No related resources

Introduction

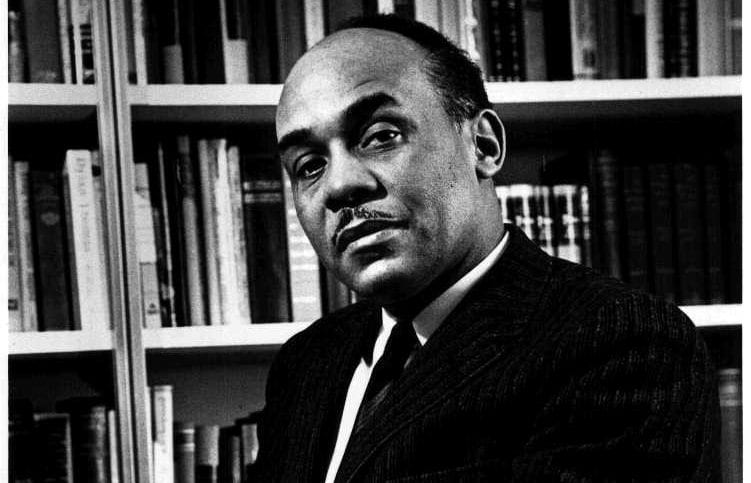

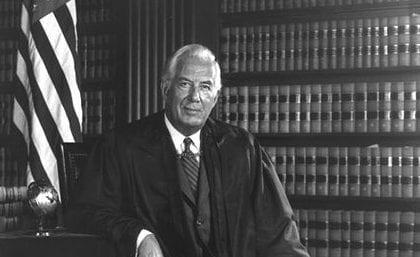

In this case, the Court by a vote of 7 to 1 (Justice Thurgood Marshall did not participate) invalidated laws of Pennsylvania and Rhode Island that allowed public money to be spent to supplement the salaries of private school teachers who were being paid less than their public school peers.

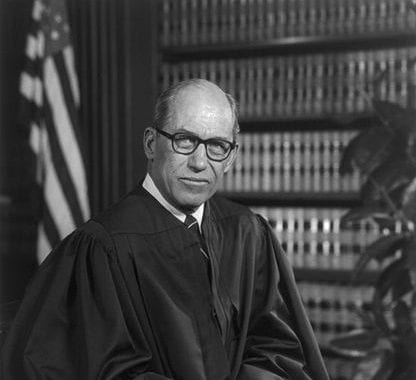

In Lemon v. Kurtzman Chief Justice Warren E. Burger tried to retain Justice Hugo L. Black’s “wall of separation between church and state.” But aware of the practical and principled difficulties that concurring Justice Robert H. Jackson had predicted in McCullom v. Board of Education, Burger summarized major, often clashing cases involving government assistance to public schools and developed what became known as “the Lemon test” for constitutionality. This test has three “prongs”: “First, the statute must have a secular legislative purpose; second, its principal or primary effect must be one that neither advances nor inhibits religion . . . ; finally, the statute must not foster ‘an excessive government entanglement with religion.’” Whether these tests and their variants add clarity or simply paper over incoherence here or in future cases has been vigorously disputed over the years.

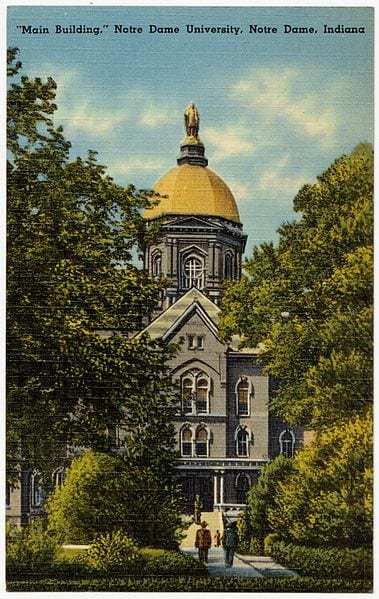

For the sake of brevity, we present only the Rhode Island portion of the case in excerpts of Chief Justice Burger’s opinion for the Court. We omit Justice William J. Brennan Jr.’s dissent, which completely foreclosed federal aid to a religious school “in which the propagation and advancement of a particular religion are a function or purpose of the institution,” and Justice Byron R. White’s opinion, in which he concurred in part with and dissented in part from the Court’s decision. It should be noted that a companion case, Tilton v. Richardson, 403 U.S. 672 (1971) upheld a federal aid to higher education law that funded building construction at religious universities.

