No study questions

No related resources

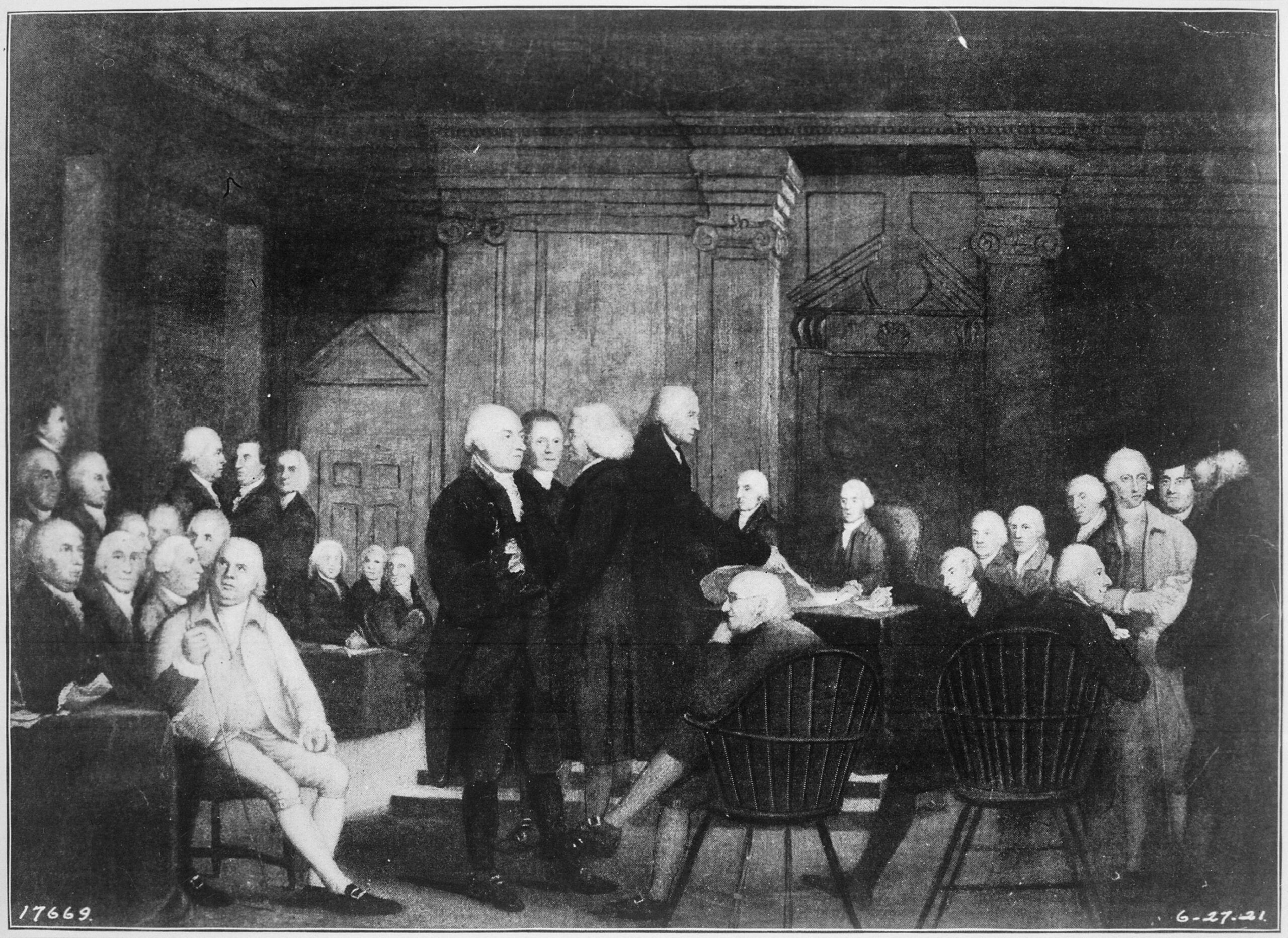

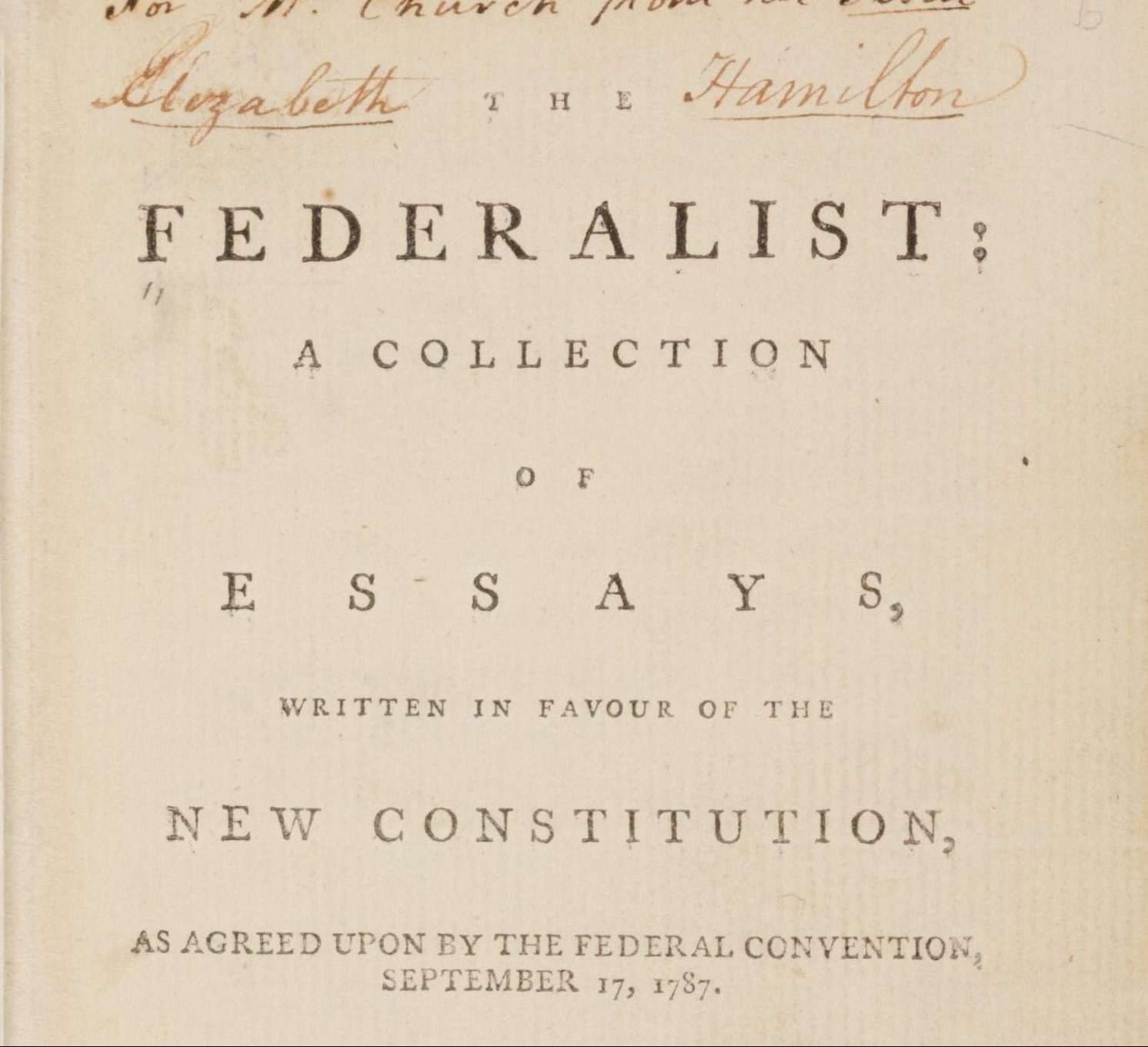

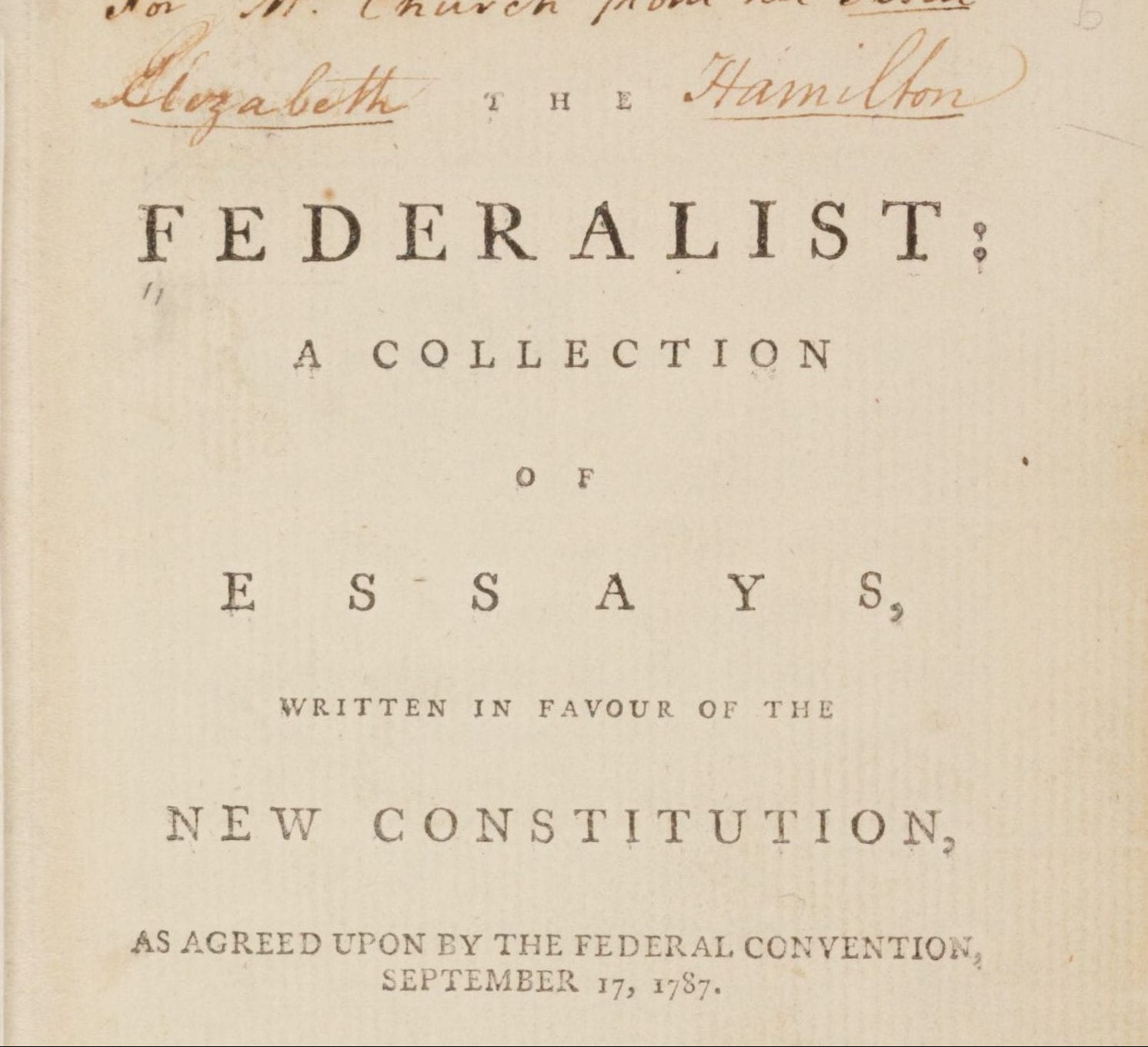

In Convention. — Article 7, Section 4, was resumed.

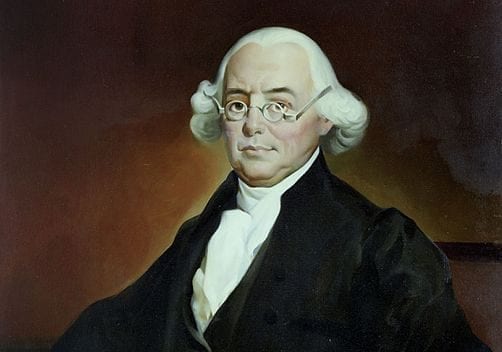

Mr. SHERMAN was for leaving the clause as it stands. He disapproved of the slave-trade; yet as the States were now possessed of the right to import slaves, as the public good did not require it to be taken from them, and as it was expedient to have as few objections as possible to the proposed scheme of government, he thought it best to leave the matter as we find it. He observed that the abolition of slavery seemed to be going on in the United States, and that the good sense of the several States would probably by degrees complete it. He urged on the Convention the necessity of despatching its business.

