No related resources

Introduction

The position of federal revenue collector was an important and highly coveted job in American government prior to the Civil War. To make sure that revenue collectors carried out their duties faithfully, Congress made them personally liable for any injuries they caused while carrying out their responsibilities. For instance, if a revenue collector overestimated the taxes owed to the government by a citizen, he could be sued by that citizen and held personally responsible for damages awarded.

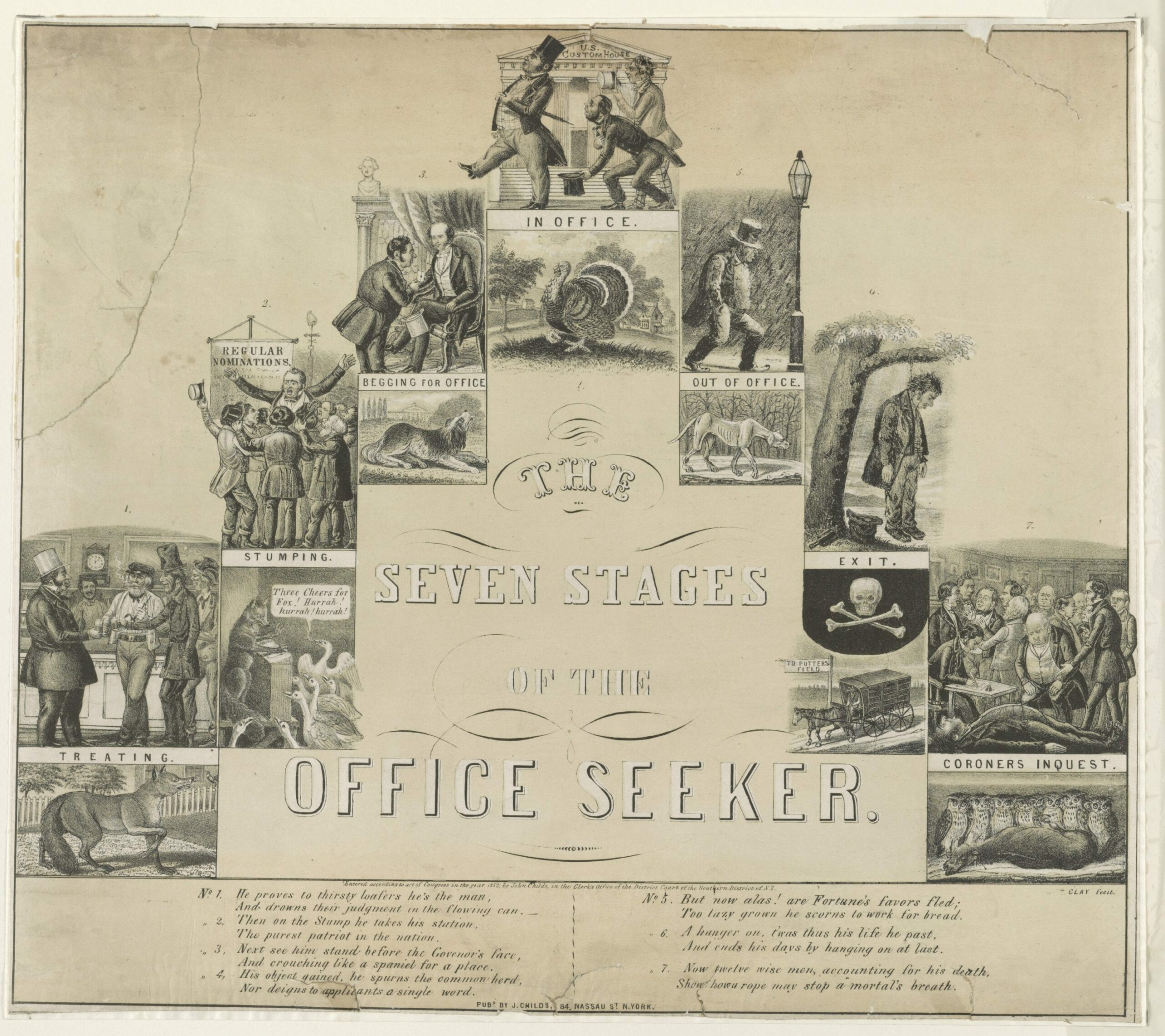

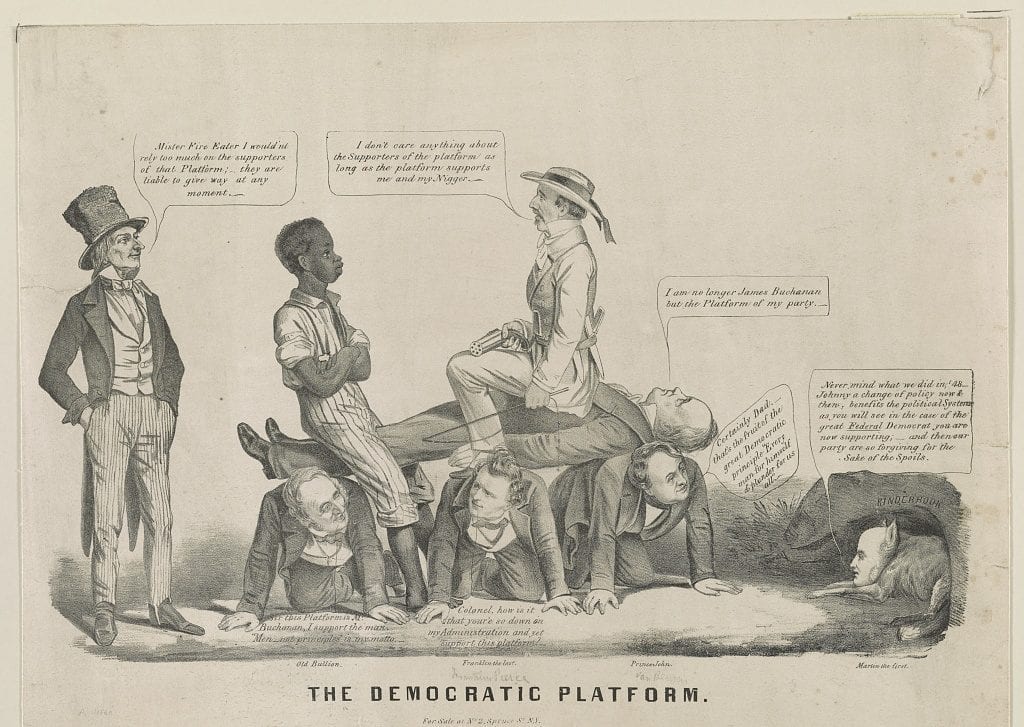

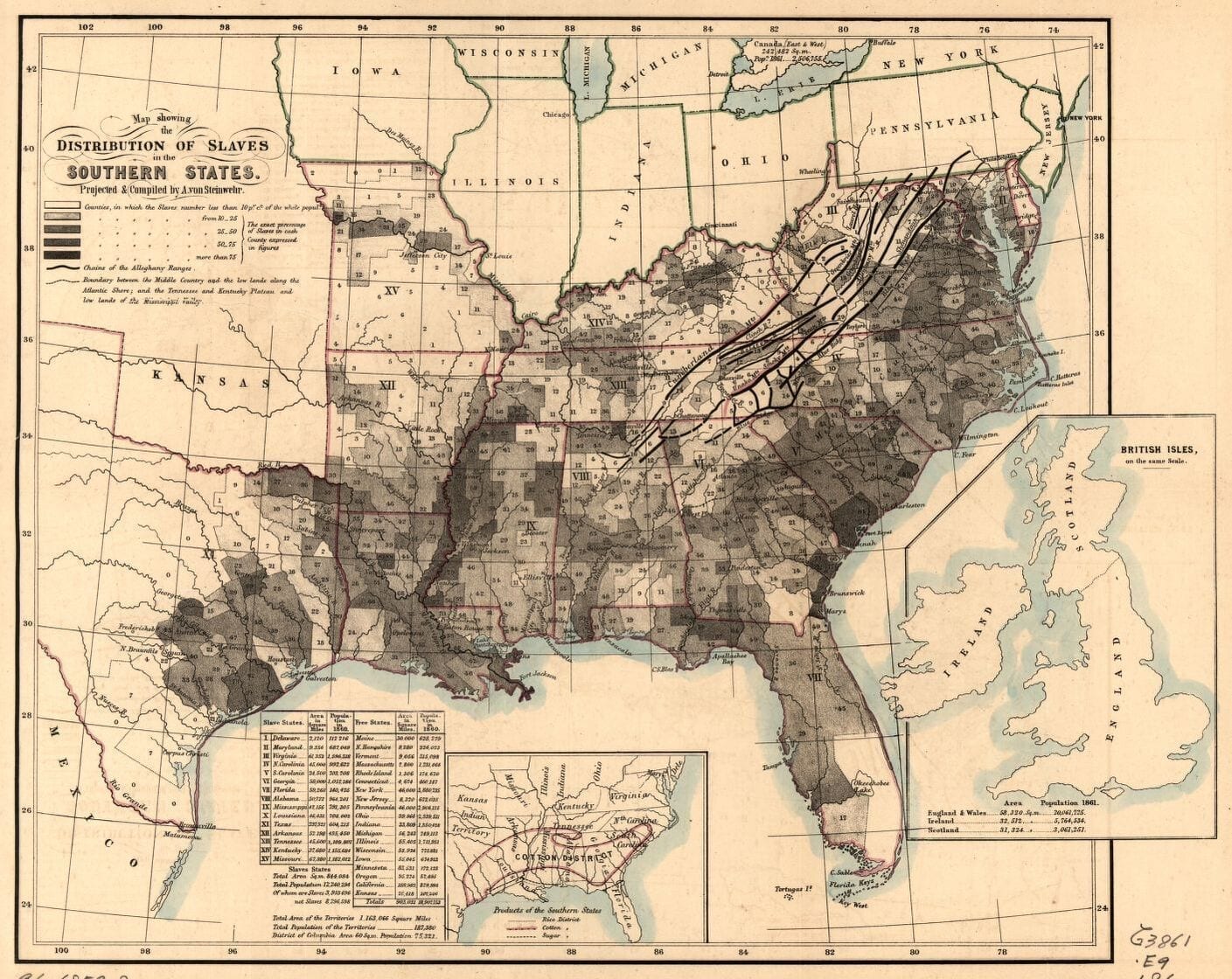

As a security to ensure that revenue collectors were capable of paying out judgments in such lawsuits, early Congresses allowed collectors to keep the revenue they collected for the government for a period of time. Congress changed this rule due to the infamous activities of Samuel Swartwout, a customs collector who ran off to England with a sizable amount of government money he had collected. Cary v. Curtis arose because Congress passed a new law in 1839 requiring collectors to submit the money they collected directly to the U.S. Treasury. Some argued that Congress intended for the law to eliminate all legal liability for customs collectors because Congress no longer allowed them to hold on to the revenue they collected. The Court held that Congress had indeed eliminated legal liability by changing the rule. But this raised a more fundamental question: Can Congress strip the judiciary of the power to review the legality of executive branch decisions? Some of the justices believed that if the legislature could immunize the executive branch from judicial review, the executive branch would effectively be above the law. Thus, this case raised larger questions about whether executive officers were bound to the law and responsible to courts of law for the legal validity of their actions.