Source: 403 U.S. 602 (1971) https://www.law.cornell.edu/supremecourt/text/411/192. All footnotes added by the editors.

CHIEF JUSTICE BURGER delivered the opinion of the Court.

These two appeals raise questions as to Pennsylvania and Rhode Island statutes providing state aid to church-related elementary and secondary schools. Both statutes are challenged as violative of the Establishment and Free Exercise Clauses of the First Amendment and the Due Process Clause of the Fourteenth Amendment.

Pennsylvania has adopted a statutory program that provides financial support to nonpublic elementary and secondary schools by way of reimbursement for the cost of teachers’ salaries, textbooks, and instructional materials in specified secular subjects. Rhode Island has adopted a statute under which the state pays directly to teachers in nonpublic elementary schools a supplement of 15% of their annual salary. Under each statute, state aid has been given to church-related educational institutions. We hold that both statutes are unconstitutional.

I

The Rhode Island Statute

The Rhode Island Salary Supplement Act was enacted in 1969. It rests on the legislative finding that the quality of education available in nonpublic elementary schools has been jeopardized by the rapidly rising salaries needed to attract competent and dedicated teachers. The act authorizes state officials to supplement the salaries of teachers of secular subjects in nonpublic elementary schools by paying directly to a teacher an amount not in excess of 15% of his current annual salary. As supplemented, however, a nonpublic school teacher’s salary cannot exceed the maximum paid to teachers in the state’s public schools, and the recipient must be certified by the state board of education in substantially the same manner as public school teachers.

In order to be eligible for the Rhode Island salary supplement, the recipient must teach in a nonpublic school at which the average per-pupil expenditure on secular education is less than the average in the state’s public schools during a specified period. Appellant State Commissioner of Education also requires eligible schools to submit financial data. If this information indicates a per-pupil expenditure in excess of the statutory limitation, the records of the school in question must be examined in order to assess how much of the expenditure is attributable to secular education and how much to religious activity.

The act also requires that teachers eligible for salary supplements must teach only those subjects that are offered in the state’s public schools. They must use “only teaching materials which are used in the public schools.” Finally, any teacher applying for a salary supplement must first agree in writing “not to teach a course in religion for so long as or during such time as he or she receives any salary supplements” under the act . . . .

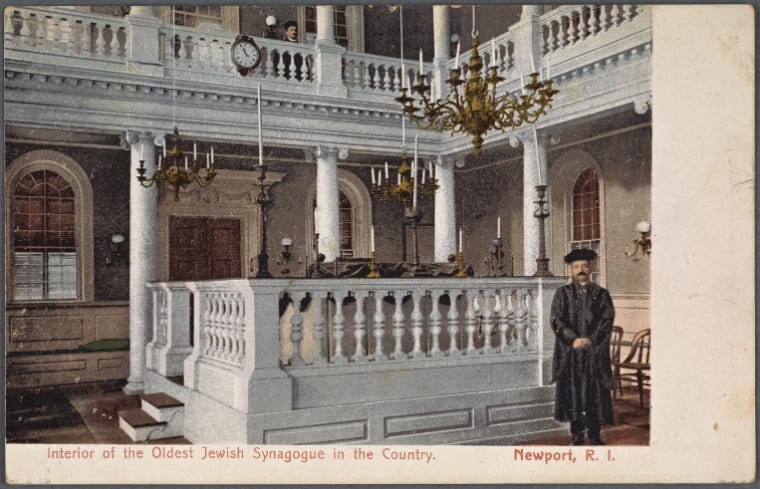

A three-judge federal court . . . found that Rhode Island’s nonpublic elementary schools accommodated approximately 25% of the state’s pupils. About 95% of these pupils attended schools affiliated with the Roman Catholic church. To date, some 250 teachers have applied for benefits under the act. All of them are employed by Roman Catholic schools.

The court held a hearing at which extensive evidence was introduced concerning the nature of the secular instruction offered in the Roman Catholic schools whose teachers would be eligible for salary assistance under the act. Although the court found that concern for religious values does not necessarily affect the content of secular subjects, it also found that the parochial school system was “an integral part of the religious mission of the Catholic Church.”

