No study questions

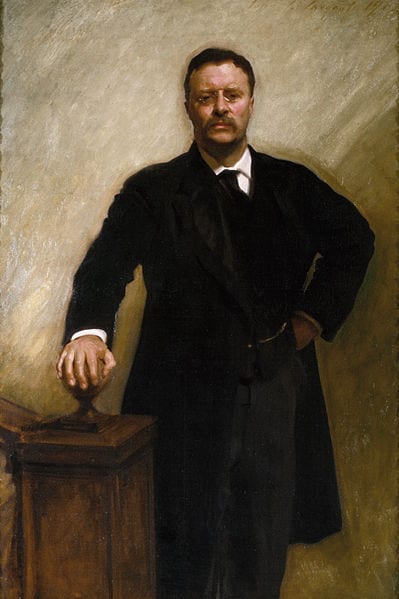

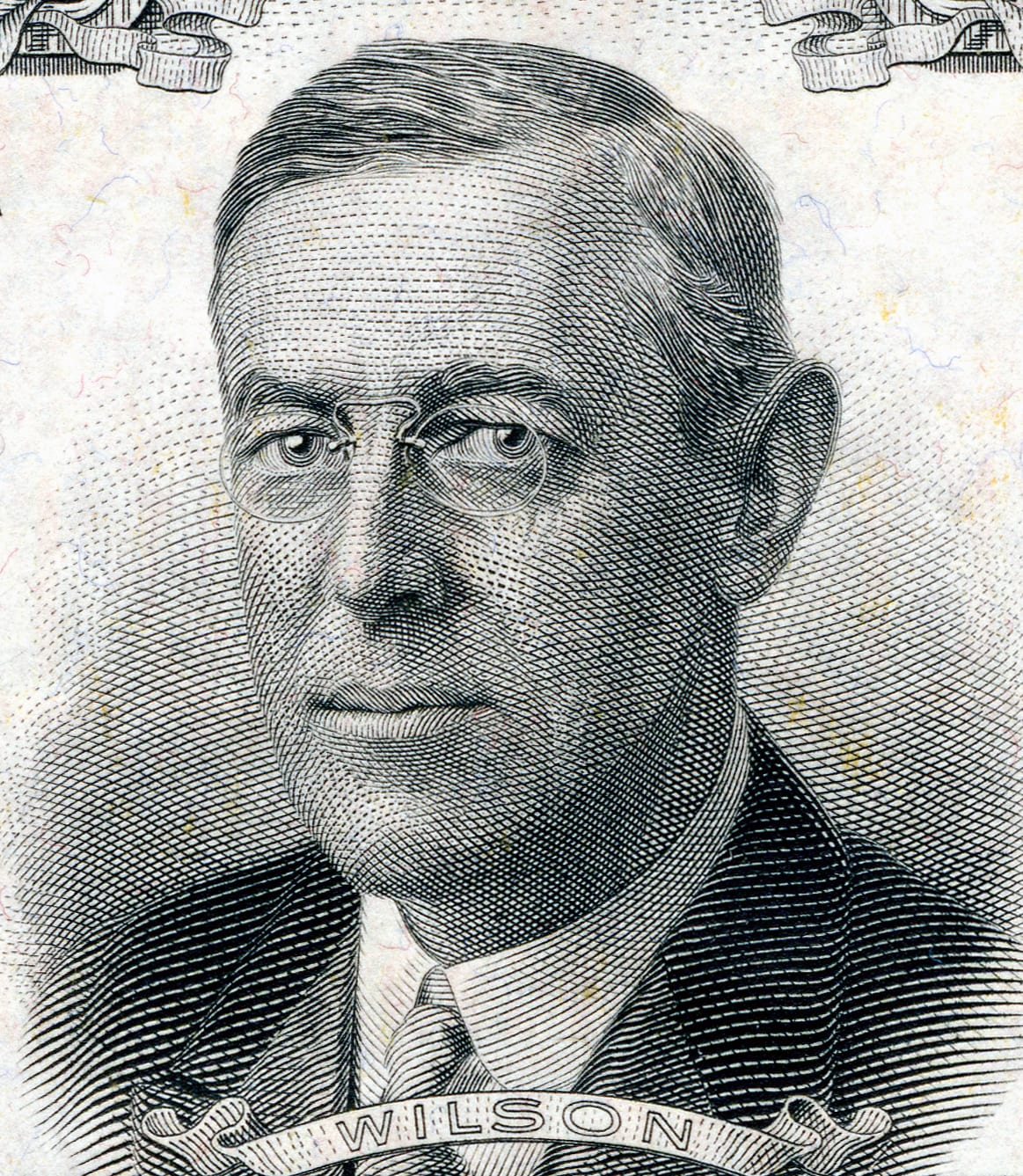

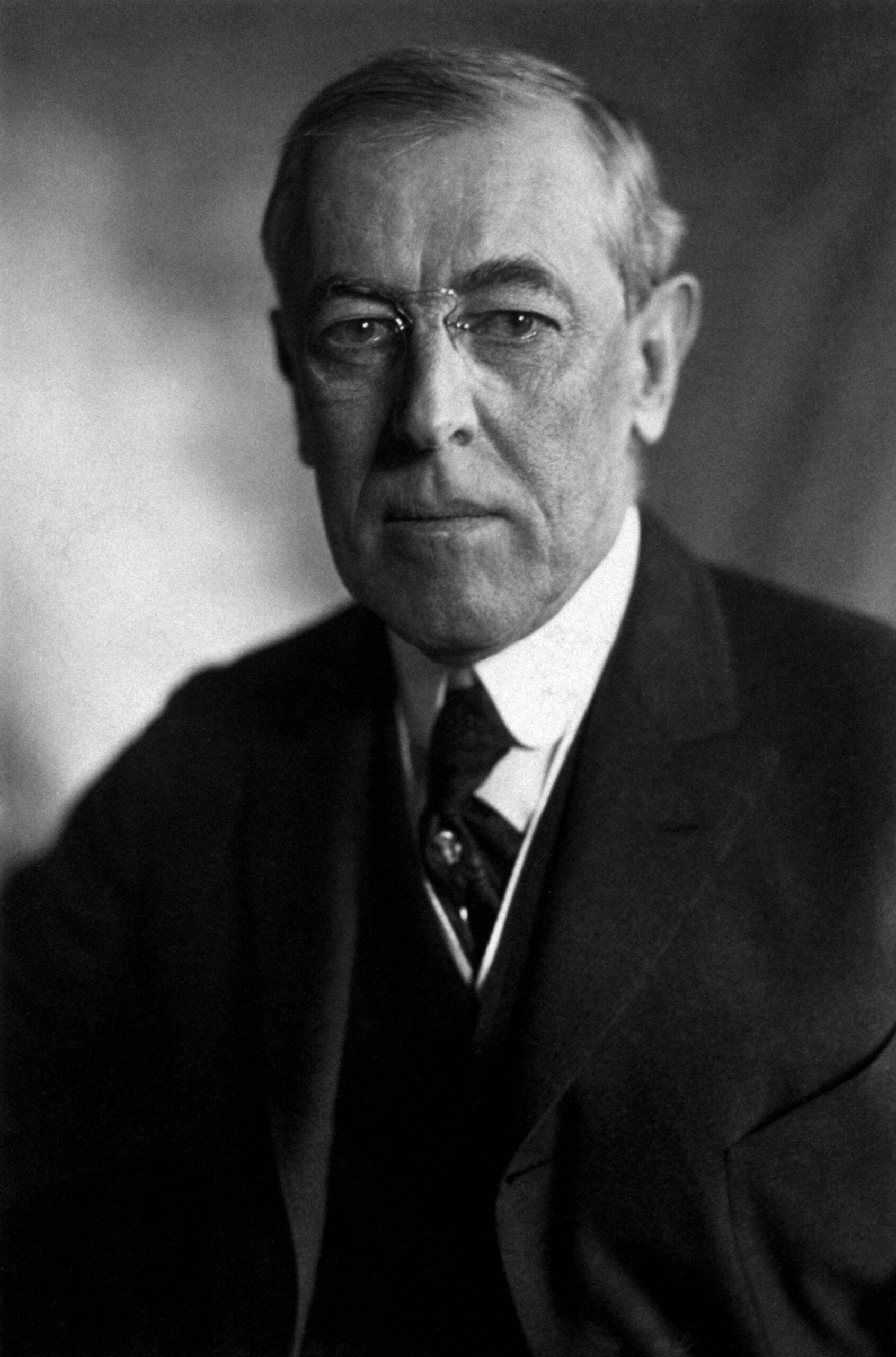

