the House. 40 But in 1828 the course of events in the Senate was in the main similar to that in the House. The bill was referred to the committee on manufactures, and was returned with amendments, of which the most important referred to the duty on molasses and to the duties on woollen goods. The duty on molasses was to be reduced from 10 cents, the rate fixed by the House, to 74 cents. The duties on woollen goods, in the bill as passed by the House, had been made specific, equivalent to 40 per cent. on minimum valuations of 50 cents, $1.00, $2.50, and $4.00. The Senate committee’s amendment made the duties ad valorem in form, to be assessed on the minimum valuation just mentioned. The rate was to be 40 per cent. for the first year; thereafter, 45 per cent. 41

Other amendments were proposed, all tending to make the bill less objectionable to the New England Senators. Most of them were rejected. The proposed reduction on molasses was rejected by the same combination that had prevented the reduction from being made in the House. The Southern Senators, and those from the North who supported Jackson, united to retain the duty of 10 cents. When Webster moved to reduce the duty on hemp, only the New England Senators voted with him. Again, an attempt was made to increase the duty on coarse woollens, on which, it will be remembered, the House had put a low rate, notwithstanding the heavy duty on coarse wool. The Senate, by a strict party vote, retained the duty as the House had fixed it. One of the amendments, however, was carried-that which changed the duties on woollens to an ad valorem rate of 45 per cent. Two Democratic Senators, Van Buren and Woodbury, who had voted with the South against other amendments, voted in favor of this one. It was carried by a vote of 24 to 22, while all others had been rejected by a vote of 22 to 24.42

1. The character of the protective movement after 1819 is best illustrated by title numerous pamphlets of Matthew Cary. See especially the “Appeal to Common Sense and Common Justice” (1822) and “The Crisis : A Solemn Appeal,” etc. (1823). “Niless Register,” which had said little about tariff before 1819, thereafter became a tireless and effective advocate of protection. Return to text

2. The vote on the bill of 1820, by States, is given in Niles, XVIII.,169. Of the Massachusetts members 10 voted yes, 6 no, and 4 were absent. Of the New England members 19 voted yes, 9 no, and 9 were absent. The opposition to the bill in Massachusetts was the occasion of a meeting at which Webster made his first speech on tariff, which is not reprinted in his works, but may be found in the newspapers of the day. Return to text

3. But no reference was made to the Missouri struggle in the debates on the tariff bill of 1820. Return to text

4. See the interesting account of a Cabinet meeting in November, 1821. in “J. Q. Adam’s Memoirs,” vol. V., pp. 408-411, “The lowest point of the depression was reached at the close of last year” [1820]. Calhoun thought “the prosperity of the manufacturers was now so clearly established that it might be mentioned in the message as a subject for congratulation.” Crawford said “there would not he much trouble in the ensuing session with the manufacturing interest,” and Adams himself “had no apprehension that there would be much debate on manufacturing interests.” Return to text

5. John Randolph said, in his vigorous fashion, of the tariff bill of 1824 :”The merchants and manufacturers of Massachusetts and New Hampshire repel this bill, while men in hunting shirts, with deerskin leggings and moccasins on their feet, want protection for home manufactures.” Debates of Congress, 1824, p. 237 Return to text

6. This can be shown very easily. The cost of the wool is about one half the cost of making woollen goods. Then we have in 1816 :

Duty on woollens . . . . 25 percent.

Deduct duty on wool, (1/2) of 15 cent. . 7(1/2) percent

Net protection in 1816 . . . . 17 (1/2) percent

And in 1824 we have:

Duty on woollens. . . . . 33(1/3) percent

Deduct duty on wool, (1/2) of 30 per cent. . 15 percent

Net protection in 1824 . . . 18 (1/3) percent Return to text

7. The rise in duties both on wool and on woollens took place gradually by the terms of the act of 1824. The calculation is based on the final rates which were reached in 1826. Return to text

8. See above, pp. 25-36. Return to text

9. The vote was 104 to 101. “Annals of Congress.” 1823-24. p. 2310. Return to text

10. See the Report of the Harrisburg Convention of 1827 in Niles. XXXIII., 109 : Tibbits, “Essay on Home Market” (1827), pp. 26, 27: Henry Lee. “Boston Report of 1827,” pp. 64 seq. Return to text

11. It is sometimes said that this reduction of the wool duty in England was undertaken with the express purpose of counteracting the protective duties imposed on woollens in the United States. But there is little ground for supposing that our duties were watched so vigilantly in England, or were the chief occasion for English legislation. The agitation for getting rid of the restriction on the import and export of wool began as early as 1819, and during its course very little reference, if any, was made to the American duties. See the sketch in Bischoff’s “History of the Woollen 2nd Worsted Manufactures,” vol. II chapters 1 and 2. Return to text