The district court concluded that the act violated the Establishment Clause, holding that it fostered “excessive entanglement” between government and religion. In addition, two judges thought that the act had the impermissible effect of giving “significant aid to a religious enterprise.” We affirm. . . .

Every analysis in this area must begin with consideration of the cumulative criteria developed by the Court over many years. Three such tests may be gleaned from our cases. First, the statute must have a secular legislative purpose; second, its principal or primary effect must be one that neither advances nor inhibits religion, Board of Education v. Allen, 392 U.S. 236, 243 (1968); finally, the statute must not foster “an excessive government entanglement with religion.” Walz v. Tax Commission of the City of New York, 397 U.S. 664 (1970).

Inquiry into the legislative purposes of the Pennsylvania and Rhode Island statutes affords no basis for a conclusion that the legislative intent was to advance religion. On the contrary, the statutes themselves clearly state that they are intended to enhance the quality of the secular education in all schools covered by the compulsory attendance laws. . . .

In Allen, the Court acknowledged that secular and religious teachings were not necessarily so intertwined that secular textbooks furnished to students by the state were, in fact, instrumental in the teaching of religion. The legislatures of Rhode Island and Pennsylvania have concluded that secular and religious education are identifiable and separable. In the abstract, we have no quarrel with this conclusion.

The two legislatures, however, have also recognized that church-related elementary and secondary schools have a significant religious mission, and that a substantial portion of their activities is religiously oriented. They have therefore sought to create statutory restrictions designed to guarantee the separation between secular and religious educational functions, and to ensure that state financial aid supports only the former. All these provisions are precautions taken in candid recognition that these programs approached, even if they did not intrude upon, the forbidden areas under the Religion Clauses. We need not decide whether these legislative precautions restrict the principal or primary effect of the programs to the point where they do not offend the Religion Clauses, for we conclude that the cumulative impact of the entire relationship arising under the statutes in each state involves excessive entanglement between government and religion.

III

In Walz v. Tax Commission the Court upheld state tax exemptions for real property owned by religious organizations and used for religious worship. That holding, however, tended to confine, rather than enlarge, the area of permissible state involvement with religious institutions by calling for close scrutiny of the degree of entanglement involved in the relationship. The objective is to prevent, as far as possible, the intrusion of either into the precincts of the other.

Our prior holdings do not call for total separation between church and state; total separation is not possible in an absolute sense. Some relationship between government and religious organizations is inevitable. Zorach v. Clauson, 343 U.S. 306, 312 (1952); Sherbert v. Verner (1963).[1] Fire inspections, building and zoning regulations, and state requirements under compulsory school attendance laws are examples of necessary and permissible contacts. Indeed, under the statutory exemption before us in Walz, the state had a continuing burden to ascertain that the exempt property was, in fact, being used for religious worship. Judicial caveats against entanglement must recognize that the line of separation, far from being a “wall,” is a blurred, indistinct, and variable barrier depending on all the circumstances of a particular relationship. . . .

In order to determine whether the government entanglement with religion is excessive, we must examine the character and purposes of the institutions that are benefited, the nature of the aid that the state provides, and the resulting relationship between the government and the religious authority. . . . Here we find that both statutes foster an impermissible degree of entanglement.

(a) Rhode Island program

The district court made extensive findings on the grave potential for excessive entanglement that inheres in the religious character and purpose of the Roman Catholic elementary schools of Rhode Island, to date the sole beneficiaries of the Rhode Island Salary Supplement Act.

The church schools involved in the program are located close to parish churches. This understandably permits convenient access for religious exercises, since instruction in faith and morals is part of the total educational process. The school buildings contain identifying religious symbols such as crosses on the exterior and crucifixes, and religious paintings and statues either in the classrooms or hallways. Although only approximately 30 minutes a day are devoted to direct religious instruction, there are religiously oriented extracurricular activities. Approximately two-thirds of the teachers in these schools are nuns of various religious orders. Their dedicated efforts provide an atmosphere in which religious instruction and religious vocations are natural and proper parts of life in such schools. Indeed, as the district court found, the role of teaching nuns in enhancing the religious atmosphere has led the parochial school authorities to attempt to maintain a one-to-one ratio between nuns and lay teachers in all schools, rather than to permit some to be staffed almost entirely by lay teachers.

