No related resources

Introduction

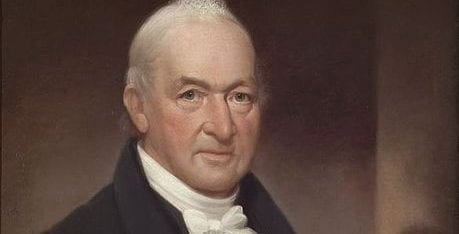

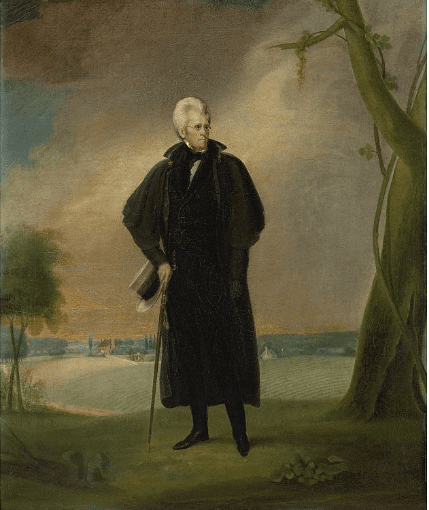

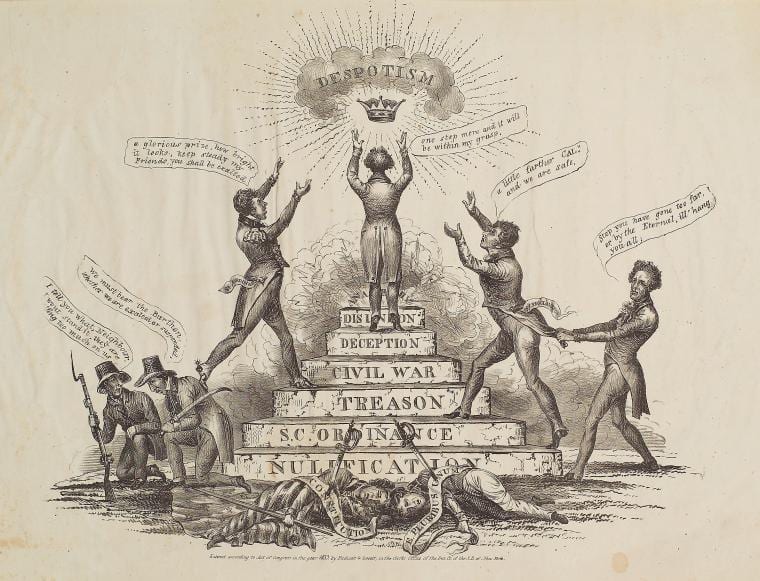

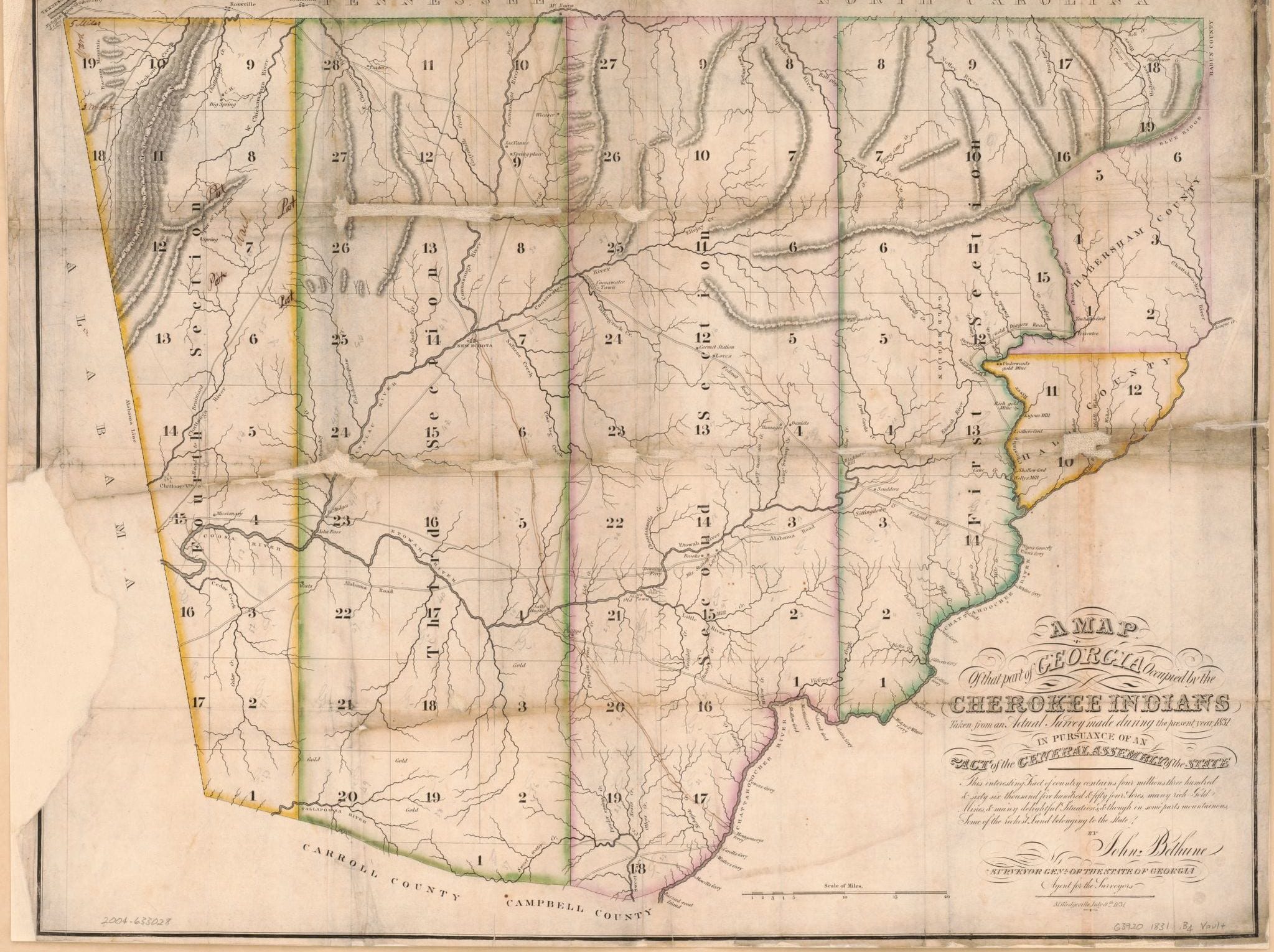

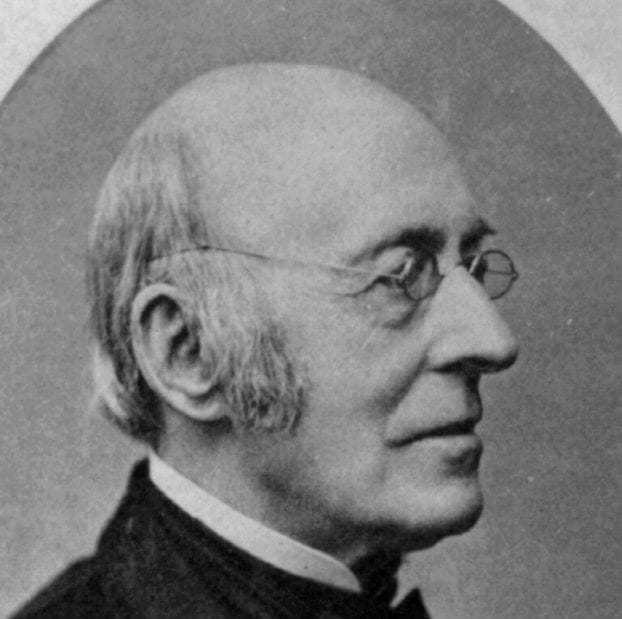

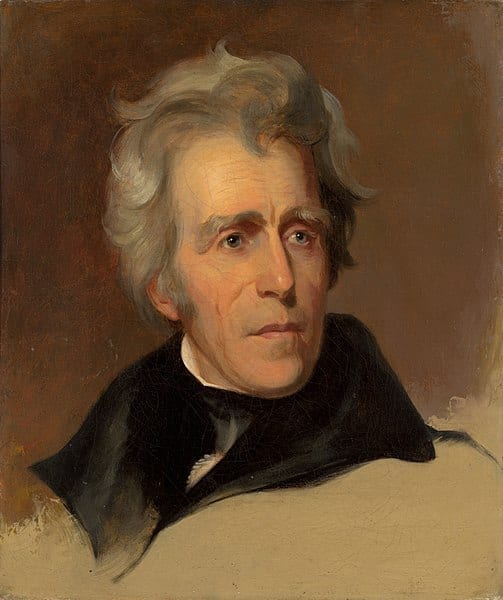

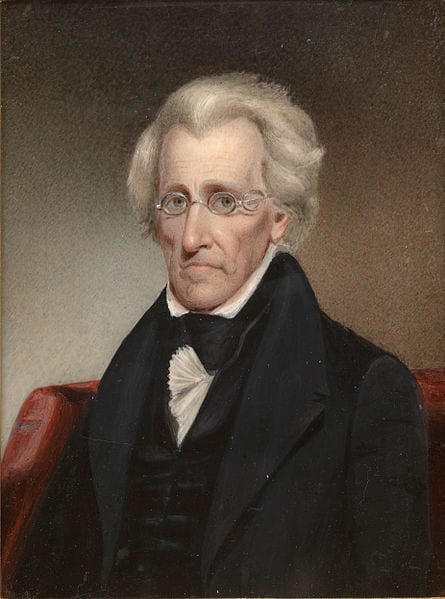

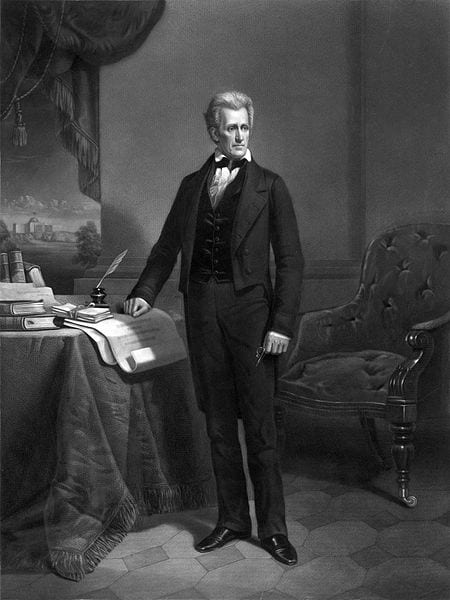

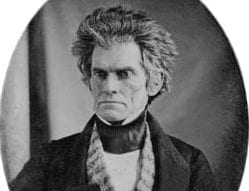

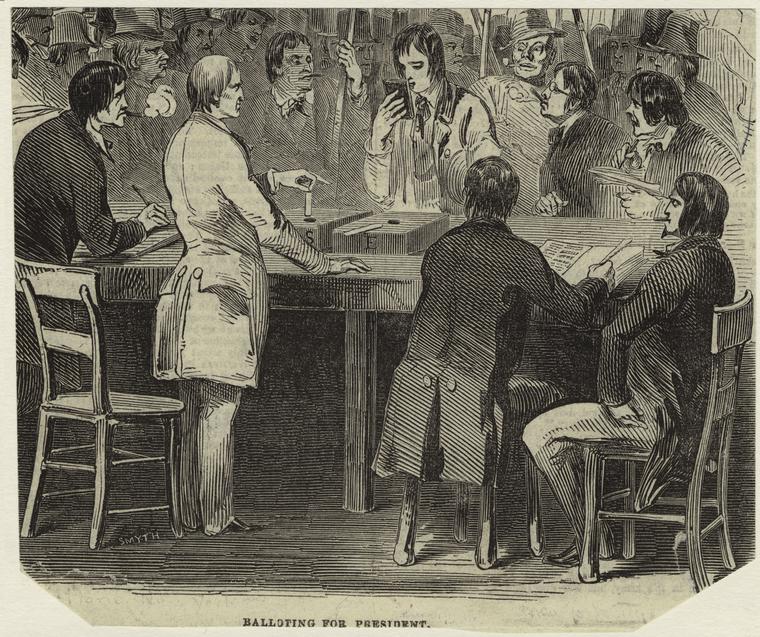

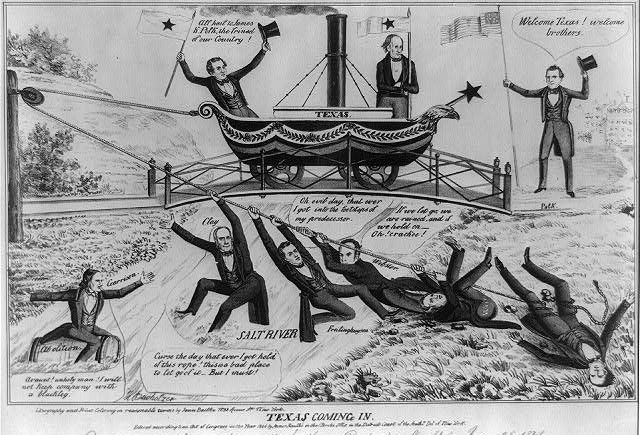

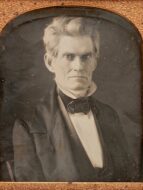

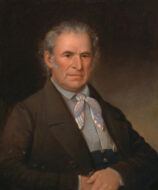