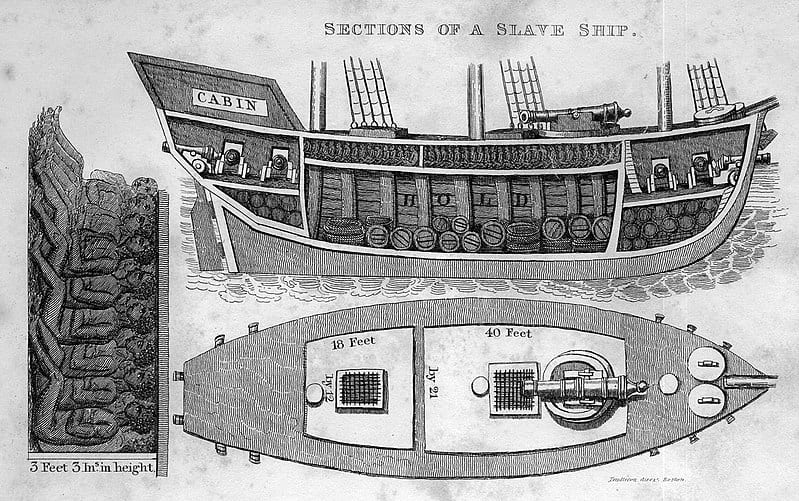

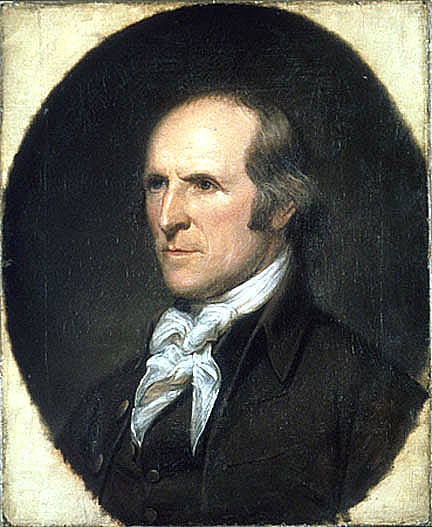

Colonel MASON. This infernal traffic originated in the avarice of British merchants. The British Government constantly checked the attempts of Virginia to put a stop to it. The present question concerns not the importing States alone, but the whole Union. The evil of having slaves was experienced during the late war. Had slaves been treated as they might have been by the enemy, they would have proved dangerous instruments in their hands. But their folly dealt by the slaves as it did by the tories. He mentioned the dangerous insurrections of the slaves in Greece and Sicily; and the instructions given by Cromwell to the commissioners sent to Virginia, to arm the servants and slaves, in case other means of obtaining its submission should fail. Maryland and Virginia, he said, had already prohibited the importation of slaves expressly. North Carolina had done the same in substance. All this would be in vain, if South Carolina and Georgia be at liberty to import. The Western people are already calling out for slaves for their new lands; and will fill that country with slaves, if they can be got through South Carolina and Georgia. Slavery discourages arts and manufactures. The poor despise labor when performed by slaves. They prevent the emigration of whites, who really enrich and strengthen a country. They produce the most pernicious effect on manners. Every master of slaves is born a petty tyrant. They bring the judgment of Heaven on a country. As nations cannot be rewarded or punished in the next world, they must be in this. By an inevitable chain of causes and effects, Providence punishes national sins by national calamities. He lamented that some of our Eastern brethren had, from a lust of gain, embarked in this nefarious traffic. As to the States being in possession of the right to import, this was the case with many other rights, now to be properly given up. He held it essential in every point of view, that the General Government should have power to prevent the increase of slavery.

Mr. ELLSWORTH, as he had never owned a slave, could not judge of the effects of slavery on character. He said, however, that if it was to be considered in a moral light, we ought to go further and free those already in the country. As slaves also multiply so fast in Virginia and Maryland that it is cheaper to raise than import them, whilst in the sickly rice swamps foreign supplies are necessary, if we go no further than is urged, we shall be unjust towards South Carolina and Georgia. Let us not intermeddle. As population increases, poor laborers will be so plenty as to render slaves useless. Slavery in time, will not be a speck in our country. Provision is already made in Connecticut for abolishing it. And the abolition has already taken place in Massachusetts. As to the danger of insurrections from foreign influence, that will become a motive to kind treatment of the slaves.

Mr. PINCKNEY. If slavery be wrong, it is justified by the example of all the world. He cited the case of Greece, Rome, and other ancient states; the sanction given by France, England, Holland, and other modern states. In all ages one half of mankind have been slaves. If the Southern States were let alone, they will probably of themselves stop importations. He would himself, as a citizen of South Carolina, vote for it. An attempt to take away the right, as proposed, will produce serious objections to the Constitution, which he wished to see adopted.

General PINCKNEY declared it to be his firm opinion, that if himself and all his colleagues were to sign the Constitution, and use their personal influence, it would be of no avail towards obtaining the assent of their constituents. South Carolina and Georgia cannot do without slaves. As to Virginia, she will gain by stopping the importations. Her slaves will rise in value, and she has more than she wants. It would be unequal, to require South Carolina and Georgia to confederate on such unequal terms. He said the Royal assent, before the Revolution, had never been refused to South Carolina, as to Virginia. He contended, that the importation of slaves would be for the interest of the whole Union. The more slaves, the more produce to employ the carrying trade; the more consumption also; and the more of this, the more revenue for the common treasury. He admitted it to be reasonable that slaves should be dutied like other imports; but should consider a rejection of the clause as an exclusion of South Carolina from the Union.

Mr. BALDWIN had conceived national objects alone to be before the Convention; not such as, like the present, were of a local nature. Georgia was decided on this point. That State has always hitherto supposed a General Government to be the pursuit of the central States, who wished to have a vortex for every thing; that her distance would preclude her from equal advantage; and that she could not prudently purchase it by yielding national powers. From this it might be understood, in what light she would view an attempt to abridge one of her favorite prerogatives. If left to herself, she may probably put a stop to the evil. As one ground for this conjecture, he took notice of the sect of —; which he said was a respectable class of people, who carried their ethics beyond the mere equality of men, extending their humanity to the claims of the whole animal creation.

Mr. WILSON observed, that if South Carolina and Georgia were themselves disposed to get rid of the importation of slaves in a short time, as had been suggested, they would never refuse to unite because the importation might be prohibited. As the section now stands, all articles imported are to be taxed. Slaves alone are exempt. This is in fact a bounty on that article.

Mr. GERRY thought we had nothing to do with the conduct of the States as to slaves, but ought to be careful not to give any sanction to it.

Mr. DICKINSON considered it as inadmissible, on every principle of honor and safety, that the importation of slaves should be authorized to the States by the Constitution. The true question was, whether the national happiness would be promoted or impeded by the importation; and this question ought to be left to the National Government, not to the States particularly interested. If England and France permit slavery, slaves are, at the same time, excluded from both those kingdoms. Greece and Rome were made unhappy by their slaves. He could not believe that the Southern States would refuse to confederate on the account apprehended; especially as the power was not likely to be immediately exercised by the General Government.