On the basis of these findings, the district court concluded that the parochial schools constituted “an integral part of the religious mission of the Catholic Church.” The various characteristics of the schools make them “a powerful vehicle for transmitting the Catholic faith to the next generation.” This process of inculcating religious doctrine is, of course, enhanced by the impressionable age of the pupils, in primary schools particularly. In short, parochial schools involve substantial religious activity and purpose.

The substantial religious character of these church-related schools gives rise to entangling church-state relationships of the kind the Religion Clauses sought to avoid. . . .

The dangers and corresponding entanglements are enhanced by the particular form of aid that the Rhode Island Act provides. Our decisions from Everson to Allen have permitted the states to provide church-related schools with secular, neutral, or nonideological services, facilities, or materials. Bus transportation, school lunches, public health services, and secular textbooks supplied in common to all students were not thought to offend the Establishment Clause. We note that the dissenters in Allen seemed chiefly concerned with the pragmatic difficulties involved in ensuring the truly secular content of the textbooks provided at state expense.

In Allen, the Court refused to make assumptions, on a meager record, about the religious content of the textbooks that the state would be asked to provide. We cannot, however, refuse here to recognize that teachers have a substantially different ideological character from books. In terms of potential for involving some aspect of faith or morals in secular subjects, a textbook’s content is ascertainable, but a teacher’s handling of a subject is not. We cannot ignore the danger that a teacher under religious control and discipline poses to the separation of the religious from the purely secular aspects of pre-college education. The conflict of functions inheres in the situation.

In our view, the record shows these dangers are present to a substantial degree. The Rhode Island Roman Catholic elementary schools are under the general supervision of the Bishop of Providence and his appointed representative, the diocesan superintendent of schools . . . . Religious authority necessarily pervades the school system. . . .

Several teachers testified, however, that they did not inject religion into their secular classes. And the district court found that religious values did not necessarily affect the content of the secular instruction. But what has been recounted suggests the potential, if not actual, hazards of this form of state aid. The teacher is employed by a religious organization, subject to the direction and discipline of religious authorities, and works in a system dedicated to rearing children in a particular faith. These controls are not lessened by the fact that most of the lay teachers are of the Catholic faith. Inevitably, some of a teacher’s responsibilities hover on the border between secular and religious orientation. . . .

We do not assume, however, that parochial school teachers will be unsuccessful in their attempts to segregate their religious belief from their secular educational responsibilities. But the potential for impermissible fostering of religion is present. . . . The Rhode Island Legislature has not, and could not, provide state aid on the basis of a mere assumption that secular teachers under religious discipline can avoid conflicts. The state must be certain, given the Religion Clauses, that subsidized teachers do not inculcate religion—indeed, the state here has undertaken to do so. To ensure that no trespass occurs, the state has therefore carefully conditioned its aid with pervasive restrictions. An eligible recipient must teach only those courses that are offered in the public schools and use only those texts and materials that are found in the public schools. In addition, the teacher must not engage in teaching any course in religion.

A comprehensive, discriminating, and continuing state surveillance will inevitably be required to ensure that these restrictions are obeyed and the First Amendment otherwise respected. Unlike a book, a teacher cannot be inspected once so as to determine the extent and intent of his or her personal beliefs and subjective acceptance of the limitations imposed by the First Amendment. These prophylactic contacts will involve excessive and enduring entanglement between state and church.

There is another area of entanglement in the Rhode Island program that gives concern. The statute excludes teachers employed by nonpublic schools whose average per-pupil expenditures on secular education equal or exceed the comparable figures for public schools. In the event that the total expenditures of an otherwise eligible school exceed this norm, the program requires the government to examine the school’s records in order to determine how much of the total expenditures is attributable to secular education and how much to religious activity. This kind of state inspection and evaluation of the religious content of a religious organization is fraught with the sort of entanglement that the Constitution forbids. . . .