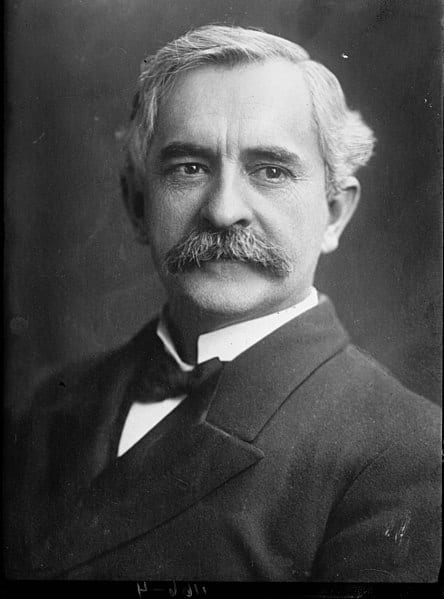

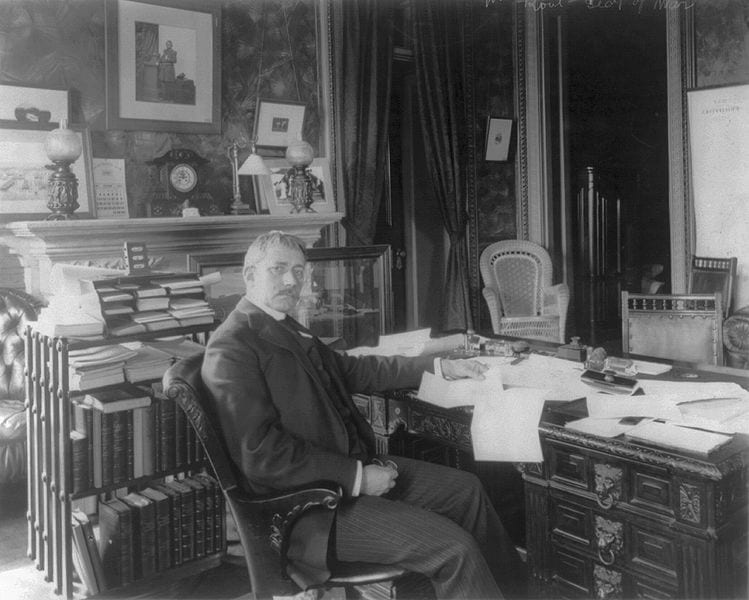

Annual Message of the President. (1912) Office of the Historian, U.S. Department of State. https://history.state.gov/historicaldocuments/frus1912/message-of-the-president

