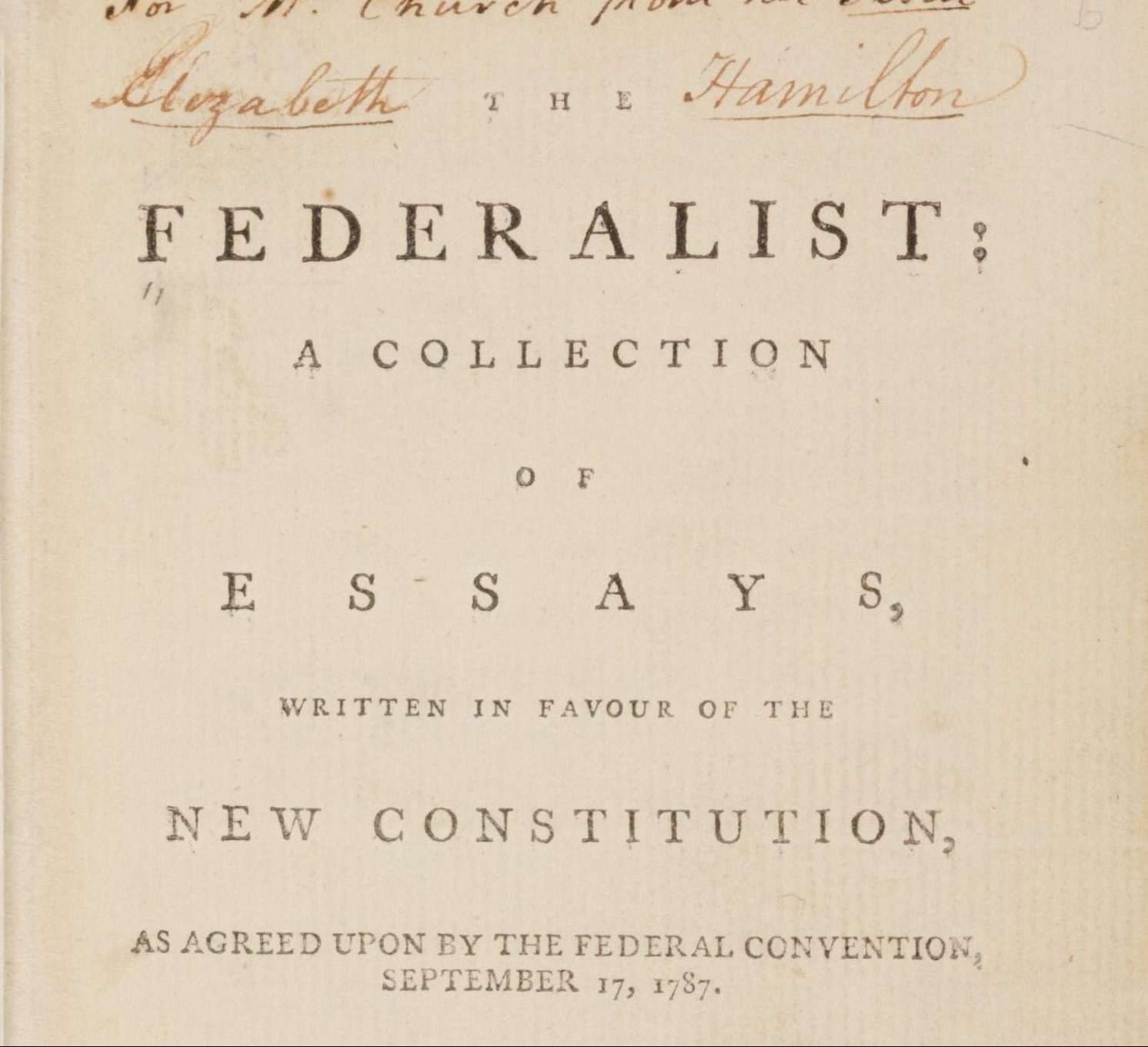

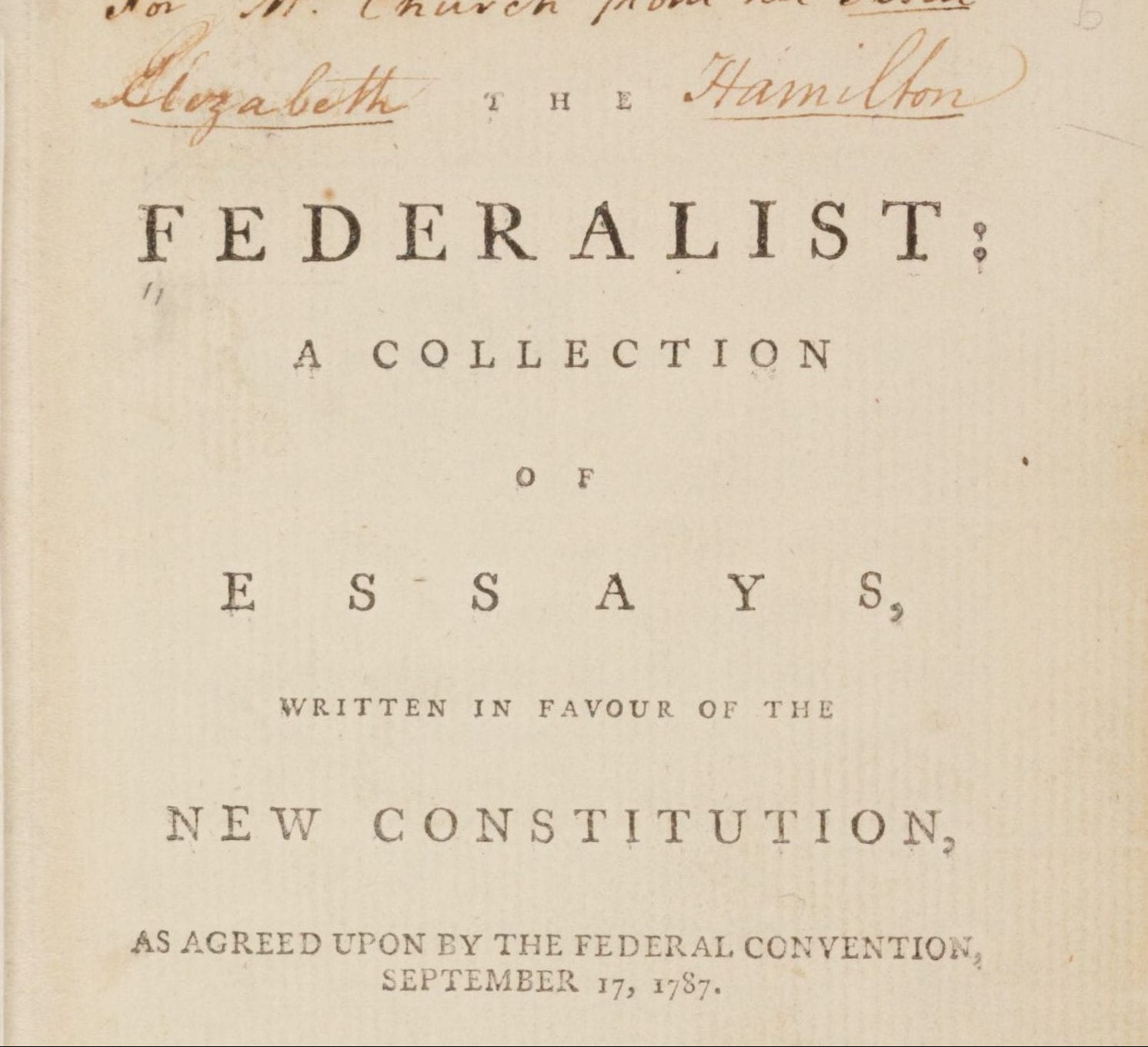

The paragraph which respects taxes, imposts and excises, was largely debated, by several Gentlemen.