William F. Cary and Samuel T. Cary, Plaintiffs v. Edward Curtis, 44 U.S. 236, https://www.law.cornell.edu/supremecourt/text/44/236.

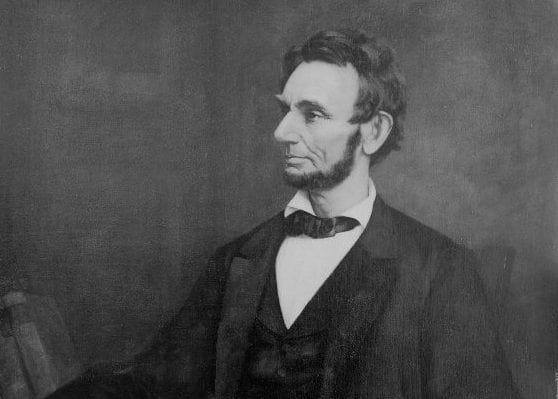

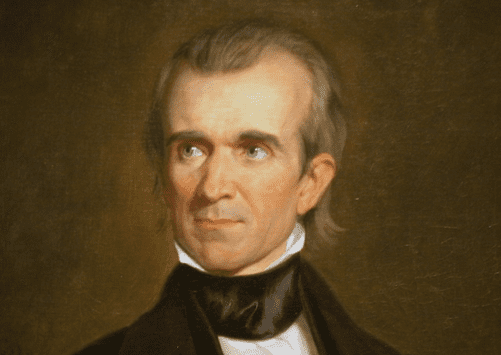

Mr. Justice Daniel delivered the opinion of the Court:1

. . . What is the plain and obvious import of this provision [requiring direct payment to the Treasury], taking it independently and as a whole? It is that all moneys thereafter paid to any collector for unascertained duties, or duties paid under protest (i.e., with notice of objection by the payer) shall, notwithstanding such notice, be placed to the credit of the treasurer, kept and disposed of as all other money aid for duties is required by law to be kept and disposed of—that is, they shall be paid over by the collector, received by the treasurer, and disbursed by him in conformity with appropriations by law precisely as if no notice or protest had been given or made. . . .

This section of the act of Congress. . .must be understood as leaving with the collector no lien2 upon or discretion over the sums received by him on account of the duties described therein; but as converting them into the mere bearer of those sums to the Treasury of the United States. . . . Looking then to the immediate operation of this section upon the conclusions either directly announced or as implied in the decision of Elliott v. Swartwout,3 how are those conclusions affected by it? They must be influenced by consequences like the following:. . . because he [the collector] is announced to be the mere instrument or vehicle to convey the duties paid into his hands into the Treasury; that it is the secretary of the Treasury alone in whom the rights of the government and the claimant are to be tested. . . .

It is contended, however, that the language and purposes of Congress, if really what we hold them to be declared in the statute . . . cannot be sustained, because they would be repugnant to the Constitution, inasmuch as they would debar the citizen of his right to resort to the courts of justice. . . .[This] objection . . . admits of the most satisfactory refutation. This may be found in the following positions. . . that the government, as a general rule, claims an exemption from being sued in its own courts. That although, as being charged with the administration of the laws, it will resort to those courts as means of securing this great end, it will not permit itself to be impleaded therein, save in instances forming conceded and express exceptions. Secondly . . . that the judicial power of the United States, although it has its origin in the Constitution, is. . . dependent for its distribution and organization, and for the modes of its exercise, entirely upon the action of Congress, who possess the sole power of creating the tribunals. . . and of investing them with jurisdiction either limited, concurrent, or exclusive, and of withholding jurisdiction from them in the exact degrees and character which to Congress may seem proper for the public good. To deny this position would be to elevate the judicial power over the legislative branch of the government, and to give to the former powers limited by its own discretion merely. It follows, then, that the courts created by statute must look to the statute as the warrant for their authority, certainly they cannot go beyond the statute and assert an authority with which they may not be invested by it, or which may be clearly denied to them. . . .

