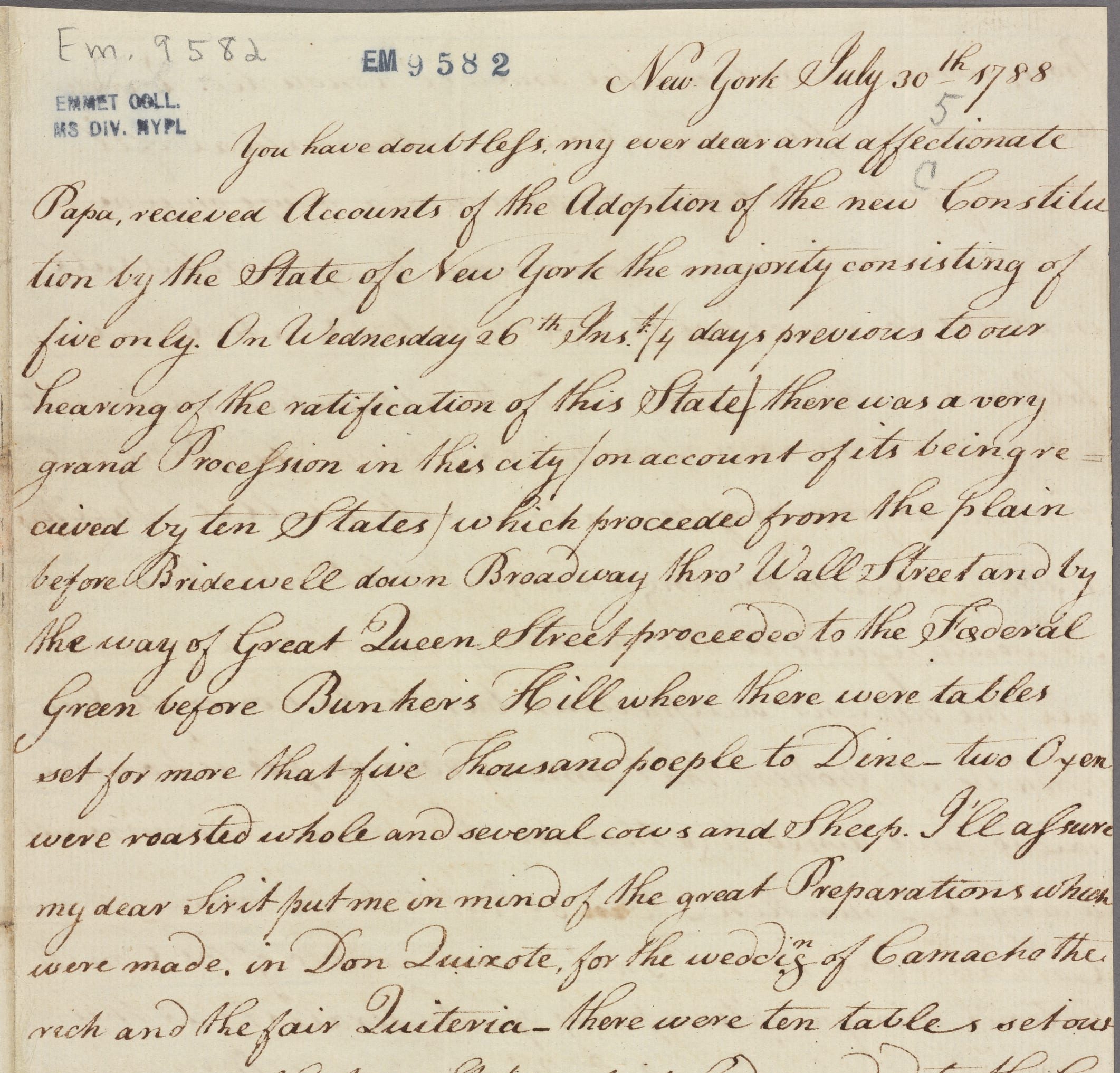

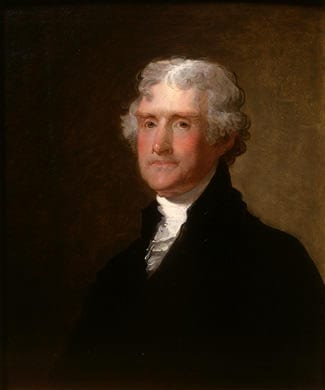

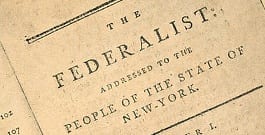

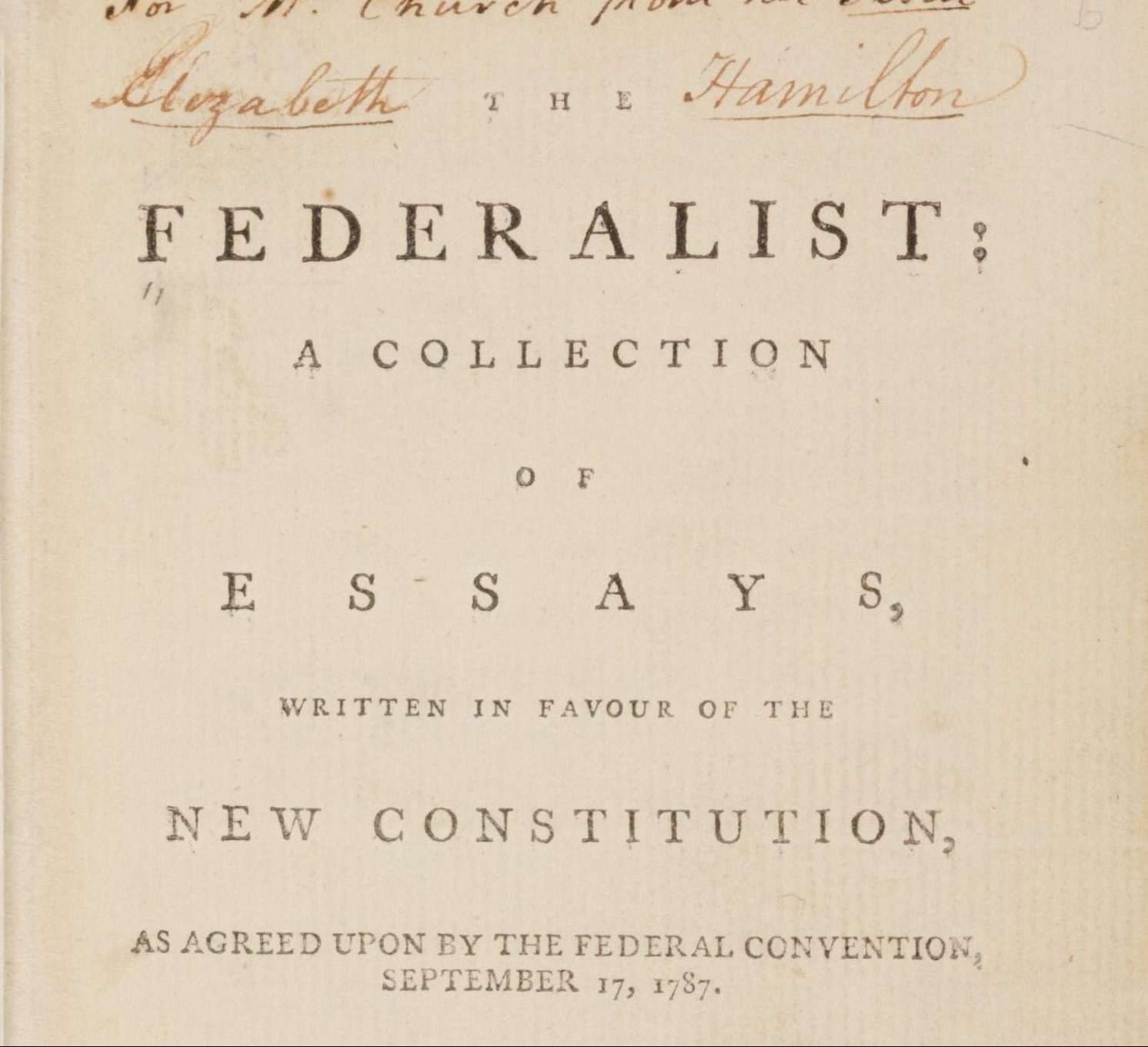

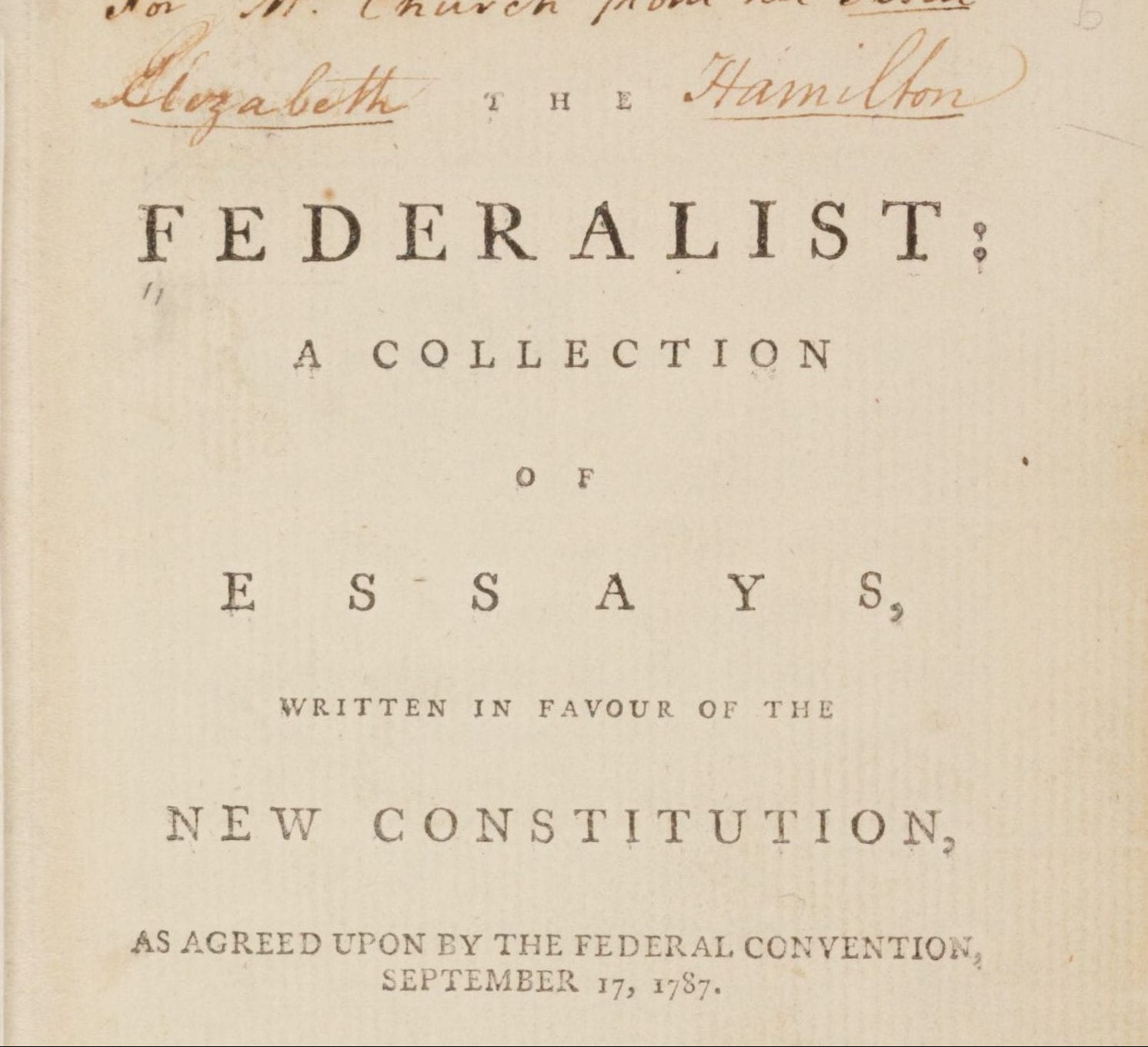

To the People of the State of New York,

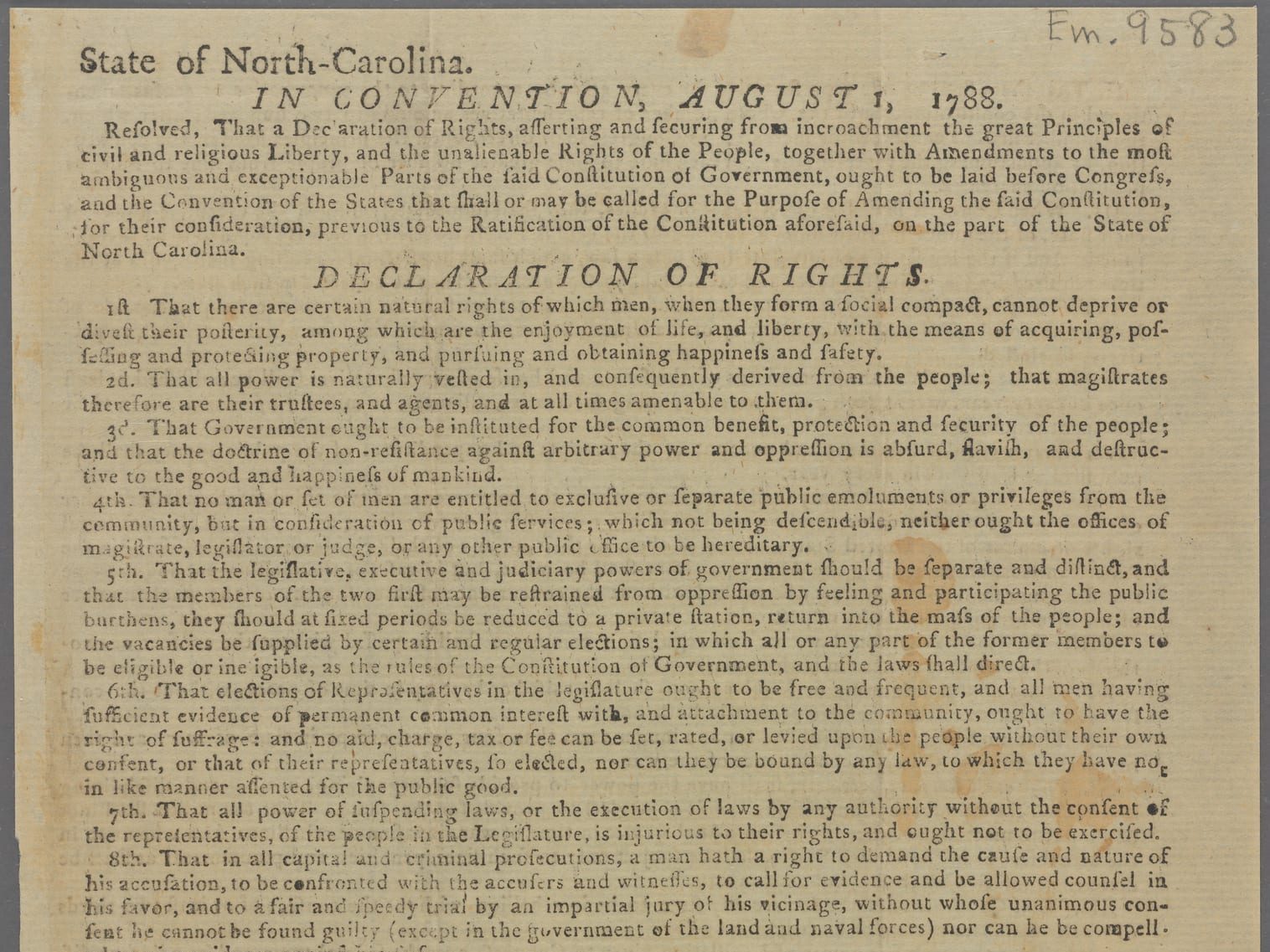

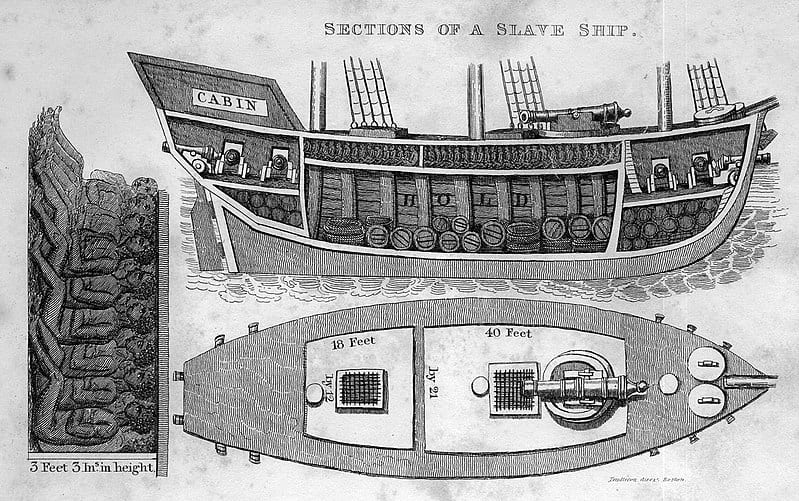

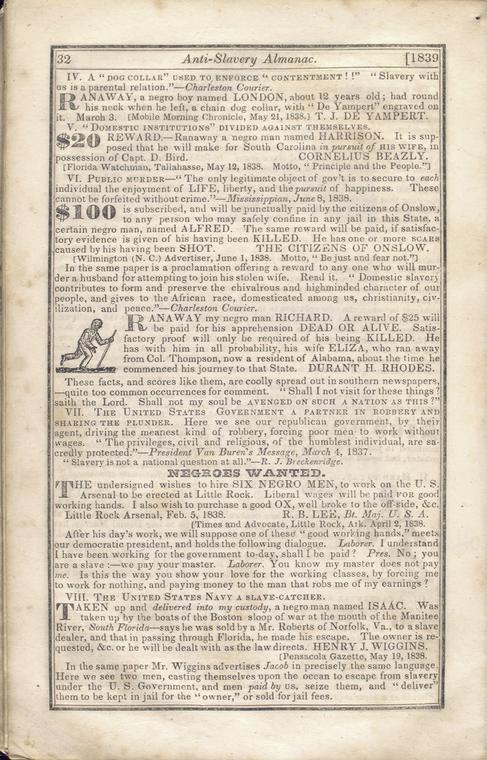

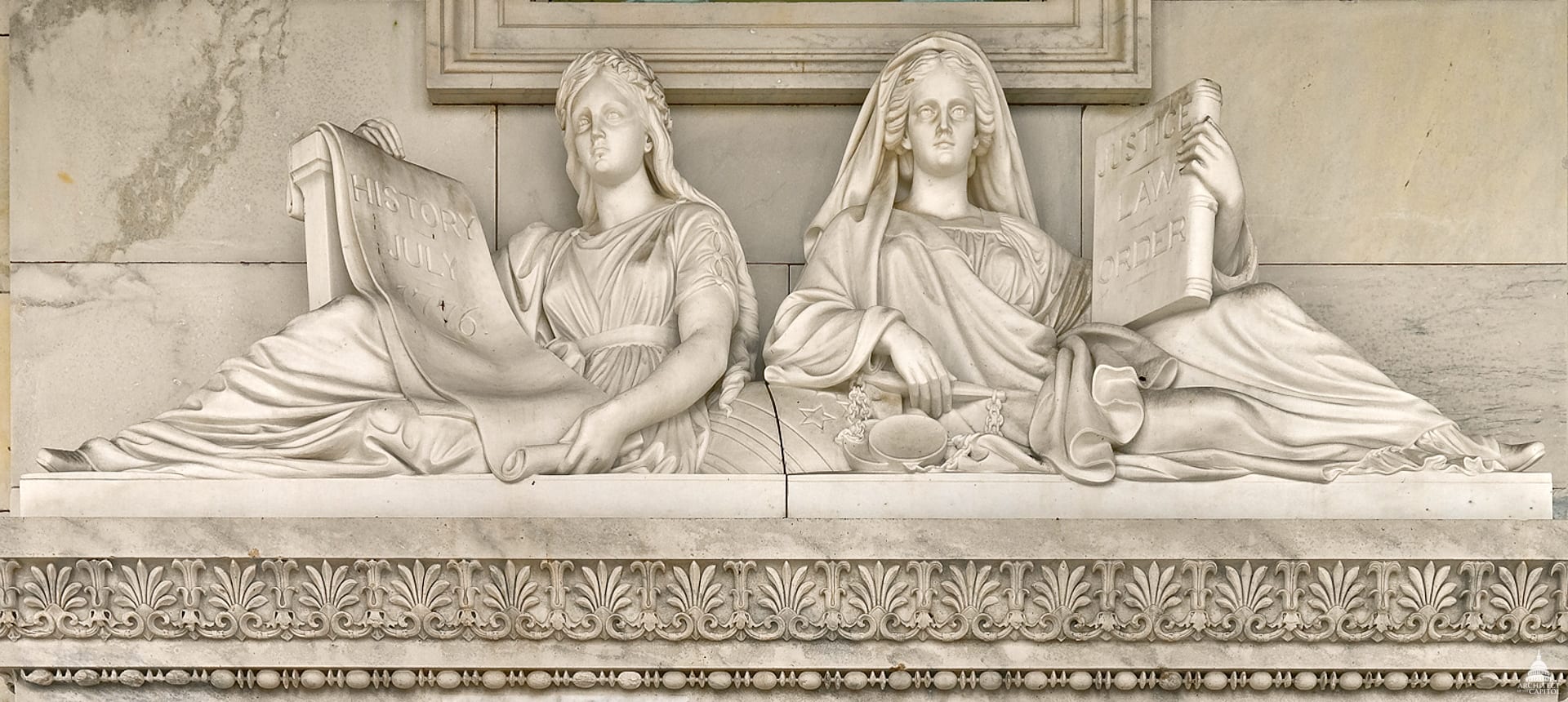

The next objection that arises against this proferred constitution is, that the apportionment of representatives and direct taxes are unjust.—The words as expressed in this article are, “representatives and direct taxes shall be apportioned among the several states, which may be included in this union, according to their respective numbers, which shall be determined by adding to the whole number of free persons, including those bound to service for a term of years, and excluding Indians not taxed three fifths of all other persons.” In order to elucidate this, it will be necessary to repeat the remark in my last number, that the