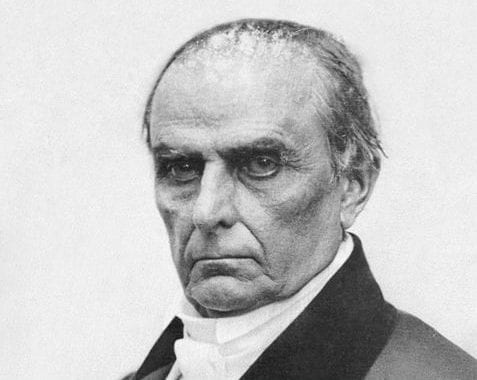

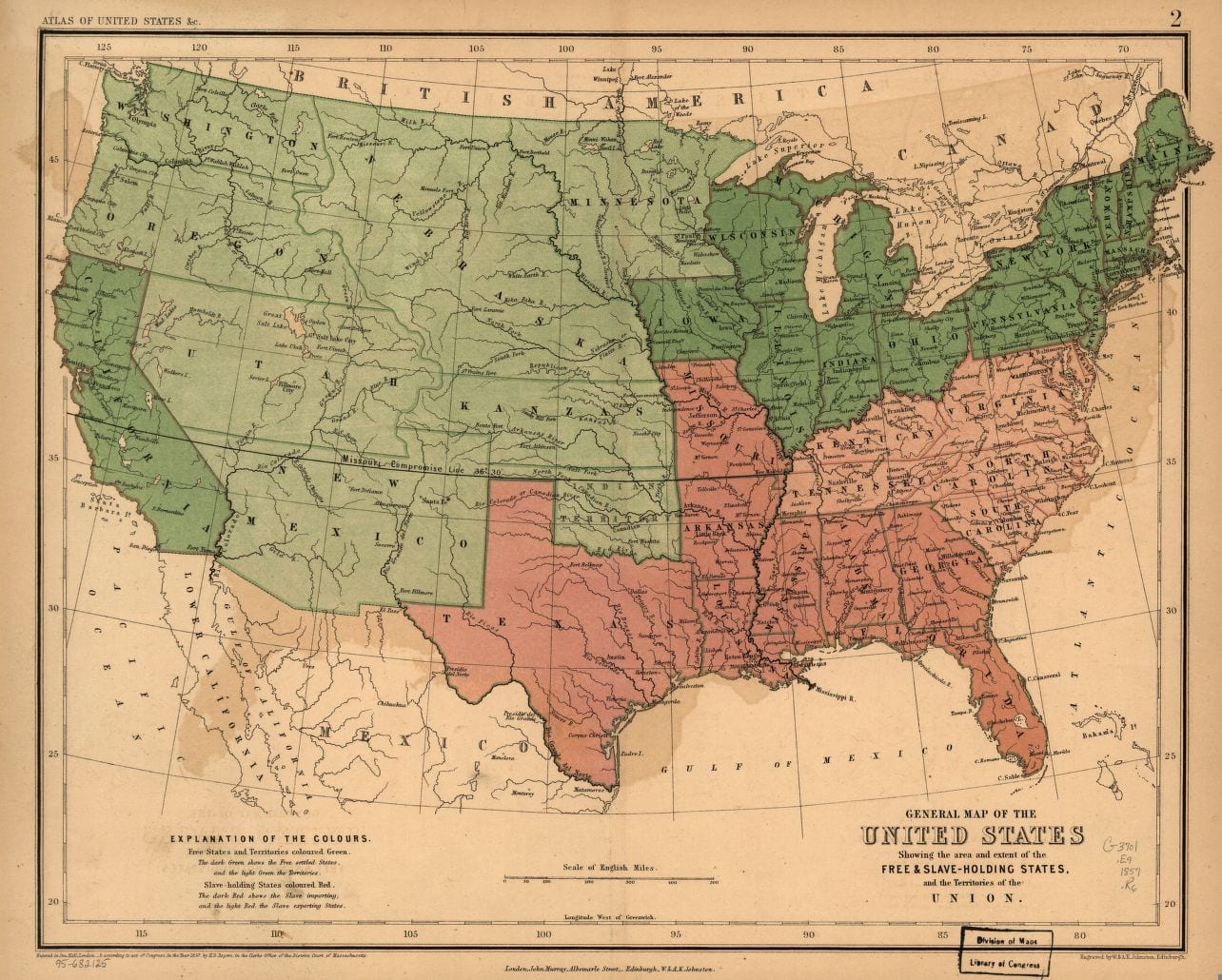

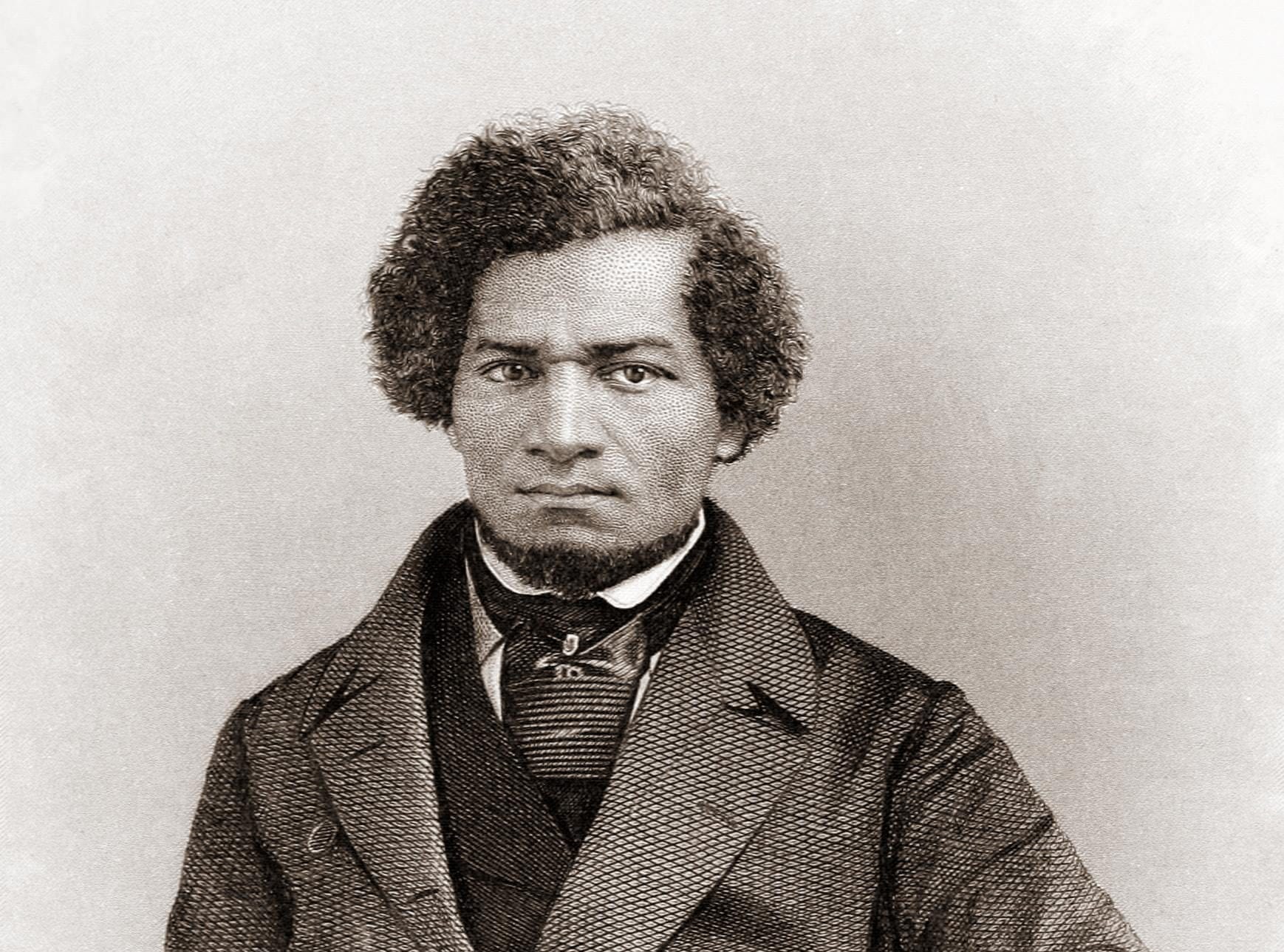

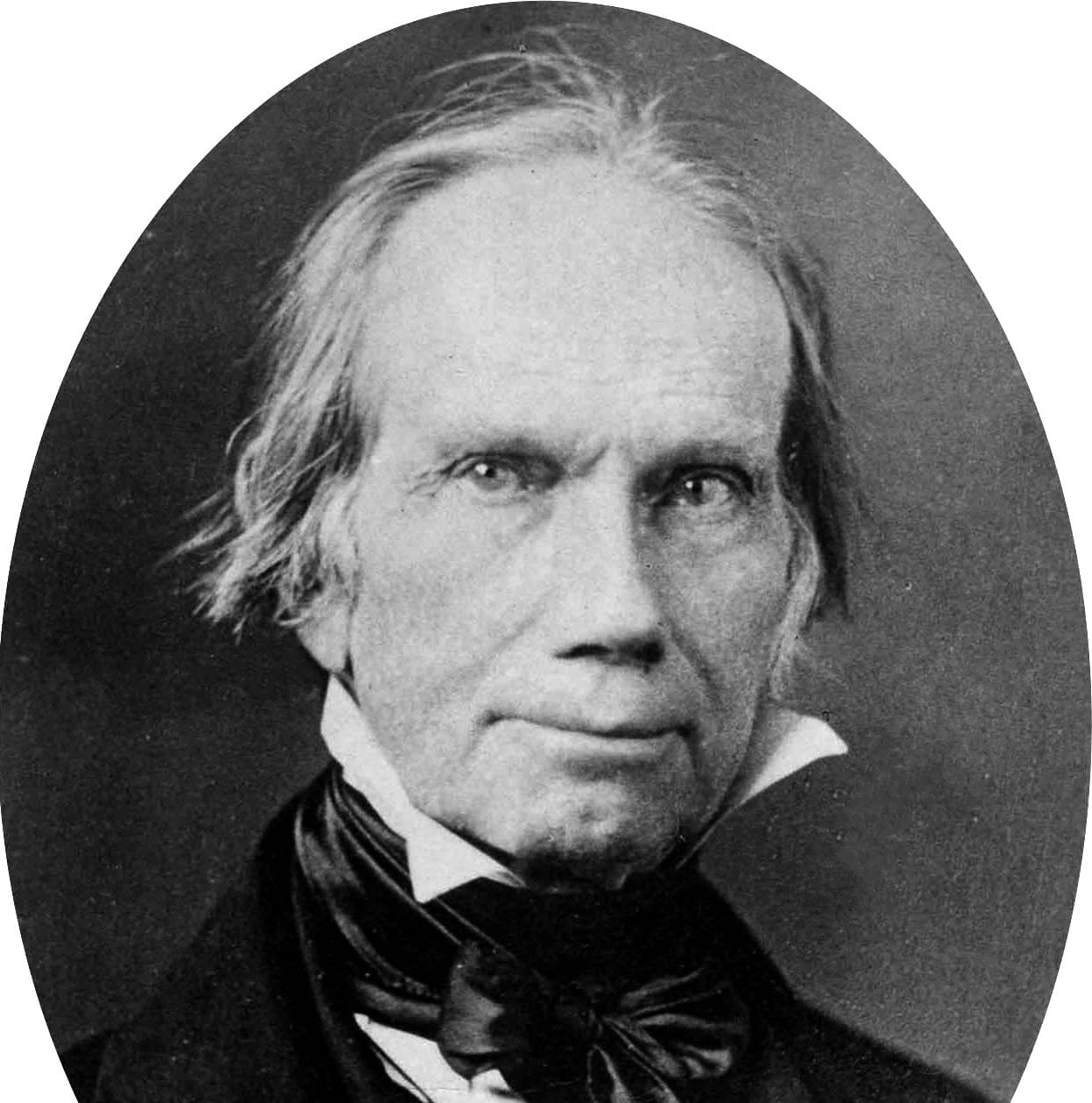

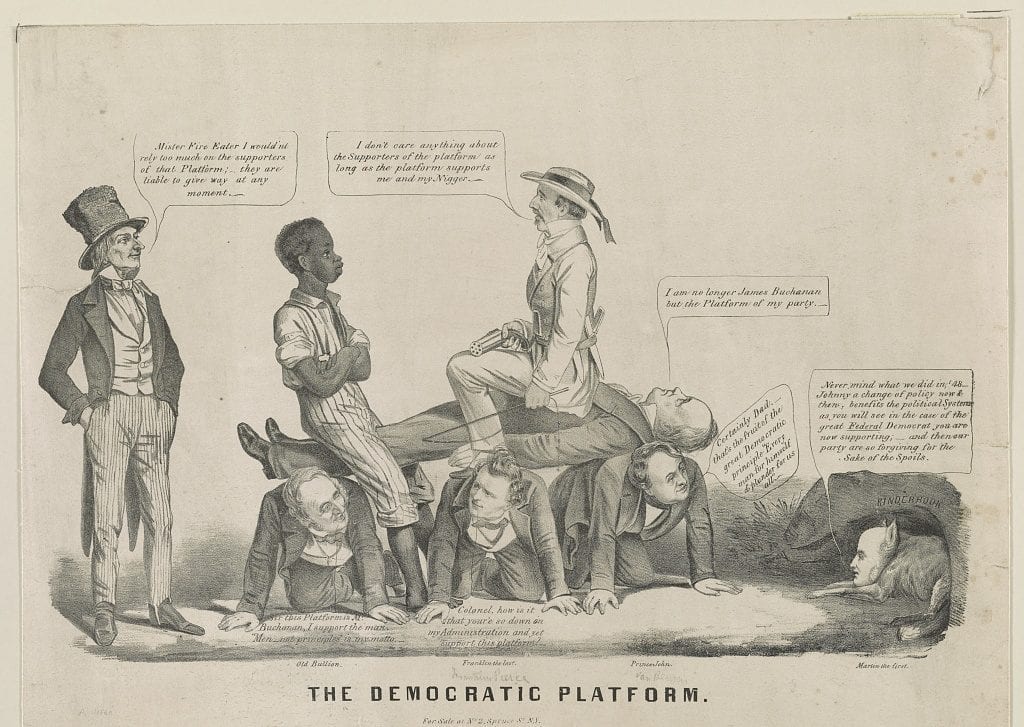

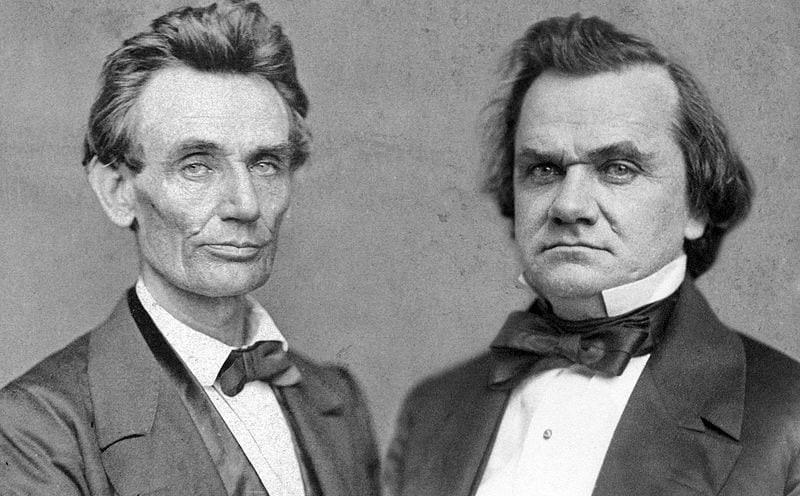

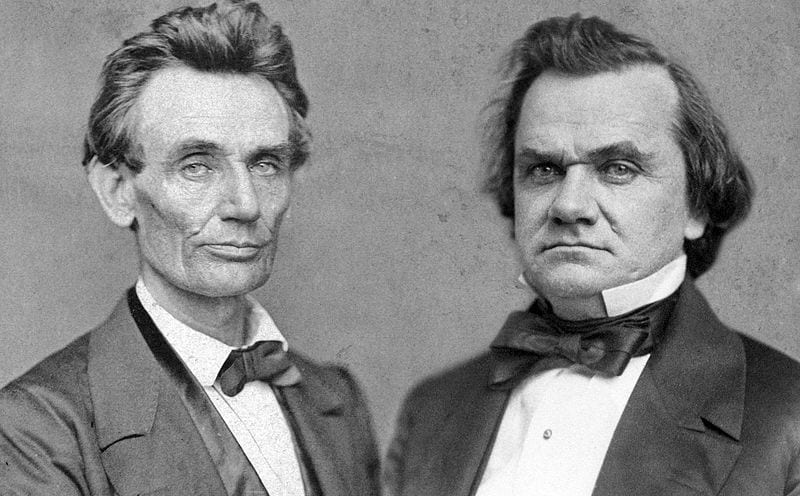

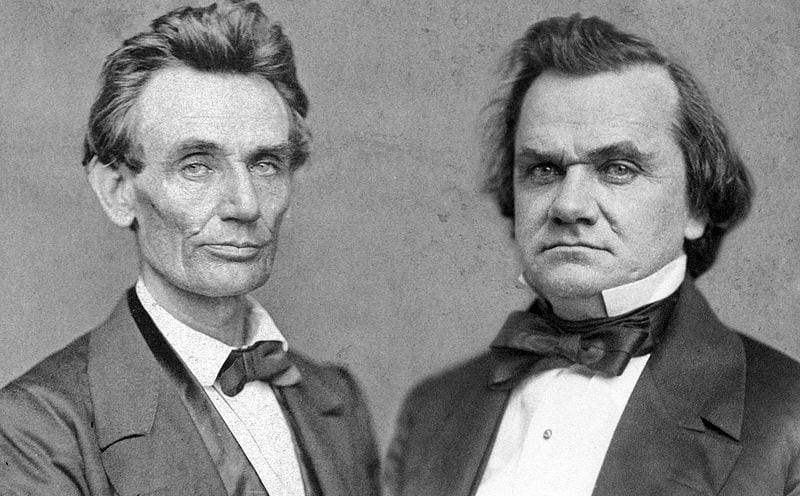

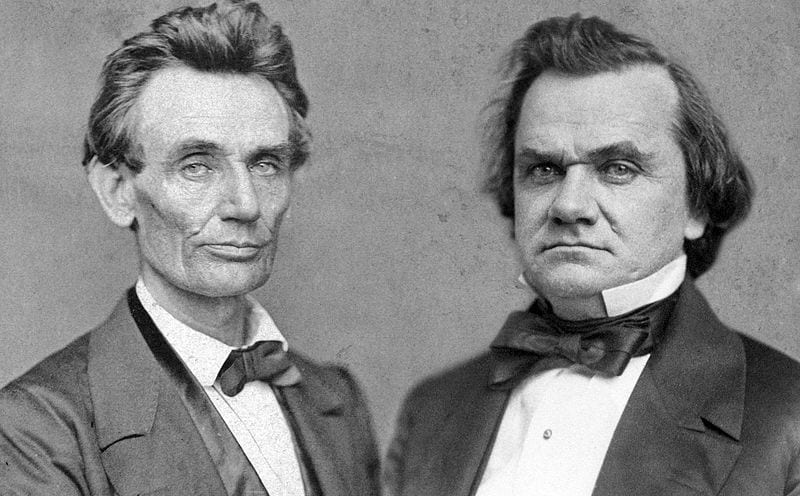

In 1832, Congress passed a bill rechartering the Second Bank of the United States. The bill was partly a political ploy (the previous charter still had four years in