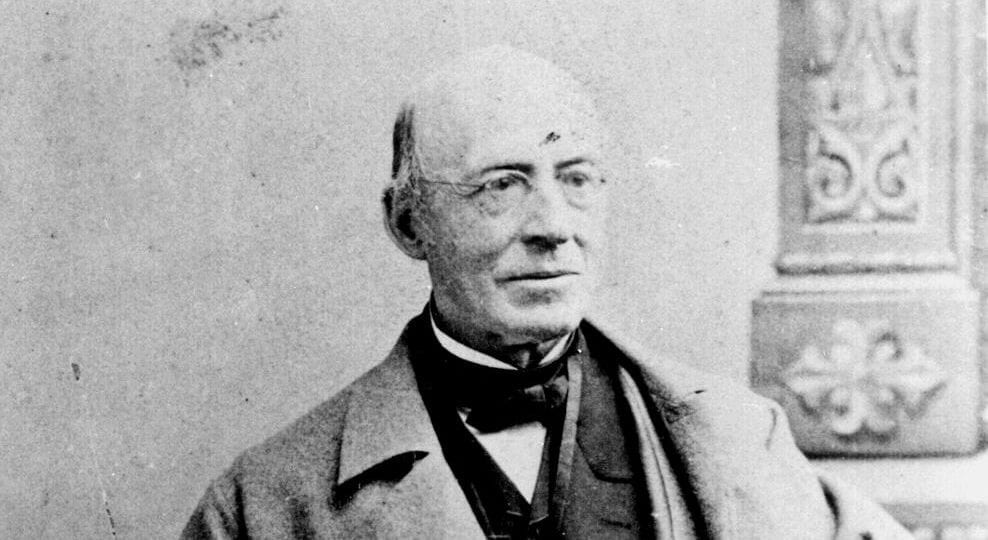

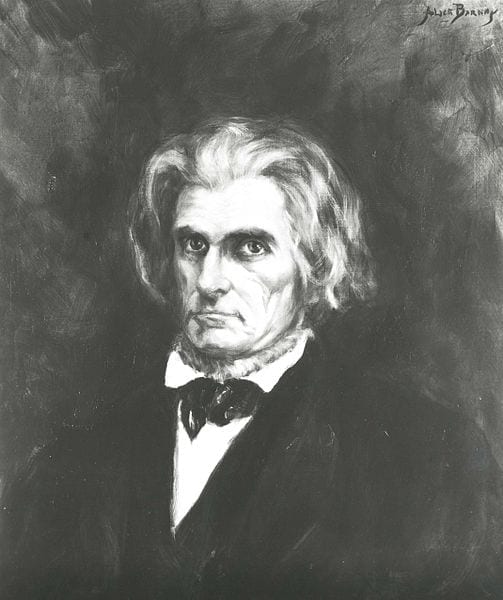

Mr. Justice McLean, dissenting:4

. . .In the case of Elliott v. Swartwout. . .this court held that legal duties exacted by the collector were recoverable from him, where paid under protest, by the importer, in an action of assumpsit.5 This doctrine is not questioned in this country or in England. Has the 2nd section of the act above cited changed the law in this respect?6 A majority of the judges have decided in the affirmative, and that that act constitutes a bar to an action in such a case. I dissent from the opinion of the court.

The above section, in my judgment, so far from taking away the legal remedy, expressly recognizes it. . . . From the proceedings of the court we know that collectors of the customs after their removal from office or the expiration of their terms, and sometimes while in office, under the pretext of indemnifying themselves against suits for the exaction of illegal duties, were in the practice of withholding from the Treasury large sums of money. And it was to remedy this evil, that the above law was passed. . . .

Feeling, as I do, an unfeigned respect for the opinion of the judges who differ from me, yet I cannot, without concern, look at the consequences of the principle established in this case. The right of a citizen to resort to the judicial tribunals of the country, federal or state, for redress for an injury done by a public officer, is taken away by the construction of an act of Congress. . . . But I will take higher ground, and say that Congress have no constitutional power to pass such an act as the statute of 1839 is construed to be by this decision. . . .

In a matter of private right [the majority] takes from the judiciary the power of construing the law, and vests it in the secretary of the Treasury; the executive officer under whose sanction or instruction the wrong complained of was done. . . .

The right to construe the laws in all matters of controversy is of the very essence of judicial power. Executive officers who are required to act under the laws, of necessity, must give a construction to them. But their construction is not final. When it operates injuriously to the citizen, he may, by any and every possible means through which it may be brought before the courts, have the construction of the law submitted to them, and their decision is final.

. . .[E]specially, where, in this respect, a wrong has been done to the citizen, the courts should be open to him. His remedy should be without obstruction. But my brethren say that the act of 1839 takes away from the plaintiff all remedy except an appeal to the secretary. . . .

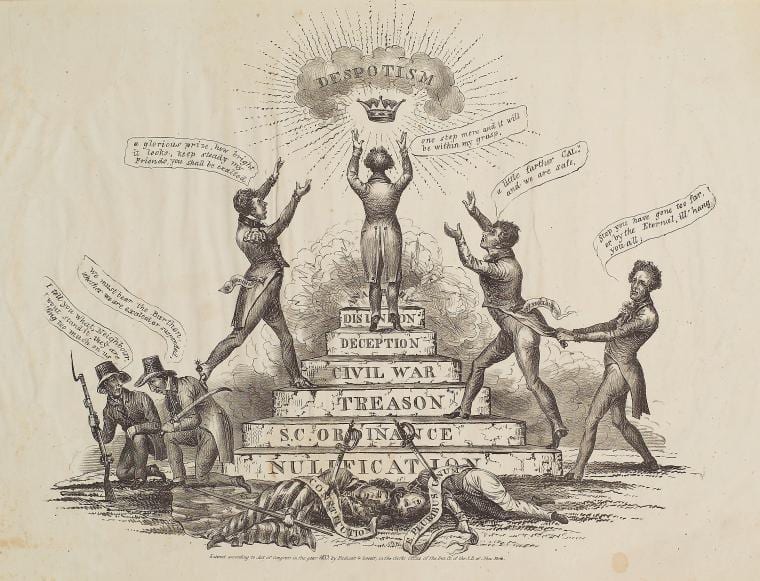

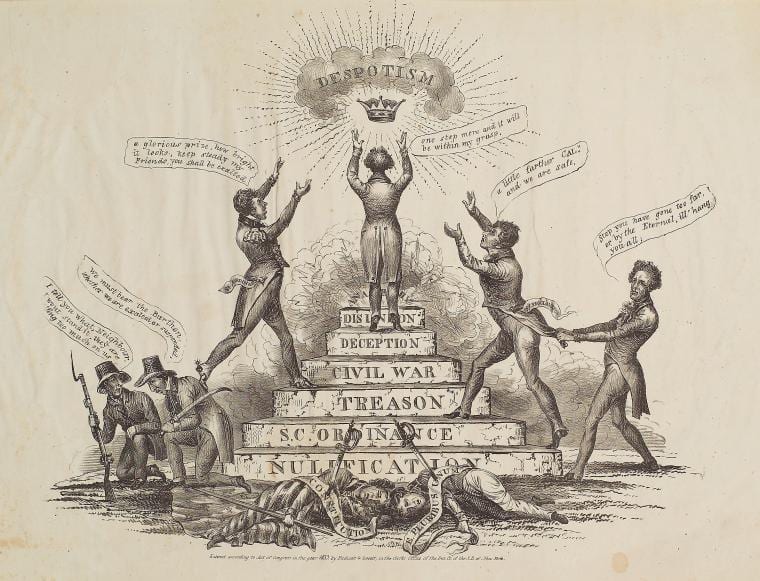

The able men who laid the foundation of this government saw that, to secure the great objects they had in view, the executive, legislative, and judicial powers must occupy distinct and independent spheres of action. That the union of these in one individual or body of men constitutes a despotism. And every approximation to this union partakes of this character. . . .