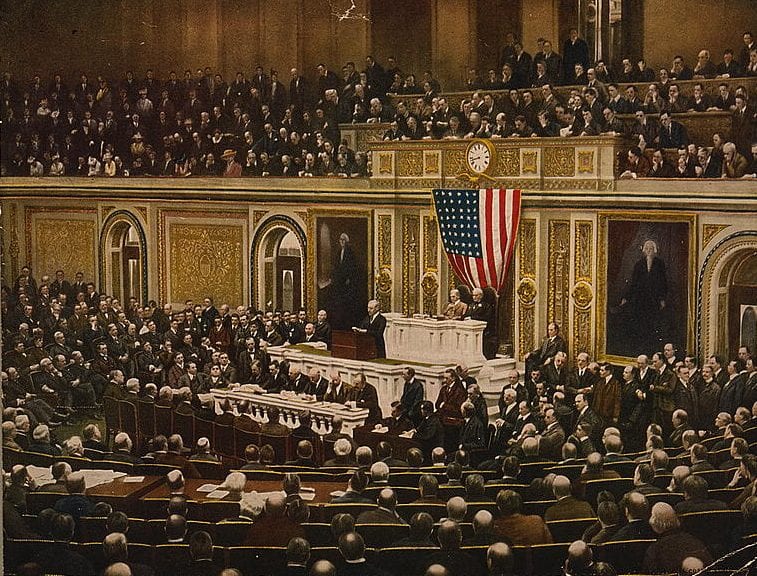

The foreign relations of the United States actually and potentially affect the state of the Union to a degree not widely realized and hardly surpassed by any other factor in the welfare of the whole nation. The position of the United States in the moral, intellectual, and material relations of the family of nations should be a matter of vital interest to every patriotic citizen. The national prosperity and power impose upon us duties which we cannot shirk if we are to be true to our ideals. The tremendous growth of the export trade of the United States has already made that trade a very real factor in the industrial and commercial prosperity of the country. With the development of our industries, the foreign commerce of the United States must rapidly become a still more essential factor in its economic welfare.

Whether we have a farseeing and wise diplomacy and are not recklessly plunged into unnecessary wars, and whether our foreign policies are based upon an intelligent grasp of present-day world conditions and a clear view of the potentialities of the future, or are governed by a temporary and timid expediency or by narrow views befitting an infant nation, are questions in the alternative consideration of which must convince any thoughtful citizen that no department of national polity offers greater opportunity for promoting the interests of the whole people on the one hand, or greater chance on the other of permanent national injury, than that which deals with the foreign relations of the United States.

The fundamental foreign policies of the United States should be raised high above the conflict of partisanship and wholly dissociated from differences as to domestic policy. In its foreign affairs the United States should present to the world a united front. The intellectual, financial, and industrial interests of the country and the publicist, the wage earner, the farmer, and citizen of whatever occupation must cooperate in a spirit of high patriotism to promote that national solidarity which is indispensable to national efficiency and to the attainment of national ideals.

The relations of the United States with all foreign powers remain upon a sound basis of peace, harmony, and friendship. A greater insistence upon justice to American citizens or interests wherever it may have been denied and a stronger emphasis of the need of mutuality in commercial and other relations have only served to strengthen our friendships with foreign countries by placing those friendships upon a firm foundation of realities as well as aspirations. . . .

DIPLOMACY A HANDMAID OF COMMERCIAL INTERCOURSE AND PEACE

The diplomacy of the present administration has sought to respond to modern ideas of commercial intercourse. This policy has been characterized as substituting dollars for bullets. It is one that appeals alike to idealistic humanitarian sentiments, to the dictates of sound policy and strategy, and to legitimate commercial aims. It is an effort frankly directed to the increase of American trade upon the axiomatic principle that the government of the United States shall extend all proper support to every legitimate and beneficial American enterprise abroad.

How great have been the results of this diplomacy, coupled with the maximum and minimum provision of the Tariff Law, will be seen by some consideration of the wonderful increase in the export trade of the United States. Because modern diplomacy is commercial, there has been a disposition in some quarters to attribute to it none but materialistic aims. How strikingly erroneous is such an impression may be seen from a study of the results by which the diplomacy of the United States can be judged.