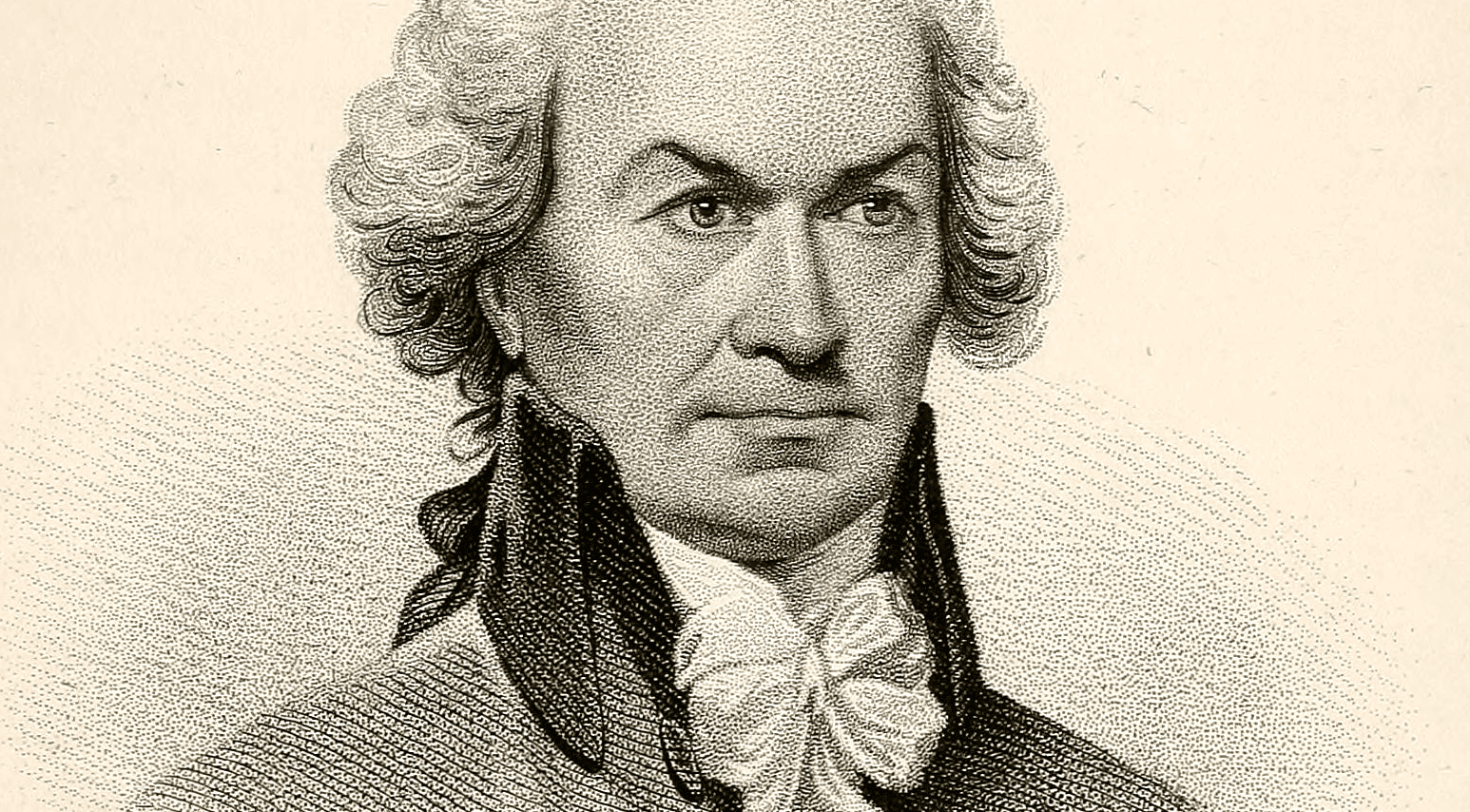

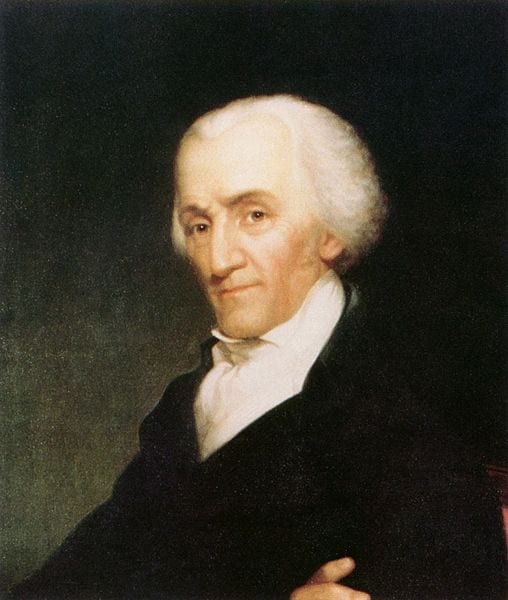

Gen. Wadsworth objected against it, because it gave the power of the purse to the general Legislature; another paragraph gave the power of the sword; and that authority, which has the power of the sword and purse, is despotic. He objected against imposts and excises, because their operation would be partial and in favour of the southern States. Some other objections were likewise made against this Paragraph. In answer to them Mr. Ellsworth expressed himself nearly to the following effect.

Mr. President, This is a most important clause in the constitution; and the Gentlemen do well to offer all the objections which they have against it. Through the whole of this debate, I have attended to the objections which have been made against this clause; and I think them all to be unfounded. The clause is general; it gives the general Legislature “power to lay and collect taxes, duties, imposts and excises to pay the debts, and provide for the common defence and general welfare of the United States.” There are three objections against this clause. First, that it is too extensive, it extends to all the objects of taxation; secondly, that it is partial; thirdly, that Congress ought not to have power to lay taxes at all.

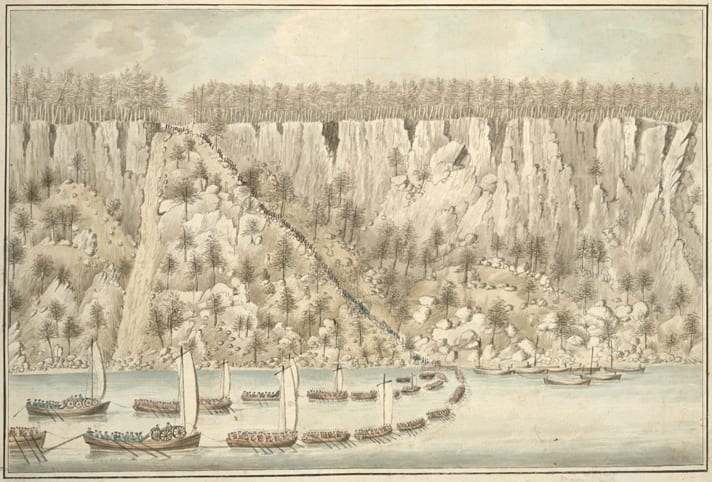

The first objection is that this clause extends to all the objects of taxation. But, though it does extend to all, it does not extend to them exclusively. It does not say that Congress shall have all these sources of revenue, and the States none. All, excepting the impost, still lie open to the States. This State owes a debt, it must provide for the payment of it. So do all the other States. This will not escape the attention of Congress. When making calculations to raise a revenue, they will bear this in mind. They will not take away that which is necessary for the States. They are the head, and will take care that the members do not perish. The State debt, which now lies heavy upon us arose, from the want of powers in the federal system. Give the necessary powers to the national government, and the State will not be again necessitated to involve itself in debt for its defence in war. It will lie upon the national government to defend all the States, to defend all its members, from hostile attacks. The United States will bear the whole burden of war. It is necessary, that the power of the general Legislature should extend to all the objects of taxation, that Government should be able to command all the resources of the country; because no man can tell what our exigencies may be. Wars have now become rather war of the purse, than of the sword. Government must therefore be able to command the whole power of the purse; otherwise a hostile nation may look into our constitution, see what resources are in the power of Government, and calculate to go a little beyond us; then they may obtain a decided superiority over us, and reduce us to the utmost distress. A gov—ernment, which can command but half its resources, is like a man with but one arm to defend himself.