. . .In my judgment, no principle can be more dangerous than the one mentioned in this case [that the legislature can strip a citizen’s right to challenge the government in a court of law]. It covers from legal responsibility executive officers. In the performance of their ministerial duties, however they may disregard and trample upon the rights of the citizen, he can claim no indemnity by an action at law. This doctrine has no standing in England. No ministerial officer in that country is sheltered from legal responsibility. Shall we in this country be less jealous of private rights and of the exercise of power? Is it not our boast that the law is paramount, and that all are subject to it, from the highest officer of the country to its humblest citizen? But can this be the case if any or every executive officer is clothed with the immunities of the sovereignty? If he cannot be sued, what may he not do with impunity? I am sure that my brethren are as sincere as I am in their convictions of what the law is, in this case; and I have only to regret that their views do not coincide with those I have stated.

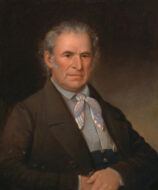

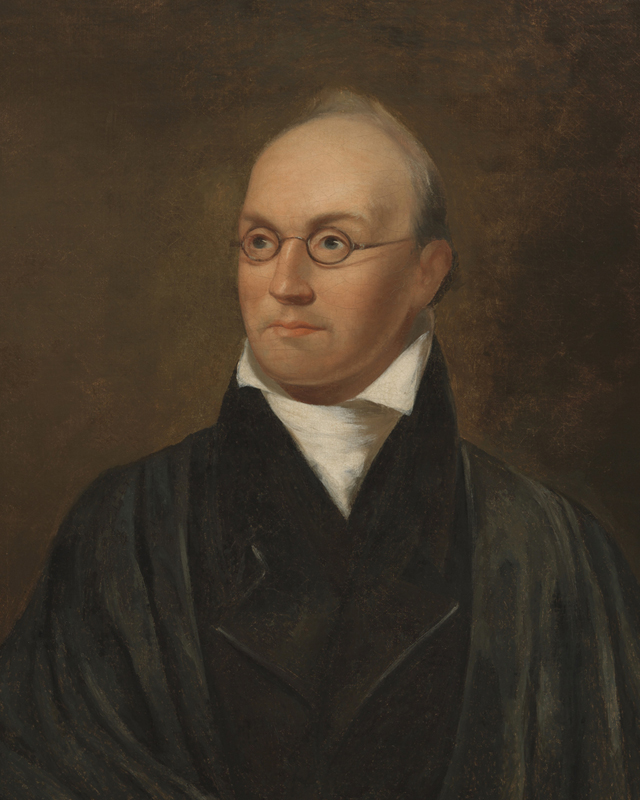

Mr. Justice Story, dissenting:7

I regret exceedingly being compelled by a sense of duty to express openly my dissent from the opinion of the majority of the court in this case. . . .[T]he present case involves, in my judgment, doctrines and consequences which, with the utmost deference and respect for those who think otherwise, I cannot but deem most deeply affecting the rights of all our citizens, and calculated to supersede the great guards of those rights intended to be secured by the Constitution through the instrumentality of the judicial power, state or national. The question, stripped of all formalities, is neither more nor less than this: Whether Congress have a right to take from the citizens all right of action in any court to recover back money claimed illegally, and extorted by compulsion, by its officers under color of law, but without any legal authority, and thus to deny them all remedy for an admitted wrong, and to clothe the secretary of the Treasury with the sole and exclusive authority to withhold or restore that money according to his own notions of justice or right? If Congress may do so in the present case, in the exercise of its power to levy and collect taxes and duties, and thus take away from all courts, state and national, all right to interpret the laws for levying and collecting taxes and duties, and to confide such interpretation to one of its own executive functionaries, whose judgment is to be at once summary and final, then I must say that it seems to me to be not what I had hitherto supposed it to be: a government where the three great departments, legislative, executive, and judicial, had independent duties to perform each in its own sphere; but the judicial power, designed by the Constitution to be the final and appellate jurisdiction to interpret our laws, is superseded in its most vital and important functions. I know of no power, indeed, of which a free people ought to be more jealous, than of that of levying taxes and duties; and yet if it is to rest with a mere executive functionary of the government absolutely and finally to decide what taxes and duties are leviable under a particular act, without any power of appeal to any judicial tribunal, it seems to me that we have no security whatsoever for the rights of the citizens. And if Congress possess a constitutional authority to vest such summary and final power of interpretation in an executive functionary, I know no other subject within the reach of legislation which may not be exclusively confided in the same way to an executive functionary; nay, to the executive himself. . . .