SUCCESSFUL EFFORTS IN PROMOTION OF PEACE

In the field of work toward the ideals of peace, this government negotiated, but to my regret was unable to consummate, two arbitration treaties which set the highest mark of the aspiration of nations toward the substitution of arbitration and reason for war in the settlement of international disputes. Through the efforts of American diplomacy, several wars have been prevented or ended. I refer to the successful tripartite mediation of the Argentine Republic, Brazil, and the United States between Peru and Ecuador; the bringing of the boundary dispute between Panama and Costa Rica to peaceful arbitration; the staying of warlike preparations when Haiti and the Dominican Republic were on the verge of hostilities; the stopping of a war in Nicaragua; the halting of internecine strife in Honduras.

The government of the United States was thanked for its influence toward the restoration of amicable relations between the Argentine Republic and Bolivia. The diplomacy of the United States is active in seeking to assuage the remaining ill feeling between this country and the Republic of Colombia. In the recent civil war in China, the United States successfully joined the other interested powers in urging an early cessation of hostilities. An agreement has been reached between the governments of Chile and Peru whereby the celebrated Tacna-Arica dispute, which has so long embittered international relations on the west coast of South America, has at last been adjusted. Simultaneously came the news that the boundary dispute between Peru and Ecuador had entered upon a stage of amicable settlement.

The position of the United States in reference to the Tacna-Arica dispute between Chile and Peru has been one of nonintervention, but one of friendly influence and pacific counsel throughout the period during which the dispute in question has been the subject of interchange of views between this government and the two governments immediately concerned. In the general easing of international tension on the west coast of South America, the tripartite mediation, to which I have referred, has been a most potent and beneficent factor.

CHINA

In China the policy of encouraging financial investment to enable that country to help itself has had the result of giving new life and practical application to the open door policy. The consistent purpose of the present administration has been to encourage the use of American capital in the development of China by the promotion of those essential reforms to which China is pledged by treaties with the United States and other powers. The hypothecation to foreign bankers in connection with certain industrial enterprises, such as the Hukuang railways, of the national revenues upon which these reforms depended, led the Department of State, early in the administration, to demand for American citizens participation in such enterprises, in order that the United States might have equal rights and an equal voice in all questions pertaining to the disposition of the public revenues concerned.

The same policy of promoting international accord among the powers having similar treaty rights as ourselves in the matters of reform, which could not be put into practical effect without the common consent of all, was likewise adopted in the case of the loan desired by China for the reform of its currency. The principle of international cooperation in matters of common interest upon which our policy had already been based in all of the above instances has admittedly been a great factor in that concert of the powers which has been so happily conspicuous during the perilous period of transition through which the great Chinese nation has been passing.

CENTRAL AMERICA NEEDS OUR HELP IN DEBT ADJUSTMENT

In Central America the aim has been to help such countries as Nicaragua and Honduras to help themselves. They are the immediate beneficiaries. The national benefit to the United States is twofold. First, it is obvious that the Monroe Doctrine is more vital in the neighborhood of the Panama Canal and the zone of the Caribbean than anywhere else. There, too, the maintenance of that doctrine falls most heavily upon the United States. It is therefore essential that the countries within that sphere shall be removed from the jeopardy involved by heavy foreign debt and chaotic national finances and from the ever present danger of international complications due to disorder at home. Hence, the United States has been glad to encourage and support American bankers who were willing to lend a helping hand to the financial rehabilitation of such countries because this financial rehabilitation and the protection of their customhouses from being the prey of would-be dictators would remove at one stroke the menace of foreign creditors and the menace of revolutionary disorder.

The second advantage to the United States is one affecting chiefly all the Southern and Gulf ports and the business and industry of the South. The republics of Central America and the Caribbean possess great natural wealth. They need only a measure of stability and the means of financial regeneration to enter upon an era of peace and prosperity, bringing profit and happiness to themselves and at the same time creating conditions sure to lead to a flourishing interchange of trade with this country.