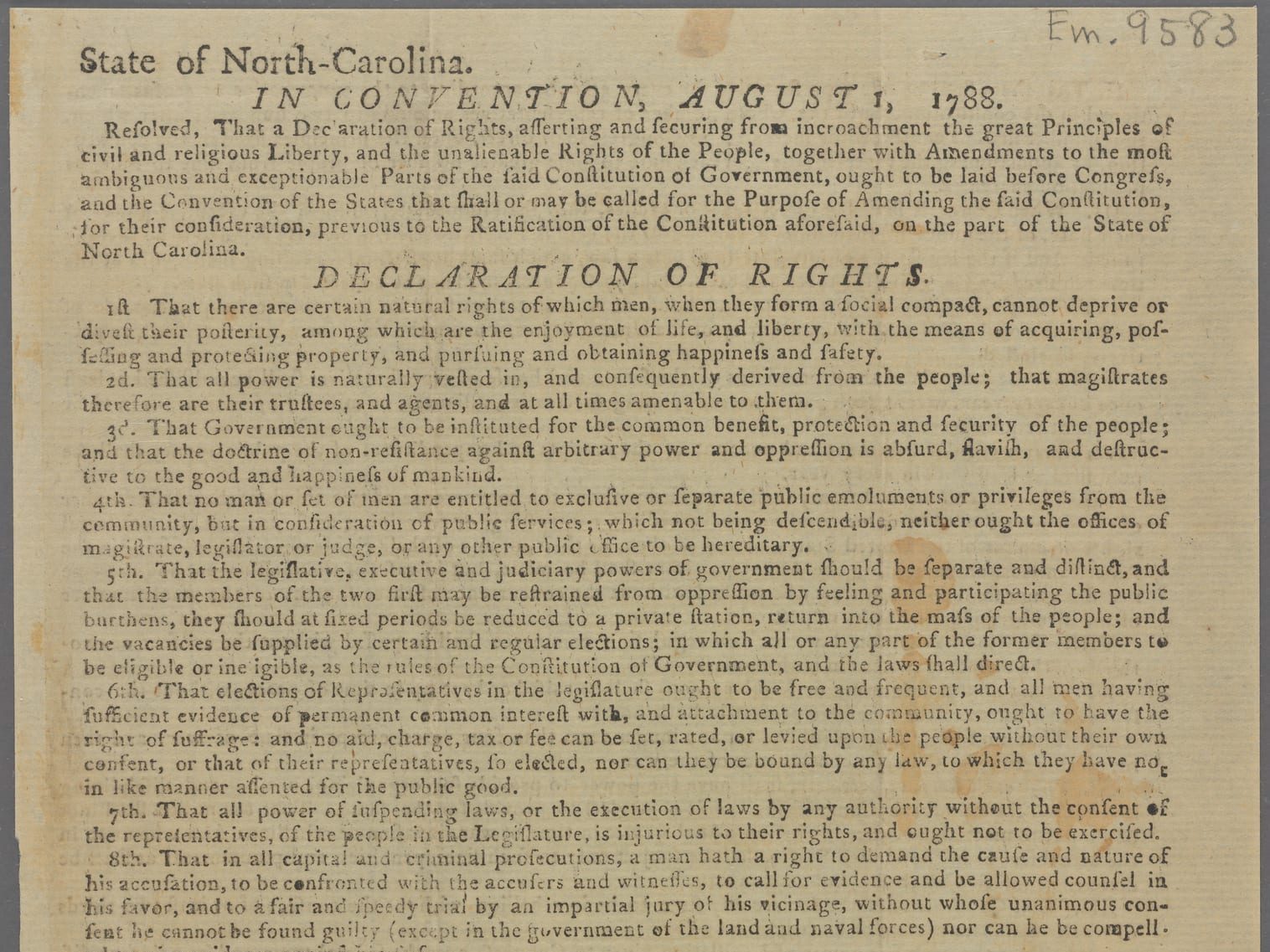

Mr. WILLIAMSON stated the law of North Carolina on the subject, to wit, that it did not directly prohibit the importation of slaves. It imposed a duty of £5 on each slave imported from Africa; £10 on each from elsewhere; and £50 on each from a State licensing manumission. He thought the Southern States could not be members of the Union, if the clause should be rejected; and that it was wrong to force any thing down not absolutely necessary, and which any State must disagree to.

Mr. KING thought the subject should be considered in a political light only. If two States will not agree to the Constitution, as stated on one side, he could affirm with equal belief on the other, that great and equal opposition would be experienced from the other States. He remarked on the exemption of slaves from duty, whilst every other import was subjected to it, as an inequality that could not fail to strike the commercial sagacity of the Northern and Middle States.

Mr. LANGDON was strenuous for giving the power to the General Government. He could not, with a good conscience, leave it with the States, who could then go on with the traffic, without being restrained by the opinions here given, that they will themselves cease to import slaves.

General PINCKNEY thought himself bound to declare candidly, that he did not think South Carolina would stop her importations of slaves in any short time; but only stop them occasionally, as she now does. He moved to commit the clause, that slaves might be made liable to an equal tax with other imports; which he thought right, and which would remove one difficulty that had been started.

Mr. RUTLEDGE. If the Convention thinks that North Carolina, South Carolina, and Georgia, will ever agree to the plan, unless their right to import slaves be untouched, the expectation is vain. The people of those States will never be such fools as to give up so important an interest. He was strenuous against striking out the section, and seconded the motion of General PINCKNEY for a commitment.