The second objection is that the impost is not a proper mode of taxation; that it is partial to the southern States. I confess I am mortified, when I find gentlemen supposing that their delegates in convention were inattentive to their duty, and made a sacrifice of the interests of their constituents. If however the impost be a partial mode, this circumstance, high as my opinion of it is, would stagger my belief in it; for I abhor partiality. But I think there are three special reasons, why an impost is the best way of raising a national revenue.

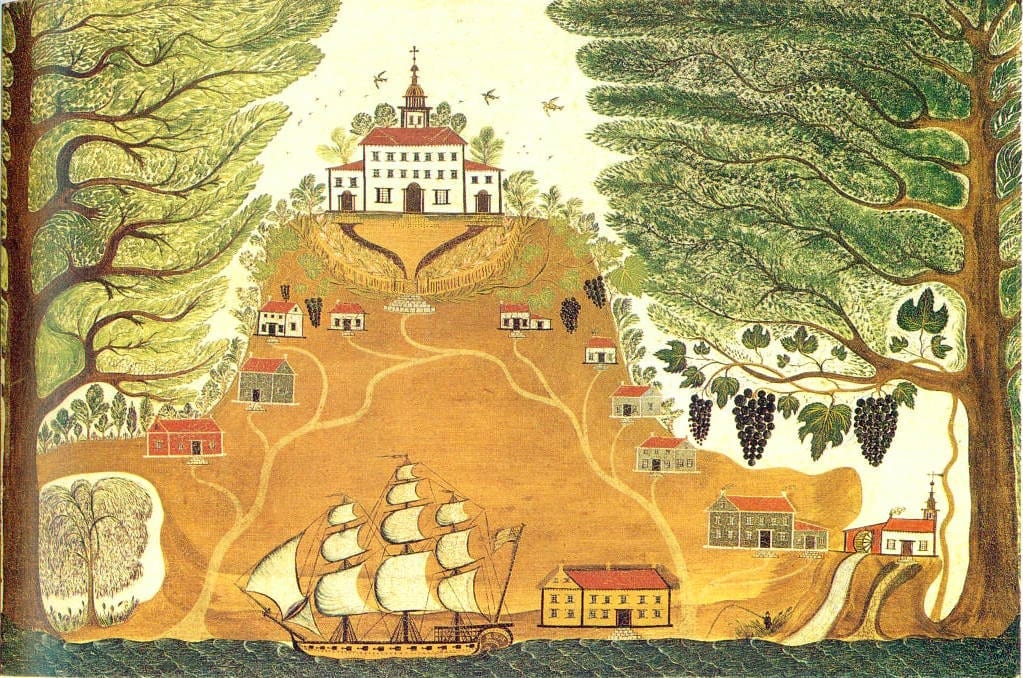

The first is, it is the most fruitful and easy way. All nations have found it to be so. Direct taxation can go but little way towards raising a revenue. To raise money in this way, people must be provident; they must be constantly laying up money to answer the demands of the collector. But you cannot make people thus provident; if you would do any thing to purpose, you must come in when they are spending, and take a part with them. This does not take away the tools of a man’s business, or the necessary utensils of his family: It only comes in, when he is taking his pleasure, and feels generous, when he is laying out a shilling for superfluities, it takes two—pence of it for public use, and the remainder will do him as much good as the whole. I will instance two facts, which shew how easily and insensibly a revenue is raised by indirect taxation. I suppose people in general are not sensible, that we pay a tax to the State of New—York. Yet it is an uncontrovertible fact, that we the people of Connecticut pay annually into the Treasury of New—York more than fifty Thousand Dollars. Another instance I will mention: One of our common river sloops pays in the West—Indies a Portage Bill of £.60. This is a tax which foreigners lay upon us and we pay it. For a duty laid upon our shipping which transports our produce to foreign markets, sinks the price of our produce, and operates as an effectual tax upon those who till the ground, and bring the fruits of it to market. All nations have seen the necessity and propriety of raising a revenue by indirect taxation, by duties upon articles of consumption. France raises a revenue of 24 Millions Sterling per annum, and it is chiefly in this way. 50 Millions of Livres they raise upon the single article of Salt. The Swiss cantons raise almost the whole of their revenue upon Salt. Those States purchase all the Salt which is to be used in the country; they sell it out to the people at an advanced price; the advance is the revenue of the country. In England the whole public revenue is about 12 Millions Sterling per annum. The land tax amounts to about 2 Millions, the window and some other taxes to about two millions more. The other 8 Millions is raised upon articles of consumption. The whole standing army of Great—Britain could not enforce the collection of this vast sum by direct taxation. In Holland their prodigious taxes amounting to forty shillings for each inhabitant, are levied chiefly upon articles of consumption. They excise every thing, not excepting even their houses of infamy.