I wish to call your especial attention to the recent occurrences in Nicaragua, for I believe the terrible events recorded there during the revolution of the past summer — the useless loss of life, the devastation of property, the bombardment of defenseless cities, the killing and wounding of women and children, the torturing of noncombatants, to exact contributions, and the suffering of thousands of human beings — might have been averted had the Department of State, through approval of the loan convention by the Senate, been permitted to carry out its now well-developed policy of encouraging the extending of financial aid to weak Central American states, with the primary objects of avoiding just such revolutions by assisting those republics to rehabilitate their finances, to establish their currency on a stable basis, to remove the customhouses from the danger of revolutions by arranging for their secure administration, and to establish reliable banks.

During this last revolution in Nicaragua, the government of that republic having admitted its inability to protect American life and property against acts of sheer lawlessness on the part of the malcontents, and having requested this government to assume that office, it became necessary to land over 2,000 Marines and Bluejackets in Nicaragua. Owing to their presence the constituted government of Nicaragua was free to devote its attention wholly to its internal troubles, and was thus enabled to stamp out the rebellion in a short space of time. When the Red Cross supplies sent to Granada had been exhausted, 8,000 persons having been given food in one day upon the arrival of the American forces, our men supplied other unfortunate, needy Nicaraguans from their own haversacks.

I wish to congratulate the officers and men of the United States Navy and Marine Corps who took part in reestablishing order in Nicaragua upon their splendid conduct, and to record with sorrow the death of seven American Marines and Bluejackets. Since the reestablishment of peace and order, elections have been held amid conditions of quiet and tranquillity. Nearly all the American Marines have now been withdrawn. The country should soon be on the road to recovery. The only apparent danger now threatening Nicaragua arises from the shortage of funds. Although American bankers have already rendered assistance, they may naturally be loath to advance a loan adequate to set the country upon its feet without the support of some such convention as that of June 1911, upon which the Senate has not yet acted.

ENFORCEMENT OF NEUTRALITY LAWS

In the general effort to contribute to the enjoyment of peace by those Republics which are near neighbors of the United States, the administration has enforced the so-called neutrality statutes with a new vigor, and those statutes were greatly strengthened in restricting the exportation of arms and munitions by the joint resolution of last March. It is still a regrettable fact that certain American ports are made the rendezvous of professional revolutionists and others engaged in intrigue against the peace of those Republics. It must be admitted that occasionally a revolution in this region is justified as a real popular movement to throw off the shackles of a vicious and tyrannical government. Such was the Nicaraguan revolution against the Zelaya regime. A nation enjoying our liberal institutions can not escape sympathy with a true popular movement, and one so well justified. In very many cases, however, revolutions in the Republics in question have no basis in principle, but are due merely to the machinations of conscienceless and ambitious men, and have no effect but to bring new suffering and fresh burdens to an already oppressed people. The question whether the use of American ports as foci of revolutionary intrigue can be best dealt with by a further amendment to the neutrality statutes or whether it would be safer to deal with special cases by special laws is one worthy of the careful consideration of the Congress.

OUR MEXICAN POLICY

For two years revolution and counter-revolution has distraught the neighboring Republic of Mexico. Brigandage has involved a great deal of depredation upon foreign interests. There have constantly recurred questions of extreme delicacy. On several occasions very difficult situations have arisen on our frontier. Throughout this trying period, the policy of the United States has been one of patient nonintervention, steadfast recognition of constituted authority in the neighboring nation, and the exertion of every effort to care for American interests. I profoundly hope that the Mexican nation may soon resume the path of order, prosperity, and progress. To that nation in its sore troubles, the sympathetic friendship of the United States has been demonstrated to a high degree. There were in Mexico at the beginning of the revolution some thirty or forty thousand American citizens engaged in enterprises contributing greatly to the prosperity of that Republic and also benefiting the important trade between the two countries. The investment of American capital in Mexico has been estimated at $1,000,000,000. The responsibility of endeavoring to safeguard those interests and the dangers inseparable from propinquity to so turbulent a situation have been great, but I am happy to have been able to adhere to the policy above outlined-a policy which I hope may be soon justified by the complete success of the Mexican people in regaining the blessings of peace and good order.