Mr. GOUVERNEUR MORRIS wished the whole subject to be committed, including the clauses relating to taxes on exports and to a navigation act. These things may form a bargain among the Northern and Southern States.

Mr. BUTLER declared, that he never would agree to the power of taxing exports.

Mr. SHERMAN said it was better to let the Southern States import slaves than to part with them, if they made that a sine qua non. He was opposed to a tax on slaves imported, as making the matter worse, because it implied they were property. He acknowledged that if the power of prohibiting the importation should be given to the General Government, it would be exercised. He thought it would be its duty to exercise the power.

Mr. READ was for the commitment, provided the clause concerning taxes on exports should also be committed.

Mr. SHERMAN observed, that that clause had been agreed to, and therefore could not be committed.

Mr. RANDOLPH was for committing, in order that some middle ground might, if possible, be found. He could never agree to the clause as it stands. He would sooner risk the Constitution. He dwelt on the dilemma to which the Convention was exposed. By agreeing to the clause, it would revolt the Quakers, the Methodists, and many others in the States having no slaves. On the other hand, two States might be lost to the Union. Let us then, he said, try the chance of a commitment.

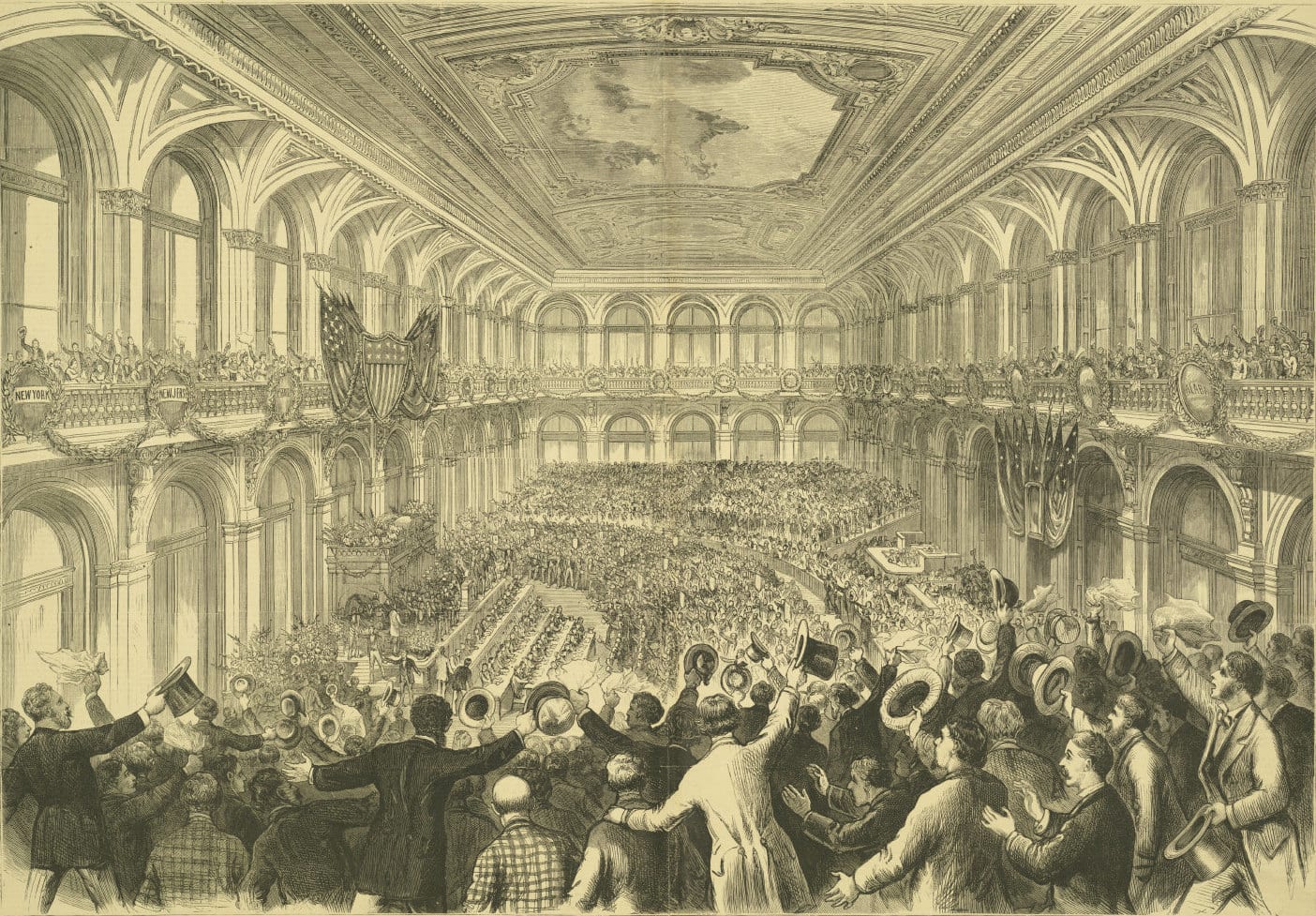

On the question for committing the remaining part of Sections 4 and 5 of Article 7, — Connecticut, New Jersey, Maryland, Virginia, North Carolina, South Carolina, Georgia, aye, — 7; New Hampshire, Pennsylvania, Delaware, no, — 3; Massachusetts, absent.