The experiments, which have been made in our own country, shew the productive nature of indirect taxes. The imports into the United States amount to a very large sum. They never will be less, but will continue to increase for ages and centuries to come. As the population of our country increases, the imposts will necessarily increase. They will increase, because our citizens will choose to be farmers living independently on their free holds, rather than to be manufacturers, and work for a groat a day. I find by calculation, that a general impost of 5 per cent would raise the sum of £.245,000 per annum, deducting 8 per cent for the charges of collecting. A further sum might be deducted for smuggling, a business which is understood too well among us, and which is looked upon in too favourable a light. But this loss in the public revenue will be over balanced by the increase of importations. And a further sum may be reckoned upon some articles, which will bear a higher duty than the one recommended by Congress. Rum, instead of 4d. per Gallon, may be set higher, without any detriment to our health or morals. In England it pays a duty of 4s.6d. the Gallon. Now let us compare this source of revenue with our national wants. The interest of the Foreign debt is £.130,000 Lawful Money per annum. The expense of the civil list is £.37,000. There are likewise further expenses, for maintaining the Frontier posts, for the support of those who have been disabled in the service of the Continent, and some other contingencies, amounting together with the civil list to £.130,000. This sum added to the interest of the foreign debt will be £.260,000. The consequence follows, that the avails of the impost will pay the interest of the whole foreign debt, and nearly satisfy these current national expenses. But perhaps it will be said, that these paper calculations are overdone, and that the real avails will fall far short. Let me point out then what has actually been done. In only three of the States, in Massachusetts, New—York, and Pennsylvania, £.160 or 180,000 per annum have been raised by impost. From this fact we may certainly conclude, that, if a general impost should be laid, it would raise a greater sum than I have calculated. It is a strong argument in favor of an impost, that the collection of it will interfere less with the internal police of the States, than any other species of taxation. It does not fill the country with revenue officers, but is confined to the sea coast, and is chiefly a water operation. Another weighty reason in favour of this branch of revenue is, if we do not give it to Congress, the individual States will have it. It will give some States an opportunity of oppressing others, and destroy all harmony between them. If we would have the States friendly to each other, let us take away this bone of contention, and place it, as it ought in justice to be placed, in the hands of the general government.