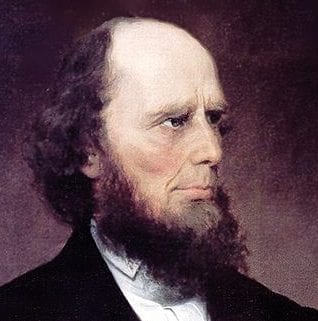

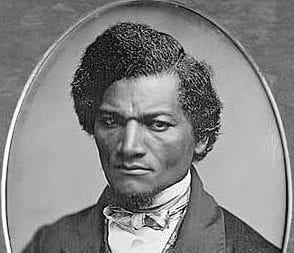

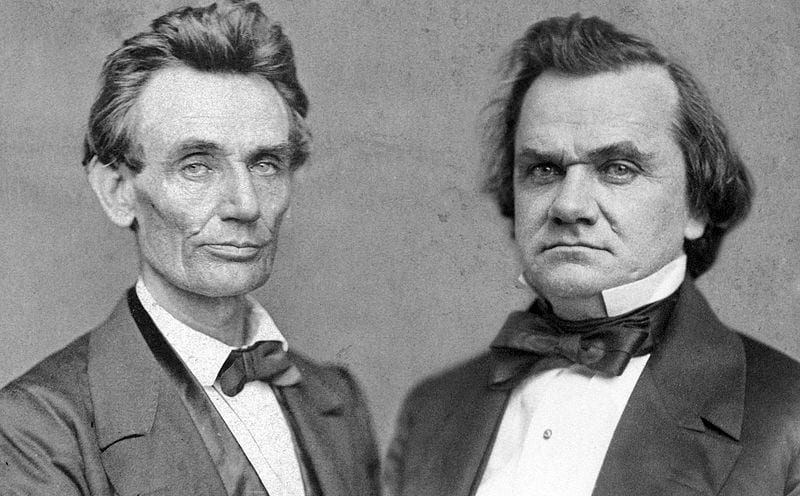

- 1. Peter V. Daniel (1784–1860).

- 2. A claim or charge on money or property to pay a debt.

- 3. An 1836 case involving the legal liability of Samuel Swartwout to pay a citizen seeking to recover unlawfully collected tax money.

