No study questions

No related resources

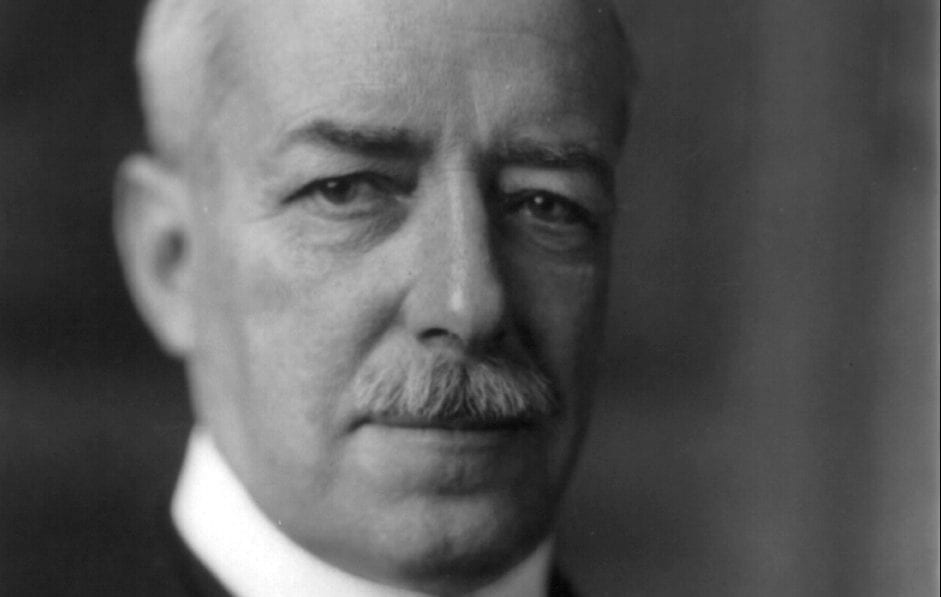

With this amendment, the bill was finally passed by the Senate, the vote being 26 to 21. The Southern Senators (except two from Kentucky, and one each from Tennessee and Louisiana) voted against it. Those from the Middle and Western States all voted for it. Those from New England split; six voted yea, five nay. The result seems to have depended largely on Webster. His colleague Silsbee voted nay, and Webster himself had been in doubt a week before the final vote.43 Finally he swallowed the bill; and he carried with him enough of the New England Senators to ensure its passage.

Webster defended his course to his constituents on the round that the woollens amendment (fixing the 45 percent ad valorem rate) had made the bill much more favorable to the manufacturers. He said he should not have voted for it in the shape in which the House passed it. 44 Calhoun made the same statement in 1837, in the speech to which reference has already been made.45 No doubt the slight change on woollens mollified in some degree the New England men; but after all, political motives, or, as Webster put it, “other paramount considerations,” caused them to swallow the bill. They were afraid to reject it, for fear of the effect in the approaching campaign and election. 46

The act of 1828 had thus been passed in a form approved by no one. It was hardly to be expected that a measure of this kind should long remain on the statute book, and it was superseded by the act of 1832. During the intervening four years several causes combined to lead to more moderate application of the protective principle. The protective feeling diminished. Public opinion in the North had been wellnigh unanimous in favor of protection between 1824 and 1828; but after 1828, although there was still a large preponderance for protection, 47 there was a strong and active minority against it. The tariff question ceased to be an important factor in politics, so that this obstacle to its straightforward treatment was removed. And, finally, there was a strong desire to make some concession to the growing opposition of the South. It is true that in 1832 Clay and the more extreme protectionists wished to retain the act of 1828 intact, and to effect reductions in the revenue by lowering the non-protective duties only. 48 But most of the protectionists, led by Adams, took a more moderate course, and consented to the removal of the abominations of 1828.