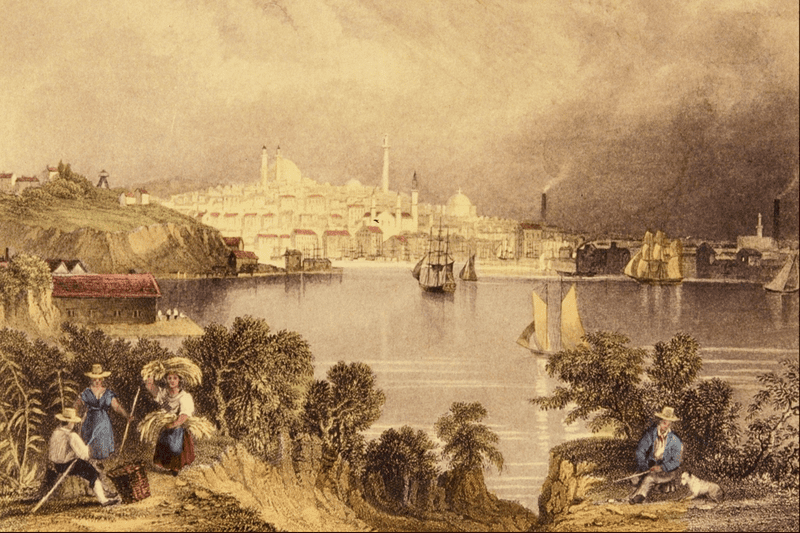

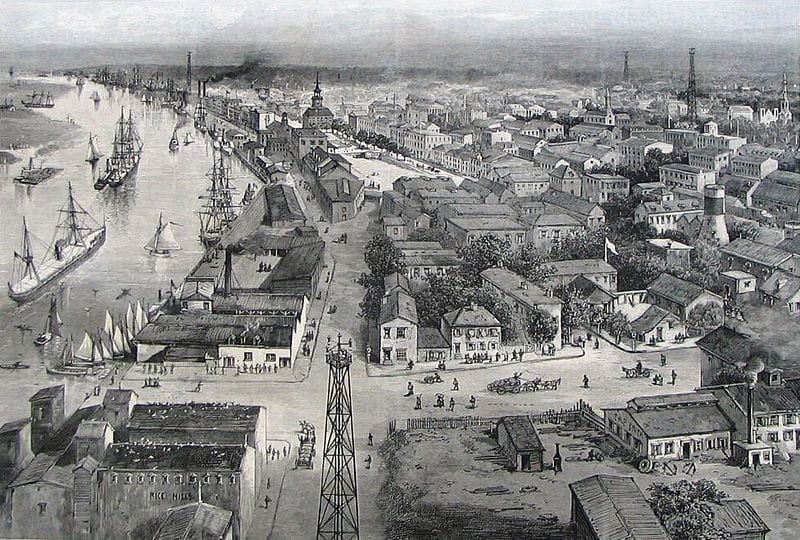

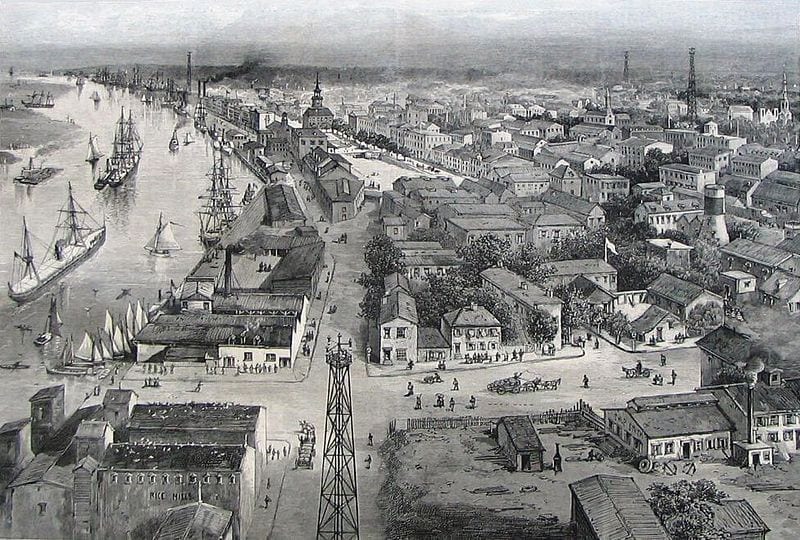

But says an honourable Gentleman near me, the impost will be a partial tax; the southern States will pay but little in comparison with the Northern. I ask, what reason is there for this assertion? Why says he, we live in a cold climate, and want warming. Do not they live in a hot climate, and want quenching? Until you get as far south as the Carolinas, there is no material difference in the quantity of cloathing which is worn. In Virginia they have the same course of cloathing, that we have. In Carolina, they have a great deal of cold, raw, chilly weather: even in Georgia, the river Savannah has been crossed upon the ice. And if they do not wear quite so great a quantity of cloathing in those States as with us; yet people of rank wear that which is of a much more expensive kind. In these States, we manufacture one half of our cloathing and all our tools of Husbandry; in those, they manufacture none, nor ever will. They will not manufacture, because they find it much more profitable to cultivate their lands which are exceedingly fertile. Hence they import almost every thing, not excepting the carriages in which they ride, the hoes with which they till the ground, and the Boots which they wear. If we doubt of the extent of their importations, let us look at their exports. So exceedingly fertile and profitable are their Lands, that a hundred large ships are every year loaded with rice and indigo from the single port of Charlestown. The rich returns of these cargoes of immense value will be all subject to the impost. Nothing is omitted, a duty is to be paid upon the blacks which they import. From Virginia their exports are valued at a million sterling per annum; the single article of tobacco amounts to seven or eight hundred thousand. How does this come back? not in money, for the Virginians are poor to a proverb in money. They anticipate their crops; they spend faster than they earn; they are ever in debt. Their rich exports return in eatables, in drinkables, in wearables. All these are subject to the impost. In Maryland their exports are as great in proportion as those in Virginia. The imports and exports of the southern States are quite as great in proportion as those of the northern. Where then exists this partiality, which has been objected? It exists no where but in the uninformed mind.

But there is one objection, Mr. President, which is broad enough to cover the whole subject. Says the objector, Congress ought not to have power to raise any money at all. Why? Because they have the power of the sword, and if we give them the power of the purse, they are despotic. But I ask, Sir, was there ever a government without the power of the sword and the purse? This is not a new coined phraise; but it is misapplied; it belongs to quite another subject. It was brought into use in Great—Britain, where they have a king vested with hereditary power. Here, say they, it is dangerous to place the power of the sword and the purse in the hands of one man, who claims an authority independent of the people. Therefore we will have a parliament. But the king and parliament together, the supreme power of the nation, they have the sword and the purse. And they must have both, else how could the country be defended? For the sword without the purse is of no effect, it is a sword in the scabbard. But does it follow, because it is dangerous to give the power of the sword and the purse to a hereditary prince, who is independent of the people, that therefore, it is dangerous to give it to the parliament, to congress which is your parliament, to men ap—pointed by yourselves, and dependent upon yourselves? This argu—ment amounts to this, you must cut a man in two in the middle, to prevent his hurting himself.