12. The memorial of the manufacturers to Congress is in Niles, XXXI., 185. It asks for minimum duties, on the ground that ad valorem duties

are fraudulently evaded. For the circular sent out by this committee, see ibid., p. 200. Return to text

13. “American State Papers, Finance,” V., 599; “Annals of Congress.” 1826-27, p. 1010. Return to text

14. “Congressional Debates,” III., 1099,496. Return to text

15. It is not very clear in what quarter the scheme of holding such a convention had its origin. The first public suggestion came from the Philadelphia Society for the Promotion of Domestic Industry, an association founded by Hamilton, of which Matthew Carey and C. J. Ingersoll were at this time the leading spirits. Return to text

16. Among the politicians was Mallary of Vermont, who had been chairman of the committee on manufactures in the preceding Congress, and became the spokesman of the protectionists in the ensuing session, when the tariff of 1828 was passed. Return to text

17. The proceedings of the convention, the address of the people, the memorial to Congress, etc., are in Niles, XXXII. and XXXIII. Return to text

18. I have been able to find little direct evidence as to the political bearing of the Harrisburg convention. Matthew Carey, in a letter of July, 1827, while admitting he is an Adams man, protests against “amalgamating the question of the presidency with that for the protection of manufactures.” Niles, SXXII., 389. The (New Yolk) Evening Post, a Jackson paper, did the convention was a maneuver of the Adams men; see its issues of August 1 and August 9, 1827. This was denied in the National Intelligencer (Adams) on July 9th, and also in the (New York) American (Adams) on July 9th The Evening Post admitted (August 11th ) that “doubtless many members of the convention were innocent of political views,” and that “the 1st were induced to postpone or abandon their political views.” Van Buren apparently suspected that the convention might have a political meaning, and warned its members against forming “a political cabal” cf. the National Intelligencer of July 26th. But among the delegates from New York were both Jackson and Adams men. See Hammond, “Political History of New York,” II., 256-258 ; Niles, XXXII,. 349. Niles, who was an active member of the convention, denied strenuously that politics had any thing to do with it. Kiles, XXXIV., 187.-Since the above was put in type, however, a letter of Clay’s has been found which seems to indicate that the movement for holding such a convention was at least started by the anti-Jackson leaders. The letter is printed in the “Quarterly Journal of Economics,” vol. 11.. July, 1888. Return to text

19. There is ground for suspecting that the Adams party would have been willing to make the tariff question the decisive issue of the presidential campaign. Clay made it the burden of his speeches during his journey to the West in the early summer of 1827. Very soon after this, however, the correspondence between Jackson and Carter Beverly was published, and fixed attention on the “bargain and corruption” cry. That was the point which the Jackson managers succeeded in making most prominent in the campaign. Clay dropped the question of protection ; he found enough to do in answering the charge that in 1825 a corrupt bargain had made Adams President and himself Secretary of State. See Clay’s speech at Pittsburg, June 20, 1827, in Niles, XXXII., 299. On June 29th, Clay published his first denial of the “bargain and corruption” charges. Ibid., p. 35a Cf. Parton, “Life of Jackson,”III Return to text

20. Stephenson’s election is said to have been brought about by Van Buren’s influence; Parton, “Life of Jackson,” III., 135. It is worth while to bear this in mind, in view of the part played by Van Buren later in the session. Return to text

21. The power granted to the committee by this resolution, to examine witnesses, was used to a moderate extent. A dozen wool manufacturers were examined, and their testimony throws some light on the state of the woollen manufacture at that time. See the preceding essay, pp. 42-44. Return to text

22. In “Congressional Debates,” IV., 862, 870. Return to text

23. Speech of 1837 ; “Works,” III., 46-51. Return to text

24. The bill as reported by the committee is printed in “Congressional Debates,” IV., 1727 Return to text

25. See the testimony of the three iron manufacturers who were examined, “American State Papers, Finance,” V., 784-792. Mallary, in introducing the bill, said : “The committee gave the manufacturer of iron all he asked, even more.” “Congressional Debates,” IV., 1748. Return to text

26. Gallatin, “Memorial of the Free-Trade Convention” (1831) p. 51. This admirable paper, perhaps the best investigation on tariff subjects ever made in the United States, is unfortunately not reprinted in the edition of Gallatin’s collected works. The original pamphlet is very scarce. The memorial is printed in U. S. Documents, 1st session, 22d Congress, Senate Documents, vol. I., No.55. Return to text