effect) by the Bank’s president, Nicholas Biddle (1786–1844), and Senator Henry Clay (1777–1852) of Kentucky. The rechartering was designed as a challenge in the coming presidential election to President Andrew Jackson (1767–1845), who had already expressed reservations about the Bank. In one of the most controversial decisions of his presidency, Jackson vetoed the recharter. The veto was controversial for several reasons. First, the Supreme Court had already weighed in on the constitutionality of the Bank in 1819, upholding the bank as a necessary and proper exercise of power under Article I, section 8 of the Constitution. Second, a bill for such a bank had passed into law in numerous reiterations since 1791. Finally, Jackson’s use of the veto significantly departed from previous presidents’ exercises of the veto power. Prior to Jackson, presidents restricted their use of the veto to bills of dubious constitutionality. Despite Jackson’s pretense to be acting on the same grounds, it was clear that the matter here was really a disagreement over policy. The veto provoked an acrimonious division between the Whigs and Democrats, a contest in which Jackson prevailed with his reelection in 1832.

Jackson’s veto message offers some particularly interesting reflections on the separation of powers. First, Jackson challenged the common assumption that the Court has the final say on the meaning of the Constitution. Rather than recognizing the Court as the supreme arbiter of constitutional interpretation, Jackson argued that the Court had the power to determine only constitutional issues in particular “cases and controversies.” Insofar as the veto was assigned to the president and not the Court, the executive had through the veto a concurrent authority to judge the constitutionality of laws. The veto message also challenged Congress’ judgment in policymaking. Jackson argued that the bank was simply bad policy because it created exclusive privileges that benefited a small number of stockholders, “mak[ing] the rich richer and the potent more powerful.” Unlike his predecessors, Jackson did not restrict the use of the veto to measures he regarded as unconstitutional but also used it as a means of checking Congress’ own policymaking.