mode of legislation in the infancy of free communities was by the collective body, and this consisted of free persons, or those whose age admitted them to the rights of mankind and citizenship—whose sex made them capable of protecting the state, and whose birth may be dominated Free Born, and no traces can be found that even women, children, and slaves, or those who were not sui juris, in the early days of legislation, meeting with the free members of the community to deliberate on public measures; hence is derived this maxim in free governments, that representation ought to bear a proportion to the number of free inhabitants in a community; this principle your own state constitution, and others, have observed in the establishment of a future census, in order to apportion the representatives, and to increase or diminish the representation to the ratio of the increase or diminution of electors. But, what aid can the community derive from the assistance of women, infants, and slaves, in their deliberation, or in their defence? and what motive therefore could the convention have in departing from the just and rational principle of representation, which is the governing principle of this state and of all America.

The doctrine of taxation is a very important one, and nothing requires more wisdom and prudence than the regulation of that portion, which is taken from, and of that which is left to, the subject—and if you anticipate, what will be the enormous expence of this new government added also to your own, little will that portion be which will be left to you. I know there are politicians who believe, that you should be loaded with taxes, in order to make you industrious, and, perhaps, there were some of this opinion in the convention, but it is an erroneous principle—For, what can inspire you with industry, if the greatest measures of your labours are to be swallowed up in taxes? The advocates for this new system hold out an idea, that you will have but little to pay, for, that the revenues will be so managed as to be almost wholly drawn from the source of trade or duties on