27. In the earlier editions of this volume it was stated that this was the first mixed duty ever imposed. Professor D. R. Dewey has called my attention to the fact that in 1824 mixed duties were imposed on certain kinds of glassware. Return to text

28. Gallatin, “Memorial,” p. 67. Return to text

29. It was followed in 1824, 1832, 1842, and again in the wool and woollens act of 1867, on which the existing duties [1887] are based. The rates on wool have been: General duty on wool — 1828– 30 percent, 1832– 4 c. plus 40 percent, 1842– 3 c. plus 30 percent, 1867– 10c. — 12 c. plus 11 percent. Duty on cheap wool 1828 — 15 percent on wool under 10 c., 1832– free wool under 8 c., 1842– 5 percent on wool under 7 c.,1867– 3 c. on wool under 12 c. Return to text

30. Sail-duck was charged 9 cents a yard, with an increase of 4 percent yearly, until the duty should finally be 124 cents. This was equivalent to 40 or 50 percent. In 1824 the duty had been 15 per cent. Drawback was refused on any quantity less than 50 bolts exported in one vessel at one time. Return to text

31. “Congressional Debates,” IV., 2274. See the statement of the effect of the minimum system in “State Papers,” 1827-28, No. 143. Davis (of Massachusetts) said that the minimum of $1.00 “falls at a point the most favorable that could be fixed for the British manufacturer. It falls into the centre of the great body of American business.” “Congressional Debates,” IV., 1894, 1895. See to the same effect the speech of Silas Wright, IBid., p. 1867. Return to text

32. “I have heard, without vouching for the fact, that it [the tariff of 1828] was so framed on the advice of a prominent citizen, now abroad [Van Buren had been made minister to England in 1331], with the view of ultimately defeating the bill, and with assurances that, being altogether unacceptable to the friends of the American system. the bill would be lost. Clay’s speech of February, 1832. “Works” II., 13. Return to text

33. See Calhoun’s speech of 1837, as cited above, p. 88. In the debate of 1837, Wright admitted the compact with the Southern members, but said that he had warned them that the New England men in the end might swallow the obnoxious bill. “Congressional Debates,” XIII., 922,926-927. Wright was a member of the committee on manufactures, was the spokesman of the Jackson met1 who formed the majority of its members, and had charge of the measure before the House. Jenkins, “Life of Wright,” p . 53-60 Return to text

34. The Adams men saw through the scheme at the time. Clay wrote to J. Crittenden, in February, even before the House began the discussion of he bill “The Jackson party are playing a game of brag on the subject of .he tariff. They do not really desire the success of their own measure; and it may happen in the sequel that what is desired by neither party will command the votes of both.” “Life of Crittenden,” I., 67. Return to text

35. “Congressional Debates,” IV.. 2018. Return to text

36. See Niles, XXXV., 57, where the various votes on the bill are analyzed. The vote on Mallary’s amendment was :

Yeas . . . 78 Adams men, 2 Jackson men . . . 80

Nays . . . 14 Adams men 100 Jackson men . . . 114 Return to text

37. “Congressional Debates,” IV., 2050. Return to text

38. The Adams men seem to have opposed this reduction. The vote was :

Yeas . . . 10 Adams men, 90 Jackson men . . .100

Nays . . . 79 Adams men 20 Jackson men — 99 Return to text

39. On reducing the molasses duty, the vote was :

Yeas . . . 72 Adams men, 10 Jackson men . . . 82

Nays . . . 19 Adams men 95 Jackson men . . . 114 Return to text

40. Most of the Southern members kept silence during the debates on the details of the bill. After its third reading, McDuffie and others made long speeches against it. One of the South Carolina Congressmen, however said frankly : “He should vote for retaining the duty on molasses, because he believed that keeping it in the bill would get votes against its final passage” “Congressional Debates,” IV., 2349. The Jackson free-traders from the North (there were a few such) followed the same policy. See – Cambreleng’s remarks, ibid., 3326. See also the passage quoted in Niles. XXXV., 52. Return to text

41. — The vote was :

Yeas . . . . 61 Adams men, 44 Jackson men . . . 105

Nays . . . . 35 Adams men, 59 Jackson men — 94

If six of those New England members who voted yea, had voted nay, the bill would have failed. Niles. lor. cit. Return to text

42. The tariff of 1824 was much changed in the Senate from the shape in which it had been passed by the House. “Annals of Congress,” 1823-24, pp. 723-735. Return to text

Conversation-based seminars for collegial PD, one-day and multi-day seminars, graduate credit seminars (MA degree), online and in-person.