Even before 1832 some changes were made. In 1830 the molasses abomination was got rid of. The duty on molasses was reduced from ten cents a gallon to five cents, the rate imposed before 1828, and the drawback on exportation of rum was restored. 49 At the same time the duties on tea, coffee, and cocoa were lowered, as one means of reducing the revenue. 50

The most important step taken in 1832 was the entire abolition of the minimum system. Woollen goods were subjected to a simple ad valorem duty of 50 percent. The minimum system, as arranged in the act of 1828, had been found to work badly. The manufacturers said it had been positively injurious to them. 51 As might have been expected, it led to attempts at evasion of duties, to undervaluation, and to constant disputes at the custom-houses. The troubles arose mainly under the dollar minimum. Goods worth $1.25 or $1.50 were invoiced so as to bring their values below $1.00, in order to escape the duty under the next minimum point, $2.50. The difficulties were ascribed to the depravity of foreign exporting houses and to the laxity of the revenue laws, and in 1830 a special act in regard to goods made of cotton or wool was passed, making more stringent the provisions for collecting duties. But the troubles continued nevertheless, 52 and, in truth, they were inevitable under a system which imposed specific duties graded according to the value of the goods. Similar duties were much in use during the period of high protection after the Civil War, and led to the same unceasing complaints of dishonesty and fraud, and the same efforts to make the law effective by close inspection and severer penalties. In 1832, the protectionists themselves swept away the minimum system. The ad valorem duty of 50 percent which was put in its place was felt to be not without its dangers in the matter of fraud and undervaluation, but it was harmless as compared with the minimum system of 1828. 53

The other “abominations” of the act of 1828 were also done away with in 1832. The duty on hemp, which had been $60 a ton in 1828, was reduced to a duty of $40. Flax, which had also been subjected to a duty of $60 a ton in 1828, was put on the free list. The duties on pig-and bar-iron were put back to the rates of 1824. The duty on wool alone remained substantially as it had been in 1828, being left as a compound duty of 4 cents a pound and 40 per cent. But even here the special abomination of 1828 was removed; cheap wool, costing less than 8 cents a pound, was admitted free of duty. In fact, the protective system was put back, in the main, to where it had been in 1824. The result was to clear the tariff of the excrescences which had grown on it in 1828, and to put it in a form in which the protectionists could advocate its permanent retention.

Even in this modified form, however, the system could not stand against the attacks of the South. In the following year, 1833, the compromise tariff was passed. It provided for a gradual and steady reduction of duties. That reduction took place; and in July, 1842, a general level of 20 per cent. was reached. Two months later, in September, 1842, a new tariff act, again of distinctly protective character, went into effect. But this act belongs to a different period, and has a different character from the acts of 1824, 1828, and 1832. The early protective movement, which began in 1819, and was the cause of the legislation of the following decade, lost its vigor after 1832. Strong popular sentiment in favor of protection wellnigh disappeared, and the revival of protection in 1842 was due to causes different from those that brought about the earlier acts. The change in popular feeling is readily explained. The primary object of the protective legislation of the earlier period had been attained in 1842. The movement was, after all, only an effort, half conscious of its aim, to make more easy the transition from the state of simple agriculture and commerce which prevailed before the war of I 8 12, to the more diversified condition which the operation of economic forces was reasonably certain to bring about after 1815. The period of transition was passed, certainly by 1830, probably earlier. At all events, very soon after 1820 it was felt that there was not the same occasion as in previous years for measures to tide it over, and a decline in the protective feeling was the natural consequence.

Not the least curious part of the history of the act of 1828 is the treatment it has received from the protectionist writers. At the time, the protectionists were far from enthusiastic about it. Niles could not admit it to be a fair application of the protective policy,54 while Matthew Carey called it a “crude mass of imperfection,” and admitted it to be a disappointment to the protectionists.55 In later years, however, when the details of history had been forgotten, it came to be regarded with more favor.The duties being on their face higher than those of previous years, it was considered a better application of protective principles. Henry C. Carey, on whose authority rest many of the accounts of our economic history, called it “an admirable tariff.” 56 He represented it as having had great effect on the prosperity of the country, and his statements have often been repeated by protectionist writers.