Mr. PINCKNEY and Mr. LANGDON moved to commit Section 6, as to a navigation act by two thirds of each House.

Mr. GORHAM did not see the propriety of it. Is it meant to require a greater proportion of votes? He desired it to be remembered, that the Eastern States had no motive to union but a commercial one. They were able to protect themselves. They were not afraid of external danger, and did not need the aid of the Southern States.

Mr. WILSON wished for a commitment, in order to reduce the proportion of votes required.

Mr. ELLSWORTH was for taking the plan as it is. This widening of opinions had a threatening aspect. If we do not agree on this middle and moderate ground, he was afraid we should lose two States, with such others as may be disposed to stand aloof; should fly into a variety of shapes and directions, and most probably into several confederations, — and not without bloodshed.

On the question for committing Section 6, as to a navigation act, to a member from each State, — New Hampshire, Massachusetts, Pennsylvania, Delaware, Maryland, Virginia, North Carolina, South Carolina, Georgia, aye, — 9; Connecticut, New Jersey no, — 2.

The Committee appointed were, Messrs. LANGDON, KING, JOHNSON, LIVINGSTON, CLYMER, DICKINSON, L. MARTIN, MADISON, WILLIAMSON, C. C. PINCKNEY, and BALDWIN.

To this committee were referred also the two clauses, above mentioned of the fourth and fifth Sections of Article 7.

Mr. RUTLEDGE from the Committee to whom were referred, on the eightenth and twentieth instant, the propositions of Mr. MADISON and Mr. PINCKNEY, made the report following:

“The Committee report that, in their opinion, the following additions should be made to the report now before the Convention, namely:

“At the end of the first clause of the first section of the seventh article, add, ‘for payment of the debts and necessary expenses of the United States; provided, that no law for raising any branch of revenue, except what may be specially appropriated for the payment of interest on debts or loans, shall continue in force for more than — years.’

“At the end of the second clause, second section, seventh article, add, ‘and with Indians, within the limits of any State, not subject to the laws thereof.’

“At the end of the sixteenth clause, of the second section, seventh article, add, ‘and to provide, as may become necessary, from time to time, for the well managing and securing the common property and general interests and welfare of the United States in such manner as shall not interfere with the government of individual States, in matters which respect only their internal police, or for which their individual authority may be competent.’

“At the end of the first section, tenth article, add, ‘he shall be of the age of thirty-five years, and a citizen of the United States, and shall have been an inhabitant thereof for twenty-one years.’

“After the second section, of the tenth article, insert the following as a third section: ‘The President of the United States shall have a Privy Council, which shall consist of the President of the Senate, the Speaker of the House of Representatives, the Chief Justice of the Supreme Court, and the principal officer in the respective departments of foreign affairs, domestic affairs, war, marine, and finance, as such departments of office shall from time to time be established; whose duty it shall be to advise him in matters respecting the execution of his office, which he shall think proper to lay before them: but their advice shall not conclude him, nor affect his responsibility for the measures which he shall adopt.’

“At the end of the second section of the eleventh article, add, ‘the Judges of the Supreme Court shall be triable by the Senate, on impeachment by the House of Representatives.’

“Between the fourth and fifth lines of the third section of the eleventh article, after the word ‘controversies,’ insert, ‘between the United States and an individual State, or the United States and an individual person.’”

A motion to rescind the order of the House, respecting the hours of meeting and adjourning, was negatived, — Massachusetts, Pennsylvania, Delaware, Maryland, aye, — 4; New Hampshire, Connecticut, New Jersey, Virginia, North Carolina, South Carolina, Georgia, no, — 7.

Mr. GERRY and Mr. McHENRY moved to insert, after the second Section, Article 7, the clause following, to wit: “The Legislature shall pass no bill of attainder, nor any ex post facto law.” 1

Mr. GERRY urged the necessity of this prohibition, which, he said, was greater in the National than the State Legislature; because, the number of members in the former being fewer, they were on that account the more to be feared.

Mr. GOUVERNEUR MORRIS thought the precaution as to ex post facto laws unnecessary, but essential as to bills of attainder.

Mr. ELLSWORTH contended that there was no lawyer, no civilian, who would not say, that ex post facto laws were void of themselves. It cannot, then, be necessary to prohibit them.

Mr. WILSON was against inserting any thing in the Constitution, as to ex post facto laws. It will bring reflections on the Constitution and proclaim that we are ignorant of the first principles of legislation, or are constituting a government that will be so.

The question being divided, the first part of the motion relating to bills of attainder was agreed to, nem. con.

On the second part relating to ex post facto laws, —

Mr. CARROLL remarked, that experience overruled all other calculations. It had proved that, in whatever light they might be viewed by civilians or others, the State Legislatures had passed them, and they had taken effect.