IV

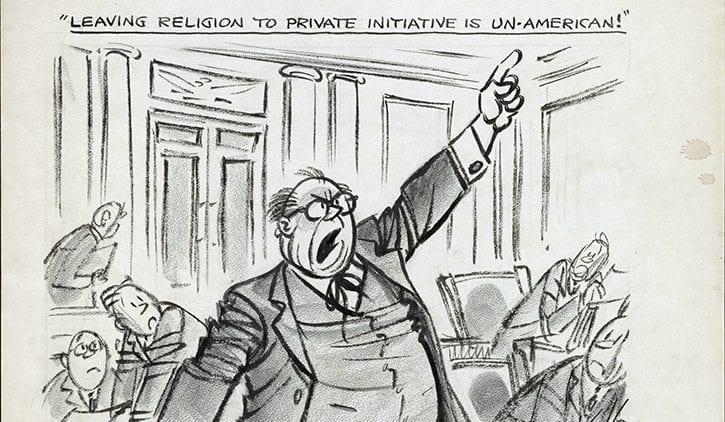

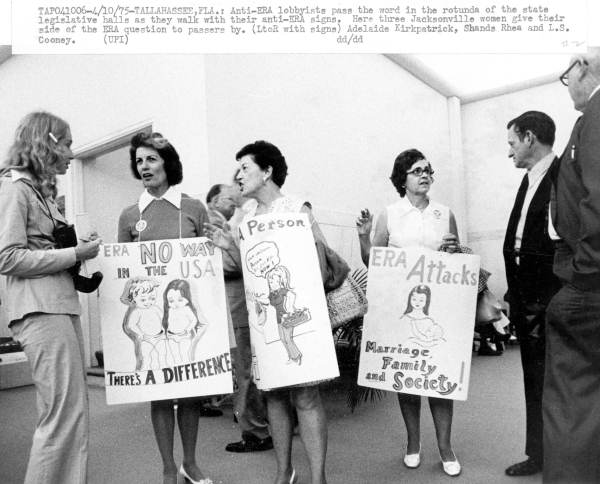

A broader base of entanglement of yet a different character is presented by the divisive political potential of these state programs. In a community where such a large number of pupils are served by church-related schools, it can be assumed that state assistance will entail considerable political activity. . . .

Ordinarily, political debate and division, however vigorous or even partisan, are normal and healthy manifestations of our democratic system of government, but political division along religious lines was one of the principal evils against which the First Amendment was intended to protect. The potential divisiveness of such conflict is a threat to the normal political process. To have states or communities divide on the issues presented by state aid to parochial schools would tend to confuse and obscure other issues of great urgency. We have an expanding array of vexing issues, local and national, domestic and international, to debate and divide on. It conflicts with our whole history and tradition to permit questions of the Religion Clauses to assume such importance in our legislatures and in our elections that they could divert attention from the myriad issues and problems that confront every level of government. The highways of church and state relationships are not likely to be one-way streets, and the Constitution’s authors sought to protect religious worship from the pervasive power of government. The history of many countries attests to the hazards of religion’s intruding into the political arena or of political power intruding into the legitimate and free exercise of religious belief. . . .

The potential for political divisiveness related to religious belief and practice is aggravated in these two statutory programs by the need for continuing annual appropriations and the likelihood of larger and larger demands as costs and populations grow. . . .

V

. . .

Finally, nothing we have said can be construed to disparage the role of church-related elementary and secondary schools in our national life. Their contribution has been and is enormous. Nor do we ignore their economic plight in a period of rising costs and expanding need. Taxpayers generally have been spared vast sums by the maintenance of these educational institutions by religious organizations, largely by the gifts of faithful adherents.

The merit and benefits of these schools, however, are not the issue before us in these cases. The sole question is whether state aid to these schools can be squared with the dictates of the Religion Clauses. Under our system, the choice has been made that government is to be entirely excluded from the area of religious instruction, and churches excluded from the affairs of government. The Constitution decrees that religion must be a private matter for the individual, the family, and the institutions of private choice, and that, while some involvement and entanglement are inevitable, lines must be drawn.

The judgment of the Rhode Island District Court in No. 569 and No. 570 is affirmed. The judgment of the Pennsylvania District Court in No. 89 is reversed, and the case is remanded[2] for further proceedings consistent with this opinion.

New York Times Co. v. United States

June 30, 1971

Conversation-based seminars for collegial PD, one-day and multi-day seminars, graduate credit seminars (MA degree), online and in-person.