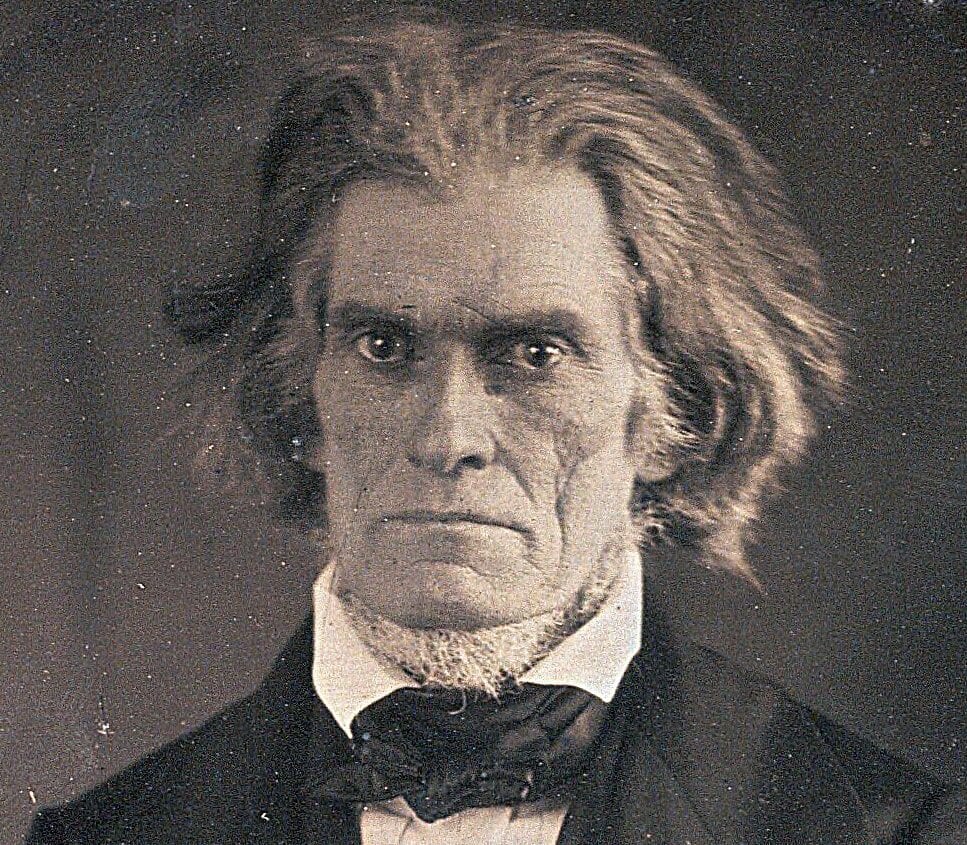

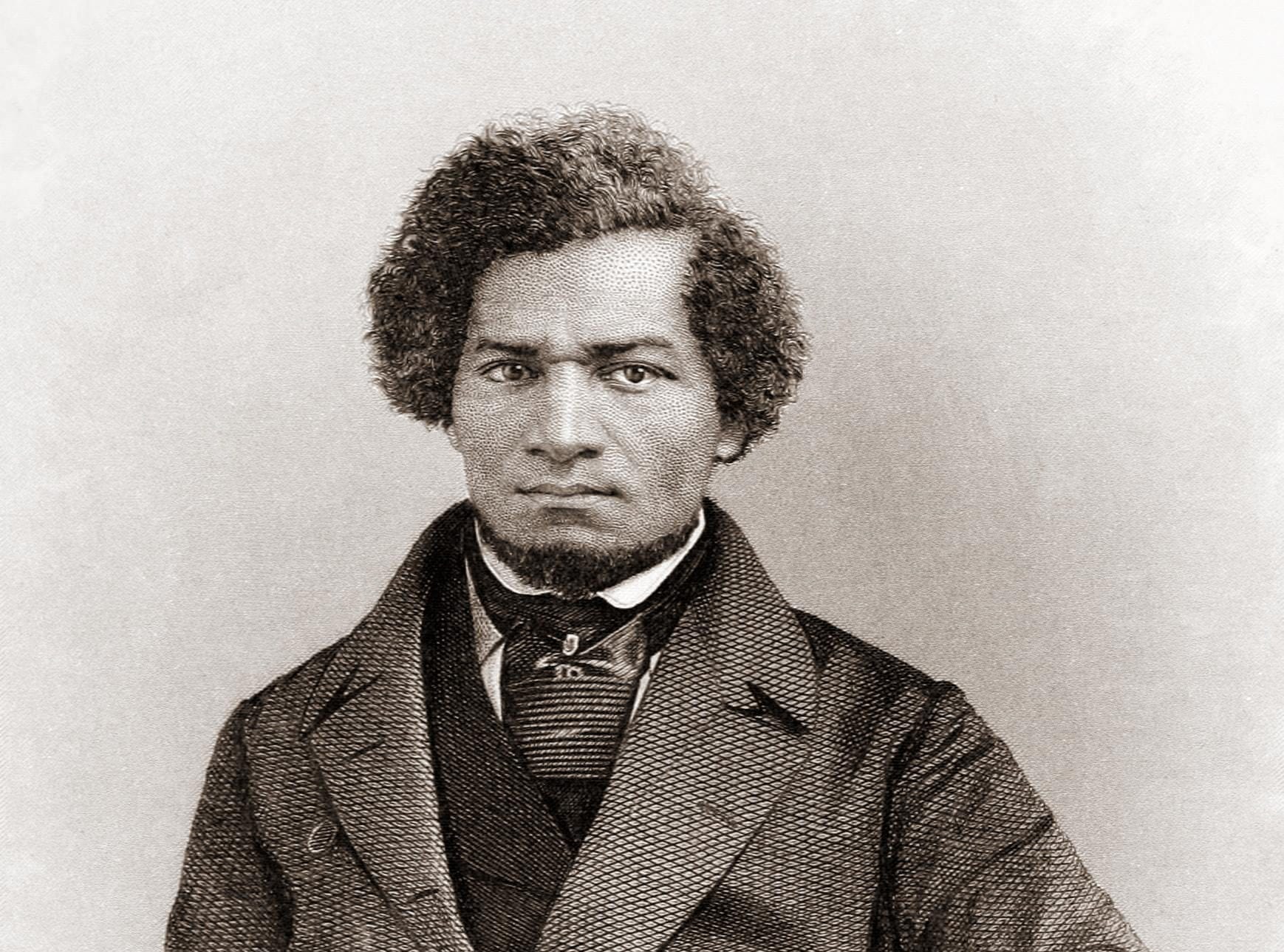

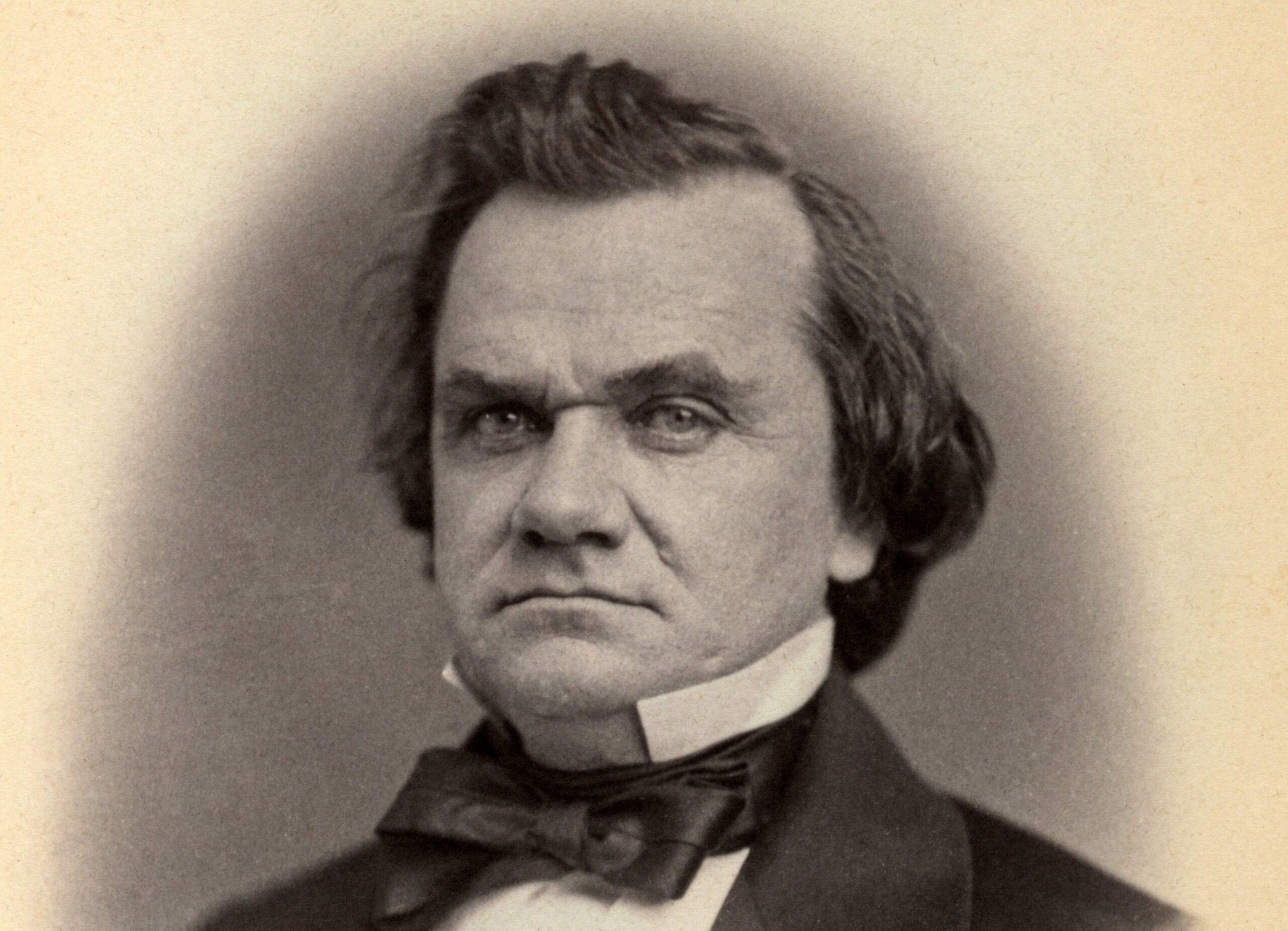

- 4. Justice John McLean (1785–1861).

- 5. A legal action to recover damages in the event of a breach of contract.

- 6. Justice McLean referred to the law requiring collectors to submit monies collected directly to the Treasury.