It is almost impossible to trace the economic effect of any legislative measure that remains in force no more than four years; and certainly we have not the materials for ascertaining the economic effects of the act of 1828. Taken by itself, that act is but a stray episode in our political history. It illustrates the change in the character of our public men and our public life which took place during the Jacksonian time. As an economic measure, it must be considered, not by itself, but as one of a series of measures, begun tentatively in 1816, and carried out more vigorously in 1824, 1828, and 1832, by which a protective policy was maintained for some twenty years. It is very doubtful whether, with the defective information at our disposal, we can learn much as to the effect on the prosperity of the country even of the whole series of tariff acts. Probably we can reach conclusions of any value only on certain limited topics, such as the effects of protection to young industries during this time; as to the general effect of the protective measures we must rely on deduction from general principles. At all events, no one can trace the economic effects of the act of 1528. To ascribe to it the supposed prosperity of the years in which it was in force, as Henry C. Carey and his followers have done, is only a part of that exaggeration of the effect of protective duties which is as common among their opponents as among their advocates.

CHAPTER III THE TARIFF, 1830-1860

In the years between 1832 and 1860 there was great vacillation in the tariff policy of the United States; there were also great fluctuations in the course of trade and industry. A low tariff was succeeded by a high tariff, which was in turn succeeded by another low tariff. Periods of undue inflation and of great demoralization, of prosperity and of depression, followed each other. The changes in the rates of duty and the fluctuations in industrial history have often been thought to be closely connected. Protectionists have ascribed prosperity to high tariffs, depression to low tariffs; free traders have reversed the inference. It is the object of the present essay to trace, so far as this can be done, the economic effect of tariff legislation during the thirty years of varying fortune that preceded the civil war.

First, by way of introduction, a sketch must be given of the history of the tariff. We begin with the tariff act of 1832, a distinctly protectionist measure, passed by the Whigs, or National Republicans, which put the protective system in a shape such as the advocates of protection hoped it might retain permanently. It levied high duties on cotton and woollen goods, iron, and other articles to which protection was meant to be applied. On articles not produced in the United States, either low duties were imposed, as on silks, or no duties at all, as on tea and coffee. The average rate on dutiable articles was about 33 percent.