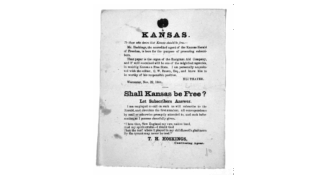

Andrew Jackson, Veto message from the President of the United States, returning the

bank bill, with his objections, &c. to the Senate. . . (Washington, D.C.: Herald Office, 1832,

https://www.loc.gov/item/rbpe.19403000/

To the Senate.

The bill “to modify and continue” the act entitled “An act to incorporate the subscribers to the Bank of the United States” was presented to me on the 4th July instant. Having considered it with that solemn regard to the principles of the Constitution which the day was calculated to inspire, and come to the conclusion that it ought not to become a law, I herewith return it to the Senate, in which it originated, with my objections.

A bank of the United States is in many respects convenient for the government and useful to the people. Entertaining this opinion, and deeply impressed with the belief that some of the powers and privileges possessed by the existing bank are unauthorized by the Constitution, subversive of the rights of the states, and dangerous to the liberties of the people, I felt it my duty at an early period of my administration to call the attention of Congress to the practicability of organizing an institution combining all its advantages and obviating these objections. I sincerely regret that in the act before me I can perceive none of those modifications of the bank charter which are necessary, in my opinion, to make it compatible with justice, with sound policy, or with the Constitution of our country.

The present corporate body, denominated the president, directors, and company of the Bank of the United States, will have existed at the time this act is intended to take effect twenty years. It enjoys an exclusive privilege of banking under the authority of the general government, a monopoly of its favor and support, and, as a necessary consequence, almost a monopoly of the foreign and domestic exchange. The powers, privileges, and favors bestowed upon it in the original charter, by increasing the value of the stock far above its par value, operated as a gratuity of many millions to the stockholders.1…

It is maintained by the advocates of the bank that its constitutionality in all its features ought to be considered as settled by precedent and by the decision of the Supreme Court.2 To this conclusion I cannot assent. Mere precedent is a dangerous source of authority, and should not be regarded as deciding questions of constitutional power except where the acquiescence of the people and the states can be considered as well settled. So far from this being the case on this subject, an argument against the bank might be based on precedent. One Congress, in 1791, decided in favor of a bank; another, in 1811, decided against it. One Congress, in 1815, decided against a bank; another, in 1816, decided in its favor. . . .

If the opinion of the Supreme Court covered the whole ground of this act, it ought not to control the coordinate authorities of this government. The Congress, the Executive, and the Court must each for itself be guided by its own opinion of the Constitution. Each public officer who takes an oath to support the Constitution swears that he will support it as he understands it, and not as it is understood by others. It is as much the duty of the House of Representatives, of the Senate, and of the president to decide upon the constitutionality of any bill or resolution which may be presented to them for passage or approval as it is of the supreme judges when it may be brought before them for judicial decision. The opinion of the judges has no more authority over Congress than the opinion of Congress has over the judges, and on that point the president is independent of both. The authority of the Supreme Court must not, therefore, be permitted to control the Congress or the executive when acting in their legislative capacities, but to have only such influence as the force of their reasoning may deserve.

But in the case relied upon, the Supreme Court have not decided that all the features of this corporation are compatible with the Constitution. It is true that the Court have said that the law incorporating the bank is a constitutional exercise of power by Congress; but taking into view the whole opinion of the Court and the reasoning by which they have come to that conclusion, I understand them to have decided that inasmuch as a bank is an appropriate means for carrying into effect the enumerated powers of the general government, therefore the law incorporating it is in accordance with that provision of the Constitution which declares that Congress shall have power “to make all laws which shall be necessary and proper for carrying those powers into execution.” Having satisfied themselves that the word “necessary” in the Constitution means “needful,” “requisite,” “essential,” “conducive to,” and that “a bank” is a convenient, a useful, and essential instrument in the prosecution of the government’s “fiscal operations,” they conclude that to “use one must be within the discretion of Congress” and that “the act to incorporate the Bank of the United States is a law made in pursuance of the Constitution”; “but,” say they, “where the law is not prohibited and is really calculated to effect any of the objects intrusted to the government, to undertake here to inquire into the degree of its necessity would be to pass the line which circumscribes the judicial department and to tread on legislative ground.”

The principle here affirmed is that the “degree of its necessity,” involving all the details of a banking institution, is a question exclusively for legislative consideration. A bank is constitutional, but it is the province of the legislature to determine whether this or that particular power, privilege, or exemption is “necessary and proper” to enable the bank to discharge its duties to the government, and from their decision there is no appeal to the courts of justice. Under the decision of the Supreme Court, therefore, it is the exclusive province of Congress and the president to decide whether the particular features of this act are necessary and proper in order to enable the bank to perform conveniently and efficiently the public duties assigned to it as a fiscal agent, and therefore constitutional, or unnecessary and improper, and therefore unconstitutional.

Without commenting on the general principle affirmed by the Supreme Court, let us examine the details of this act in accordance with the rule of legislative action which they have laid down. It will be found that many of the powers and privileges conferred on it cannot be supposed necessary for the purpose for which it is proposed to be created, and are not, therefore, means necessary to attain the end in view, and consequently not justified by the Constitution. . . .

The original act of incorporation, section 2I, enacts “that no other bank shall be established by any future law of the United States during the continuance of the corporation hereby created, for which the faith of the United States is hereby pledged: Provided, Congress may renew existing charters for banks within the District of Columbia not increasing the capital thereof, and may also establish any other bank or banks in said District with capitals not exceeding in the whole $6,000,000 if they shall deem it expedient.” This provision is continued in force by the act before me fifteen years from the ad of March 1836.