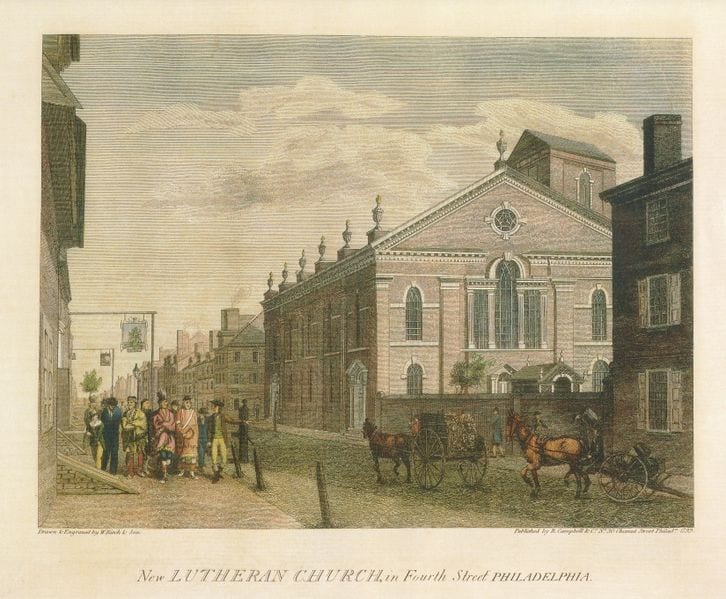

But says the Honourable objector, if Congress levy money, they must legislate. I admit it. Two Legislative powers, says he, cannot exist together in the same place. I ask, why can they not? It is not enough to say they cannot. I wish for some reason. I grant that both cannot legislate upon the same object, at the same time, and carry into effect Laws which are contrary to each other. But the constitution excludes every thing of this kind. Each Legislature has its province; their limits may be distinguished. If they will run foul of each other, if they will be trying who has the hardest head, it cannot be helped. The road is broad enough, but if two men will justle each other, the fault is not in the road. Two several Legislatures have in fact existed, and acted at the same time in the same territory. It is in vain to say, they cannot exist, when they actually have done it. In the time of the war we had an army. Who made the laws for the army? By whose authority were offenders tried and executed? Congress was the power. By their authority, a man was taken, tried, condemned and hanged, in this very town. He belonged to the army; he was a proper subject of military law; he deserted to the enemy; he deserved his fate. Wherever the army was, in whatever state, there congress had complete legislative, judicial and executive power. This very spot where we now are, is a city. It has complete legislative, judicial and executive powers. It is a complete state in miniature. Yet it breeds no confusion, it makes no scism. The city has not eat up the state, nor the state the city. But if this is a new city, if it has not had time to unfold its principles, I will instance the city of New—York, which is and long has been an important part of that state, it has been found beneficial, its powers and privileges have not clashed with the state. The city of London contains three or four times as many inhabitants as the whole state of Connecticut. It has extensive powers of government, and yet it makes no interference with the general government of the kingdom. This constitution defines the extent of the powers of the general government. If the general legislature should at any time overleap their limits, the judicial department is a con—stitutional check. If the United States go beyond their powers, if they make a law which the constitution does not authorise, it is void; and the judicial power, the national judges, who to secure their im—partiality are to be made independent, will declare it to be void. On the other hand, if the states go beyond their limits, if they make a law which is an usurpation upon the general government, the law is void, and upright independent judges will declare it to be so. Still however, if the united states and the individual states will quarrel, if they want to fight, they may do it, and no frame of government can possibly prevent it. It is sufficient for this constitution, that, so far from laying them under a necessity of contending, it provides every reasonable check against it. But perhaps at some time or other there will be a contest, the states may rise against the general government. If this does take place, if all the states combine, if all oppose, the whole will not eat up the members, but the measure which is opposed to the sense of the people, will prove abortive. In republics, it is a fundamental principle, that the majority govern, and that the minority comply with the general voice. How contrary then to republican principles, how humiliating is our present situation. A single state can rise up, and put a veto upon the most important public measures. We have seen this actually take place, a single state has controuled the general voice of the union, a minority, a very small minority has governed us. So far is this from being consistent with republican principles, that it is in effect the worst species of monarchy.