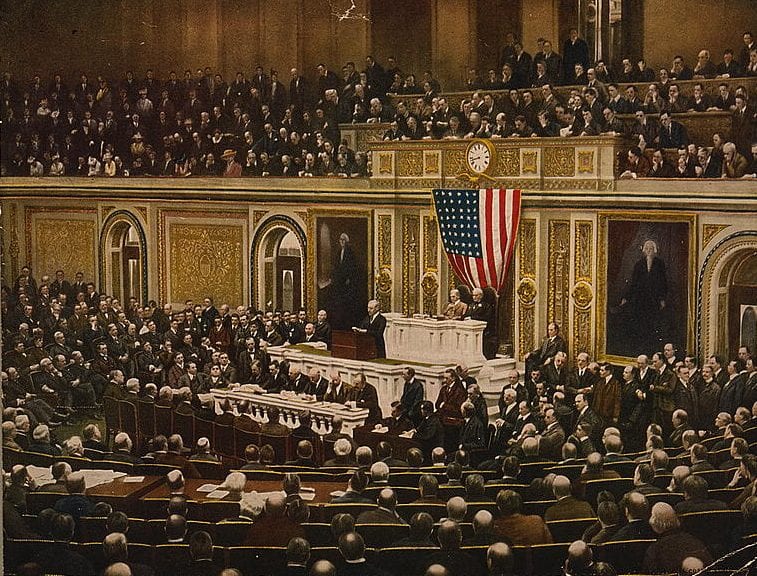

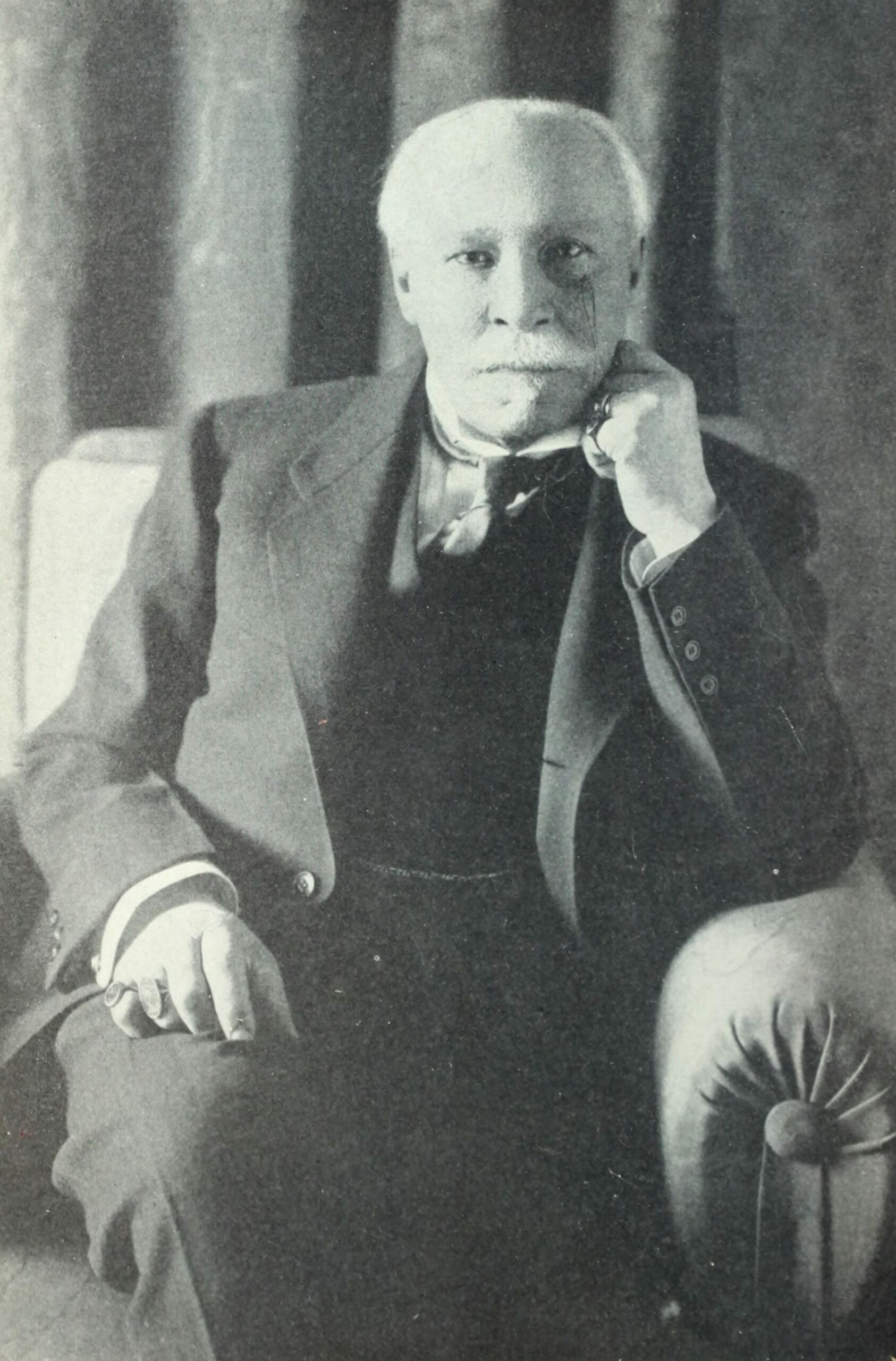

In 1833, the Compromise Tariff Act was passed, and remained in force until 1842. That act, there can be little doubt, was the result of an agreement between Clay and Calhoun, the leaders of the protectionists and free traders, while it secured also the support of the Jackson administration. Clay had been hitherto the most uncompromising of the protectionists ; Calhoun had represented the extreme Southern demand that duties should be reduced to a horizontal level of 15 or 20 percent.57 The compromise provided for the retention of a considerable degree of protection for nearly nine years, and thereafter for a rapid reduction to a uniform 20 per cent. rate. The tariff of 1832 was the starting-point. All duties which in that tariff exceeded 20 percent were to have one tenth of the excess over 20 per cent. taken off on January 1, 1834; one tenth more on January 1, 1836; again one tenth in 1838 ; and another in 1840. That is, by 1840, four tenths of the excess over 20 per cent. would be gone. Then, on January 1, 1842, one half the remaining excess was to be taken off ; and on July 1, 1842, the other half of the remaining excess was to go. After July 1, 1842, therefore, there would be a uniform rate of 20 percent on all articles. Obviously, the reduction was very gradual from 1833 till 1842, while in the first six months of 1842 a sharp and sudden reduction was to take place.