If Congress possessed the power to establish one bank, they had power to establish more than one if in their opinion two or more banks had been “necessary” to facilitate the execution of the powers delegated to them in the Constitution. If they possessed the power to establish a second bank, it was a power derived from the Constitution to be exercised from time to time, and at any time when the interests of the country or the emergencies of the government might make it expedient. It was possessed by one Congress as well as another, and by all Congresses alike, and alike at every session. But the Congress of 1816 have taken it away from their successors for twenty years, and the Congress of 1832 proposes to abolish it for fifteen years more. It cannot be “necessary” or “proper” for Congress to barter away or divest themselves of any of the powers vested in them by the Constitution to be exercised for the public good. It is not “necessary” to the efficiency of the bank, nor is it “proper” in relation to themselves and their successors. They may properly use the discretion vested in them, but they may not limit the discretion of their successors. This restriction on themselves and grant of a monopoly to the bank is therefore unconstitutional. . . .

It cannot be necessary to the character of the bank as a fiscal agent of the government that its private business should be exempted from that taxation to which all the state banks are liable, nor can I conceive it “proper” that the substantive and most essential powers reserved by the states shall be thus attacked and annihilated as a means of executing the powers delegated to the general government.3 It may be safely assumed that none of those sages who had an agency in forming or adopting our Constitution ever imagined that any portion of the taxing power of the states not prohibited to them nor delegated to Congress was to be swept away and annihilated as a means of executing certain powers delegated to Congress.

If our power over means is so absolute that the Supreme Court will not call in question the constitutionality of an act of Congress the subject of which “is not prohibited, and is really calculated to effect any of the objects entrusted to the government,” although, as in the case before me, it takes away powers expressly granted to Congress and rights scrupulously reserved to the states, it becomes us to proceed in our legislation with the utmost caution. Though not directly, our own powers and the rights of the states may be indirectly legislated away in the use of means to execute substantive powers. We may not enact that Congress shall not have the power of exclusive legislation over the District of Columbia, but we may pledge the faith of the United States that as a means of executing other powers it shall not be exercised for twenty years or forever. We may not pass an act prohibiting the states to tax the banking business carried on within their limits, but we may, as a means of executing our powers over other objects, place that business in the hands of our agents and then declare it exempt from state taxation in their hands. Thus may our own powers and the rights of the states, which we cannot directly curtail or invade, be frittered away and extinguished in the use of means employed by us to execute other powers. That a bank of the United States, competent to all the duties which may be required by the government, might be so organized as not to infringe on our own delegated powers or the reserved rights of the states I do not entertain a doubt. Had the executive been called upon to furnish the project of such an institution, the duty would have been cheerfully performed. In the absence of such a call it was obviously proper that he should confine himself to pointing out those prominent features in the act presented which in his opinion make it incompatible with the Constitution and sound policy. A general discussion will now take place, eliciting new light and settling important principles; and a new Congress, elected in the midst of such discussion, and furnishing an equal representation of the people according to the last census, will bear to the Capitol the verdict of public opinion, and, I doubt not, bring this important question to a satisfactory result. . . .

The bank is professedly established as an agent of the executive branch of the government, and its constitutionality is maintained on that ground. Neither upon the propriety of present action nor upon the provisions of this act was the executive consulted. It has had no opportunity to say that it neither needs nor wants an agent clothed with such powers and favored by such exemptions. There is nothing in its legitimate functions which makes it necessary or proper. Whatever interest or influence, whether public or private, has given birth to this act, it cannot be found either in the wishes or necessities of the executive department, by which present action is deemed premature, and the powers conferred upon its agent not only unnecessary, but dangerous to the government and country. . . .

It is to be regretted that the rich and powerful too often bend the acts of government to their selfish purposes. Distinctions in society will always exist under every just government. Equality of talents, of education, or of wealth cannot be produced by human institutions. In the full enjoyment of the gifts of heaven and the fruits of superior industry, economy, and virtue, every man is equally entitled to protection by law; but when the laws undertake to add to these natural and just advantages artificial distinctions, to grant titles, gratuities, and exclusive privileges, to make the rich richer and the potent more powerful, the humble members of society—the farmers, mechanics, and laborers—who have neither the time nor the means of securing like favors to themselves, have a right to complain of the injustice of their government. There are no necessary evils in government. Its evils exist only in its abuses. If it would confine itself to equal protection, and, as heaven does its rains, shower its favors alike on the high and the low, the rich and the poor, it would be an unqualified blessing. In the act before me there seems to be a wide and unnecessary departure from these just principles.

- 1. Jackson had two reasons for regarding the Bank of the United States as a monopoly. First, the Bank’s deposits were supported in part by federal taxpayer dollars, thereby giving the Bank a significant advantage over private banking institutions. Second, Congress created only one federal banking institution, making it the exclusive banking institution of the federal government.

- 2. McCulloch v. Maryland, 17 U.S. 4 Wheat. 316 316 (1819). In McCulloch, Chief Justice Marshall sustained the first Bank of the United States as an appropriate exercise of Congress’ power under Article I, section 8 “to make all laws which shall be necessary and proper for carrying into execution the foregoing powers, and all other powers vested by this Constitution in the government of the United States.” Ostensibly, Jackson was arguing that this recharter bill was not constitutional even according to the decision of McCulloch. Yet the very point of Marshall’s reasoning in the decision was to leave the choice of necessary means up to Congress: “Let the end be legitimate, let it be within the scope of the Constitution, and all means which are appropriate, which are plainly adapted to that end, which are not prohibited, but consist with the letter and spirit of the constitution.”

- 3. In McCulloch v. Maryland, Chief Justice Marshall decided that the state of Maryland could not lay a tax on the federally incorporate Bank of the United States. Jackson argued that by giving a wholesale exemption to a branch bank located within a state, the Bank of the United States would enjoy a privilege unavailable to any other banking institution.

Conversation-based seminars for collegial PD, one-day and multi-day seminars, graduate credit seminars (MA degree), online and in-person.