Mr. WILSON. If these prohibitions in the State Constitutions have no effect, it will be useless to insert them in this Constitution. Besides, both sides will agree to the principle, but will differ as to its application.

Mr. WILLIAMSON. Such a prohibitory clause is in the Constitution of North Carolina; and though it has been violated, it has done good there, and may do good here, because the Judges can take hold of it.

Doctor JOHNSON thought the clause unnecessary, and implying an improper suspicion of the National Legislature.

Mr. RUTLEDGE was in favor of the clause.

On the question for inserting the prohibition of ex post facto laws, —

New Hampshire, Massachusetts, Delaware, Maryland, Virginia, South Carolina, Georgia, aye, — 7; Connecticut, New Jersey, Pennsylvania, no, — 3; North Carolina, divided.

The Report of the Committee of five, made by Mr. RUTLEDGE, was taken up, and then postponed, that each member might furnish himself with a copy.

The Report of the Committee of eleven, delivered in and entered on the Journal of the twenty-first instant, was then taken up; and the first clause, containing the words, “The Legislature of the United States shall have power to fulfil the engagements which have been entered into by Congress,” being under consideration, —

Mr. ELLSWORTH argued that they were unnecessary. The United States heretofore entered into engagements by Congress, who were their agents. They will hereafter be bound to fulfil them by their new agents.

Mr. RANDOLPH thought such a provision necessary: for though the United States will be bound, the new Government will have no authority in the case, unless it be given to them.

Mr. MADISON thought it necessary to give the authority, in order to prevent misconstruction. He mentioned the attempt made by the debtors to British subjects, to show that contracts under the old Government were dissolved by the Revolution, which destroyed the political identity of the society.

Mr. GERRY thought it essential that some explicit provision should be made on this subject; so that no pretext might remain for getting rid of the public engagements.

Mr. GOUVERNEUR MORRIS moved by way of amendment, to substitute, “The Legislature shall discharge the debts, and fulfil the engagements of the United States.”

It was moved to vary the amendment, by striking out “discharge the debts,” and to insert “liquidate the claims”; which being negatived, the amendment moved by Mr. GOUVERNEUR MORRIS was agreed to, — all the States being in the affirmative.

It was moved and seconded to strike the following words out of the second clause of the Report: “and the authority of training the militia according to the discipline prescribed by the United States.” Before a question was taken, the House

- 1. The proceedings on this motion, involving the two questions on attainders and ex post facto laws, are not so fully stated in the printed Journal.

Conversation-based seminars for collegial PD, one-day and multi-day seminars, graduate credit seminars (MA degree), online and in-person.

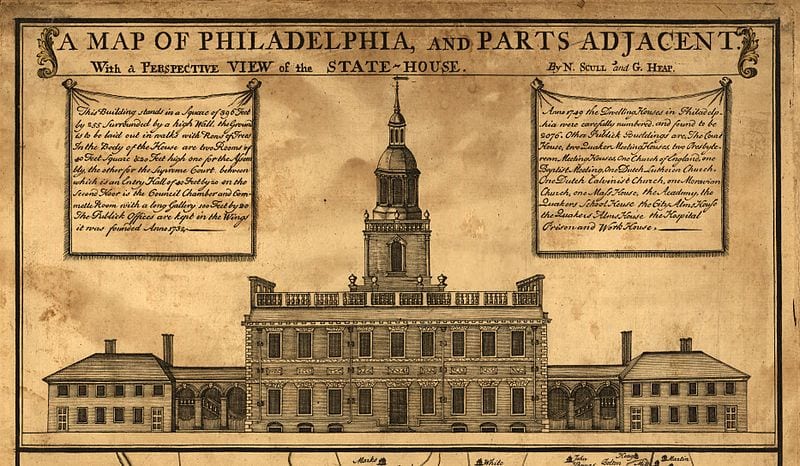

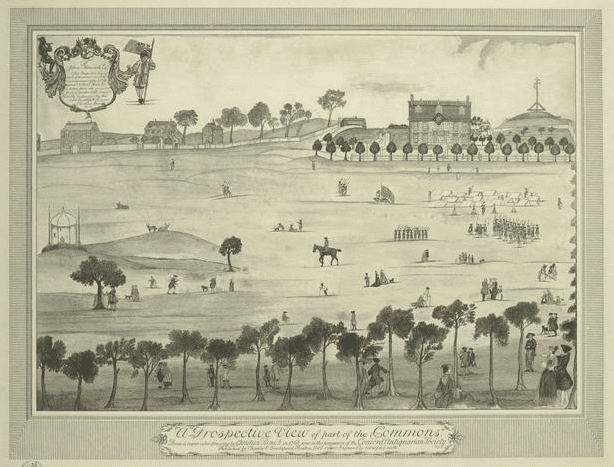

![Finley, A. (1829) Pennsylvania. Philada. [Map] Retrieved from the Library of Congress, https://www.loc.gov/item/98688548/.](/content/uploads/2024/02/Map-of-PA--273x190.jpg)