Considered as a political measure, the act of 1833 may deserve commendation. As an economic or financial measure, there is little to be said for it. I t was badly drafted. No provision was made in it as to specific duties; yet it was obviously meant to apply to such duties, and the Secretary of the Treasury had to take it on himself to frame rules as to the manner of ascertaining the ad valorem equivalents of specific duties and making the reductions called for by the act.58 Again, the reductions of duty were irregular. Thus on one important article, rolled bar iron, the duty of 1832 had been specific, -$1.50 per hundredweight. This was equivalent, at the prices of 1832, to about 95 per cent. The progress of the reductions is shown in the note.59 Up to 1842, they were comparatively moderate; but in the six months from January 1 to July 1, 1842, the duty dropped from 65 to 20 percent. Producers and dealers necessarily found it hard to deal with such changes. It is true that a long warning was given them; but, on the other hand, Congress might at any moment interfere to modify the act. Finally, and not least among the objections, there was the ultimate horizontal rate of 20 per cent.-a crude and indiscriminating method of dealing with the tariff problem, which can be defended on no ground of principle or expediency. The 20 percent rate, according to the terms of the act, was to remain in force indefinitely, that being the concession which in the end was made to the extremists of the South.60

As it happened, however, the 20 percent. duty remained in force for but two months, from July 1 till September 1, 1842.61 At the latter date the tariff act of 1842 went into force. That act was passed by the Whigs as a party measure, and its history is closely connected with the political complications of the time. The Whigs had broken with President Tyler, and had a special quarrel with him as to the distribution among the States of the proceeds of the public lands. Tyler vetoed two successive tariff bills because of clauses in them in regard to distribution. The bill which he finally signed, and which became law, was passed hurriedly, without the distribution clause. Attention was turned mainly to the political quarrel and to the political effect of the bill in general.62 The act, naturally enough, was a hasty and imperfect measure, of which the details had received little consideration. The duties which it levied were high, probably higher than they would have been had the tariff discussion been less affected by the breach between Tyler and the Whigs. Though distinctively protective, and proclaimed to be such by the Whigs, it had not such a strong popular feeling behind it as had existed in favor of the protective measures of 1824, 1828, and 1832. In the farming States the enthusiasm for the home-market idea had cooled perceptibly; and in the manufacturing States the agitation came rather from the producers directly interested than from the public at large. There is much truth in Calhoun’s remark that the act of 1842 was passed, not so much in compliance with the wishes of the manufacturers, as because the politicians wanted an issue.63