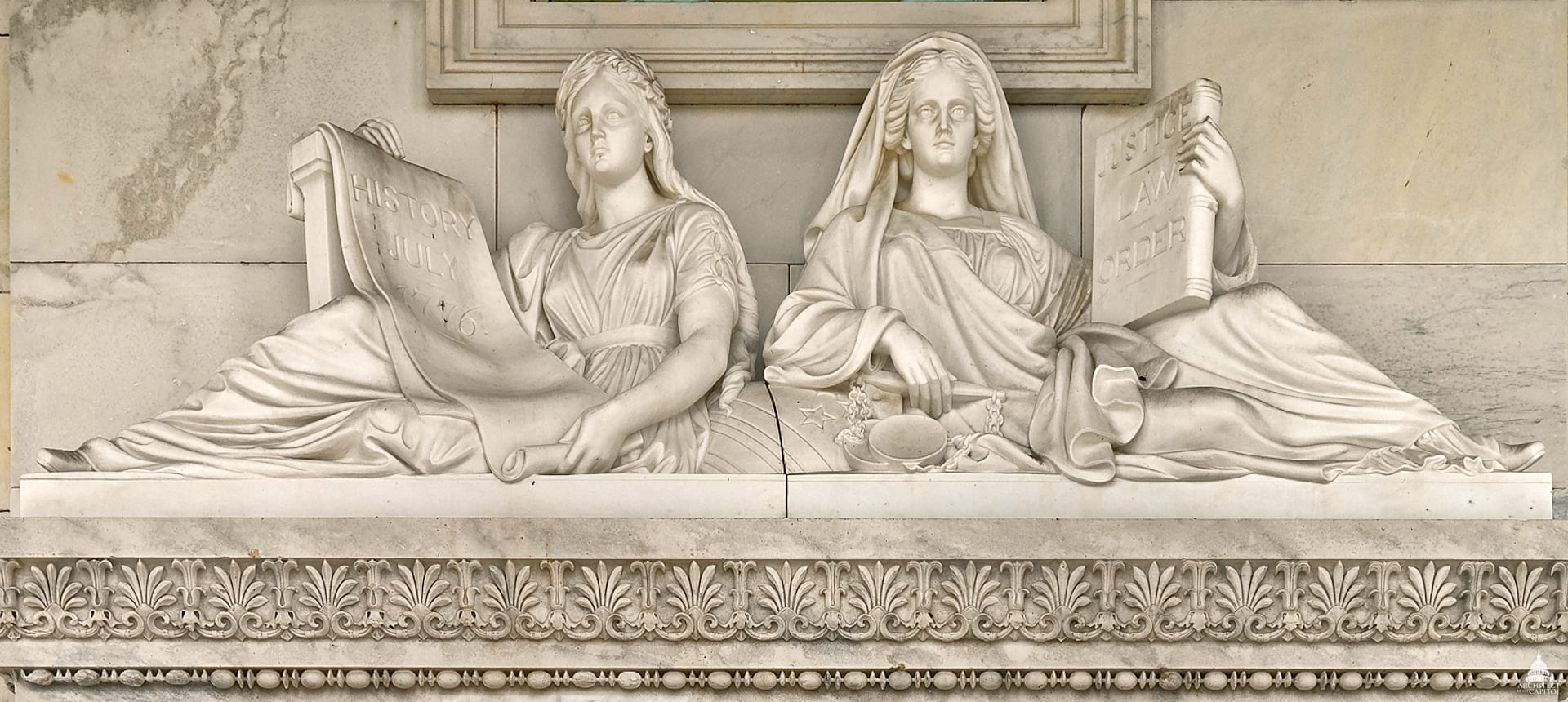

Hence we see, how necessary for the union is a coercive principle. No man pretends the contrary. We all see and feel this necessity. The only question is, shall it be a coercion of Law, or a coercion of arms: There is no other possible alternative. Where will those who oppose a coercion of Law, come out? where will they end? A necessary consequence of their principles is a war of the States one against another. I am for coercion by Law, that coercion which acts only upon delinquent individuals. This constitution does not attempt to coerce sovereign bodies, States in their political capacity. No coercion is applicable to such bodies, but that of an armed force. If we should attempt to execute the Laws of the Union by sending an armed force against a delinquent State, it would involve the good and bad, the innocent and guilty, in the same calamity. But this legal coercion singles out the guilty individual, and punishes him for breaking the Laws of the union. All men will see the reasonableness of this, they will acquiesce, and say, let the guilty suffer. How have the morals of the people been depraved for the want of an efficient government which might establish justice and righteousness. For the want of this, iniquity has come in upon us like an overflowing flood. If we wish to prevent this alarming evil, if we wish to protect the good citizen in his right, we must lift up the standard of justice, we must establish a national government, to be enforced by the equal decisions of Law, and the peaceable arm of the magistrate.

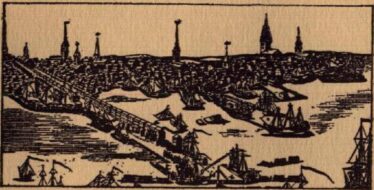

Resolutions of the Tradesmen of Boston

January 07, 1788

Conversation-based seminars for collegial PD, one-day and multi-day seminars, graduate credit seminars (MA degree), online and in-person.

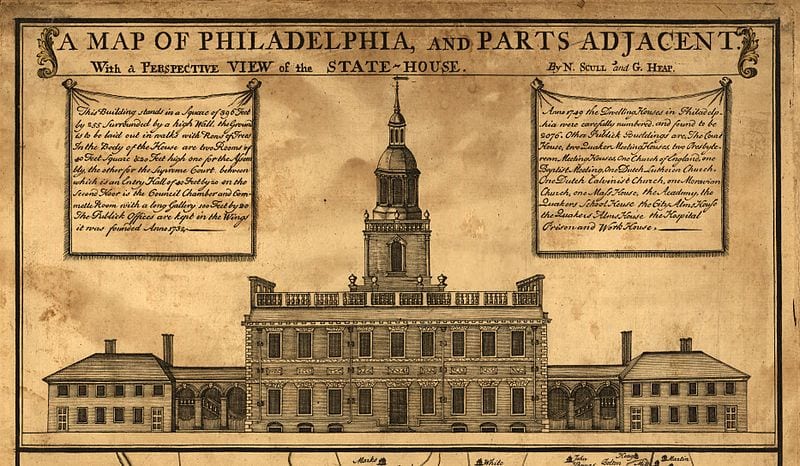

![Finley, A. (1829) Pennsylvania. Philada. [Map] Retrieved from the Library of Congress, https://www.loc.gov/item/98688548/.](/content/uploads/2024/02/Map-of-PA--273x190.jpg)