imports, but this is delusive—for this government to discharge all its incidental expences, besides paying the interests on the home and foreign debts, will require more money than its commerce can afford; and if you reflect one moment, you will find, that if heavy duties are laid on merchandize, as must be the case, if government intend to make this the prime medium to lighten the people of taxes, that the price of the commodities, useful as well as luxurious, must be increased; the consumers will be fewer; the merchants must import less; trade will languish, and this source of revenue in a great measure be dried up; but if you examine this a little further, you will find, that this revenue, managed in this way, will come out of you and be a very heavy and ruinous one, at least—The merchant no more than advances the money for you to the public, and will not, not cannot pay any part of it himself, and if he pays more duties, he will sell his commodities at a price portionably raised—thus the laborer, mechanic, and farmer, must feel it in the purchase of their utensils and clothing—wages, &c. must rise with the price of things, or they must be ruined, and that must be the case with the farmer, whose produce will not increase, in the ratio, with labour, utensils, and clothing; for that he must sell at the usual price or lower, perhaps, caused by the decrease of trade; the consequence will be, that he must mortgage his farm, and then comes inevitable bankruptcy.

In what manner then will you be eased, if the expences of government are to be raised solely out of the commerce of this country; do you not readily apprehend the fallacy of this argument. But government will find, that to press so heavily on commerce will not do, and therefore must have recourse to other objects; these will be a capitation or poll-tax, window lights, &c. &c. And a long train of impositions which their ingenuity will suggest; but will you submit to be numbered like the slaves of an arbitrary despot; and what will be your reflections when the tax-master thunders at your door for the duty on that light which is the bounty of heaven. It will be the policy of the great landholders who will chiefly compose this senate, and perhaps a majority of this house of representatives, to keep their lands free from taxes; and this is confirmed by the failure of every attempt to lay a land-tax in this state; hence recourse must and will be had to the sources I mentioned before. The burdens on you will be insupportable—your complaints will be inefficacious—this will beget public disturbances, and I will venture to predict, without the spirit of prophecy, that you and the government, if it is adopted, will one day be at issue on this point. The force of government will be exerted, this will call for an increase of revenue, and will add fuel to the fire. The result will be, that either you will revolve to some other form, or that government will give peace to the country, by destroying the opposition. If government therefore can, notwithstanding every opposition, raise a revenue on such things as are odious and burdensome to you, they can do any thing.