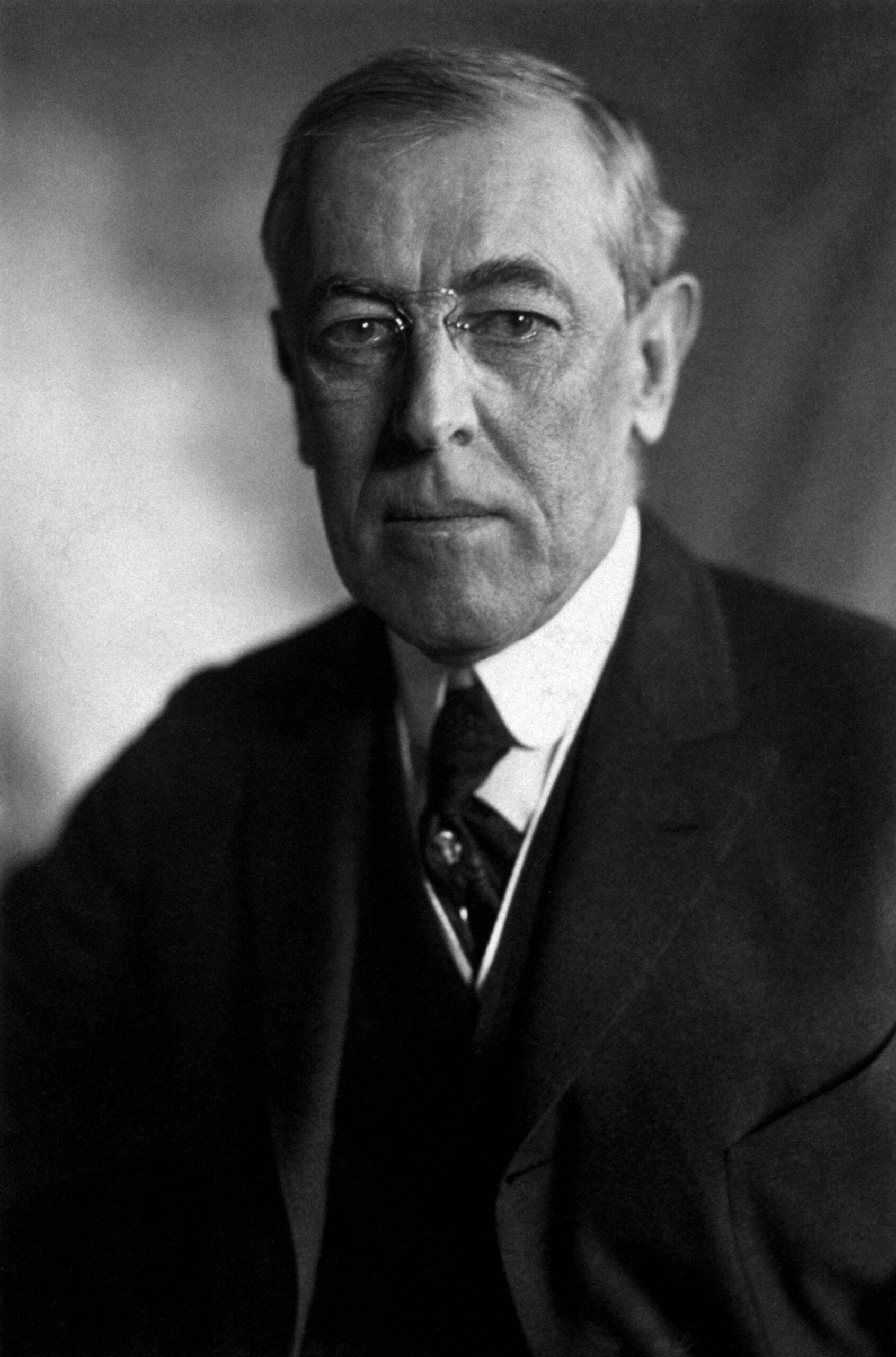

The act of 1842 remained in force for but four years. It was in turn superseded by the act of 1846, again a political measure, passed this time by the Democrats. The act of 1846 carried out the suggestions made by Secretary Walker in his much debated Treasury Report of 1845. Indeed, it may be regarded as practically framed by Walker, who professed to adhere to the principle of free trade; and the act of 1846 is often spoken of as an instance of the application of free-trade principles. In fact, however, it effected no more than a moderation in the application of protection. The act established several schedules, indicated by the letters A, R, C, D, and so on. All the articles classed in schedule A paid 100 percent., all in schedule B paid 40 percent., all in schedule C paid 30 percent., and so on for the rest. Schedule C, with the 30 percent. duty, included most articles with which the protective controversy is concerned, iron and metals in general, manufactures of metals, wool and woollens, manufactures of leather, paper, glass, and wood. Cottons were in schedule D, and paid 25 per cent. Tea and coffee, on the other hand, were exempt from duty.