INCREASE OF FOREIGN TRADE

In my last annual message I said that the fiscal year ended June 30, 1911, was noteworthy as marking the highest record of exports of American products to foreign countries. The fiscal year 1912 shows that this rate of advance has been maintained, the total domestic exports having a valuation approximately Of $2,200,000,000, as compared with a fraction over $2,000,000,000 the previous year. It is also significant that manufactured and partly manufactured articles continue to be the chief commodities forming the volume of our augmented exports . . . .

BUSINESS SECURED TO OUR COUNTRY BY DIRECT OFFICIAL EFFORT

As illustrating the commercial benefits of the Nation derived from the new diplomacy and its effectiveness upon the material as well as the more ideal side, it may be remarked that through direct official efforts alone there have been obtained in the course of this administration, contracts from foreign Governments involving an expenditure of $50,000,000 in the factories of the United States. Consideration of this fact and some reflection upon the necessary effects of a scientific tariff system and a foreign service alert and equipped to cooperate with the business men of America carry the conviction that the gratifying increase in the export trade of this country is, in substantial amount, due to our improved governmental methods of protecting and stimulating it.

GOVERNMENTAL EFFORT IN RETENTION AND EXPANSION OF OUR FOREIGN TRADE

It is not possible to make to the Congress a communication upon the present foreign relations of the United States so detailed as to convey an adequate impression of the enormous increase in the importance and activities of those relations. If this government is really to preserve to the American people that free opportunity in foreign markets which will soon be indispensable to our prosperity, even greater efforts must be made. Otherwise the American merchant, manufacturer, and exporter will find many a field in which American trade should logically predominate preempted through the more energetic efforts of other governments and other commercial nations.

There are many ways in which, through hearty cooperation, the legislative and executive branches of this government can do much. The absolute essential is the spirit of united effort and singleness of purpose. I will allude only to a very few specific examples of action which ought then to result.

America cannot take its proper place in the most important fields for its commercial activity and enterprise unless we have a Merchant Marine. American commerce and enterprise cannot be effectively fostered in those fields unless we have good American banks in the countries referred to. We need American newspapers in those countries and proper means for public information about them.

We need to assume the permanency of a trained foreign service. We need legislation enabling the members of the foreign service to be systematically brought in direct contact with the industrial, manufacturing, and exporting interests of this country in order that American businessmen may enter the foreign field with a clear perception of the exact conditions to be dealt with and the officers themselves may prosecute their work with a clear idea of what American industrial and manufacturing interests require.

CONCLUSION

Congress should fully realize the conditions which obtain in the world as we find ourselves at the threshold of our middle age as a nation. We have emerged full grown as a peer in the great concourse of nations. We have passed through various formative periods. We have been self-centered in the struggle to develop our domestic resources and deal with our domestic questions. The nation is now too mature to continue in its foreign relations those temporary expedients natural to a people to whom domestic affairs are the sole concern.

In the past, our diplomacy has often consisted, in normal times, in a mere assertion of the right to international existence. We are now in a larger relation with broader rights of our own and obligations to others than ourselves. A number of great guiding principles were laid down early in the history of this government. The recent task of our diplomacy has been to adjust those principles to the conditions of today, to develop their corollaries, to find practical applications of the old principles expanded to meet new situations. . . . The successful conduct of our foreign relations demands a broad and a modern view. We cannot meet new questions nor build for the future if we confine ourselves to outworn dogmas of the past and to the perspective appropriate at our emergence from colonial times and conditions. . . .

The Heirs of Abraham Lincoln

February 12, 1913

Conversation-based seminars for collegial PD, one-day and multi-day seminars, graduate credit seminars (MA degree), online and in-person.