But why should the number of individuals be the principle to apportion the taxes in each state, and to include in that number, women, children and slaves. The most natural and equitable principle of apportioning taxes, would be in a ratio to their property, and a reasonable impost in a ratio to their trade; but you are told to look for the reason of these things in accommodation; but this much admired principle, when striped of its mistery, will in this case appear to be no less than a basis for an odious poll-tax—the offspring of despotic governments, a thing so detestable, that the state of Maryland, in their bill of rights, declares, “that the levying taxes by the poll, is grievous and oppressive, and ought to be abolished.”—A poll-tax is at all times oppressive to the poor, and their greatest misfortune will consist in having more prolific wives than the right.

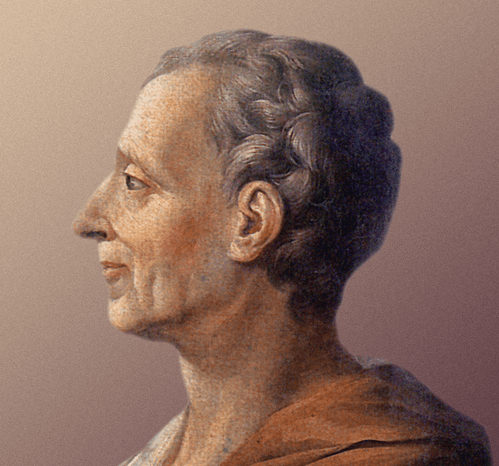

In every civilized community, even in those of the most democratic kind, there are principles which lead to an aristocracy—these are superior talents, fortunes, and public employments. But in free governments, the influence of the two former is resisted by the equality of the laws, and the latter by the frequency of elections, and the chance that every one has in sharing in public business; but when this natural and artificial eminence is assisted by principles interwoven in this government—when the senate, so important a branch of the legislature, is so far removed from the people, as to have little or no connexion with them; when their duration in office is such as to have the resemblance to perpetuity, when they are connected with the executive, by the appointment of all officers, and also, to become a judiciary for the trial of officers of their own appointments: added to all this, when none but men of opulence will hold a seat, what is there left to resist and repel this host of influence and power. Will the feeble efforts of the house of representatives, in whom your security ought to subsist, consisting of about seventy-three, be able to hold the balance against them, when, from the fewness of the number in this house, the senate will have in their power to poison even a majority of that body by douceurs of office for themselves or friends. From causes like this both Montesquieu and Hume have predicted the decline of the British government into that of an absolute one; but the liberties of this country, it is probable if this system is adopted, will be strangled in their birth; for whenever the executive and senate can destroy the independence of the majority in the house of representatives then where is your security?—They are so intimately connected, that their interests will be one and the same; and will the slow increase of numbers be able to afford a repelling principle? but you are told to adopt this government first, and you will always be able to alter it afterwards; this would be first submitting to be slaves and then taking care of your liberty; and when your chains are on, then to act like freemen.