The act of 1846 remained in force till 1857, when a still further reduction of duties was made. The revenue was redundant in 1857, and this was the chief cause of the reduction of duties. The measure of that year was passed with little opposition, and was the first tariff act since 1816 that was not affected by politics.64 It was agreed on all hands that a reduction of the revenue was imperatively called for, and, except from Pennsylvania, there was no opposition to the reduction of duties made in it. The framework of the act of 1846 was retained,-the schedules and the ad valorem duties. The duty on the important protective articles, in schedule C, was lowered to 24 percent., cottons being transferred, moreover, to that schedule. Certain raw materials were at the same time admitted free of duty.

The act of 1857 remained in force till the close of the period we now have under examination. We begin with a high protective tariff in 1832 ; then follows a gradual reduction of duties, ending in 1842 with a brief period of very low duties. In the four years 1842-46 we have a strong application of protection. In 1846 begins what is often called a period of free trade, but is in reality one of moderated protection. In 1857 the protection is still further moderated, and for a few years there is as near an approach to free trade as the country has had since 1816.

43. It was expected that this change to ad valorem duties would have still another effect. According to the method then in use for assessing ad valorem duties, the dutiable value of goods imported from Europe was ascertained by adding 10 per cent. to the cost or invoice value. See the act of 1828, “Statutes at Large,”IV., 274, substantially re-enacting the provisions of the revenue-collection act of 1789, “Statutes at Large,” I., 14;. It was expected that by the force of this provision the effect of the ad valorem rate, under the Senate amendment, mould be to increase the duty not merely to 45 per cent., but to 494 per cent. Hence Webster, in his speech on the bill, spoke of the amendment as carrying the duty “up to 45 or perhaps 50 per cent. ad valorem.” “Works.” III., 231. But the Secretary of the Treasury, Rush, finally decided, very properly, that the provision did not apply to duties assessed on minimum valuations, thereby causing much dissatisfaction among the protectionists. See “Congressional Debates.” VI., 302. Return to text

44. The votes in the Senate are given in Niles, XXXIV., 178, 179, 196. Return to text

45. “Memoirs of J. Q. Adams,” VII., 530, 534. Return to text

46. In a speech made a month later; printed in his “Works,” I., 165. In the House, the representative from Boston had voted against the bill, and Webster commended his action. In his Senate speech Webster had said that, even at the 45 percent rate, the duty on woollens was barely sufficient to compensate for the duty on wool. “Works,” 111.. 241. Return to text

47. “Works,” III., 50, 51. Calhoun even accused Van Buren of being the “real author” of the tariff of 1828. He said that, but for Van Buren’s vote in favor of the woollens amendment, there would have been a tie on the amendment; his own casting vote as Vice-President would have defeated it: the bill, without the amendment, would have been rejected by Webster and the other New England Senators. Therefore, Van Buren was responsible for its having been passed. Return to text

48. After the final vote in the House, John Randolph said. “The bill referred to manufactures of no sort or kind, except the manufacture of a President of the United States.” In 1833, Root, a representative from New York, said : “The act of 1828 he had heard called the bill of Abominations.. . . It certainly grew out of causes connected with President making. It was fastened on the country in the scuffle to continue the then incumbent in office, on one side, and on the other to oust him and put another in his stead. . . . The public weal was disregarded, and the only question was: Shall we put A or B in the presidential chair? When it was thought necessary to secure a certain State in favor of the then incumbent, a convention was called at Harrisburg to buy them over. [See, however, the note to p. 84, above.] On the other side another convention was called, who mounted the same hobby. The price offered was the same on both sides: a high tariff. One candidate was thought to be a favorite, because he w-as supposed to be a warm friend of the protective system, and would support a high tariff; but they were told, on the other side, that their candidate would go for as high a tariff.” “Congressional Debates,” IX., 1104. 1105. Return to text

49. As Gallatin admits: “It is certain that at this time (1832) the tariff system is supported by a majority of the people and of both Houses of Congress.” “Works,” II., 455. Return to text

50. “Works,” I., 586-595. Return to text

51. Statutes at Large,” IV., 419. The act seems to have passed without debate or opposition. Return to text

52. Ibid p. 403. Return to text

53. Browne, of Boston, a manufacturer who had actively supported the minimum system, declared: “I could manufacture to better advantage under the tariff of 1816 than under that of 1828; for the duty on wool was then lower, and that on cloths a better protection.” Niles. XLI.. 204 Return to text