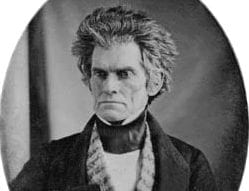

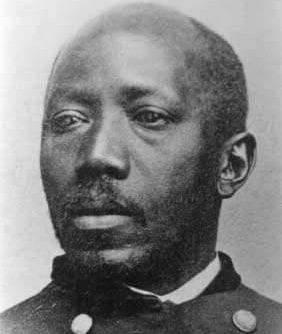

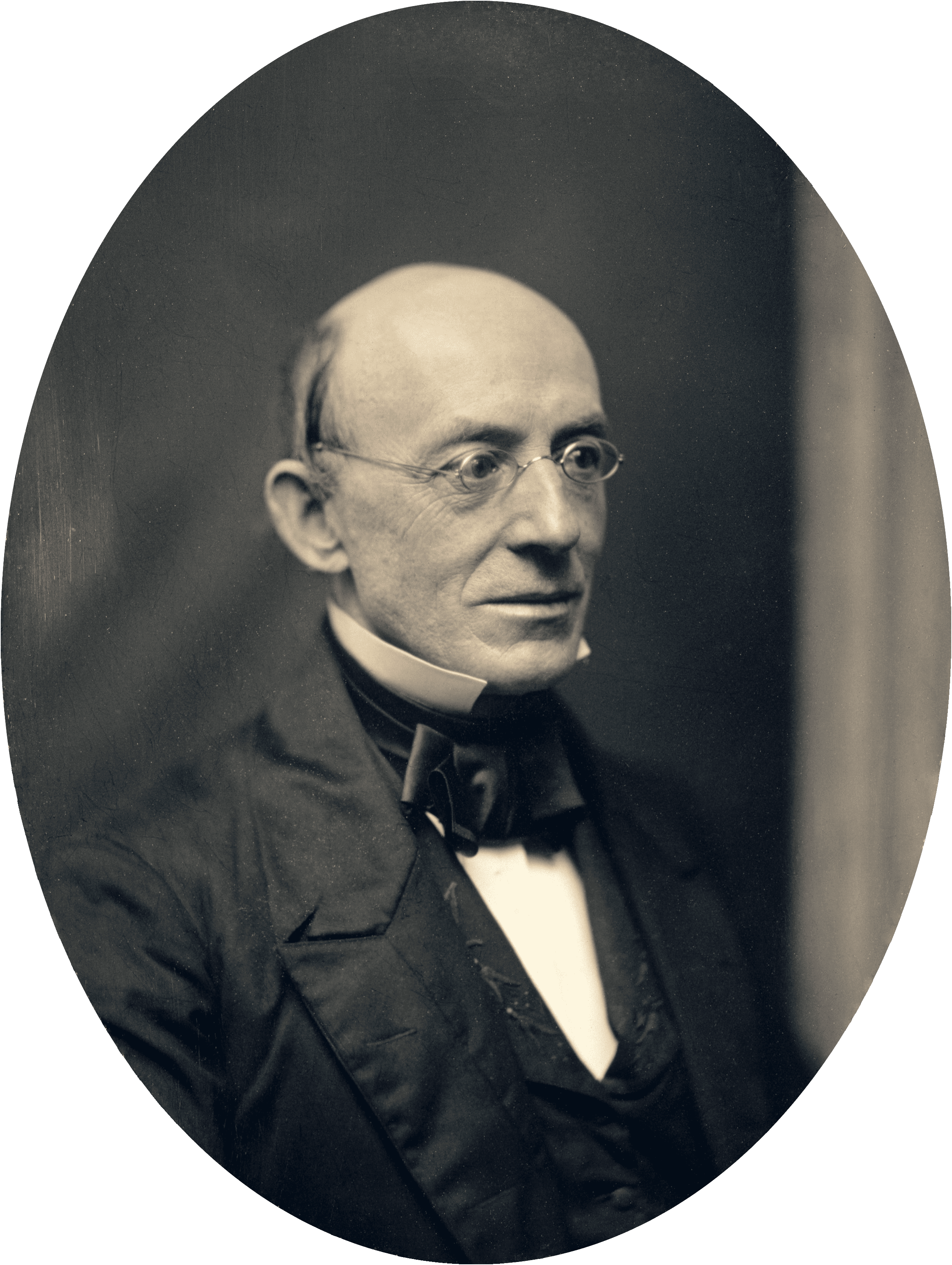

- 7. Justice Joseph Story (1779–1845).

The American Union

January 10, 1845

Conversation-based seminars for collegial PD, one-day and multi-day seminars, graduate credit seminars (MA degree), online and in-person.