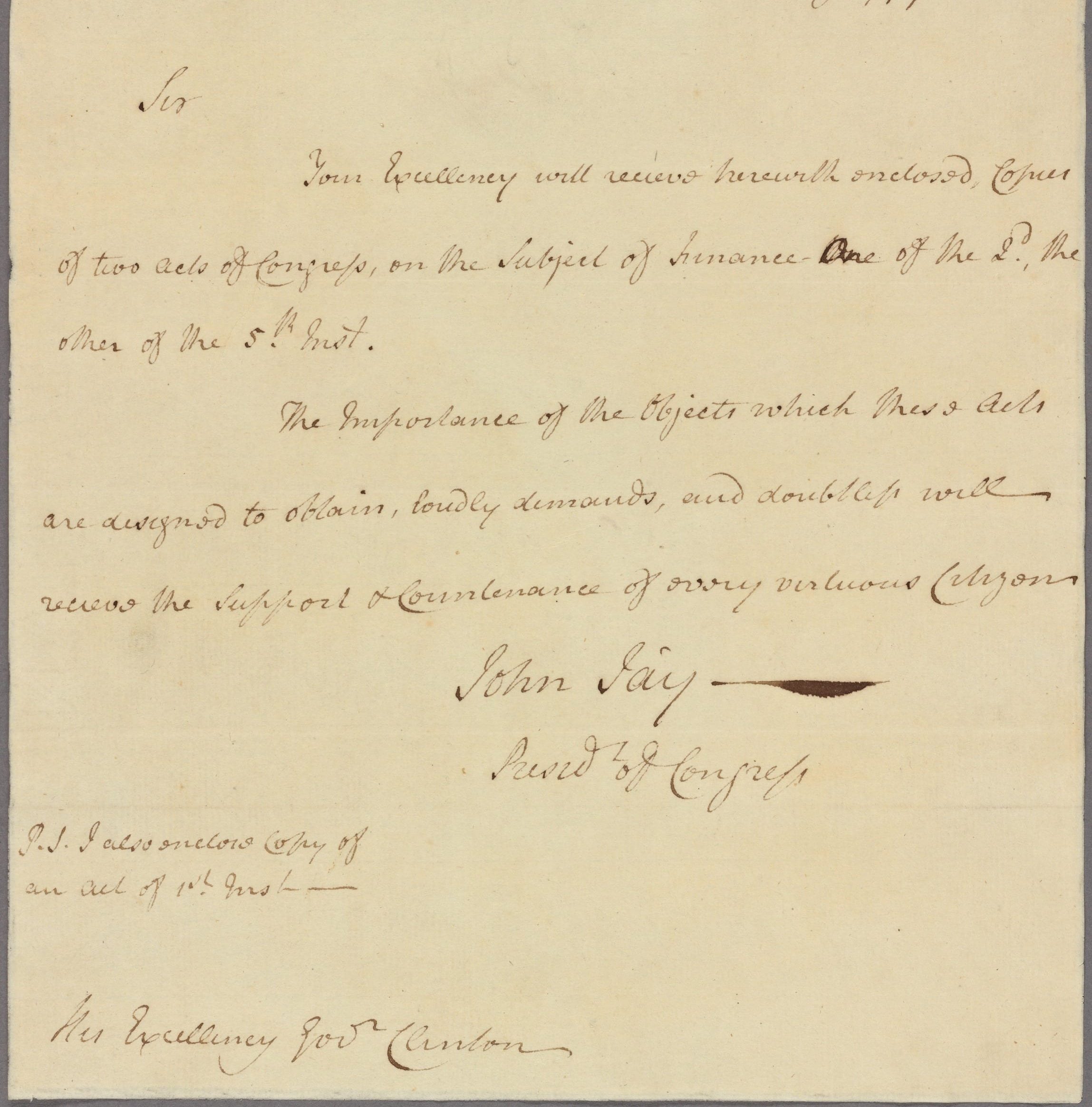

Complete acts of legislation, which are to become the supreme law of the land, ought to be the united act of all the branches of government; but there is one of the most important duties may be managed by the senate and executive alone, and to have all the force of the law paramount without the aid or interference of the house of representatives; that is the power of making treaties. This power is a very important one, and may be exercised in various ways, so as to affect your person and property, and even the domain of the nation. By treaties you may defalcate part of the empire; engagements may be made to raise an army, an you may be transported to Europe, to fight the wars of ambitious princes; money may be contracted for, and you must pay it; and a thousand other obligations may be entered into; all which will become the supreme law of the land, and you are bound by it. If the treaties are erroneously or wickedly made who is there to punish—the executive can always cover himself with the plea, that he was advised by the senate, and the senate being a collective body are not easily made accountable for mal-administration. On this account we are in a worse situation than Great-Britain, where they have secured by a ridiculous fiction, the King from accountability, by declaring; that he can do no wrong; by which means the nation can have redress against his minister; but with us infallibility pervades every part of the system, and neither the executive nor his council, who are a collective body, and his advisers, can be brought to punishment for mal-administration.

CATO

Brutus 5

December 13, 1787

Conversation-based seminars for collegial PD, one-day and multi-day seminars, graduate credit seminars (MA degree), online and in-person.

![Finley, A. (1829) Pennsylvania. Philada. [Map] Retrieved from the Library of Congress, https://www.loc.gov/item/98688548/.](/content/uploads/2024/02/Map-of-PA--273x190.jpg)