54.”Statutes at Large,” IV., 400. See the speeches of Mallary, “Congressional Debates,” VI., 795-803, and of Davis, ibid., p. 874, for instances and roofs of the frauds. The act provided for forfeiture of goods fraudulently undervalued ; but no verdicts under it could be obtained. At the proteconist convention held in New York in 1831, one of the speakers said: The same mistaken current of opinion which prevailed on change, ensured and influenced the jury-box. Men thought the law rigorous and severe. They considered it hard that a man should forfeit a large amount of property for a mere attempt to evade an enormous duty In two years here was but a single case pursued into a court of justice.” Niles, XLI., 203. See also the Report on Revenue Frauds, made by a committee of this same convention, in Niles, XLI., Appendix, p. 33. Return to text

55. J. Q. Adams, who was most active in framing the act of 1832, tried to embody the “home valuation” principle into it; but in vain.” Congressional Debates,” VIII., 3658, 3671. He also tried to give the government an option to take goods on its own account at a slight advance over the declared value ; but this plan also was rejected. Ibid., p. 3779. Return to text

56. Niles. XXXVII., SI ; XXXVI., 113, and elsewhere. Niles objected especially to the $1.00 minimum on woollens. Return to text

57. See his “Common-Sense Address” (1829), p. XI.; “The Olive Branch,” No. III., p. 54; NO. IV., p. 3 (1832). Return to text

58. See his “Review of the Report of D. A. Wells” (1869), p. 4 ; and to the same effect “Harmony of Interests,” p.5 and “Social Science,” II., 225 Return to text

59. The Nullifiers had said that such a horizontal rate was the least they were willing to accept. See the Address to the People of the United States by the South Carolina Convention, in the volume of “State Papers on Nullification,” published by the State of Massachusetts, p. 69. Return to text

60. The instructions issued from the Treasury Department may be found in ” Exec. Doc.” 1833-34, vol. I., No. 43. It has been thought that the act did not apply to specific duties ; but this is a mistake.

Year. Duty, per cent.

1834 87

1836 80

1838 72.5

1840 65

Jan. 1, 1842 42.5

July 5, 1842 20

This calculation is on the basis of the prices of 1833. If prices changed (and they did change greatly), the rates under the Compromise Act would vary materially from those given in the text ; since the ad valorem equivalent of the specific duty, and its excess over 20 percent., were ascertained for each year according to the prices of that year. Return to text

61. Clay, who drafted the act, probably had no expectation that the 20 percent. rate ever would go into effect. He thought Congress would amend before 1842, and intended to meet by his compromise the immediate emergency only. See his “Works,” vol. II., pp.131, 132He tried to show Appleton and Davis, two leading representatives of the protectionists, that “no future Congress would be bound by the act.” See Appleton’s speech on the Tariff Act of 1842, “Appendix to Cong. Globe,”1841-42, p. 575 Return to text

62. The Compromise Act was so loosely constructed that doubt was entertained whether under its terms any duties at all could be collected after June 30, 1842. The point was carried before the Supreme Court, which decided, however, that the rate of 20 percent was in effect during the two months before the act of 1842 went in force. (Aldridge vs. Williams, 3 Howard, 9.) Justice McLean dissented ; and there is much force to his dissenting opinion and to the argument of Reverend Johnson, the counsel against the government. Return to text

63. A full account of this struggle is in Von Holst’s “Constitutional History,” vol. III., pp. 451-463. Return to text

64. Works,” vol. IV., pp. 199, 200. Calhoun thought that a good deal was due also to the influence of the “moneyed men” who wanted the Treasury to be filled. Seward said, in 1857, that ” the vote of not a single Senator will be governed by any partisan consideration whatever.” Appendix to ” Congressional Globe,” 1856-57, p. 344; and see Hunter’s speech. ibid. p. 331 Return to text

Conversation-based seminars for collegial PD, one-day and multi-day seminars, graduate credit seminars (MA degree), online and in-person.